Chapter 2 - Discovery, Listing, and Classification

Three administrative steps must be taken by the assessor prior to determining the value of personal property. These steps are discovery of all taxable personal property, creation of an accurate listing of taxable personal property, and proper classification of the property. The assessor must ensure that effective office procedures exist to complete these steps, so that all taxable property will be properly assessed for property tax purposes.

Discovery and Listing of Personal Property

One of the most difficult jobs for a county assessor is the discovery of personal property. However, good discovery practices will yield positive results in accurate property records and assessments.

Overview

Personal property discovery must be an ongoing task because personal property is movable and may leave the county faster than the assessor can discover it. A thorough program of discovery must be created and maintained to ensure accurate property listings. Inaccurate property listings mean that certain personal property owners may escape paying their legal share of property taxes which results in a heavier tax burden on the taxpayers who do pay their legal share.

The personal property listing process begins by setting up account records in the assessor's office for businesses owning taxable personal property. A cross-check should be conducted on existing office records to determine if a new business is filing under another name and/or at another location. An assessor's staff member should call or visit the property owner to gather any necessary information for the listing process.

Declaration Schedule

A primary source of personal property discovery is the annual declaration schedule. After the names of the businesses or owners have been recorded in the personal property account records, a declaration schedule is mailed.

It is especially important that owners of personal property located in the county on the January 1 assessment date receive the declaration schedules as soon after January 1 as possible. As noted in Chapter 1, Applicable Property Tax Laws, each person who owns more than $56,000 in total actual value of personal property per county on the assessment date must file a declaration schedule by no later than April 15. This allows the mailing of a Notice of Valuation (NOV) to the taxpayers by June 15.

However, a Special Notice of Valuation (SNOV) can be mailed at any time during the year. In this way the assessor preserves the rights of the taxpayer in the abatement process and presents a complete assessment roll to the County Board of Equalization (CBOE) in July.

In cases where property was in the county on the assessment date, but discovered after April 15, the assessor must still assess the property pursuant to §§ 39-5-110 and 125, C.R.S. In these cases, the taxpayer must be notified of the value via the SNOV and a thirty-day period must be given to the taxpayer to protest any personal property valuation made after June 15.

In addition to being a valuable discovery tool, the declaration schedule is the primary method used by the taxpayer to provide an original listing of personal property to the assessor. The taxpayer who owns taxable personal property must report all personal property owned by, in the possession of, or under the control of the taxpayer on January 1 to the assessor.

Taxable personal property that is fully depreciated or expensed by the business, must be declared and listed by the taxpayer on the declaration schedule. Property acquired prior to the January 1 assessment date, but not put into use until after January 1, should be declared for the following assessment year. For a complete discussion of “Personal Property in Storage” that have been stored after their use, refer to Chapter 7, Special Issues. Property leased from others and used in the business must be declared and the name and address of the lessor (owner) noted in the leased equipment area on the declaration schedule.

The taxpayer must completely describe all listed personal property so that the assessor can correctly classify and value it. The importance of accurate, detailed property descriptions cannot be overstated. The assessor cannot properly consider the cost, market, or income approaches to appraisal unless a very clear description has been obtained. General property descriptions such as “equipment” or “furniture and fixtures” are not acceptable because they do not sufficiently describe the property.

Information contained on the declaration schedules is often transferred directly to the appraisal records for analysis. The declaration schedule then becomes a part of the taxpayer's account valuation file.

Recorded Documents and Other Discovery Sources

Publicly recorded documents, such as real estate deeds, may also be useful in discovering personal property. Any evidence, such as notations on the TD-1000 real property transfer declaration or sales/use tax records from the Department of Revenue, which may be submitted to the clerk and recorder as proof of personal property that is included in a real property sale, can be used in the discovery process pursuant to §§ 39-13-102(5)(a) and 39-14-102, C.R.S.

Leases and bills of sale are useful in helping the assessor to discover personal property. These documents often will list specific pieces of property leased or sold from which the assessor can make an assessment even if the taxpayer does not file a declaration schedule. Leases may be recorded in the county clerk's office.

The following additional sources of information are available for the assessor to use in the discovery of personal property:

Federal Government Records

Bankruptcy filings

Lease records

State Government Records

Business licenses (sales/use tax)

Corporation filings

Trade name affidavits

State lease records

Local Government Records

Business licenses (city or county)

Permits (sign or building)

Lease records

Recorded real property conveyance documents for new owner/operators

Business Records and Publications

Business (City) or personal directories

Telephone directories

Trade journals

Utility hookups or disconnects

Media Sources

Newspaper articles and advertising

Radio and TV commercials

Real estate newsletters

Other

Location inspections, taxpayer visits, area canvasses

Voluntary filings by property owners

A complete discovery program uses all of the tools to find personal property that has not as yet been listed on the assessment roll. Most counties have an annual cycle in which one or more of these sources are reviewed, at different times of the year, to monitor any changes in the number of businesses or the locations of personal property.

Obtaining Depreciation Information

There is a provision in Colorado Revised Statutes that allows county assessors to obtain Colorado income tax returns for business taxpayers, including depreciation information, from the Colorado Department of Revenue (DOR).

Reports and returns.

(7) Notwithstanding the provisions of this section, the executive director of the department of revenue shall supply any county assessor of the state of Colorado or his representative with information relating to ad valorem tax assessments or valuation of property within his county and, in his discretion, may permit the commissioner of internal revenue of the United States, or the proper official of any state imposing a similar tax, or the authorized representative of either to inspect the reports and returns of taxes covered by this article.

(10) Notwithstanding the provisions of this section, the executive director of the department of revenue shall supply any county assessor of the state of Colorado or his representative with information obtained through audit of reports and returns covered by this article dealing with such taxpayers’ ability to pay or to properly accrue any ad valorem tax collected by such county assessor.

§ 39-21-113, C.R.S.

However, the DOR does not regularly receive depreciation information because it relies on the return information filed with the Internal Revenue Service. As such, it may not be possible to obtain this information directly from the DOR. If information is requested, discussions with DOR representatives indicated the following procedures should be used by assessors in obtaining DOR tax return information.

- Prepare a cover letter, on county letterhead, requesting under authority of §§ 39-21-113(7) and 39-21-113(10), C.R.S., taxpayer income tax returns for the tax years under review by your office. Make sure that you include sufficient information about the tax years, taxpayer's name, trade name, location, Federal Employer Identification Number, etc., so that the DOR can locate the appropriate records.

- Attach a DR 5714 (09/12/24) Request For Copy of Tax Returns form completed by you to the best of your ability. Copies of this form can be directly obtained from the DOR website.

- Mail both the letter and the completed form to:

Colorado Department of Revenue

Tax Files – Room B112

PO Box 17087

Denver, Colorado 80217-0087

Copying cost: 1 – 10 Free, each additional page is $0.25.

(303) 866-5407

NOTE: Any tax return information that you obtain from DOR must remain confidential in the same manner as the personal property declaration schedule and accompanying exhibits, pursuant to § 39-21-113(4), C.R.S.

Obtaining New Sales Tax Account Listings

DOR makes available to the counties sales tax records of their vendors. Counties that impose a sales tax have access to this information through the DOR's Sales and Use Tax System (SUTS) (previously known as the “Local Government Sales Tax Information System”). This is a secure site and you will need to contact the county finance office to request any sales tax information.

NOTE: Any sales tax information you obtain from the DOR must remain confidential in the same manner as the personal property declaration schedule and accompanying exhibits, pursuant to § 39-21-113(4), C.R.S.

Review of Property Account Files and Records

All property declaration schedules, supporting data, and correspondence contained in the taxpayer's files should be carefully reviewed before the initial telephone call. Also, any previous personal property audit information contained in the file should be reviewed. These reviews allow the assessor to become familiar with the business so that records relevant to past problems can initially be requested and so that appropriate questions regarding these records may be asked during the interview.

Physical Inspection

The physical inspection of property is another widely used tool in discovering and listing personal property. Physical inspection is fully discussed in Chapter 5, Personal Property Reviews.

Assessor Responsibilities

The assessor has several responsibilities relative to the listing of personal property. The

responsibilities are as follows:

- To provide declaration forms to taxpayers

- To use approved manuals, procedures, forms, and related data

- To maintain accurate records

Provide Declaration Forms

The assessor must provide a copy of the declaration schedule form to each taxpayer believed to own taxable personal property in the county. As described in the “Discovery” portion of this chapter, assessors attempt to discover all owners of personal property in the county so that the declaration schedules may be delivered to the taxpayer. Taxpayers must still obtain and file a declaration schedule even if the assessor fails to send the schedules as required by §§ 39- 5-107 and 108, C.R.S.

If desired, assessors have the option to mail out a declaration schedule to all personal property taxpayers. However, only when the total actual value of the personal property exceeds $56,000 per county is the taxpayer required to return the completed declaration. A late filing or failure to fully disclose penalty cannot be applied unless the total actual value exceeds $56,000 per county.

Use Approved Data

The assessor has the responsibility to use the approved manuals, procedures, and forms developed by the Division of Property Taxation as required by §§ 39-2-109(1)(d) and (e), C.R.S. Assessors must also consider any other pertinent data provided by the taxpayer to establish the total actual value of personal property as provided for in § 39-5-107, C.R.S.

Approved Manuals

ARL Volume 5, Personal Property Manual, is the approved manual to be used in the valuation of personal property. The manual contains all recommendations and procedures published by the Division of Property Taxation, as approved by the State Board of Equalization (SBOE), concerning the valuation of personal property. In Huddleston v. Grand County, 913 P. 2d 15 (Colo. 1996), the Colorado Supreme Court recognized and affirmed the Property Tax Administrator’s broad authority to prepare manuals and procedures, as well as to require that the Colorado county assessors utilize these manuals and procedures to carry out their responsibilities pursuant to Colorado Constitution, Article X, § 3.

Forms

Pursuant to § 39-2-109(1)(d), C.R.S., the Property Tax Administrator is required to approve the form and size of all personal property declaration schedules, forms, and notices furnished or sent by the assessor to owners of taxable property. Exclusive use of approved schedules, forms, and notices are required. This standardizes the information that is being requested statewide and provides for equal treatment of all taxpayers.

NOTE: County assessors may create customized or electronic county Personal Property Declaration Schedules and taxpayer notification forms if they have these forms approved by the Property Tax Administrator prior to their use.

Appraisal Records

Appraisal records are used by assessors for listing information from the declaration schedule submitted by the taxpayer and to determine the actual and assessed values of personal property.

The personal property appraisal record is a one-year value calculation worksheet for developing cost approach estimates for all machinery, equipment, and furnishings. The appraisal record provides for the determination of current replacement or reproduction cost new less depreciation (RCNLD) and for adjusting the current value to the correct level of value. Computerized output documents may be used in lieu of the following manual form. The specific manual appraisal record used to list and maintain personal property cost information is as follows:

| Form No. | Description |

|---|---|

| AR 290 | Personal Property Appraisal Record Form |

Additional documentation is required for application of the market and income approaches and reconciliation to a final value estimate. All appraisal records and appraisal documents should be initialed and dated by the assessor, the appraiser, or the data entry operator as appropriate and maintained as a part of the personal property valuation files.

Personal property may be manually valued using the AR 290 personal property appraisal record. A PDF version of the AR 290 may be found on the Division’s website.

Real property should be valued, and any related assessment records maintained, on appropriate real property appraisal records. Real and personal cross-reference indexes or files should be kept for related real and personal property. The index or file data should be reviewed annually to eliminate the possibility of duplicate or omitted assessments of property.

Notices of Valuation

The assessor must notify the taxpayers on approved Notices of Valuation (NOVs). The specific requirements and form standards for the NOV are found in ARL Volume 2, Administrative and Assessment Procedures, Chapter 9, Form Standards.

Maintain Accurate Records

Accurate property appraisal files must be maintained for each personal property taxpayer. These files, and their associated records, serve as the permanent documentation for any assessments made by the assessor. The files are the repository of all information gathered by the assessor regarding the taxpayer and the taxpayer's property.

Files should include all declaration schedules and documents submitted by an individual taxpayer or business, along with appraisal records, worksheets, copies of Notices of Valuation, all correspondence, and any other data pertaining to that specific taxpayer or business.

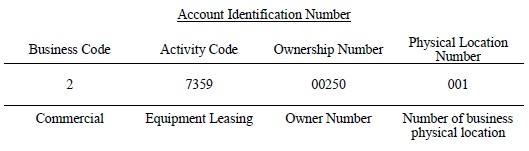

Account Identification System

To provide overall control of the ownership files and records, a permanent unique personal property account identification number should be assigned to each personal property account.

The recommended unique account identification number consists of the business activity code, ownership number, and physical location number.

Business Activity Code (5 digits):

The first digit corresponds with the general property class.

1 = residential

2 = commercial

3 = industrial

4 = agricultural

5 = open

6 = natural resources

7 = open

8 = state assessed

9 = exempt

The next four digits correspond with the Standard Industrial Classification Manual published by the Office of Statistical Standards of the Federal government for each type of business or industry.

As an example, 7359 is the standard industrial code for an equipment leasing business. Thus 27359 indicates a commercial equipment leasing business. Refer to the Standard Industrial Classification Manual that is available from any U.S. Government Printing Office or online.

Ownership Number (5 digits):

The assignment of a five-digit owner number provides for 99999 possible individual owners of personal property for each specific type of business or industry within the county. The ownership number is assigned by the assessor.

Physical Location Number (3 digits):

The assignment of a three-digit physical location number provides for 999 possible locations within the county for one owner.

An example account identification number 2-7394-00250-001 is shown below:

Account identification numbers provide for control of the personal property accounts. It also allows the assessor to keep records for similar types of businesses together for easy reference and comparison, on a business-by-business basis, when needed.

The ownership control numbers should be used on all records pertaining to a given taxpayer. Listed below are various records, which may be cross-referenced when using the ownership control numbers.

- Alpha listing

- Numerical listing

- Cadastral cards

- Property declaration schedules

- File jackets

- Appraisal records

- Master property record cards

- Notice of Valuation

- Location listing

- Correspondence

- Out of state owner listing

- Tax warrant

- Tax bills

Archives Requirements

Personal property listings and valuation records are kept for six years, plus the current year, after which they may be destroyed with the permission of the State Archivist. Refer to ARL Volume 2, Administration and Assessment Procedures, Chapter 1, Assessor’s Duties and Relationships, for specific archive retention procedures.

Confidentiality

Confidential information includes detailed listings of personal property reported by a prior owner, whether or not values are included with the listing. According to § 39-1-102(9), C.R.S., “‘Person’ means natural persons, corporations, partnerships, limited liability companies, associations, and other legal entities which are or may become taxpayers by reason of ownership of taxable real or personal property.” Pursuant to § 39-5-120, C.R.S., the declaration schedule and attachments are confidential documents and only the following persons have a legal right to view them.

- The county assessor or members of the assessor's staff

- The assessor and staff have access to the declaration schedule only as it pertains to the conduct of their official duties. Assessors may restrict which staff members may see or use the schedules.

- Counties have the authority to hire contract agents/employees to assist the assessor. A contract agent/employee is considered a county employee for the purpose of § 39-5-120, C.R.S., for the duration of their contract and they have the right to view confidential data as it pertains to the conduct of their official duties as expressed in their contract. The county’s contract with the contract agent/employee shall include language denoting that the agent/employee is bound by the confidentiality provisions of § 39-5-120, C.R.S. and subject to the statutory penalties for divulging confidential information as provided for in § 39-1-116, C.R.S.

- The county treasurer or members of the treasurer's staff

- The treasurer and staff have access to the personal property declaration schedule only as it pertains to the collection of taxes due from the property listed in the schedule. The treasurer may restrict access to only those employees directly involved in the taxation of personal property.

- The annual assessment study contractor, hired pursuant to § 39-1-104(16), C.R.S., and employees of the contractor

- The annual assessment study contractor may view the declaration schedule only as part of the fulfillment of the annual study contract. The results of any such study are reported to the Legislative Council and the State Board of Equalization. No information from personal property declaration schedules may be used by the annual study contractor for purposes outside the scope of the contract.

- The executive director of the Colorado Department of Revenue and staff members of the Department of Revenue

- The staff of the Colorado Department of Revenue may view the personal property records as part of their official duties.

- The Property Tax Administrator and Division of Property Taxation staff

- Division of Property Taxation staff may view the personal property records if it is part of their official duties.

- The county board of equalization (CBOE) and the Board of Assessment Appeals (BAA) when pertinent to a hearing or protest review

- The CBOE or the BAA may see the personal property records as part of an administrative appeal only. In addition, members of these boards may only have access to these records when the appeal is properly before them for hearing. Only county commissioners or their designees may see personal property declarations when they sit as the County Board of Equalization.

- The arbitrator, as defined in § 39-8-108.5, C.R.S., may subpoena the personal property records when they are involved in an arbitration proceeding.

- The person whose property is listed on the schedule

- The owners of the personal property may see their own schedule. This includes the authorized agent of the owner. Assessors require written authorization (letter of agency, LOA) from the personal property owners before releasing the information to a third party.

- Taxpayers who purchased personal property or businesses during the current year are not allowed to see the personal property declaration schedule of a previous owner without the consent of that owner. This may include a waiver in the sale contract that sets forth the rights of the new owner to access all information previously filed. If the waiver was not part of the contract, the assessor should require separate written authorization prior to release of any confidential information.

- If the new owner disagrees with the value established by the assessor, a physical inspection of the property should be scheduled as soon as possible. The total value determined from the physical inspection should be compared to the property's current total value to ascertain if an adjustment is warranted.

- Personal property records ordered opened by the district court

Anyone listed above who uses the personal property schedules as part of official duties is also subject to the confidentiality provisions and may be held accountable for divulging the information on the schedule.

The statutory penalties for divulging confidential information include a fine of not less than $100 nor more than $500, or by imprisonment in the county jail for not more than three months, or by both the noted fine and imprisonment as provided for in § 39-1-116, C.R.S.

26 U.S.C. Section 7602 of the Internal Revenue Code (IRC) gives representatives from the Internal Revenue Service (IRS) the authority to examine and/or summon certain information (including confidential declaration schedule information) that the Secretary may deem as proper, related to ascertaining the correctness of any return for Federal taxation purposes. Any person that is served with an IRS summons to produce confidential records and information must timely comply or be faced with penalties as noted in Section 7604 of the IRC. Section 7609 of the IRC relieves any person from liability who makes such disclosure in reliance on a summons.

The natural resources property declaration schedules and appraisal records are used for both real and personal property data. Since confidential real and personal property information is contained on both the front and back of these declaration schedules, requests for non confidential information should be directed to other public agencies which have access to this information and have the means of disclosing it to the public.

These agencies include, but are not limited to, the Energy and Carbon Management Commission, Colorado Division of Reclamation Mining and Safety, Colorado Geological Survey, and the Federal Bureau of Land Management.

Taxpayer Responsibilities – Declaration Schedules

All owners of taxable personal property are to complete and file a personal property declaration schedule no later than April 15 each year as required by § 39-5-108, C.R.S. In accordance with § 39-1-120(1)(a), C.R.S., documents that are required to be filed (declaration schedules) that are mailed are “deemed filed with and received by the public officer or agency to which it was addressed on the date shown by the cancellation mark stamped on the envelope or other wrapper containing the document required to be filed.” The taxpayer must make a full and complete disclosure of all personal property owned by, under the control of, or in the possession of the taxpayer on the schedule, including any costs incurred for acquisition, sales/use tax, installation, and freight to the point of use of the personal property as required by § 39-1-103(13)(b), C.R.S. The taxpayer must also submit any other information requested by the assessor so that the assessor may place a value on the property as required by § 39-5- 115(1), C.R.S.

Declaration schedules have been developed by the Division of Property Taxation for use by the county assessors as required by § 39-2-109(1)(d), C.R.S. Assessors must provide these forms to the taxpayers for submission of their personal property data as required by § 39-5-107, C.R.S.

The primary form used by commercial business taxpayers is the Personal Property Declaration Schedule - DS 056. Other forms have been developed for residential rental taxpayers, lessors of personal property, renewable energy, and natural resource operations. A list of forms may be found in the assessor's archives retention schedule located in ARL Volume 2, Administration and Assessment Procedures, Chapter 1, Assessor’s Duties and Relationships.

Electronic versions of the each of the most current versions of the approved declaration schedules may be found on the Division’s website.

Classification

After property has been located or "discovered" and listed, it must be properly classified. Proper classification is necessary because the property valuation methodology may vary depending on the classification. Furthermore, there are several classes of property that are exempt from taxation by statute. The two fundamental classifications that the assessor must make are whether property is real or personal and whether the property is taxable or exempt. Assessors must also determine whether personal property is locally assessed or state assessed.

Real or Personal

The first classification that the assessor must make is to determine whether the property being

appraised is real or personal.

As discussed in Chapter 1, Applicable Property Tax Laws, real property is defined as paraphrased from §§ 39-1-102(6.3) and (14), C.R.S., as land, water rights, fixtures, fences, mines, quarries, mineral interests, and improvements. The statutes further define personal property as anything subject to ownership that is not real property.

Characteristics of Fixtures

Fixtures are defined in § 39-1-102(4), C.R.S. The definition may be paraphrased as those articles that were once movable chattels, but have become an accessory to or a part of real property by having been physically incorporated therein or annexed or affixed thereto.

Fixtures include systems for the heating, air conditioning, ventilation, sanitation, lighting, and plumbing of a building. Fixtures do not include machinery, equipment, or other articles related to a commercial or industrial operation which are affixed to the real property for proper utilization of such articles. In addition, for property tax purposes only, fixtures do not include security devices and systems affixed to any residential improvements including, but not limited to security doors, security bars, and alarm systems.

Fixtures include all components of the systems for the heating, air conditioning, ventilation, sanitation, lighting, and plumbing of a building. These will be collectively referred to as fixture systems.

Fixture systems, which are statutorily defined as real property, are appraised at the level of value designated for other real property. Fixture systems generally are given the same economic life as the building that they serve. However, if technological, economic, or functional obsolescence exist, it is possible that fixture systems may have a shorter economic life than the building that they serve.

In Del Mesa Farms, et al. v. Montrose CBOE, 956 P.2d 661 (Colo. App. 1998), using the definition of fixtures as stated in § 39-1-102(4), C.R.S., the court reasoned that a distinction must be made for classification purposes for property that are related to the operation of the building and property that are related to the operation of a business in the building. The court noted, "Thus, in our view, regardless of whether a particular item is affixed to a building and may otherwise constitute a fixture system, the item constitutes personal property if its use is primarily tied to a business operation" (emphasis added).

Major issues that arise in the classification of property as either real or personal are in the category of real property fixtures as discussed in Chapter 1, Applicable Property Tax Laws.

Definitions-.

(11) "Personal property" means everything that is the subject of ownership and that is not included within the term "real property". "Personal property" includes machinery, equipment, and other articles related to a commercial or industrial operation that are either affixed or not affixed to the real property for proper utilization of such articles. Except as otherwise specified in articles 1 to 13 of this title, any pipeline, telecommunications line, utility line, cable television line, or other similar business asset or article installed through an easement, right-of-way, or leasehold for the purpose of commercial or industrial operation and not for the enhancement of real property shall be deemed to be personal property, including, without limitation, oil and gas distribution and transmission pipelines, gathering system pipelines, flow lines, process lines, and related water pipeline collection, transportation, and distribution systems. Structures and other buildings installed on an easement, right-of-way, or leasehold that are not specifically referenced in this subsection (11) shall be deemed to be improvements pursuant to subsection (6.3) of this section.

§ 39-1-102, C.R.S.

Taxable or Exempt

All property in the state is taxable unless specifically exempt by the Colorado Constitution. Taxable personal property that is fully depreciated or expensed by a business for income tax purposes is still taxable to the owner. The types of personal property exempt from taxation are listed in Chapter 1, Applicable Property Tax Laws. What follows are the specific definitions of the exempt property and the applications of these exemptions by the assessor. All exemptions from property taxation are strictly construed and in United Presbyterian Association, et al. v. Board of County Commissioners, 167 Colo. 485, 448 P.2d 967 (1968), the court held that the taxpayer has the responsibility to prove that property is exempt. If a property owner is claiming exemption from taxation, the owner must show where in the Colorado Constitution or the statutes the exemption is justified.

Exemption of Consumable Personal Property

Defined by the Colorado Division of Property Taxation policy according to §§ 39-1-102(7.2) and 39-2-109(1)(e), C.R.S. and exempted under § 39-3-119, C.R.S.

In 2000, the Colorado Legislature amended § 39-3-119, C.R.S., to require the Division of Property Taxation to “publish in the manuals, appraisal procedures, and instructions prepared and published pursuant to section § 39-2-109(1)(e), C.R.S., a definition or description of the types of personal property that are ‘held for consumption by any business’ and therefore exempt from the levy and collection of property tax pursuant to this section.” In the 2007 published Colorado Court of Appeals case, EchoStar Satellite, LLC., and BAA v. Arapahoe County BOE and PTA, 171 P.3d 633 (Colo. App 2007), the Colorado Court of Appeals noted that, “By statute, the PTA has the responsibility to determine the scope of the ‘consumable’ exemption by publishing appropriate guidelines in the reference manuals.”

The Division developed and published the following policy language criteria, examples, and leased personal property provision to be considered together to aid in determining whether personal property is considered "consumable" and, therefore, exempt from property taxation. To be classified as “consumable,” personal property must fall under one of the following criteria:

- The personal property must have an economic life of one (1) year or less.

This criterion applies to any personal property regardless of the original installed cost. This category also includes non-functional personal property that is used as a source of parts for the repair of operational machinery and equipment with an economic life of one year or less.

The personal property has an economic life exceeding one year, but the original installed cost including acquisition cost, installation cost, sales/use tax, and freight expense to the point of use, is $350 or less.

The $350 threshold should be applied to personal property that is completely assembled and ready to perform the end user’s intended purpose(s).

The threshold should not be applied to the personal property’s or personal property system’s unassembled, individual component parts or separate accessories.

In cases where there is a separation in the ownership of the system components/accessories, the sum of the original installed costs of all of the components/accessories that are under common ownership per location should be added together for the $350 or less "consumable" exemption consideration.

If the reasonable original installed costs for the personal property or personal property system including components/accessories cannot be determined based on the information received by the assessor, the assessor may use the best information available process to determine a reasonable estimate of the original installed cost for $350 or less “consumable” exemption consideration. Note the following examples:

Example 1, Computer system with common ownership:

The original installed costs incurred for a complete computer system in-place and ready for the “end user” should be considered. The component parts of the system including the mouse, keyboard, monitor, and the CPU should not be divided and considered separately for the $350 or less “consumable” exemption.

Example 2, Theater system with common ownership:

The original installed costs incurred in the acquisition and installation of an entire theater seating system should be considered. The individual theater seats are unassembled individual component parts of a larger theater seating system and their costs should not be considered separately for the $350 or less “consumable” exemption.

Example 3, Security system with separate ownership:

A business owner signs a service agreement with a security system service provider that transfers ownership of specific security system components to the business owner upon execution of the agreement. For $350 or less “consumable” exemption consideration, the assessor must work with the taxpayers to determine the reasonable original installed cost for each of the system components/accessories. All system components/accessories under common ownership at the specific location that are used with the system should be added together for the $350 or less “consumable” exemption consideration.Leased personal property provision:

For leased personal property, the market value in use for the personal property at the retail “end user” trade level, including an allowance for acquisition costs, installation, sales/use tax, and freight to the point of use, at the time the initial agreement is executed should be estimated. The estimate of market value in use is to be used for the purposes of determining taxable status under the $350 or less “consumable” exemption.

Exemption - Actual Value of $56,000

Defined by § 39-1-102(11), C.R.S. and exempted under § 39-3-119.5, C.R.S. Exemption of personal property equal to or less than $56,000 in total actual value is provided for in § 39-3-119.5, C.R.S. An exemption is allowed and should only be applied if the total actual value of taxpayer's personal property per county is equal to or less than $56,000. The statute does not exempt the first $56,000 of each personal property taxpayer's schedule.

On September 10, 2001, in Huddleston and TCI v. Board of Equalization of Montezuma County, 31 P. 3d 155 (Colo. 2001), the Colorado Supreme Court affirmed four separate Colorado Court of Appeals’ judgments that had reversed the decisions of the State Board of Assessment Appeals (BAA). Principally, at issue was whether the Property Tax Administrator’s interpretation that § 39-3-119.5, C.R.S., should be applied on a per business location basis by the assessors of this state is consistent with section 20(8)(b) of article X of the Colorado Constitution, which provides for the exemption of personal property. This ruling changed the previous Division policy that held that this exemption should be applied on a "per business location" basis.

This decision allows taxpayers to file more than one schedule for efficiency and convenience, but clarifies that the exemption must be applied for taxpayers owning $56,000 or less of business personal property on a "per county" basis.

Listed below are important criteria that must be considered when implementing this legislation:

- This exemption applies to all personal property:

- That is not otherwise exempt by constitutional or statutory authority, and

- That is defined under § 39-1-102(11), C.R.S., as machinery, equipment, and other articles related to a commercial or industrial operation or are defined, under § 39-1-102(6) and (10), C.R.S., as household furnishings or personal effects and that are used for the production of income for any time during the assessment year, and

- Where the total actual value of the personal property owned by a specific taxpayer and located in the same county is $56,000 or less.

- Taxpayers owning personal property that has a total actual value of $56,000 or less per county are not required to file a personal property declaration schedule with the assessor in that county.

- All personal property owners, regardless of property classification subclass, are subject to the $56,000 exemption threshold. This includes all residential, commercial, industrial, other-agricultural, natural resource, producing mines, and oil and gas personal property. The exemption also applies to state assessed personal property. It is measured against the entire Colorado personal property value of a company, NOT the value apportioned to individual counties. The state assessed value apportioned to each county has already been adjusted for this exemption.

- If an assessor believes, through comparison with similar types of businesses, that the total actual value of the taxpayer’s personal property per county is likely to exceed the $56,000 threshold, a declaration schedule should be sent, a “best information available” (BIA) valuation should be assigned to the property, and the taxpayer should be notified prior to the tax bill being issued. Assessors are encouraged to contact taxpayers by telephone or through a physical inspection of the personal property, as soon as possible, to determine whether the $56,000 threshold is exceeded.

If it is apparent that the total actual value is likely to exceed the threshold, taxpayers should be advised, as soon as possible, and given the opportunity to provide an itemized list of the personal property.

As required by § 39-3-119.5, C.R.S., this exemption is adjusted biennially to account for inflation. Beginning with the 2023 tax year, the Property Tax Administrator is also required to publish an “alternative exemption amount” starting from $7,900 and adjusted biennially to account for inflation. This alternative exemption amount only applies if not all counties have received a reimbursement in accordance with §§ 39-3- 119.5(2)(b)(I)(C) and (3)(f), C.R.S. For the 2025 and 2026 tax years, the alternative exemption amount is $8,700 or less.

Agricultural

Agricultural and Livestock Products

Defined by § 39-1-102(1.1), C.R.S. and exempted under § 39-3-121, C.R.S.

Definitions.

(1.1) (a) “Agricultural and livestock products” means plant or animal products in a raw or unprocessed state that are derived from the science and art of agriculture, regardless of the use of the product after its sale and regardless of the entity that purchases the product. ‘Agriculture’, for purposes of this subsection (1.1), means farming, ranching, animal husbandry, and horticulture.

(b) On and after January 1, 2023, for the purposes of this subsection (1.1), “agricultural and livestock products” includes crops grown within a controlled environment agricultural facility in a raw or unprocessed state for human or livestock consumption. For the purposes of this subsection (1.1)(b), “agricultural and livestock products” does not include marijuana, as defined in section 18-18-102 (18)(a), or any other nonfood crop agricultural products.

§ 39-1-102, C.R.S.

This definition includes most plant or animal products in the raw or unprocessed state. These would include, but are not limited to, products such as alfalfa, all grains, eggs, milk, fruit, and crops grown within a controlled environment agricultural facility. All of these products are exempt from property taxation. Any personal property not qualifying as agricultural or livestock products and any processed products may qualify for exemption as supplies or inventories of merchandise and materials held for sale. Marijuana, as defined in section 18-18- 102 (18)(a), and any other nonfood crop agricultural products are excluded from the definition of "agricultural and livestock products" under subsection (b) of § 39-1-102 (1.1), C.R.S.

Agricultural Equipment Used on the Farm or Ranch

Defined by § 39-1-102(1.3), C.R.S. and exempted under § 39-3-122, C.R.S.

All of the following qualifications must be met for the property to be exempt as agricultural equipment:

- Agricultural equipment must be personal property to be exempt. Fixtures, as defined in § 39-1-102(4), C.R.S., are to be valued as part of the building or structure. A distinction must be made for classification purposes for property that are related to the operation of the building and property that are related to the operation of a business in the building. Regardless of whether a particular property is affixed to a building and may otherwise constitute a fixture system, the property constitutes personal property if its use is primarily tied to the business operation. Therefore, any mechanical system used on the farm or ranch for the conveyance and storage of animal products in a raw or unprocessed state is exempt regardless of whether or not it is a fixture.

- The equipment must be used on a farm or ranch, that is, land where agricultural products originate from the productivity of the land or land which is grazed by domestic animals.

- Only equipment that is used to plant, grow, or harvest an agricultural product, raise or breed livestock, or the agricultural equipment that is primarily tied to the agricultural operation are exempt.

It is very important that the terms "farm" and "ranch" be understood by the assessor when classifying agricultural personal property because only that personal property used on a farm or ranch is exempt. The specific definitions for the terms "farm" and "ranch" are found in §§ 39-1-102(3.5) and (13.5), C.R.S., respectively.

Silviculture

Silviculture is defined as the branch of forestry that is concerned with the development and care of forests. Pursuant to §39-1-102(1.3), agricultural equipment includes “silviculture personal property that is designed, adapted, and used for the planting, growing, maintenance, or harvesting of trees in a raw or unprocessed state.”

Controlled Environment Agricultural Facility

On or after January 1, 2023, personal property used in direct connection with the operation of a controlled environment agricultural (CEA) facility, as defined in § 39-1-102(3.3), C.R.S., is exempt from taxation under § 39-3-122(2). This applies to all personal property in the CEA facility, regardless of whether the personal property is attached to the building as long as it is capable of being removed from the facility. The CEA facility must be used solely for planting, growing, or harvesting crops in a raw or unprocessed state.

Greenhouses

Greenhouse personal property is defined in § 39-1-102(1.3)(b)(IV), C.R.S., as “Any personal property within a greenhouse, whether attached to the greenhouse or not, that is capable of being removed from the greenhouse and is used in direct connection with the operation of a greenhouse, which greenhouse is used solely for planting or growing crops in a raw or unprocessed state, and the sole purpose of growing crops in the greenhouse is to obtain a monetary profit from the wholesale of plant-based food for human or livestock consumption.” Greenhouse personal property is exempt under § 39-3-122(2), C.R.S.

Livestock

Defined by § 39-1-102(7.7), C.R.S. and exempted under § 39-3-120, C.R.S.

Livestock includes all animals. The animals need not be used on a farm or ranch to be exempt as indicated in section 3(1)(c) of article X, of the Colorado Constitution when read in conjunction with § 39-1-102(7.8), C.R.S.

All Other Agricultural as “All Other” Property

As required by § 39-1-102(1.6)(b), C.R.S., all other agricultural property that does not meet the definition set forth in § 39-1-102(1.6)(a), C.R.S., must be classified and valued as all other property. For purposes of identification, a classification category of “all other agricultural property” was developed and includes agribusinesses and/or agriculturally related commercial operations. The land, improvements and personal property classified as “all other agricultural property” are taxable. However any personal property used in direct connection with the operation of a controlled environment agricultural facility or greenhouse is exempt from property taxation beginning in tax year 2023.

A complete discussion of the valuation of agricultural lands is found in ARL Volume 3, Real Property Valuation Manual, Chapter 5, Valuation of Agricultural Land.

Residential Household Furnishings

Defined by § 39-1-102(6), C.R.S. and exempted under § 39-3-102, C.R.S.

Any household furniture and freestanding appliances and security systems found in private homes that are used to produce income at any time during the year are taxable for the entire year, otherwise they are exempt pursuant to § 39-3-102, C.R.S. Furniture, freestanding appliances, and security systems found in rental properties are taxable regardless of the terms or duration of the lease agreement or the physical characteristics of the rental property.

Renewable energy property that is located on a residential classified property, owned by the residential property owner, and produces energy that is used by the residential property is exempt from Colorado property taxation.

Independently owned residential solar electric generation facilities (photovoltaic solar systems) that meet criteria listed in § 39-1-102 (6.8), C.R.S. are exempt from Colorado property taxation under 39-3-102, C.R.S. To qualify for the exemption the solar electric generation facility must be located on residential real property, used to produce electricity from solar energy primarily for use in the residential improvements, and have a production capacity of no more than one hundred kilowatts.

No work of art, as defined in § 39-1-102(18), C.R.S., which is not subject to annual depreciation and which would otherwise be exempt as household furnishings shall cease to be exempt because it is stored or displayed on premises other than a residence pursuant to § 39- 3-102(2), C.R.S.

Intangible Personal Property

Exempted under §§ 39-3-118 and 39-22-611, C.R.S.

Black's Law Dictionary, Sixth Edition, defines intangible property and intangible assets, paraphrased as follows:

As used in the law of taxation, the term intangible property means that such property has no intrinsic and marketable value, but is merely the representing evidence of value such as certificates of stock, bonds, promissory notes, copyrights, and franchises:

An intangible asset is property that is a "right" such as a patent, copyright, trademark, etc., or one which is lacking physical existence, such as goodwill.

Software is classified as intangible property except for the machine language which is automatically initiated during the computer startup. The value of this machine language is inherent in the value of the computer hardware and is not to be exempted. Refer to Chapter 7, Special Issues, for a complete discussion of Software.

Inventories of Merchandise, Material and Supplies

Defined by § 39-1-102(7.2), C.R.S. and exempted under § 39-3-119, C.R.S.

The elements of what constitutes exempt inventory include the following:

- Personal property which is held primarily for sale by a business, farm, or ranch;

- Component parts of personal property held for sale by a business, farm, or ranch or parts that are a part of the manufacturing process include:

- The personal property in these two categories include any inventory held for sale; raw materials, work in progress, and finished goods held by a manufacturer; and replacement parts inventory held for sale by manufacturers, wholesalers, or retailers. There is no difference in the inventory held for sale between a wholesaler or a retailer. Any personal property held for sale by a business, whose primary purpose is the sale of such inventory and that are listed as inventory on the company's financial records are exempt.

- The definition does not include equipment that is for sale by a business, which does not regularly engage in the sale of inventory. For example, an individual who claims that all of his furniture is for sale as of January 1 cannot have his property exempted as inventory. The primary use of the property is not to be held for sale; rather it is to operate the business.

- In addition, any property that is subject to an allowance for depreciation cannot be classified as exempt inventory. Careful examination of the taxpayer's financial records should reveal any allowances for depreciation taken. An exception to this requirement is property rented for 30 days at a time or less as provided for in § 39-1-102(7.2), C.R.S.

- Personal property that is held for consumption by a business, farm, or ranch

- Supply property is generally considered to be consumed internally during the operation of a business, farm, or ranch and are not generally sold. Such things as paper, pencils, computer disks, baling wire, fuel, and fertilizer are normally included in this category.

- Rental property that is:

- Rented for thirty days at a time or less, and

- Which can be returned at the option of the person renting, and

- Is involved in transactions on which the sales/use tax will be collected before finally being sold, and

Is not governed by the terms of a lease contract covering a specific period of time and which includes financial penalties for early cancellation.

- In general, personal property held for rent or lease is taxable except for property with a life of less than one year, in which case, it is considered a supply and is therefore exempt.

- The language of § 39-1-102(7.2), C.R.S., exempts certain rental property under specific conditions. (The rental property for which exemption is claimed must meet all the criteria set forth in the law before it can be declared exempt.)

- The following describes certain types of personal property which are rented or leased and appear to conform, but in fact do not conform with the thirty days or less exemption criteria. This type of personal property can be discovered through the usual process of identifying such businesses and sending or delivering a personal property declaration schedule.

Automatic Rollover Leases

The personal property is typically rented for more than thirty days, even if the rental/lease agreement is structured to appear otherwise, then the personal property is actually rented for more than 30 days. Therefore, the personal property does not fall under the 30 days or less rental exemption. Examples of this type of personal property rollover leases would include water service bottle holders/dispensers and all rent-to-own furniture, appliances, construction tools, and equipment.

Service Organization Property Leases

Even if the personal property is "changed out" or replaced with an identical or closely similar property during a period of time of less than 30 days, these properties are actually rented for more than 30 days. Therefore, the property does not fall under the 30 days or less rental exemption. Examples of this type of service organization property would include: compressed gas tanks, water service bottles, and live plant leasing companies.

Property Secondary (Sub) Leases

If the personal property is rented for thirty days or less and conforms to all other provisions of the 30 days or less rental exemption, but this property is leased for more than 30 days from an original distributor, the property does not qualify for the thirty days or less rental exemption.

In these cases, the personal property is actually owned by the original distributor, not by the company executing secondary (sub) leases with a consumer. Therefore, the property is actually leased for more than 30 days to the secondary lessor.

Exemption of personal property held for rent in no way affects the assessment of any furniture or equipment used by the business. This property would be taxable so long as it does not meet any of the other requirements for exemption found in the law.

- Inventory owned by and in the possession of the manufacturer of the inventory when both of the following apply:

- The inventory is in the possession of the manufacturer after having been leased to a customer directly by the manufacturer.

- The inventory is designated for scrapping, reconditioning, renovation or remanufacture. Normal maintenance is not included in these criteria.

Personal property owned by manufacturers/lessors that was leased during the previous calendar year, but that has been returned to the manufacturer/lessor for scrapping, substantial reconditioning, renovating, or remanufacturing must be reported to the assessor for the assessment year following the year in which the personal property was put back into service.

The language of the statute only addresses machinery that had once been directly leased by the manufacturer to the customer and which has been returned to the manufacturer. The manufacturer must designate such property for scrapping or major reconditioning to qualify the property as exempt. Personal property that is leased through a third party or which has been returned for normal maintenance do not qualify as exempt.

Any leased property which has been returned to the manufacturer and which has not been designated for scrapping or substantial reconstruction cannot be classified as exempt inventory and must be reported to the assessor who will value and assess it as taxable equipment pursuant to § 39-5-107(1), C.R.S.

Business Personal Property Not as Yet in Use

Exempted under § 39-3-118.5, C.R.S.

Business personal property shall be exempt from the levy and collection of property tax until such business personal property is "first used" in the business after acquisition. Taxpayers are to be given this exemption during the “window” between the date that the personal property is acquired and the date when the personal property is first used in the business.

The following criteria should be used when establishing the exemption period prior to first use:

- This policy applies to newly acquired personal property, whether it was acquired either new or used or for either a new or existing business.

- Information reported by the taxpayer on the applicable declaration schedule will be the primary source in establishing the period of exemption and the point in time when the property becomes assessable. The assessor should contact the taxpayer to resolve any questions regarding acquisition year and year of first use. In case of disagreement between the taxpayer and county regarding the year of first use, the burden of proof is on the taxpayer to substantiate the year the personal property was first used in the business.

The Division has incorporated special language and formatting in all declaration schedules so that taxpayers can indicate both year of acquisition and year the personal property was first used in the business.

- Personal property that is on-site, but has not initially been put into service, qualifies for this exemption. The exemption also applies to property that is in a test or “shakedown” mode prior to being put into service. However, once personal property is put into service to function for its intended use it no longer qualifies for the exemption. This intended use may include testing property, research and development property, proof of concept property, and safety/emergency property. Personal property that is removed from service does not qualify.

- Until it is first leased, personal property newly acquired for lease by a lessor qualifies for this exemption. However, once this property is leased, it no longer qualifies for this exemption.

Internal auditing procedures in the county will have to be updated so that during on-site field inspections, information is requested from the taxpayer as to the date the personal property was acquired in addition to the date the personal property was first used in the business.

Personal Effects

Defined by § 39-1-102(10), C.R.S. and exempted under § 39-3-103, C.R.S.

Personal effects include all property used by private citizens in private life. It includes any property used by the taxpayer in sports or hobbies or other recreational activities so long as the personal property is never used to produce income. If the equipment is used to produce any income during any time of the year, it is taxable for the entire year.

There are instances in which it is difficult to ascertain whether or not income is being derived from a personal effect. One indicator is if the taxpayer advertises a service in some sort of public medium.

If the assessor suspects that a taxpayer is using personal effects for the production of income, a declaration schedule should be sent so that the taxpayer has an opportunity to file and be on record as to the nature and use of the property.

Property Leased to Governmental Entities

Personal property that is leased to certain governmental entities may be exempt from property taxation.

Refer to Chapter 1, Applicable Property Tax Laws, for a complete listing of statutory citations for these exemptions and ARL Volume 2, Administrative and Assessment Procedures, Chapter 10, Exemptions, for a complete discussion of these exemptions.

Works of Art

Defined by § 39-1-102(18), C.R.S. and exempted under §§ 39-3-102 and 39-3-123, C.R.S.

Works of art are original creations of visual art, including but not limited to the following:

- Sculpture

- Paintings or drawings

- Mosaics

- Photographs

- Crafts made from clay, fiber and textiles, wood, metal, plastics or any other material

- Calligraphy

- Mixed media

- Unique architectural embellishments

As provided in § 39-3-123, C.R.S., works of art are exempt for the period of time that they are loaned to and under the control of three types of entities.

- The State of Colorado

- A political subdivision of the State (Counties, cities, towns, special districts; and school districts)

- A library, an art gallery, or museum, if:

- Owned or operated by a charitable organization as defined by § 39-26-102(2.5), C.R.S.

- The organization's property is irrevocably dedicated to charitable purposes.

- The organization's assets do not benefit any private person upon the liquidation, dissolution, or abandonment by the owner.

- The use of the work of art is for charitable purposes. Charitable purpose is defined as follows:

- Public display

- Research

- Educational study

- Maintenance of the property

- Preparation for display

The assessor can confirm items 3a through 3c by reviewing the Certificate of Sales Tax Exemption and the Articles of Incorporation for the art gallery or museum.

Works of art that are part of an individual's private collection and not used to produce income at any time are classified as household furnishings or personal effects and are exempt pursuant to §§ 39-1-102(6) or (10), C.R.S.

Paraphrasing § 39-3-102(2), C.R.S., no work of art, as defined in § 39-1-102(18), C.R.S., which is not subject to annual depreciation and which would otherwise be exempt as household furnishings shall cease to be exempt simply because it is stored or displayed on premises other than a residence.

Works of art that are owned by a business or corporation are taxable unless they meet the requirements of §§ 39-3-102(2) or 123, or 39-5-113.5, C.R.S.

The owners of the works of art must file a works of art statement, personal property declaration, and proof of the exemption (documentation) with the assessor to substantiate the claim for exemption each assessment year. Counties creating a form to use for the works of art exemption must submit the form to the Division of Property Taxation for approval pursuant to § 39-2- 109(1)(d), C.R.S.

Proof of the Display Location's Exemption

The taxpayer claiming exemption must furnish proof of exemption according to §§ 39-26- 102(2.5) and 39-3-123, C.R.S., for the location in which the works of art are to be displayed. The necessary documentation should be available from the organization that is to display the art to comply with the provisions for proof of exemption in § 39-5-113.5(1), C.R.S. Documentation is not required in the case of government buildings.

Proration of Works of Art Valuations

The assessor determines the actual value of the property and prorates the value based on the number of days it qualifies for exemption compared to the full calendar year. After the value is determined and prorated, the assessor must notify the taxpayer pursuant to § 39-5-113.5(2), C.R.S. Procedures and an example of the proration of works of art changing taxable status are found in Chapter 7, Special Issues.

Electric Vehicle Charging Systems

Section 39-3-138, C.R.S., exempts electric vehicle charging systems from the levy and collection of property taxes for property tax years 2023 through 2029. Electric vehicle charging systems are defined in § 38-12-601, C.R.S.

(6)(a) "Electric vehicle charging system" or "charging system" means a device that is used to provide electricity to a plug-in electric vehicle or plug-in hybrid vehicle, is designed to ensure that a safe connection has been made between the electric grid and the vehicle, and is able to communicate with the vehicle’s control system so that electricity flows at an appropriate voltage and current level. An electric vehicle charging system may be wall-mounted or pedestal style and may provide multiple cords to connect with electric vehicles. An electric vehicle charging system must be certified by underwriters laboratories or an equivalent certification and must comply with the current version of article 625 of the national electrical code.

§ 38-12-601, C.R.S.

For tracking and reporting purposes, exempt electric vehicle charging systems should be assigned an abstract code of 9420. For more information on assigning abstract codes for exempt electric vehicle charging systems, see Assessors’ Reference Library, Volume 2, Chapter 6.

Local or State Assessment

Operating property owned by a public utility, as defined in § 39-4-101, C.R.S., is assessed by the Division of Property Taxation under the direction of the Property Tax Administrator. Operating property includes all property, real and personal, tangible and intangible, that is used in the operation of the public utility, regardless of its contribution to earnings. This definition typically includes leased property.

Non-operating property includes property that is not directly connected with the day-to-day operation of the company. Non-operating property is assessed by the local county assessor.

For more information on local vs. state assessment, see Assessors’ Reference Library, Volume 2, Chapter 11.