Volume 3: Real Property Valuation Manual All Chapters

The Importance of Correct Land Valuation

Under all is the Land!

This statement is a time-honored maxim in the understanding of the concept of real property. Because all people use land, whether as a source for food or as a foundation for shelter, land use serves as the cornerstone for establishing the desirability and ultimate worth of real property.

Land valuation is an essential part of a good appraisal program. A correct appraisal is absolutely dependent on a correct land value. Consider how having an accurate land value relates to the cost approach. The formula is as follows:

Land Value + ((Improvement) Replacement Cost New - Depreciation) = Estimate of Value

If the land value is incorrect, the estimate of value for the total property will also be incorrect.

Like most states, Colorado statutes require the assessor to value land separately from improvements, § 39-5-105(1), C.R.S. There are practical reasons for separation of land and improvements:

- Trends and factors affecting land and improvements can be studied separately.

- In land use analysis, it is necessary to determine the current use of the land.

- It is mandatory in the valuation of real property by the cost approach.

- It is necessary for the calculation of improvement depreciation tables.

Accurate land values also play an important part in the valuation of the improvements. A confirmed sales price includes both land and improvement value components. The depreciated value of the improvements is determined by subtracting the land value from the sales price. When this depreciated improvement value is compared to the replacement cost new, the result is market derived depreciation. The amount of market derived depreciation can be calculated on an annual basis and placed in a depreciation table. The depreciation table can be used in setting improvement values for ad valorem purposes.

Statutory and Case Law References

Colorado statutes define land as a part of real property. This definition is as follows.

Definitions.

(14) “Real property” means:

(a) All lands or interests in lands to which title or the right of title has been acquired from the government of the United States or from sovereign authority ratified by treaties entered into by the United States, or from the state;

(b) All mines, quarries, and minerals in and under the land, and all rights and privileges thereunto appertaining; and

(c) Improvements.

§ 39-1-102, C.R.S.

Colorado statutes further define vacant land and require specific procedures when using the market approach to value such land.

Actual value determined - when.

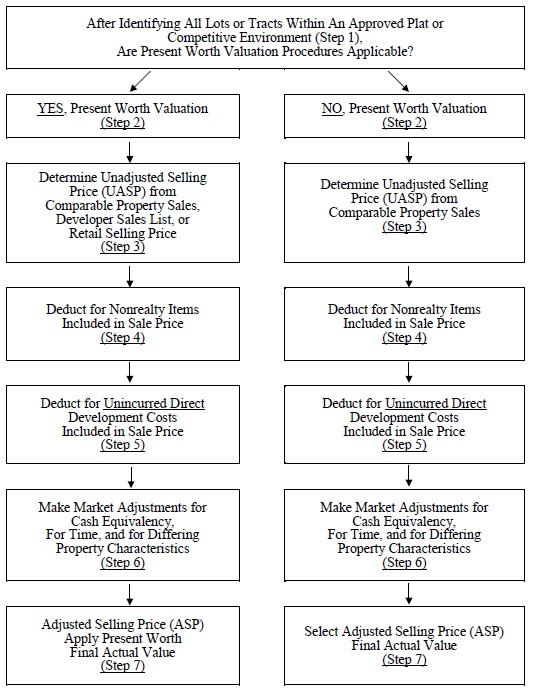

(14)(b) The assessing officers shall give appropriate consideration to the cost approach, market approach, and income approach to appraisal as required by the provisions of section 3 of article X of the state constitution in determining the actual value of vacant land. When using the market approach to appraisal in determining the actual value of vacant land as of the assessment date, assessing officers shall take into account, but need not limit their consideration to, the following factors: The anticipated market absorption rate, the size and location of such land, the direct costs of development, any amenities, any site improvements, access, and use. When using anticipated market absorption rates, the assessing officers shall use appropriate discount factors in determining the present worth of vacant land until eighty percent of the lots within an approved plat have been sold and shall include all vacant land in the approved plat. For purposes of such discounting, direct costs of development shall be taken into account. The use of present worth shall reflect the anticipated market absorption rate for the lots within such plat, but such time period shall not generally exceed thirty years. For purposes of this paragraph (b), no indirect costs of development, including, but not limited to, costs relating to marketing, overhead, or profit, shall be considered or taken into account.

(c)(I) For purposes of this subsection (14), "vacant land" means any lot, parcel, site, or tract of land upon which no buildings or fixtures, other than minor structures, are located. "Vacant land" may include land with site improvements. "Vacant land" includes land that is part of a development tract or subdivision when using present worth discounting in the market approach to appraisal; however, "vacant land" shall not include any lots within such subdivision or any portion of such development tract that improvements, other than site improvements or minor structures, have been erected upon or affixed thereto. "Vacant land" does not include agricultural land, producing oil and gas properties, severed mineral interests, and all mines, whether producing or nonproducing.

(II) For purposes of this subsection (14):

(A) "Minor structures" means improvements that do not add value to the land on which they are located and that are not suitable to be used for and are not actually used for any commercial, residential, or agricultural purpose.

(B) "Site improvements" means streets with curbs and gutters, culverts and other sewage and drainage facilities, and utility easements and hookups for individual lots or parcels.§ 39-1-103, C.R.S.

Consideration of market absorption rates, costs of development, and present worth valuation procedures are required when valuing vacant land using the vacant land present worth valuation procedures developed by the Division. These procedures are found in Chapter 4, Valuation of Vacant Land Present Worth.

In addition, consideration of market absorption rates, costs of development, and present worth discounting can be improved by acquiring a familiarity with the anticipated use or developmental cost method of land valuation. A discussion of this method can be found under Chapter 2, Appraisal Process, Economic Areas, and the Approaches to Value.

A specific statutory definition covers residential land.

Definitions.

(14.4)(a)(I) “Residential land” means a parcel of land upon which residential improvements are located. The term also includes:

(A) Land upon which residential improvements were destroyed by natural cause after the date of the last assessment as established in section 39-1-104 (10.2);

(B) Two acres or less of land on which a residential improvement is located where the improvement is not integral to an agricultural operation conducted on such land; and

(C) A parcel of land without a residential improvement located thereon, if the parcel is contiguous to a parcel of residential land that has identical ownership based on the record title and contains a related improvement that is essential to the use of the residential improvement located on the identically owned contiguous residential land.(II) “Residential land” does not include any portion of the land that is used for any purpose that would cause the land to be otherwise classified, except as provided for in section 39-1-103 (10.5).

(III) As used in this subsection (14.4)

(A) “Contiguous” means that the parcels physically touch; except that contiguity is not interrupted by an intervening local street, alley, or common element in a common-interest community.

(B) “Related improvement” means a driveway, parking space, or improvement other than a building, or that portion of a building designed for use predominantly as a place of residency by a person, a family, or families.§ 39-1-102, C.R.S.

Parcels of land, under common ownership, that are contiguous and contain a related improvement, are classified as residential land. Please refer to ARL Volume 2, Administrative and Assessment Procedures, Chapter 6, Property Classification Guidelines and Assessment Percentages, for classification information. The statutes concerning residential land under § 39-1-102(14.4) C.R.S., and vacant land listed under § 39-1-103(14), C.R.S., cannot apply at the same time to the same property. The residential land definition is only applicable to residential improved land. The vacant land statute applies to the method of valuation of vacant land, whether the land is vacant residential, vacant commercial or some other vacant subclass.

Colorado statute provides guidance in the valuation of an economic unit, a tract or parcel of land.

Valuation of Property.

Each tract or parcel of land and each town or city lot shall be separately appraised and valued, except when two or more adjoining tracts, parcels, or lots are owned by the same person, in which case the same may be appraised and valued either separately or collectively. When a single structure, used for a single purpose, is located on more than one town or city lot, the entire land area shall be appraised and valued as a single property.

§ 39-5-104, C.R.S.

The statutes require separate valuation of land and improvements.

Improvements - water rights - valuation.

(1) Improvements shall be appraised and valued separately from land, except improvements other than buildings on land which is used solely and exclusively for agricultural purposes, in which case the land, water rights, and improvements other than buildings shall be appraised and valued as a unit.

(1.1)(a)(I) Water rights, together with any dam, ditch, canal, flume, reservoir, bypass, pipeline, conduit, well, pump, or other associated structure or device as defined in article 92 of title 37, C.R.S., being used to produce water or held to produce or exchange water to support uses of any item of real property specified in section 39-1-102(14), other than for agricultural purposes, shall not be appraised and valued separately but shall be appraised and valued with the item of real property served as a unit.

§ 39-5-105, C.R.S.

Specific information on valuation of water rights can be found in Chapter 7, Special Issues in Valuation.

Land valuation must be determined by consideration of the applicable approaches to value.

Actual value determined - when.

(5)(a) All real and personal property shall be appraised and the actual value thereof for property tax purposes determined by the assessor of the county wherein such property is located. The actual value of such property, other than agricultural lands exclusive of building improvements thereon and other than residential real property and other than producing mines and lands or leaseholds producing oil or gas, shall be that value determined by appropriate consideration of the cost approach, the market approach, and the income approach to appraisal. The assessor shall consider and document all elements of such approaches that are applicable prior to a determination of actual value.

§ 39-1-103, C.R.S.

The need for appropriate consideration of the three approaches was also affirmed by the Colorado Supreme Court in Board of Assessment Appeals, et al., v. E.E. Sonnenberg & Sons, Inc., 797 P.2d 27 (Colo. 1990) and the Colorado Court of Appeals in Montrose Properties, LTD, et al., v. Board of Assessment Appeals et al., 738 P.2d 396 (Colo. App. 1987).

Specific information regarding the valuation of land using the three approaches to value can be found under Chapter 2, Appraisal Process, Economic Areas, and the Approaches to Value.

The valuation of certain specific subclasses of land is covered in the statutes.

Actual value determined - when.

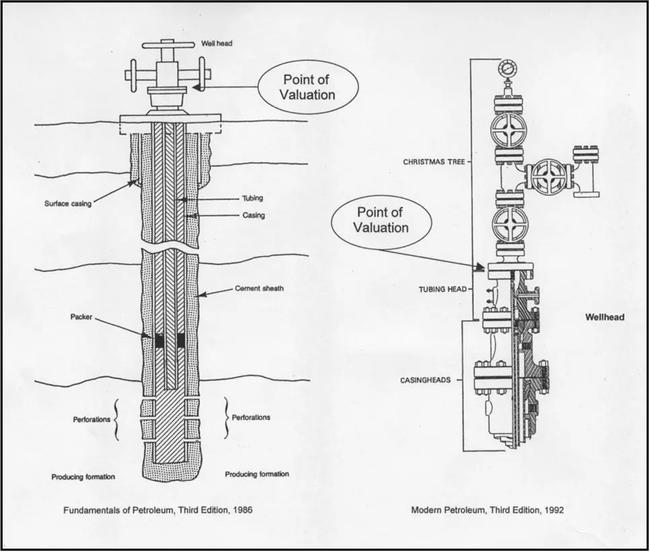

(5)(a)The actual value of agricultural lands, exclusive of building improvements thereon, shall be determined by consideration of the earning or productive capacity of such lands during a reasonable period of time, capitalized at a rate of thirteen percent. Land that is valued as agricultural and that becomes subject to a perpetual conservation easement shall continue to be valued as agricultural notwithstanding its dedication for conservation purposes; except that, if any portion of such land is actually used for nonagricultural commercial or nonagricultural residential purposes, that portion shall be valued according to such use. Nothing in this subsection (5) shall be construed to require or permit the reclassification of agricultural land or improvements, including residential property, due solely to subjecting the land to a perpetual conservation easement. The actual value of residential real property shall be determined solely by consideration of the market approach to appraisal. A gross rent multiplier may be considered as a unit of comparison within the market approach to appraisal. The valuation for assessment of producing mines and of lands or leaseholds producing oil or gas shall be determined pursuant to articles 6 and 7 of this title.

§ 39-1-103, C.R.S.

Specific procedures for the valuation of agricultural lands may be found in Chapter 5, Valuation of Agricultural Land. Specific procedures for the valuation of producing mines and oil and gas leaseholds and lands may be found in Chapter 6, Valuation of Natural Resources.

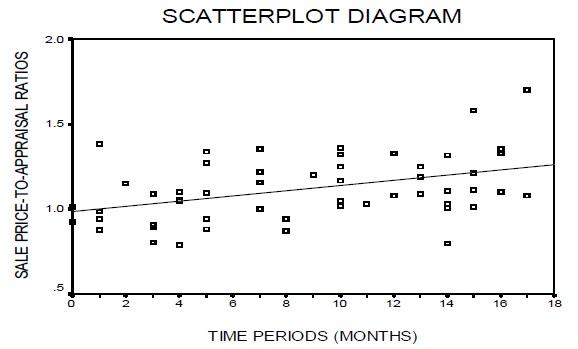

Vacant land values, as well as improved real property values, must reflect the appropriate level of value as stated in the following statute:

Valuation for assessment.

(10.2)(a) Except as otherwise provided in subsection (12) of this section, beginning with the property tax year which commences January 1, 1989, a reassessment cycle shall be instituted with each cycle consisting of two full calendar years. At the beginning of each reassessment cycle, the level of value to be used during the reassessment cycle in the determination of actual value of real property in any county of the state as reflected in the abstract of assessment for each year in the reassessment cycle shall advance by two years over what was used in the previous reassessment cycle; except that the level of value to be used for the years 1989 and 1990 shall be the level of value for the period of one and one-half years immediately prior to July 1, 1988; except that, if comparable valuation data is not available from such one-and-one-half-year period to adequately determine the level of value for a class of property, the period of five years immediately prior to July 1, 1988, shall be utilized to determine the level of value. Said level of value shall be adjusted to the final day of the data gathering period.

(d) For the purposes of this article and article 9 of this title, "level of value" means the actual value of taxable real property as ascertained by the applicable factors enumerated in section 39-1-103(5) for the one-and-one-half-year period immediately prior to July 1 immediately preceding the assessment date for which the administrator is required by this article to publish manuals and associated data. Beginning with the property tax year commencing January 1,1999, if comparable valuation data is not available from such one-and-one-half year period to adequately determine such actual value for a class of property, "level of value" means the actual value of taxable real property as ascertained by said applicable actors for such one-and-one-half-year period, the six-month period immediately preceding such one-and-one-half-year period, and as many preceding six-month periods within the five-year period immediately prior to July 1 immediately preceding the assessment date as are necessary to obtain adequate comparable valuation data. Said level of value shall be adjusted to the final day of the data-gathering period.

§ 39-1-104, C.R.S.

This statute and current Division policy require assessors to gather all sales and confirm all qualified sales within the eighteen months through June 30 of the year prior to the year of change in level of value.

If a statistically sound sales sample cannot be obtained within the eighteen-month data collection period, sales can be collected in six-month periods for up to sixty months to acquire adequate comparable valuation data, pursuant to § 39-1-104(10.2)(d), C.R.S.

All qualified sales are to be confirmed. In all cases, sales must be time adjusted to the end of the data collection period. For additional information about time adjustment of sales, refer to Chapter 2, Appraisal Process, Economic Areas, and the Approaches to Value. For additional information about sales collection, confirmation and stratification, refer to Chapter 3, Sales Confirmation and Stratification.

Land values may be changed in intervening years between reappraisal periods when certain "unusual conditions" exist.

Valuation for assessment.

(11)(b)(I) The provisions of subsection (10.2) of this section are not intended to prevent the assessor from taking into account, in determining actual value for the years which intervene between changes in the level of value, any unusual conditions in or related to any real property which would result in an increase or decrease in actual value. If any real property has not been assessed at its correct level of value, the assessor shall revalue such property for the intervening year so that the actual value of such property will be its correct level of value; however, the assessor shall not revalue such property above or below its correct level of value except as necessary to reflect the increase or decrease in actual value attributable to an unusual condition. For the purposes of this paragraph (b) and except as otherwise provided in this paragraph (b), an unusual condition which could result in an increase or decrease in actual value is limited to the installation of an on-site improvement, the ending of the economic life of an improvement with only salvage value remaining, the addition to or remodeling of a structure, a change of use of the land, the creation of a condominium ownership of real property as recognized in the "Condominium Ownership Act", article 33 of title 38, C.R.S., any new regulations restricting or increasing the use of the land, or a combination thereof, the installation and operation of surface equipment relating to oil and gas wells on agricultural land, any detrimental acts of nature, and any damage due to accident, vandalism, fire, or explosion. When taking into account such unusual conditions which would increase or decrease the actual value of a property, the assessor must relate such changes to the level of value as if the conditions had existed at that time.

(II) The creation of a condominium ownership of real property by the conversion of an existing structure shall be taken into account as an unusual condition as provided for in subparagraph (I) of this paragraph (b) by the assessor, when at least fifty-one percent of the condominium units, as defined in section 38-33-103(1), C.R.S., in a multiunit property subject to condominium ownership have been sold and conveyed to bona fide purchasers and deeds have been recorded therefore.

§ 39-1-104, C.R.S.

Under § 39-1-104(11)(b)(I), C.R.S., any real property that has not been valued at the correct level of value must be revalued to the correct level of value. Additionally, revaluation is mandatory for all properties in intervening assessment years when specific unusual conditions occur.

Correct level of value is defined as the actual value, as determined by consideration of the appropriate approaches to value:

- For any property class or subclass; or,

- For any significant property stratification, e.g., economic area, design type, construction quality, age range, etc.

Assessors need to identify all significant stratifications that are representative of property locations, age ranges, and architectural types found within the county. At a minimum, sales should be stratified and sales ratios analyzed by economic area.

Colorado case law dictates that only those unusual conditions listed within § 39-1-104(11)(b)(I), C.R.S., can be considered by the assessor. Unusual conditions that are most applicable to land are as follows:

- The installation of an on-site improvement.

- The ending of the economic life of an improvement with only salvage value remaining.

- The addition to or remodeling of a structure.

- A change in use of the land.

- The creation of a condominium ownership of real property by the conversion of an existing structure shall be considered an unusual condition when at least 51 percent of the condominium units have been sold and the deeds recorded.

- Any new regulations that increase or decrease the use of the land, or a combination of both.

- The installation and operation of surface equipment relating to oil and gas wells on agricultural land.

- Any detrimental acts of nature.

- Any damage due to accident, vandalism, fire or explosion.

Change of use of the land is any change that would affect the classification and valuation of a parcel of land. An example of change of use would be conversion of land from agricultural use to a residential site. Another example would be removal of an existing residential structure and replacement with a commercial or industrial structure.

Creation of a condominium ownership will create a common interest community ownership of associated land underlying and surrounding it along with real property common elements if certain criteria are met. Any land included on the condominium declaration is included as part of the specified interest in all real property common elements. The value of common elements are included in the market value of each condo unit, as required by § 38-33.3-105(2), C.R.S., and shall not be separately assessed. Listing of the land value can be accomplished by apportioning common elements value, including land value, to each unit based upon that unit's interest in the common elements as specified in the condominium declaration.

Care must be taken to reduce market value by this apportioned amount so that improvements are separately listed and the common elements are not valued twice. Refer to Chapter 7, Special Issues in Valuation, for more information on common interest communities.

Examples of new regulations increasing or decreasing the use of the land would be changes in zoning; creation of, or changes in, comprehensive land use policies; creation of land set-aside requirements for open space; creation of new flood zones; or any other governmental acts that would affect the ultimate use or disposition of a parcel of land.

Detrimental acts of nature would include forest fires, landslides, immediate erosion problems, or other natural occurrences that would diminish the use or availability of a parcel of land.

Under §39-1-123, C.R.S., real and business personal property that is determined by the county assessor to have been destroyed by a natural cause, as defined in §39-1-102(8.4), may be eligible for a reimbursement of property tax liability for the year in which the natural cause occurred. Please refer to Assessors’ Reference Library, Administrative and Assessment Procedures, Volume 2, Chapter 4, Assessment Math, for procedures regarding this reimbursement.

Intervening year revaluation of properties that have been affected by unusual conditions is required. Failure to make necessary revaluations is contrary to the intent of the statute.

In Leavell-Rio Grande, et al., v. Board of Assessment Appeals, et al., 753 P.2d 797 (Colo. App. 1988), the Colorado Court of Appeals ruled that § 39-1-104(11)(b)(I), C.R.S., sets forth an "exclusive and restrictive set of unusual conditions" that the assessors must use in revaluing property during intervening years. If the condition causing a change in value of a property is not specifically listed in this statute, the property cannot be revalued until the next reappraisal year.

The court also upheld the right of the assessor to correct the valuation of an incorrectly valued property during an intervening year. The right of the assessor to correct a valuation is also supported by § 39-1-103(15), C.R.S. However, the assessor must have specific evidence that the original base period valuation is incorrect before adjusting the value. This was affirmed in Thibodeau v. Denver County Board of Commissioners, 428 P.3d 706 (Colo. App. 2018).

In LaDuke, et al., v. C.F. & I. Steel Corporation, 785 P.2d 605 (Colo. 1990), the Colorado Supreme Court ruled that a partial permanent shut-down of an industrial plant did not constitute a change of use of the land.

Assessors are required by § 39-1-103(15), C.R.S., to develop evidence that a value should be changed before adjusting the value for an intervening assessment year.

Actual value determined when.

(15) The general assembly hereby finds and declares that assessing officers shall give appropriate consideration to the cost approach, market approach, and income approach to appraisal as required by section 3 of article X of the state constitution in determining the actual value of taxable property. In the absence of evidence shown by the assessing officer that the use of the cost approach, market approach, and income approach to appraisal requires the modification of the actual value of taxable property for the first year of a reassessment cycle in order to result in uniform and just and equal valuation for the second year of a reassessment cycle, the assessing officer shall consider the actual value of any taxable property for the first year of a reassessment cycle, as may have been adjusted as a result of protests and appeals, if any, prior to the assessment date of the second year of a reassessment cycle, to be the actual value of such taxable property for the second year of a reassessment cycle.

§ 39-1-103, C.R.S.

This statute precludes the assessor, without specific evidence of justification, from changing a property's value for the intervening assessment year. The burden of justification is on the assessor to develop or obtain this evidence prior to changing the value for the intervening assessment year.

In Lowe Denver Hotel Association v. Arapahoe County Board of Equalization, 890 P.2d 257 (Colo. App. 1995) the Colorado Court of Appeals ruled that assessors may make “corrective” intervening year revaluation only when the assessor’s original base period valuation for the first year of reassessment cycle is subsequently asserted to be incorrect and, therefore, in need of correction (emphasis added).

The assessor is prohibited by § 39-1-103(5)(c), C.R.S., from changing a property's classification unless the actual use changes or the assessor discovers the classification is erroneous.

Actual value determined when.

(5)(c) Except as provided in section 39-1-102(14.4)(b) or 39-1-102(14.4)(c) and in subsections (5)(e) and (5)(f) of this section, once any property is classified for property tax purposes, it shall remain so classified until such time as its actual use changes or the assessor discovers that the classification is erroneous. The property owner shall endeavor to comply with the reasonable requests of the assessor to supply information which cannot be ascertained independently but which is necessary to determine actual use and properly classify the property when the assessor has evidence that there has been a change in the use of the property. Failure to supply such information shall not be the sole reason for reclassifying the property. Any such request for such information shall be accompanied by a notice that states that failure on the part of the property owner to supply such information will not be used as the sole reason for reclassifying the property in question. Subject to the availability of funds under the assessor's budget for such purpose, no later than May 1 of each year, the assessor shall inform each person whose property has been reclassified from agricultural land to any other classification of property of the reasons for such reclassification including, but not limited to, the basis for the determination that the actual use of the property has changed or that the classification of such property is erroneous.

§ 39-1-103, C.R.S.

The assessor has the burden of justification to prove that a property's classification has changed or that the current classification is erroneous.

Assessors may request information from the taxpayer regarding the property's use, but failure by the taxpayer to provide this information shall not be the sole reason for changing the property's classification. The taxpayer must be advised of this in writing when additional information regarding property use is requested that could affect the property's classification.

The assessment rate to be applied to different subclasses of land is set forth in the Colorado Constitution.

Uniform taxation - exemptions.

(1)(b) Residential real property, which shall include all residential dwelling units and the land, as defined by law, on which such units are located, and mobile home parks, but shall not include hotels and motels, shall be valued for assessment. All other taxable property shall be valued for assessment. The valuation for assessment for producing mines, as defined by law, and lands or leaseholds producing oil or gas, as defined by law, shall be a portion of the actual annual or actual average annual production therefrom, based upon the value of the unprocessed material, according to procedures prescribed by law for different types of minerals. Non-producing unpatented mining claims, which are possessory interests in real property by virtue of leases from the United States of America, shall be exempt from property taxation.

Colo. Constitution article X, § 3

Specific information about assessment rates can be found in ARL Volume 2, Administrative and Assessment Procedures, Chapter 4, Assessment Math.

The Colorado Enabling Act, passed by the United States Congress to allow the people of the Colorado Territory to form a state, mandates that no bias, involving the assessment and taxation of land, exists between Colorado resident landowners and nonresident landowners.

Constitutional convention – requirements of constitution.

"[A]nd that the lands belonging to citizens of the United States residing without said state shall never be taxed higher than the lands belonging to residents thereof, and that no taxes shall be imposed by the state on lands or property therein belonging to, or which may hereafter be purchased by the United States."

Enabling Act to Colo. Constitution, § 4

Colorado Constitution, Article X, Section 20

Section 20(8)(c) of article X of the Colorado Constitution states, in part, "Actual value shall be stated on all property tax bills and valuation notices and, for residential real property, determined solely by the market approach to appraisal."

The market approach to appraisal is not defined in the statutes beyond being included as one of the three approaches to appraisal in article 1 of title 39, C.R.S., and being described in § 39-1-103(8), C.R.S., as follows in part.

Actual value determined - when.

(8) In any case in which sales prices of comparable properties within any class or subclass are utilized when considering the market approach to appraisal in the determination of actual value of any taxable property, the following limitations and conditions shall apply:

(a)(I) Use of the market approach shall require a representative body of sales, including sales by a lender or government, sufficient to set a pattern, and appraisals shall reflect due consideration of the degree of comparability of sales, including the extent of similarities and dissimilarities among properties that are compared for assessment purposes. In order to obtain a reasonable sample and to reduce sudden price changes or fluctuations, all sales shall be included in the sample that reasonably reflect a true or typical sales price during the period specified in section 39-1-104(10.2). Sales of personal property exempt pursuant to the provisions of sections 39-3-102, 39-3-103, and 39-3-119 to 39-3-122 shall not be included in any such sample.

§ 39-1-103, C.R.S.

Residential Market Appraisal Models

All residential appraisal models must be adjusted so they produce actual values consistent with those found in the market, as adjusted for time, for the selected data collection period. An appraisal model may be defined as a mathematical equation that produces estimates of property value based upon the decisions of individual buyers and sellers. To accomplish this model adjustment one of the following will occur:

- Square foot or other market unit of comparison analysis will be performed.

- Direct sales comparisons, with sales adjustments determined from market analysis, will be made.

- Extraction or allocation of land values from an overall value will be used.

- All sales from a selected data collection period will be used in determining market value for all properties within the residential class or a sub-class.

- A statistically representative sample of sales from a selected data collection period will be used in determining market value for all properties within a particular class or subclass.

- Market based and statistically representative valuation models will be used in the valuation of residential properties.

- A combination of these techniques will be employed.

County assessors shall prepare documentation each year concerning the measures that have been taken to adjust their residential appraisal models to the market using appropriate sales data.

Special Purpose Residential Properties

Special purpose residential properties are to be appraised using market based valuation models and techniques as described above. Examples of special purpose properties include mansions and custom built homes, nursing homes, senior citizen housing and dwellings with atypical architectural forms.

In the event that there are insufficient residential sales within a county for a particular subclass of residential property or for a type of special purpose residential property within the entire five year data collection period, the county may use comparable sales which have been collected and qualified by neighboring counties or may combine these properties with the most similar class or sub-class where sufficient sales do exist.

While most exempt property is to be valued using the cost, market, or income approaches, as applicable, the valuation of residential property which is exempt or partially exempt must be market based to conform with § 20 of article X of the Colorado Constitution. This is true for both taxable values and exempt values used in the calculation of revenue exemptions due to growth. However, since there typically are few sales of residential exempt properties, these properties are to be valued as special purpose properties.

Partially Constructed Residential Improvements

The percentage of completion of partially constructed residential improvements should be determined, as of the assessment date, within the framework of the following procedures developed by the Division. The percentages should be applied to the improvement portion of a fully constructed comparable property sale price. This comparable sale price should be adjusted for material differences between the sold property's characteristics and the characteristics of the partially constructed subject property at its completion.

The following guidelines should be employed by the county assessors in determining percentages of completion for residential improvements. If all of the description of a percentage category has not been completed as of the assessment date, the lower percentage category where all of the description is complete should be used. To achieve consistency across the state the county should use 25 percent or 50 percent instead of 30 percent or 46 percent. For additional direction on how to handle changes to classification from vacant to improved, refer to the “Partially Completed Structures” section of ARL Volume 2, Administrative and Assessment Procedures, Chapter 6, Property Classification Guidelines and Assessment Percentages. Deviation from these guidelines should be documented and defensible.

| Percent Complete | Description |

|---|---|

| 10 percent | Excavation, footing work, and foundation completed. |

| 25 percent | Exterior wall framing for all floors erected, utilities extended from main service to structure. |

| 50 percent | Rough framing, plumbing, electrical, and mechanical complete. |

| 75 percent | Partial interior finishes including dry wall, finish carpentry, cabinetry, and painting in progress. |

| 100 percent | Only final interior finish including plumbing and lighting fixture installation, floor coverings, and touchup remaining. |

If situations typically exist within a county which cause the above urban percentage descriptions not to be applicable, e.g., summer residences without electricity or plumbing, the county may establish descriptions of percentage completion which are more appropriate to these situations. However, the situations and their applicable descriptions must be documented and should be associated with the percentages shown above.

The following examples illustrate the proper use of these percentages.

Example:

In a subdivision under development there are four basic floor plans, Models A, B, C, and D, and several optional features available for each of the floor plans. On the assessment date, there are several units of each of the models completed and sold and also several of each in various stages of completion.

A basic Model A, without options and including land value, sells for a typical market price of $250,000. The options for this model include the following.

Air conditioning $4,000

Gas fireplace $3,500

One Model A under construction was inspected on the assessment date and found to have rough framing, plumbing, and mechanical complete. Since electrical rough-in was not complete, the 25 percent category was selected. Additionally it was determined that, when complete, this Model A would have air conditioning and a gas fire place, therefore adjustments to the base sales price are needed before the percentage is applied.

| Basic Model A sale price | $250,000 |

|---|---|

| Subtract land | -50,000 |

| Model A building only | 200,000 |

| Add for air conditioning | 4,000 |

| Add for gas fireplace | 3,500 |

| Total | $207,500 |

| Percentage category | x 25% |

| Partially completed actual value | $51,875 |

| Add back land value | 50,000 |

| Total actual value | $101,875 |

Example:

In an older neighborhood beginning revitalization, a small house was razed to allow construction of a newer dwelling with 2,000 square feet of living area. This is the first new dwelling being constructed in the neighborhood in ten years. The most comparable market sales are from a competing neighborhood of new homes. These sales indicate a time adjusted sale price per square foot of living area in the $95 to $105 range (not including land value). These properties do not include amenities that are partially completed such as two car garages, air conditioning, and a gas fireplace. Market analysis of properties, comparable to the partially constructed dwelling in other neighborhoods, indicates two car garages add approximately $10,000, air conditioning adds $4,000, and a gas fireplace adds $3,500 to a dwelling's value.

The partially constructed dwelling has partial interior finishes including dry wall, finish carpentry, cabinetry, and painting in progress and therefore qualifies for the 75 percent complete category.

| Sq. ft. completed dwelling | 2,000 |

|---|---|

| Comparable price per sq. ft. imps. | x $100 |

| Base actual value | $200,000 |

| Add for two car garage | 10,000 |

| Add for air conditioning | 4,000 |

| Add for gas fireplace | 3,500 |

| Total actual value | $217,500 |

| Percentage category | x 75% |

| Partially completed actual value | $163,125 |

| Add for land value | 50,000 |

| Total actual value | $213,125 |

All such partially completed properties should be flagged for analysis as to completion on the following assessment date.

Mixed-Use Residential Properties

The valuation of mixed-use properties, which include an improvement used as a residential dwelling unit, is outlined in §39-1-103(9)(a) and (b), C.R.S. The actual value of the residential portion of the improvement must be determined using only the market approach to value, §39-1-103(5)(a), C.R.S. Assessors may assign value to the residential portion of the improvement using market values per square foot of living areas found in residential properties most similar to the residential use. Consideration of the appropriate approaches to value must be applied to the non-residential portion. Land classification is allocated in proportion to the allocation of the improvement value.

Defense of Values

Section 20(8)(c) of article X of the Colorado Constitution states, in part, "Regardless of assessment frequency, valuation notices shall be mailed annually, and may be appealed annually, with no presumption in favor of any pending valuation." Since this sentence removes the presumption of correctness formerly associated with the county assessors' values, each assessor must prepare sufficient documentation to successfully defend actual values established for residential and other types of property at the CBOE or higher levels of appeal.

Past or Future Sales

Section 20(8)(c) of article X of the Colorado Constitution states, in part, "Past or future sales by a lender or government shall be considered as comparable market sales and their sales prices kept as public records."

This means that all such sales will be considered within their appropriate data gathering periods. Past sales considered shall not include sales more than 60 months old when compared to the valuation date for the current data collection period.

All government and lender sales must be considered. The same sales confirmation process applies to both public and private sales.

Therefore, Housing and Urban Development (HUD) sales or other sales by a government or lending institution cannot be disqualified merely because they are lender or government sales. All sales of real property by a government or lending institution shall be included on the Master Transaction List regardless of whether or not documentary fees for these transactions were paid to the county clerk. Such sales may be disqualified from further analysis only if the properties were sold to another lending institution or government or if the sales do not qualify as arm's-length transactions for reasons applied to other types of sales.

HUD and Veterans Administration (VA) properties may show low sales prices if they are sold "as is" since they may not be subject to remodeling or rehabilitation after HUD or VA has acquired the property. Lending institution owned properties typically are repaired before they are listed for sale. In either case, however, by the time the sale is confirmed, new owners may have remodeled or rehabilitated their property. To avoid a situation where such changes are associated with the sale price, it is important that an interior and exterior inspection of the property be made as close to the date of sale as possible.

Contracts for sale shall not be included as qualified sales unless the transaction is completed, but not necessarily formally closed, during the selected data collection period, as required in Platinum Properties Corporation, et al., v. Board of Assessment Appeals, et al., 738 P.2d 34 (Colo. App. 1987), and the sale qualifies as an arm’s-length transaction. However, if the terms and conditions of the original agreement have been consummated, as evidenced by a deed, at some time prior to a review, appeal, or abatement hearing, the transaction is to be considered as valid, but is to carry no more or less weight than any other sale.

Example:

A HUD sale occurs in the selected data collection period and, due to a declining market and the large number of such sales, the assessor is unable to inspect the property immediately after the sale. This sale must be added to the county's Master Transaction List. Several months after the sale, an appraiser inspects the property and discovers a great deal of remodeling has been completed by the new owner since the sale. This sale is disqualified due to reason code 68 - Sale involves property that has undergone extensive remodeling or building of additional improvements after its sale but before its physical inspection. The sale is placed on the "Out" (disqualified) List.

The Appraisal Process and Land Valuation

Land should be valued by incorporating the steps of the appraisal process. In this way, all sources of appraisal information will have been explored and the final estimate of value will reflect a justifiable and defensible conclusion based on this appraisal information.

The steps in the appraisal process are as follows:

- Definition of the problem

- Preliminary survey and planning

- Data collection and analysis

- Application of the approaches to value

- Reconciliation of value estimates

- Final estimate of value

Definition of the Problem

Beginning the land valuation process requires that the appraiser define the problem, the solution to which is the objective of the appraisal. In defining the problem, the appraiser needs to determine the following, prior to beginning the appraisal:

- Identification of the subject property or properties

- Property rights involved

- Date of appraisal and assessment date and level of value

- Purpose and function of the appraisal

- Definition of value

Identification of the Subject Property

Identification of the property can be provided by a street address, legal description or parcel identification number. Additional information about property identification may be found in ARL Volume 2, Administrative and Assessment Procedures, Chapter 13, Land Identification and Real Property Descriptions, and Chapter 14, Assessment Mapping and Parcel Identification.

Property Rights Involved

Colorado statute § 39-1-103(5)(a), C.R.S., requires that the fee simple estate be valued for property tax purposes. This requirement is confirmed by § 39-1-106, C.R.S., - the Unit Assessment Rule. Market value of the fee simple estate should reflect market assumptions, including market rent, market expenses, and market occupancy. For most real property interests, Colorado assessors are required by §§ 39-1-106 and 39-5-102(1), C.R.S., to assess land to the owner of record. The appraiser should be aware that fractional ownership interests in land may exist and those interests should be identified during the definition of the problem step in the appraisal process.

Possessory interests in exempt land may exist. Refer to Chapter 7, Special Issues in Valuation, under Assessment of Possessory Interest, for classification and valuation procedures for possessory interests.

Date of Appraisal and Assessment Date

The date of appraisal is June 30 of the year preceding the year of general reappraisal. All applicable approaches to appraisal must be trended or adjusted to this date.

Colorado statute § 39-1-105, C.R.S., provides that the date of assessment is to be January 1 each year and that all property is to be listed as it exists in the county where it is located on the assessment date.

To distinguish between the two dates, the assessment date refers to the date upon which property situs (location), taxable status, and the property's physical characteristics are established for that assessment year, while the appraisal date refers to the date upon which the valuation of the property is based or otherwise adjusted or trended.

For additional information on the appraisal date and the data collection period, please refer to Chapter 3, Sales Confirmation and Stratification.

Purpose and Function of the Appraisal

The purpose of the land appraisal is to estimate value. The function of the land appraisal refers to the reason that the appraisal was created, i.e., as a basis for property taxation.

Definition of Value

Other than very generally in §§ 39-1-103(5)(a) and 104(10.2)(d), C.R.S., Colorado statutes do not provide a specific definition of actual value. However, there are a number of Colorado court cases that mention actual value and market value. In Fellows v. Grand Junction Sugar Co., 78 Colo. 393, 242 P. 635 (1925), the court concluded that "In determining ‘fair value’ or ‘actual value’, market value is usually taken as the measure, because it is most likely to be just and least difficult of ascertainment." Other Colorado cases such as Colorado & Utah Coal Co. v. Rorex, 149 Colo. 502, 369 P.2d 796 (1962) and May Stores Shopping Centers, Inc. v. Shoemaker, 151 Colo. 100, 376 P.2d 679 (1962) mention market value and attempt to define it.

The definition of market value developed by the Appraisal Institute is based on California case law: Sacramento Southern R.R. Co. v. Heilbron, 156 Cal. 408, 104 P. 979 (1909).

The Appraisal Institute market value definition derived from the above case is as follows:

"The most probable price, as of a specified date, in cash, or in terms equivalent to cash, or in other precisely revealed terms, for which the specified property rights should sell after reasonable exposure in a competitive market under all conditions requisite to a fair sale, with the buyer and seller each acting prudently, knowledgeably, and for self-interest, and assuming that neither is under undue duress."

Preliminary Survey and Planning

After definition of the appraisal problem, the appraiser must begin development of a plan for the appraisal. In developing the plan, an analysis of property uses must be completed.

There are basically two steps in preliminary survey and planning:

- Determination of the use of the property and an analysis of how actual use of the property relates to its highest and best use

- Development of the plan for the appraisal

Use Determination and Highest and Best Use

In developing a good land valuation program, the assessor must correctly classify land. The primary criterion for classification is the actual use of the land on the assessment date. When actual use cannot be determined through physical inspection, the property owner should be contacted. The assessor may also consider such things as zoning or use restrictions, historical use, or consistent use, in determining land use. When unable to determine actual use, the assessor may consider the land’s most probable use, as of the assessment date, based on the best information available.

Proper classification is also very important for abstract purposes. To ensure that each parcel has the proper coding, and for classification descriptions, refer to ARL Volume 2, Administrative and Assessment Procedures, Chapter 6, Property Classification Guidelines and Assessment Percentages. After reviewing the instructions and codes, land appraisers should enter the county's appropriate classification and subclassification code on each parcel's property record.

Proper land classification is essential in order to establish how the property is to be valued. Classification, based on actual use, should not be confused with determining value. Colorado statutes require that certain types of land be valued using variations on, or elimination of, one or more of the three approaches, i.e., the cost, market, or income approach, to value. Examples of this requirement would be in the valuation of residential improved land, agricultural land, oil and gas leaseholds and lands, and producing mines. Unless otherwise directed by law, the three approaches to value should be considered.

Valuation for ad valorem property taxation should be based on a property’s highest and best use. The requirement of valuing property at its highest and best use was affirmed by the Colorado Supreme Court in Board of Assessment Appeals, et al, v. Colorado Arlberg Club, 762 P.2d 146 (Colo. 1988). In that case the court concluded that “reasonable future use is relevant to a property’s current market value for tax assessment purposes.” The court further noted “our statute does not preclude consideration of future uses” and it quoted the American Institute of Real Estate Appraisers, referencing The Appraisal of Real Estate 33, 1983, 8th Edition, “In the market, the current value of a property is…based on what market participants perceive to be the future benefits of acquisition.” Reasonable future use is based on the actions and expectations of the market, and is consistent with the highest and best use concept that requires use to be physically possible, legally permissible, financially feasible, and maximally productive.

Economic Unit Analysis (AKA, Tie-Back Parcels)

Colorado Statute 39-5-104, titled Valuation of Property, states that “When a single structure, used for a single purpose, is located on more than one town or city lot, the entire land area shall be appraised and valued as a single property.” Also, the statute requires that these parcels are under the same ownership and are adjoining. This statute applies the economic unit concept as explained in the Dictionary of Real Estate Appraisal, 7th ed.: “A combination of parcels in which land and improvements are used for mutual economic benefit.” The Dictionary also notes that “identification of economic units is essential in highest and best use analysis.” A highest and best use analysis is the foundation of all appraisal and is the first step in identifying an economic unit. The Highest and Best Use analysis will answer the question whether an out parcel is part of the economic unit or instead is excess or surplus land. If it is determined that an out parcel is excess or surplus land, then it should be valued separate from the economic unit. On the other hand, if the out parcel is determined to be part of the economic unit, then its value is included as part of that unit. The overarching concept here is that these properties are valued as a unit rather than as the sum of the individual parcels that make up the economic unit. However for ad valorem appraisal a separate value must be assigned to each parcel that makes up the economic unit. Guidance from the Dictionary is only that each parcel must make a positive economic contribution to the unit. For fee appraisal this distinction is typically not an issue as the appraiser’s assignment is to value the economic unit. A common example of this situation is shopping centers that include out parcels that provide access or the required parking to meet market standards. (These out parcels are often referred to as tie-back parcels.) In this situation the market value of the shopping center, the economic unit, is established by consideration of the three approaches to value. Although most of this value is with the parent parcel, value must be assigned to each out parcel. A corresponding reduction must be made to the total market value of the center as reflected in the parent parcel, so that the economic unit is not overvalued.

Development of an Appraisal Plan

Development of a plan, especially when undertaking a mass appraisal of land, is essential in order to use available resources at maximum efficiency. Planning for an appraisal involves the following:

- Consider, determine, and document which approaches to value will be most appropriate.

In considering, determining, and documenting which valuation approach or approaches should be used, Colorado case law should be referenced.

Montrose Properties, LTD., et al., v. Colorado Board of Assessment Appeals, et al., 738 P.2d 396 (Colo. App. 1987) affirms § 39-1-103(5)(a), C.R.S., and defines the assessor's "appropriate consideration" of all required approaches to value. The court concluded that "appropriate consideration" was used by an assessor when the assessor decided that insufficient information precluded the use and calculation of one or more of the required approaches. The court reasoned appropriate consideration was used in determining the approach(es) that were not applicable. The need for appropriate consideration of the three approaches was affirmed by the Colorado Supreme Court in Board of Assessment Appeals, et al., v. Sonnenberg, 797 P.2d 27 (Colo. 1990).

Transamerica Realty Corporation v. Clifton, et al., 817 P.2d 1049 (Colo. App. 1991) requires the assessor to provide evidence to support adequate documentation of the values established for all applicable approaches to appraisal. Insufficient time is not a reasonable excuse for failure to consider the applicable approaches to appraisal.

These requirements have considerable current impact due to § 20 of article X of the Colorado Constitution removing the presumption of correctness from the assessor's values. Beginning January 1, 1993, valuation issues shall be decided based on the preponderance of the evidence.

- Determine what type of appraisal data must be gathered and what data sources are available.

- Determine resource requirements and allocate existing resources in a manner to complete a quality appraisal.

- Estimate the budget cost for the appraisal. If budgets have been previously set and additional funds are not available, the appraisal plan must be redrawn to fit into existing budget constraints.

Specific information on development of an appraisal plan may be found in ARL Volume 2, Administrative and Assessment Procedures, Chapter 2, Assessment Operations.

Data Collection and Analysis

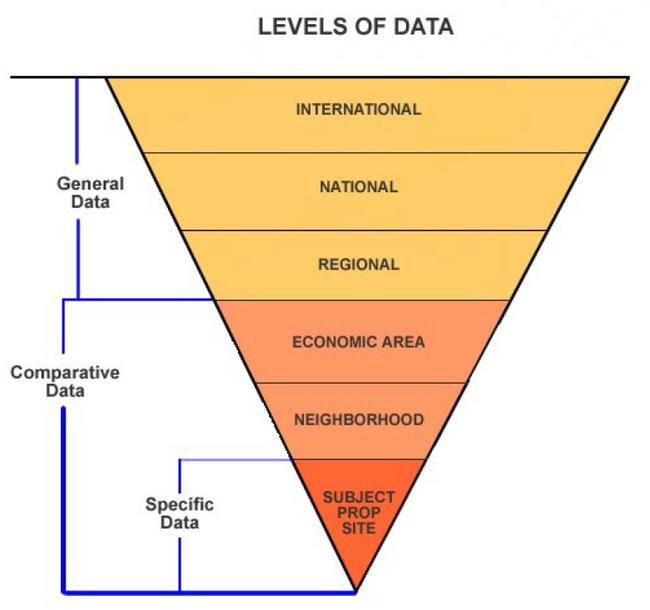

Appraisal data that will be collected and analyzed will fall into one of three categories:

- General

- Specific

- Comparative

General data is an overall category that pertains to information about the four forces (physical, economic, governmental and social) originating outside a subject property and those forces' influence on that property's value. General data provides a background basis for analysis of international, national, and regional trends that affect value.

Examples of general data would be U.S. Census publications, U.S. Labor Department employment statistics, and Colorado Division of Housing information on construction costs and housing starts.

Specific data pertains primarily to information about the site. Examples of specific data would be title and recorded information such as legal description, special assessments, zoning, easements, other public restrictions, and physical information about the site.

Comparative data consists of cost, sales, and income information on individual properties. When properly screened and confirmed, comparative data is used directly in the cost, market, and income approaches to valuing the subject property.

Examples of comparative data are vacant land sales collected within the statutory data collection period as stated in § 39-1-104(10.2), C.R.S., development costs for comparable subdivisions, and economic rental rates.

Refer to the following diagram for a graphic representation of how general, specific, and comparative data are collected for various geographic areas.

Survey of Appraisal Information Sources

Data sources of appraisal information may be divided into two categories.

- Public records

- Private sources

The major sources of public records are found in the county courthouse.

The local county clerk is a source of information on the following:

- Documentary fee information for land sales

- "Real Property Transfer Declarations" (Form TD-1000) for deeds requiring documentary fees and recorded after July 1, 1989. “Manufactured Home Transfer Declarations" for titled manufactured homes that are conveyed after July 1, 2009. These are confidential

- Copies of recorded leases

- Land descriptions from recorded plats

- Other general data about the county and cities within the county

The local planning office is a good source of information on the following:

- Zoning

- Building codes

- Traffic patterns

- Water and sewer availability

- Other important data about the property

Private sources include the following:

- A subscription to the Multiple Listing Service sold book*

- Real estate agents' records

- Publications of all types

- Media advertising

- The local Chamber of Commerce office

- Other appraisers

- Title companies

- Mortgage banks

- Property managers

- University or college studies

- Other similar sources

*Provided by the local Realtor's Association.

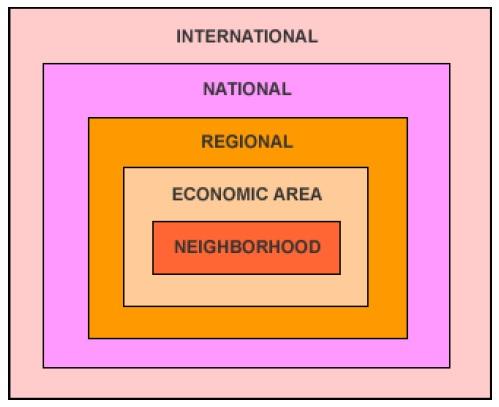

Neighborhoods and Economic Areas

The following subsections refer to the development of neighborhoods and economic areas.

Economic Base Analysis

Economic base analysis is the evaluation of the supply of products produced and services delivered in a given area and the demand for these products in the local, regional, national, and international markets.

In the context of the appraisal process, the supply of and demand for various goods and services affect the value of real estate in the smallest unit of analysis: the neighborhood.

Neighborhoods, as used in the appraisal process, are an essential part of valuing property. Neighborhoods are created through the collection, grouping, and analysis of data. The correct establishment and use of neighborhoods must be a part of every assessor's job.

Social, environmental, economic, and governmental forces directly affect the subject property within a neighborhood. In single-property appraisal, neighborhood analysis should begin with the definition of a neighborhood and proceed to the analysis and discussion of the relevant forces influencing the subject property at this level. The neighborhood boundary should be described in detail and its historical significance explained.

A neighborhood has direct and immediate effects on value. A neighborhood is defined by natural, man-made, or political boundaries and is established by a commonalty based on land uses, types and age of buildings or population, the desire for homogeneity, or similar factors.

Each neighborhood may be characterized as being in a stage of growth, stability, decline, or revitalization. The growth period is a time of development and construction. In the period of stability, or equilibrium, the forces of supply and demand are about equal. The period of decline reflects diminishing demand or desirability. During decline, general property use may change. Declining neighborhoods may become economically desirable again and experience renewal, reorganization, rebuilding, or restoration, marked by modernization and increasing demand.

The appraiser must analyze whether a particular neighborhood is in a period of growth, stability, decline, or revitalization and predict changes that will affect future use and value.

In mass appraisal applications, neighborhood information can be useful for comparing or combining neighborhoods or for developing neighborhood ratings, which are introduced as adjustments in mass appraisal models.

Byrl N. Boyce and William N. Kinard, authors of Appraising Real Property, 1984, Lexington Books, pp. 103-104 state:

The farther removed from the subject property the market level is, the less direct and immediate will be the effect of any change on the subject property and its value. Thus, international market forces (such as oil prices or the price of gold) or national market factors (such as the prime rate of interest or the purchasing power of the dollar) create general market conditions within which real estate values and prices are set and fluctuate along with other prices or values.

Further:

Regional market forces (such as area employment and construction volume) have a closer, more nearly direct, more nearly immediate impact on the value of the subject property and of properties which are competitive with it. Local or community market forces (e.g., local population, employment, incomes, and competition) are even closer to the subject property and influence its value even more directly. Closest of all is the neighborhood level, where any change tends to have a direct and immediate impact on the value of the subject property.

In looking at neighborhoods, the first matter that should be examined is the nature of the data involved. Data can be classified in various groupings. While some data crosses group boundaries, there are certain characteristics each group possesses that distinguish it from the others.

Examples:

| International Data | Oil Prices |

|---|---|

| National Data | Prime Interest Rate |

| Regional Data | Area Employment |

| Economic Area Data | Local Interest Rate |

| Neighborhood Data | Northwood Subdivision |

The first three groups, international, national, and regional, do not have a direct impact on a county level, with the exception of special purpose properties, e.g., breweries, mines, and cement plants.

Economic Areas

An economic area is a geographic area, typically encompassing a group of neighborhoods, defined on the basis that the properties within its boundaries are more or less equally subject to a set of one or more economic forces that largely determine the value of the properties in question. Economic areas can contain a neighborhood consisting of single family homes as well as a neighborhood consisting of multi-family properties as long as each neighborhood is subject to the same forces.

A neighborhood may be defined as the immediate environment of a subject property that has a direct and immediate impact on its value. The terms "work area" and "modeling area" are frequently associated with "neighborhood" and are considered synonymous.

Neighborhood boundaries should be used primarily as a tool when determining "similar values for similar properties in similar areas." The neighborhoods should then be combined into economic areas for sales ratio analysis, statistical analysis, or any other market data tests.

Neighborhood and, subsequently, economic area analyses are required because what occurs in the economic area has a direct and immediate impact on the values of the properties within it.

Additional terms frequently used in appraisal, but not considered synonymous to the term economic area are "subdivision," "filings," "absorption rate," and "approved plat." These terms are specific to other procedures such as "land use" or "vacant land present worth" and are not to be confused with economic areas.

Economic Area Analysis

An economic area exhibits a greater degree of uniformity than a larger area. Obviously, no group of inhabitants, buildings, or business enterprises can possess identical features or attributes, but an economic area is perceived to be relatively uniform. In addition, the neighborhoods that are grouped within the economic areas are equally subject to the same economic forces.

Economic area boundaries identify the physical area that influences the value of a subject property. Economic areas commonly contain properties of different use and types.

Therefore, the purpose in developing neighborhood boundaries is to evaluate a specific class or subclass of property within a larger economic area boundary. Neighborhoods are grouped into economic areas for purposes of statistical analysis.

In developing economic area boundaries the four forces that affect value need to be considered:

- Physical/Environmental

- Economic

- Governmental

- Social

The interaction of all the forces influences the value of every parcel of real estate in the market. Although the four forces are discussed separately, they work together to create, maintain, modify, or destroy value.

Physical/Environmental Force

By using maps and other geographic information, the appraiser can identify physical boundaries and where changes in these boundaries occur. By driving around a defined economic area, the appraiser can note the similarity in land use, structures, styles, and maintenance of the area.

Location is the most important factor of the physical forces and it has the greatest impact on valuation. Other physical factors that may be analyzed in developing neighborhood boundaries and, subsequently, economic areas include the following:

- Topography and soil

- Natural barriers to future development, such as rivers, mountains, and lakes

- Primary transportation systems, including federal and state highway systems, railroads, and airports

- The nature and desirability of the immediate area surrounding a property

Economic Force

Economic force considerations relate to the financial capacity of economic area occupants to rent or to own property, to maintain it in an attractive and desirable condition, and to renovate or rehabilitate it when needed.

Economic factors that determine the ability of residents or tenants to own and maintain properties in a competitive market include mortgage interest rates, income levels, and ownership and rental information. These economic factors should be listed to allow analysis of their contribution to value.

The economic characteristics of residents and the physical characteristics of individual properties, their neighborhood, and the larger economic area may indicate the relative financial strength of area occupants and how this strength is reflected in economic area development and upkeep.

Market characteristics considered in the analysis of economic forces include the following:

- Employment, wage levels, and industrial expansion

- The economic base for the region

- Community price levels

- The cost and availability of mortgage credit

- Availability of vacant and improved properties and new development under construction or being planned

- Occupancy rates

- The rental and price patterns of existing properties

- Construction costs

Governmental Force

Governmental actions and regulations also act as a force to influence the character of economic areas. Government factors should be listed and analyzed for their contribution to value. These government factors include local laws, regulations, taxes, and restrictions that affect neighborhoods and their economic areas by influencing the type of occupants that will be found in the area.

The government provides many facilities and services that influence and control land use patterns. The following should be listed and analyzed for possible contributions to value:

- Public services such as fire and police protection, utilities, refuse collection, and transportation networks

- Local zoning, building codes, and health codes, especially those that obstruct or support land use

- National, state, and local fiscal policies

- Special legislation that influences general property values, e.g., rent control laws, restrictions on forms of ownership such as condominiums and timeshare arrangements, homestead exemption laws, environmental legislation regulating new developments, and legislation affecting the types of loans, loan terms, and investment powers of mortgage lending institutions

- Tax burdens relative to the services provided, and special assessments

Social Force

The social force is exerted primarily through social attitudes and demographics (population characteristics) including changes in total population, the rate of family formations and dissolutions, and age distributions. An economic area's character and real property values are strongly influenced by the residents who live and work there.

Social factors are closely tied to the life cycles of neighborhoods and their economic areas. People are attracted to certain economic areas by life style, services available, price range, and convenience.

According to The Appraisal of Real Estate, 2013, 14th Edition, Appraisal Institute, page 167 (Paraphrased):

The important social characteristics that the market considers in neighborhood analysis

include:

- Population density, particularly important in commercial neighborhoods

- Occupant skill levels, particularly important in industrial or high-technology districts

- Occupant age levels, particularly important in residential neighborhoods

- Household size

- Occupant employment status, including types of unemployment

- Extent or absence of crime

- Extent or absence of litter

- Quality and availability of educational, medical, social, recreational, cultural, and commercial services

- Community or neighborhood organizations, e.g., improvement associations, block clubs, crime watch groups

Development of Economic Areas

Differences in economic area desirability often coincide with natural barriers, major streets, subdivision lines, and housing style. These differences are usually reflected in the price of land, trends in property values, and the prices for which houses of seemingly comparable physical characteristics tend to sell.

Before economic area boundaries are defined, neighborhoods should be developed for each class of property. It is possible for residential, commercial, industrial, and vacant land neighborhood boundaries to overlap.

However, neighborhood subclass boundaries cannot overlap within the same subclass. For example, the neighborhood boundary for NBHD 1, consisting of single family homes, cannot overlap into NBHD 2, which also consists of single family homes. However if NBHD 1 and NBHD 2 are equally subject to the four forces, they can both be in the same economic area.

Stratifying a class of property into homogeneous subclasses can enable the assessor to develop accurate values for property. For example, if condominium values are based only on condominium sales, the values placed on unsold condominium properties will be more reflective of the condominium market than would be the case if these values were based on a composite of all residential sales. It is also possible to stratify the subclasses of property into age, style, construction type, and quality groupings. However, the appropriate level of stratification is dependent on the number of available qualified sales and whether the number of qualified sales allows a statistically reliable estimate of value.

The development of economic areas begins first by considering the physical, economic, governmental, and social forces affecting value within neighborhoods and by considering property subclass homogeneity as discussed above. The identification of each economic area boundary can then be completed through the completion of the following steps:

- Inspect the physical characteristics of neighborhoods. Drive around the region to develop a visual sense of possible groupings of neighborhoods into economic areas, noting the degree of similarity in land uses, types of structures, architectural designs, quality, and condition. On a map of the area, note the points where these characteristics show perceptible changes and mark any physical barriers such as streets, hills, rivers, and railroads that coincide with the changes. These notes and marks establish preliminary economic area boundaries.

- Compare the preliminary economic area boundaries against the socioeconomic characteristics of the area's population and make adjustments to the boundaries taking into consideration the economic, governmental, and social forces affecting value, as well as, elements of homogeneity. Reliable data may be obtained from local chambers of commerce, universities, and research organizations. Additional information may be gathered from informal interviews with property owners, business persons, real estate professionals, and community representatives to determine the extent of an economic area.

- Review and analyze sales data within each adjusted economic area by plotting sales prices per square foot (or other unit of comparison), coded by subclass, within the adjusted economic area boundaries on a property sales map and/or by performing statistical tests such as sales ratio studies for the economic area with sales ratios coded by neighborhood. Make final adjustments to economic area boundaries with the understanding that these boundaries may change along with changes in the economic forces and factors in subsequent reappraisal years.

Examples of market analysis procedures can be found in Property Appraisal and Assessment Administration, 1990, and the Standard on Ratio Studies, 2010, both published by the International Association of Assessing Officers.

Land Subclass Analysis

Residential Land

Residential land values are based on desirability, scarcity, surroundings, restrictions, utilities, and location. The more desirable the location, the more valuable the land. Desirability is stimulated by the factors of surroundings, land use restrictions, utilities, availability of transportation, shopping facilities, schools, and churches.

Commercial Land

Commercial lands are primarily bought as investments or as income producing properties. The value of this type of land is based on the need for commercial goods and services in the economic area, availability of suitable sites to accommodate those goods and services, and reasonable access to the land by both the owner/user and potential purchasers of goods and services.

Industrial Land

Industrial lands are subject to highly specialized and intensive use analyses that are wholly dependent upon each individual owner's requirements. Industrial properties rarely sell on the open competitive market as other than unimproved sites. Each industrial property requires special analysis because of the land's individual characteristics. Each site should be studied in detail as to use, topography, shape, utility, site improvements, industrial capacity, zoning, location in relation to transportation, proximity of the labor market, and accessibility to the customer market.

"Other Agricultural" Land

Agricultural land valuations are based upon productivity formulas contained in the Colorado Constitution, statutes, and Division policy. Refer to Chapter 5, Valuation of Agricultural Lands.