Chapter 12 - Special Topics

Tax Increment Financing (TIF)

Overview

Throughout this section the following abbreviations are used:

- “URA” - urban renewal authority/ies

- “DDA” - downtown development authority/ies

- "CRA" - county revitalization authority/ies

- “UR” - urban renewal

- “DD” - downtown development

- "CR" - county revitalization

- “TIF” - tax increment financing

- A UR, DD, CR, or TIF plan is a plan approved for urban renewal, downtown development or county revitalization that includes a provision authorizing the authority to utilize TIF.

The statutory definitions related to these abbreviations are covered later in this section.

“Assessed value”, “valuation for assessment” and “total valuation for assessment” refer to the same terms used in the TIF provision of UR law § 31-25-107(9), C.R.S., DD law § 31-25-807(3), C.R.S., and CR law § 30-31-109(13), C.R.S. Pursuant to § 2-4-115, C.R.S., the Property Tax Administrator determines that in the context of TIF procedures, the terms assessed value and valuation for assessment mean the valuation for assessment for the purpose of levies imposed by local governmental entities, and do not include levies imposed by school districts.

Title 31 of the Colorado Revised Statutes authorizes urban renewal authorities and downtown development authorities to use tax increment financing, while Title 30 applies to county revitalization authorities. TIF revenue may be derived from municipal sales taxes, ad valorem property taxes, or both.

Sections 31-25-107(9)(h) (governing UR TIF), 31-25-807(3)(f) (governing DD TIF), and 30-31-109(13)(h) (governing CR TIF), C.R.S., require the Property Tax Administrator to prepare and publish manuals to give direction to county assessors regarding the manner and methods by which the statutory TIF provisions are to be implemented. Additionally, the Administrator has the general requirement to assist in the administration of all property tax laws, § 39-2-109, C.R.S.

Some differences between urban renewal, downtown development and county revitalization statutes are identified in this section. Each TIF plan is unique. The Assessors’ Reference Library cannot anticipate every TIF related issue and does not summarize all provisions of UR/DD/CR law. This section is intended to be a procedural resource for county assessors and focuses only on ad valorem property tax procedural issues related to administering the TIF provisions. Sales tax issues do not fall under the authority of the Division or county assessors.

TIF statutes do not supersede or alter the ad valorem statutes in title 39, C.R.S., requiring assessors to value all taxable property according to its actual value pursuant to section 3 of article X of the Colorado Constitution.

The TIF Provision

A TIF provision is intended to finance projects from future tax revenues. When a TIF-funded project is undertaken as part of a UR, DD, or CR plan, there is an expectation that the project will drive new growth and redevelopment within the plan area and, in turn, new and increased property value within the plan area. The increase in value will generate increased tax revenue that the authority can use to help pay for the project.

A UR plan may contain a provision that property taxes levied upon taxable property in the urban renewal area (TIF area) after the effective date of the plan may be split between the authority and local taxing entities for a period that cannot exceed 25 years. A CR plan has a maximum 30 year term. A DD plan may contain a provision that property taxes levied upon taxable property in the downtown development area (TIF area) after the effective date of the plan may be split between the authority and local taxing entities for a period that cannot exceed 30 years, except when a 20-year extension is enacted pursuant to § 31-25-807(3)(a)(IV), C.R.S. (See 20-Year Extension to DDA TIF Area in this section.) The process for determining the final year of a TIF’s life is discussed later in this section under Determining the Final Year.

The division of property tax is made according to the “base” valuation of the area and any “increment” valuation that may have occurred in the area. The base valuation of the tax increment area begins as the total assessed valuation of all taxable property last certified by the assessor prior to the effective date of the approval of the tax increment financing plan. All property taxes attributable to the base valuation are paid to each taxing entity (school district, county, city, etc.) within the area according to the mill levy rates fixed each year by or for each such political body.

The “increment” valuation of the tax increment financing area is the amount of assessed valuation, if any, which exceeds the base valuation. All property taxes attributable to the “increment” valuation are paid into the special fund of the URA, DDA, or CRA to pay debt service on the bonds and other indebtedness. Division of Property Taxation policy is that the increment value never drops below zero even if the total valuation of the area drops below the established base valuation. The assessor reports a negative increment as a zero increment and does not certify a negative increment to taxing entities.

The mills of these same taxing authorities are also levied on the increment and paid into the special fund of the TIF authority. There is no separate mill levy for the increment. However, an exception exists for certain urban renewal plans created or substantially modified after January 1, 2016. Authorities with such plans are not entitled to receive the additional revenue generated by voter-approved measures that allow taxing entities to assess an additional mill levy or to retain and spend previously collected excess revenue, if those measures were approved after January 1, 2016.

In its simplest form, a TIF project is funded with debt, typically in the form of bonds issued by the authority or the underlying municipality. Various other financing agreements involving government entities and private developers are permitted, and are common. The tax revenue derived from the increment is pledged as the basis for payment of debt.

Once increment value exists, the taxes on that value are statutorily required to be put into a special fund to pay debts and other obligations. When the obligations of the TIF have been paid, or the maximum time period authorized has elapsed, the base/increment division stops and all taxes from that point on are paid to the tax entities for that tax area. A TIF provision in a UR plan may last for a maximum of 25 years.

The statutes require the municipality or county in which a TIF plan is established to timely notify the assessor when any of the following occur:

- A plan has been approved or modified that includes a TIF provision.

- TIF funded debt has been repaid.

- The purposes of the authority have been otherwise achieved.

The assessor’s role in TIF is to track and segregate the two property value components, base and increment, annually for the maximum duration authorized by statute, or until the assessor is notified that a project is completed, whichever comes first.

Base value generates property tax revenue within the plan area as if the TIF plan never existed. Once established, base and increment values are adjusted proportionately or exclusively as a result of at least one of nine of the following events:

NOTE: Proportional adjustments are covered in more detail later in this section, under the heading Base and Increment Proportional Adjustments.

- The biennial reassessment of real property to a new level of value. (proportionately)

- The annual valuation of personal property, natural resource production, state assessed property, and possessory interests. (proportionately)

- The adoption of a substantial modification to a plan. (exclusively)

- Modifications to a plan area adding property (exclusively)

- Modifications to a plan area removing property (proportionately)

- The issuance of a reappraisal order by the State Board of Equalization. (proportionately or exclusively)

- A valuation adjustment ordered as a result of an appeal or abatement. (proportionately or exclusively)

- The identification of omissions or errors that the assessor is required to correct. (proportionately or exclusively)

- A 20-year extension of a DDA. (proportionately)

Increment value is tracked and calculated annually, as of the assessment date, to capture new and changed values not resulting from these nine events. Such non-reassessment changes are property specific and are presumed to result from the effects of the TIF plan.

NOTE: The increment value may be subject to proportional adjustment as described later in the section Base and Increment Proportional Adjustments.

All taxes in excess of the base are allocated to and, when collected, paid into the special fund. No taxes are exempt from this division. However, §§ 31-25-107(9.5) and (11), C.R.S. allow the URA and a taxing entity whose mill levy contributes to incremental property tax revenues to negotiate an agreement for sharing the incremental property tax revenue. These agreements are administered by the URA. The assessor has no role in the distribution of these shared funds. The assessor certifies values to the taxing entities and delivers the tax warrant to the treasurer such that 100 percent of the taxes derived from the increment is paid into the special fund without regard to the portion of that revenue that is shared by the URA with the various taxing entities.

Property Tax Administrator’s Authority

The manner and methods by which TIF provisions are to be implemented by assessors are prepared and published by the Property Tax Administrator. The Administrator has direct statutory authority over these procedures, §§ 31-25-107(9)(h) and 807(3)(f), C.R.S.

For most practical purposes, implementation of the TIF provisions of both the UR law and the DD law is the same except where noted.

NOTE: Other than certain provisions related to the inclusion of agricultural land in a UR plan, the assessor has no role in administering a UR or DD plan that has no property TIF provision.

Formation and Powers of URA, DDA and CRA Relevant to Tax Increment Financing

Creation

The governing body of any Colorado municipality may create and establish a URA, a DDA, or both. URA is created by a resolution of the governing body of the municipality upon the petition of twenty-five electors. A DDA may be created only after the qualified electors in the municipality have approved the establishment of a DDA at a regular or special election. The election question must state the boundaries of the DDA district and whether an ad valorem tax or sales tax, or both, will be used to finance DDA operations.

Creation of a CRA requires a petition signed by at least 25 qualified electors (voters) of the county, or the governing body may adopt a resolution setting forth the need for a CRA. In either case, a public hearing must take place prior to a resolution finding the need for, and creating, the authority is adopted.

NOTE: If a UR plan and a DD plan that both contain a TIF provision coexist in the same area, only one TIF diversion is possible. However, the law does contemplate that the two authorities overseeing the coexisting plans could manage to share increment revenue through the terms of an intergovernmental agreement. When UR and DD plans coexist in the same area the Division recommends that assessors administer the TIF diversion according to whichever plan was first approved.

Area of Authority

URA boundaries are identical to those of the municipality. A governing body may approve any number of UR plans, each of which contain a UR project with one or more TIF areas. A UR plan may also include property outside the boundary of the municipality if that inclusion is approved by the county commissioners, the owners of each property, and the mortgagees of each property, § 31-25-112.5, C.R.S.

DDA boundaries are limited to the “central business district” of the municipality. A DDA TIF area can be any approved, specified area within that central business district. See Inclusion of Property to a TIF Area later in this section.

CRA boundaries are the county boundaries, excluding municipalities.

Authority to Levy Taxes

A URA and CRA does not have the authority to levy ad valorem taxes. They receive property tax revenue derived from ad valorem taxes on increment value from within a UR or CR plan with a TIF provision.

An important difference with a CRA is that school districts are excluded from participating in a CR plan. Taxing entities within the CRA boundaries must petition to participate in a CR plan. Only those taxing entities qualified to participate in a CRA will have revenue generated by their respective mill levies diverted into the special fund of the CRA, § 30-31-104(6), C.R.S.

A municipality is authorized to levy up to five mills on behalf of its DDA, § 31-25-817, C.R.S. If the total valuation for assessment within a DD plan area is divided pursuant to a TIF provision, this levy is on the base (net) valuation within the DD plan area. A DDA therefore has potentially two separate property tax revenue streams authorized by two separate statutory provisions. Revenue from the ad valorem tax on the base (net) valuation may be used for a development project, for non-debt funded expenditures of the authority, and for its annually budgeted operations, § 31-25-817, C.R.S. TIF revenues paid into a special fund (which includes the increment portion of the DDA’s mill levy) are to be used to finance project debt, § 31-25-809, C.R.S.

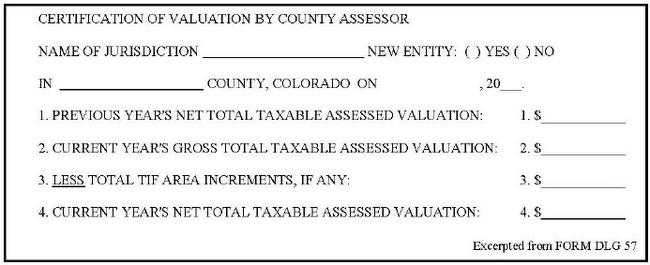

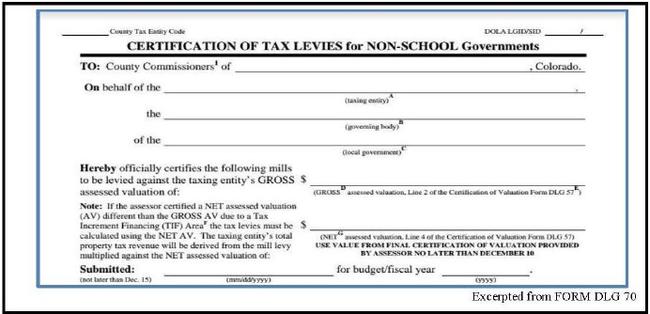

All taxing entities determine their mill levies and derive their revenue from the net value. If increment value exists, the certifications of value that are annually prepared by the assessor, report the total valuation for assessment, the increment value and the net value. See Chapter 7, Abstract, Certification and Tax Warrant for more information about certification of levies.

Issuance of Bonds/Debt

A URA or CRA has the discretion to issue bonds or other debt obligations without prior voter approval. Such debt may finance URA or CRA activities or operations and may be either general obligations or special obligations. General obligations are secured by the full faith and credit of the authority. Special obligations are payable solely from and secured only by a pledge of the specific revenue identified in the debt documents, including money paid into the special fund of the URA or CRA from a TIF project, §§ 30-31-111 and 31-25-109, C.R.S.

DDA do not have independent authority to issue tax increment bonds, but the municipality may issue such bonds approved by the qualified electors within the boundaries of the DDA at a special election held for that purpose. Such bonds are payable either from revenues paid into the special fund derived from TIF or from property tax revenues derived from the DDA’s mill levy, § 31-25-809, C.R.S.

Relevant Statutes

UR Plans

UR plan “means a plan, as it exists from time to time, for an urban renewal project...,” § 31-25-103(9), C.R.S. A UR project “means undertakings and activities for the elimination and for the prevention of the development or spread of slums and blight...,” § 31-25-103(10), C.R.S. A UR area “means a slum area, or a blighted area, or a combination thereof which the local governing body designates as appropriate for an urban renewal project,” § 31-25-103(8), C.R.S. In other words, there is only one UR project, consisting of multiple undertakings and activities in each UR area designated by an approved UR plan.

Following is an abbreviated summary of some of the statutory provisions to which UR plans are subject pursuant to § 31-25-107, C.R.S. Familiarity with these statutes can aid in discovering information about proposed UR plans, planning workflow, and establishing communications with the appropriate personnel.

- (1)(a), Governing body must pass a resolution determining an area to be blighted before a URA can undertake a UR project within a UR area.

- (1)(c)(I), Except for UR plans subject to § 31-25-103(2)(l), C.R.S., the boundaries of a UR plan area shall be drawn as narrowly as feasible to accomplish the planning and development objectives of the proposed UR area.

- Further in (1)(c)(I), a URA shall not acquire real property for a UR project unless a UR plan has been approved.

- (1)(c)(II), No UR area shall contain agricultural land unless . . . . Refer to Agricultural Land Inclusion in this section.

- (1)(d), In the case of an urban renewal plan approved or substantially modified on or after June 1, 2010, the plan shall include a legal description of the urban renewal area, including the legal description of any agricultural land proposed for inclusion within the urban renewal area, pursuant to subparagraph (II) OR (III) of paragraph (c) of this subsection (1).

- (2), Prior to approval of a UR plan, the governing body shall submit such plan to the municipality planning commission for review and recommendations as to its conformity with the municipality’s master plan.

- (3)(a), The governing body shall hold a public hearing on a UR plan or substantial modification of an approved plan, no less than thirty days after public notice thereof.

- (3.5)(a), At least thirty days prior to the hearing on a UR plan or substantial modification of a plan, the governing body or URA shall submit such plan or modification to the county board of commissioners. If property taxes collected as a result of the county levy will be utilized, the governing body or URA shall also submit a UR impact report, which shall include certain information. (Refer to § 31-25-107(3.5)(a) for the complete list.)

- (7), If a plan is modified that substantially changes previously approved provisions of the UR plan regarding land area, land use, authorization to collect incremental tax revenue, the extent of the use of tax increment financing, the scope or nature of the urban renewal project, the scope or method of financing, design, building requirements, timing or procedure, or where such modification substantially clarifies a plan that, when approved, was lacking in specificity as to the urban renewal project or financing, then the modification is substantial and all of the requirements of § 31-25-107, C.R.S, apply.

- (8) Upon the approval by the governing body of a UR plan or a substantial modification, the provisions of the plan with respect to the land area, land use, design, building requirements, timing, or procedure applicable to the property covered by the plan shall be controlling with respect thereto.

- (9) The TIF provision, covered in more detail later in this section.

- (9.5) Before a municipal governing body may approve a UR plan, representatives of the governing body, the board of county commissioners and each public body whose taxes would be diverted shall negotiate an agreement governing the types and limits of tax revenues of each taxing entity to be allocated to the urban renewal plan. In the absence of an agreement the parties must submit to mediation.

- (9.6)(a) Permits urban renewal plans to specify that the valuation attributable to extraction of mineral resources shall not be subject to the division of base/increment value. If a UR plan specifies this exclusion, all property tax revenue derived from the extraction of mineral resources within the UR plan area is distributed to the public bodies as if the UR plan was not in effect. Value attributable to mineral resources includes both real and personal property associated with extracting oil, gas, coal, sand, gravel, and other minerals, § 36-1-100.3, C.R.S.

- (9.7)(b) The changes enacted by HB 15-1348 and SB 17-279 apply to municipalities, urban renewal authorities, and urban renewal plans created or substantially modified after January 1, 2016

- (10) The municipality in which an urban renewal authority has been established shall timely notify the assessor of the county in which such authority has been established when:

(a) An urban renewal plan or a substantial modification has been approved that contains a TIF provision or a substantial modification of the plan adds land to the plan, which plan contains a TIF provision;

(b) Any outstanding obligation incurred by such authority pursuant to the provisions of subsection (9) of this section has been paid off; and

(c) The purposes of such authority have otherwise been achieved.

(11) The governing body or the authority may enter into an agreement with any taxing entity within the boundaries of which property taxes collected as a result of the taxing entity's levy, or any portion of the levy, will be subject to allocation pursuant to subsection (9) of this section. The agreement may provide for the allocation of responsibility among the parties to the agreement for payment of the costs of any additional county infrastructure or services necessary to offset the impacts of an urban renewal project and for the sharing of revenues.

And, § 31-25-110(2), C.R.S. All property of an authority acquired or held for any purpose of this part 1 . . . shall be exempt from all taxes of the state of Colorado or any other public body thereof; except that such tax exemption shall terminate when the authority sells, leases, or otherwise disposes of the particular property to a purchaser, lessee, or other alienee which is not a public body entitled to tax exemption with respect to such property.

DD Plans

The term “DD plan” used in this section is synonymous with the statutory term “plan of development” which “means a plan as it exists from time to time, for the development or redevelopment of a downtown development area, including all properly approved amendments thereto,” § 31-25-802(6.6), C.R.S. “‘Development project’ or ‘project’ means undertakings and activities of an authority or municipality as authorized in this part 8 in a plan of development area…,” § 31-25-802(3.5), C.R.S. “‘Downtown’ means a specifically defined area of the municipality in the central business district, established by the governing body of the municipality pursuant to this part 8,” § 31-25-802(5), C.R.S. “‘Central business district’ means the area in a municipality which is and traditionally has been the location of the principal business, commercial, financial, service and governmental center, zoned and used accordingly,” § 31-25-802(3), C.R.S. As with a UR project, there is just one DD project consisting of multiple undertakings and activities within a DD area approved by a DD plan, and all properly approved amendments thereto.

The statutory provisions for creating a DD plan are less comprehensive than those for a UR plan. The DDA statutes do not provide a notification requirement similar to that found in the UR statute. The assessor should rely on the results of the election and public hearings in determining whether a DD plan has been approved, as provided for in §§ 31-25-804 and 807(4), C.R.S.

Following is an abbreviated summary of some of the provisions to which DD plans are subject, pursuant to § 31-25-807, C.R.S. The DDA may:

- (2)(d) Plan and propose, within the downtown development area, plans of development for public facilities and other improvements to public or private property of all kinds, including removal, site preparation, renovation, repair, remodeling, reconstruction, or other changes in existing buildings which may be necessary or appropriate to the execution of any such plan which in the opinion of the board will aid and improve the downtown development area;

- (2)(e) Implement, as provided in this part 8, any plan of development, whether economic or physical, in the downtown development area as is necessary to carry out its functions.

- (2)(f) In cooperation with the planning board and the planning department of the municipality, develop long-range plans designed to carry out the purposes of the authority as stated in section 31-25-801, C.R.S., and to promote the economic growth of the district and may take such steps as may be necessary to persuade property owners and business proprietors to implement such plans to the fullest extent possible.

- (3) The TIF provision, covered in more detail later in this section.

- (4)(a) A DDA shall not actually undertake a development project for a plan of development area unless the governing body, by resolution, has first approved the plan of development which applies to such development project.

- (4)(b) Prior to its approval of a plan of development, the governing body shall submit such plan to the planning board of the municipality, if any, for review and recommendations.

- (4)(c) The governing body shall hold a public hearing on a plan of development, or substantial modification of an approved plan of development.

- (4)(d) Following such hearing, the governing body may approve a plan of development if it finds that there is a need to take corrective measures in order to halt or prevent deterioration of property values or structures within the plan of development area or to halt or prevent the growth of blighted areas therein.

CR Plans

Similar to UR law, CR law gives broad power to CRAs to undertake projects for revitalization. An important difference is that remediation of blight is not a statutorily required condition of revitalization. Instead, the statutory goal is to target areas that would benefit from revitalization and economic investment that would not occur without additional funding. A CR plan attempts to promote sound growth of the county, improve economic and social conditions, and further the health, safety, and well being of the public in the revitalization area. Section 30-31-103(14), C.R.S., outlines nine opportunity factors of which one or more should be actualized through the plan.

The nine factors include:

- 1. Investment in critical infrastructure to achieve desired levels of residential density and employment growth.

- 2. Improvement of mobility and increased access to transportation corridors.

- 3. Development of affordable housing proximate to transportation hubs and corridors.

- 4. Development of economic opportunities for job creation.

- 5. Expansion of access to healthy food systems, medical services, parks, and education opportunities.

- 6. Improvement of circulation patterns and enhancement of reliable transportation.

- 7. Remediation of contaminated soils or water.

- 8. Clearance, abatement, or rehabilitation of unsound, deteriorating, or unsafe structures.

- 9. Redevelopment of former landfills, floodplains or other areas challenged by topography that pose a threat to public safety.

TIF Procedures for Assessors

TIF procedures are implemented when a municipality approves a new UR or DD plan that includes a TIF provision, or when an existing plan is substantially modified to add a TIF provision. Once notified of the approval of a plan that contains a TIF provision, the assessor sets up the TIF area in their records, establishes an initial base value for the TIF area, and then annually calculates and certifies the base and increment values in the TIF area. This process continues annually until the assessor receives notification that the TIF plan is complete, or after the statutory time limit of the TIF has expired.

All taxing entities that service the TIF area calculate their mill levies based on the net total taxable value (gross total taxable value minus increment value) certified each year by the assessor. The treasurer then divides property tax revenue between the taxing entity and the authority based on the annual base/increment split calculated by the assessor. The tax revenue on the base goes to the taxing entity. The tax revenue on the increment goes to the TIF special fund.

The assessor may enforce a provision that restricts the inclusion of agricultural land into an urban renewal or county revitalization area for which the use of property tax TIF has been authorized. There is no such restriction for the inclusion of agricultural land in DDA law. Refer to Assessor Enforcement of Agricultural Land Restriction.

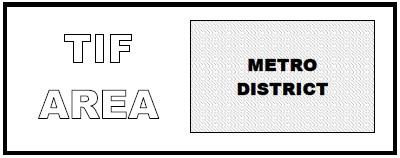

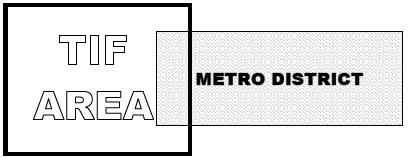

The assessor must annually account for the total assessed valuation of the tax increment area so that the amount of the increment, if any, can be determined. In order to identify all of the taxing entities authorized to levy within the boundaries of the TIF plan area, the assessor first maps the boundaries and then creates a specific tax area or authority area identification code, and then assigns each parcel this code.

See the following illustrations:

In the examples above, the individual property owner whose property is located in the DD plan

area pays taxes on the total assessed value of their property, then 73.53% of his taxes are

disbursed to the taxing entities and 26.47% is diverted into the special fund.

The procedures listed below explain the process by which the assessor:

- Establishes the TIF area in the assessor’s records

- Enforces the agricultural land restriction, if applicable. Refer to Agricultural Land in Urban Renewal Area in this section.

NOTE: Procedurally the agricultural land restriction analyses must occur before establishing the initial base value. But for clarity, these procedures are covered separately, later in this section.

Sets the initial base value - Calculates the base and increment value during each successive year

- Reports those values to taxing entities, the authority, and the county treasurer

Setting Up the TIF Area in the Assessor’s Records

The assessor typically receives advance notice when an authority is considering adoption or the substantial modification of a plan that uses TIF. The authority will often consult with the assessor as they determine the boundaries of the proposed TIF area, which properties are located in the area, the classification of those properties, and the properties’ values. Assessors are encouraged to work with the authority during this process but are cautioned against providing forecasts of future valuations.

A municipality is required to timely notify the assessor when it has approved a UR plan authorizing the use of TIF, § 31-25-107(10), C.R.S. In addition, the plan shall include a legal description of the UR area, § 31-25-107(1)(d), C.R.S. The assessor should also obtain a copy of the plan, the relevant city ordinances and corresponding resolutions.

When a plan containing a TIF provision is approved, the assessor’s office should first complete related steps A and B, then proceed with steps 1 through 7.

A - With a UR plan containing a TIF provision, determine whether agricultural land has been properly included within the area, even if the TIF provision only pertains to sales tax. Refer to Assessor Enforcement of Agricultural Land Restriction and Setting the Initial Base Value in this section. There are no such agricultural land restrictions for DD plans.

B - Determine whether the plan authorizes the use of property tax increment. If such a TIF provision is not part of the approved plan, the assessor has no further role other than opting to enforce the agricultural land restriction. If the approved plan authorizes property tax increment, complete the steps that follow:

- Determine the date on which the plan was approved by the municipality. The date of approval directly affects the establishment of the initial base value. Refer to Setting the Initial Base Value in this section.

NOTE: Statutes permit the addition of land to an existing plan. Although these statutes are silent on the issue of removing land from an existing plan, courts have concluded that such removal is permissible under statute. Either event, adding or removing land, does not necessarily restart the base value or the timing of TIF, unless such event is part of new or substantially modified plan, which then must include the due process, notification, or election requirements outlined in statute. Such events require the base value to be increased when land is added, and may require the base value to be reduced when land is removed. See, NURA v. Reyes, 300 P.3d 984 (Colo. App. 2013).

- Map the legal description of the TIF area. Confirm that the boundaries of the legal description stated in the plan match the boundaries on the map provided by the authority.

- Identify all property, real and personal, located within the TIF area.

- Establish a new tax area code for each portion of the TIF area that is serviced by the same set of taxing entities. When values are certified in subsequent years, taxing entities that overlap less than 100 percent of the TIF area will be certified only their proportionate share of the increment value. Refer to Taxing Entity Covers Part of TIF Area in this section.

- Assign the new tax area code to each parcel/schedule located within the TIF area.

- Closely analyze land uses, zoning regulations, classification codes, and property values to determine if any parcels are erroneously classified or valued. All errors should be corrected promptly to avoid future errors in the base/increment calculations.

- Establish the initial base value.

Upon completing these steps the assessor’s work file will include the following information. The assessor should strive to share this information with the municipality and/or authority to verify accuracy and correct mistakes prior to certifying final values:

- The map provided by the authority and reviewed by the assessor, showing the TIF area boundaries, the tax area boundaries within the TIF area, and each parcel/schedule located within the TIF area.

- A list of taxable and exempt parcels/schedules in the TIF area, including their classification, current year assessed value, tax area code and mill levy, along with any parcels whose classification and/or value should be corrected.

- If the initial base value is calculated from prior year values, provide a second list containing the same information stated above as it existed when values were last certified during the prior year. If corrections have been made to those values, include the corrected values.

- The initial base value

- A list of the taxing entities and mill levies associated with each tax area

Setting the Initial Base Value

The assessor’s annual calculations of the base and increment value begin with the establishment of the initial base value. Pursuant to §§ 31-25-107(9)(a)(I), 31-25-807(3)(a)(I), and 30-31-109(13)(a)(I), C.R.S., the initial base value is the total assessed valuation of all taxable property last certified by the assessor prior to the effective date of the approval of the urban renewal or downtown development tax increment financing plan.

Assessors certify final values to entities by December 10. The base of any plan with a TIF provision that is approved prior to this final certification will reflect the total taxable value in the plan area as of the prior assessment year. If a TIF plan is approved in December, after final values are certified, the base is derived from the most recent certified values, and the plan could not realize an increment until the following year.

For more information on this subject, see Determining the Final Year in this section.

Identify and Correct Errors Prior to Setting the Initial Base Value

Prior to establishing the initial base value, the assessor’s office should carefully review the classification and value of each property in the TIF area as it existed when values were last certified. If errors are discovered, they should be corrected prior to setting the initial base value. If the errors are for the prior tax year, they generally can be corrected only through the approval of abatement petitions or the issuance of Special Notices of Valuation. Such corrections should be made without delay because a failure to make them before setting the initial base value can cause repeating annual shortages or windfalls of TIF revenue.

- For locally assessed property, real and personal property appraisers should review the listing, classification, inventory and valuation of each property located within the TIF area.

- Areas included in a UR/DD/CR plan containing a TIF provision are likely to transition from decline to redevelopment. Therefore, it is crucial for appraisers to accurately value land and improvements according to its condition, zoning and land-use regulations in place prior to the approval of a UR/DD/CR plan.

- For state assessed property, provide each state assessed company with an updated tax area map and explain in a cover letter why it is important to have a correct distribution of state assessed values for the new TIF area. When a distribution appears to be unreasonable, contact the state assessed company and discuss how the distribution percentages were derived.

Adjusting the Base Value in Subsequent Years

Each year, the assessments of many properties within a TIF area change as a result of changes to the characteristics or use of properties and as a result of statutory reassessments. Therefore, the total assessed valuation of the area is recalculated annually at the appropriate level of value. When the total valuation of the TIF area exceeds the adjusted base valuation, the portion of value that exceeds the adjusted base is the increment.

Once established, the base valuation of the TIF area is adjusted in subsequent years to account for the following changes:

- Pursuant to §§ 31-25-107(9)(e), 31-25-807(3)(e), and 30-31-109(13)(e), C.R.S., whenever there is a general reassessment of property, the base and increment values are proportionately adjusted in accordance with the reassessment. The law does not define general reassessment. Current statutes provide that odd numbered years are years of general reassessment for real property, while the general reassessment of personal property, natural resources, state assessed public utilities and possessory interests occurs annually as of the January 1 assessment date. Therefore, the following events affect base valuation:

- A general reassessment of real property to a new “level of value” occurs in odd-numbered years, pursuant to § 39-1-104(10.2)(d), C.R.S.

- The State Board of Equalization issues an order pursuant to its authority to reappraise a class or subclass of property, some of which is located in a TIF area, pursuant to §§ 39-1-105.5, 39-2-111, and 114, C.R.S.

- The annual reassessment of personal property, § 39-1-104(12.3), C.R.S. In an intervening year the change in value attributable to personal property is proportionately adjusted, including personal property associated with oil and gas production, § 39-7-103, C.R.S.

- The annual reassessment of natural resource operations, oil & gas wells, and producing mines. The increase or decrease of such valuation is a reassessment change and therefore requires proportionate adjustment of the base and increment, §§ 39-6-104, 39-6-106, and 39-7-102, C.R.S.

- The annual reassessment of state assessed property, § 39-4-106, C.R.S. The increase or decrease of such valuation is a reassessment change and therefore requires proportionate adjustment of the base and increment.

- The annual reassessment of possessory interests, pursuant to § 39-1-103(17)(a)(I) and (II)(B), C.R.S.

- The base and increment may be proportionately adjusted as a result of abatement or an appeals board or court order. Abatement petitions can be filed up to two full tax years after a property’s change in level of value, and court ordered adjustments can take even longer. Therefore, the base/increment split must be recalculated retroactively, in the year that produced the incorrect value, and then carried forward; otherwise, base/increment proportions will be incorrect in subsequent years. Refer to Value Reductions Resulting from Abatements or Orders in this section.

- If a TIF plan is modified to include additional property in the TIF area, the added property value is included in the base value. Refer to Inclusion of Property to a TIF Area in this section.

- Pursuant to § 39-5-125 C.R.S., when errors or omissions are discovered that pertain to either the base or increment, and it can be ascertained what was intended, such errors should be corrected in the current year but not retroactively. The basis for correction should be documented and communicated to the authority and the taxing entities when the assessor certifies values annually. Such corrections do not include abatements or orders issued by an appeals board or court. See Value Corrections due to Mistakes in this section.

- When property is removed from a TIF area, the total valuation for assessment should be reduced according to the value of the removed property and the removed property’s base value should be removed from the base. The removal of property from a TIF area is significantly different from property within a TIF area going from taxable to exempt. In the former event the taxing entities continue to receive taxes from the removed property. In the latter event the tax revenue derived from the exempt property is eliminated. Refer to Removal of Property from a TIF Area in this section.

The TIF provisions do not require an assessor to calculate an increment value for each property. Rather, the amount of the increment, if any, is based on the aggregate total valuation for assessment of the entire TIF area. However, the assessor must know of and track the changes in each property in a TIF area. The Division recommends that a TIF model or tracking system be developed that produces and preserves the portion of the increment value, if any, attributed to each property in TIF area due to non-reassessment changes.

Increment Value Adjustments Only: Attributable to Non-Reassessment Changes

Non-reassessment changes are property specific and affect the increment only. Value changes to specific properties are caused by one or more of three events:

- Changes to the physical characteristics of a property

- Changes to the legal characteristics of a property

- Changes in a property’s use

Typically these events follow the undertakings of a TIF authority. The value, if any, attributed to new development is evidenced by these events. A non-reassessment event that impacts the value of property in a TIF area is attributable to the increment, whether or not such change is demonstrated to be directly caused by undertakings of the authority. However, indirect benefits resulting from market perceptions that properties located in a TIF plan are more or less desirable/valuable are evidenced when any sort of reassessment event occurs, and such event applies proportionately to both the base and increment.

Prior to the assessor’s annual calculation of the base and the increment, the TIF authority is encouraged to provide the assessor with a description of planned redevelopment activities and a list of properties that the authority believes fall within any of the three events described above. Although the assessor is responsible for making any determination and calculating the associated value, it may be difficult for the assessor to identify every change that satisfies one or more of the above non-reassessment conditions.

Listed below are examples of changes to properties that may fall within one or more of the three events described above. The list is not intended to encompass all possible examples.

- Value attributable to new construction, including new improvements, remodels, additions, new personal property associated with newly constructed real property and state assessed new construction.

- Value attributable to new personal property accounts located within the TIF area as a result of the development project.

NOTE: Value changes to existing personal property accounts are the result of annual reassessment and affect the base and increment proportionately. - Value attributable to a change in taxable status. A classification change can increase value within a TIF plan area (for example, exempt to taxable or residential to commercial) or decrease value (for example, taxable to exempt or vacant to partially complete residential). Such changes are attributed entirely to the increment. Value attributable to demolished or destroyed real property. Demolition can decrease or increase the value of property, such as in the case of the demolition of an improvement that is contaminated or which has reached the end of its economic life.

- Value attributable to changes in land use entitlements, such as the platting or re-platting of land, the filing of a condominium declaration and plat, or a change in zoning.

- Value attributable to the assemblage or splitting of land parcels.

- Value attributable to an “unusual condition” as defined in § 39-1-104(11)(b)(I), C.R.S.

- Value attributable to the development of public improvements such as the installation of roads, streets, curbs, sidewalks and utilities; the mitigation of environmental contamination; the mitigation of unusual topography; or similar site improvements, when those improvements are an inherent characteristic of the property and are necessary to its intended development.

When errors are discovered that pertain solely to increment property, or when a value adjustment is ordered or abatement is processed on a property or a portion of a property that contributed solely to the increment value, only the increment should be adjusted.

In deriving changes in value due to a non-reassessment event, the objective is to isolate the value attributable solely to the change in the property. If the current value of the subject is at the current level of value and its prior year value is based on the prior level of value, simply subtracting the current year value from the prior year value will produce an inaccurate value change, one that accounts for reappraisal and non-reassessment changes. This mistake overstates the increment gain when the current level of value reflects an appreciating market. Similarly, when the current level of value reflects a depreciating market, the mistake will understate the increment gain.

When changes occur in an intervening year, the calculation is simple: the new value minus the prior year value accounts for the change. In a reappraisal year this calculation applies a hypothetical condition. The appraiser must compare the value of the changed property to its value as if the change had not occurred; both need to be at the current level of value. See the proper calculation that follows:

[Current assessed value of subject property (non-reassessment change effective at current level of value)] - [Assessed value assigned to the property (as if the change is not effective, but at the current level of value)] = Value attributable to non-reassessment change(s)

Base and Increment Proportional Adjustments

Proportional adjustment means that when a class or subclass of property is revalued as a result of statutory ad valorem provisions, such revaluation must be applied uniformly so that similar properties are valued similarly according to how the physical, economic, governmental, and social market forces affect such properties. Proportional adjustments recognize that the appreciation or depreciation of property located within a TIF area, whether caused directly by, or incidental to, the undertakings of a URA, DDA or CRA, affect all property similarly. This is why, after accounting for non-reassessment changes, the base and increment are adjusted annually by the change demonstrated within each TIF area due to reassessment.

The statutory ad valorem provisions that change the value of class or subclass of property are as follows, with the last item being a specific DD law provision:

- A change in the “level of value” of all taxable real property due to reappraisal every odd-numbered year.

- The annual valuation of existing personal property, natural resources, state assessed property, and possessory interests. This does not include new personal property associated with new development, state assessed new construction or new oil and gas well basic equipment lists.

- The State Board of Equalization issues a reappraisal order, if such order includes property located in a UR/DD/CR plan area.

- A valuation adjustment resulting from an appeal or abatement, if such adjustment pertains to both base and increment.

- The identification of errors and omissions that the assessor is required to correct, if such corrections pertain equally to base and increment. For example, if a newly platted parcel with partially complete new construction is omitted by the assessor, the assessor should enter the omitted property on the tax roll and correct the base/increment calculation to reflect the base portion attributed to the value of the parent parcel, and the increment portion attributed to both new platting and new construction.

- The 20-year extension of DD plan containing a TIF provision. Refer to 20-Year Extension to DDA TIF Area later in this section.

Procedures for Annual Calculation of the Base and the Increment

Every year the base and increment are affected by two broad categories of changes:

- Changes due to non-reassessment

- Changes due to reassessment

Applying a single calculation annually creates consistency and accounts for all changes that can occur within these two broad categories. The outline for the annual calculation is as follows:

- Apply tax roll corrections to the prior year’s total valuation for assessment and re-establish a corrected base/increment split as if these corrections were in place and reflected on the annual certification of value that the assessor issued the prior year.

- Determine the current year total valuation for assessment.

- Subtract the corrected prior year total valuation for assessment (Step 1) from the current year total valuation for assessment (Step 2) to determine the year-over-year change in the total valuation for assessment. This includes changes due to both reassessment and non-reassessment.

- Identify and total the value changes resulting from non-reassessment events. This will be the increment gain or loss in the current year.

- Subtract the result in Step 4 from the result in Step 3. This reflects all value changes resulting from reassessment in any year. It includes increases or decreases in the prior year base and increment caused by a real property reassessment, personal property reassessment, reassessment of natural resources, reassessment of state assessed public utilities, and reassessment of possessory interests.

- The value derived in Step 5 is proportioned by multiplying by the prior year (corrected if necessary) base/increment percentages as follows:

- Multiply the result in Step 5 by last year’s base percentage to find the current year adjusted base portion.

- Multiply the result in Step 5 by last year’s increment percentage to find the current year’s adjusted increment portion.

- Add the adjusted increment calculated in Step 6.b. to the increment gain or loss calculated in Step 4. This is the total increment portion in the current year.

- Calculate the new total current year base and increment values

- New Base =

Result in Step 6.a. + the prior year corrected base value (Step 1) - New Increment =

Result in Step 7 + prior year corrected increment value (Step 1) - Step 8.a. + Step 8.b. = the current year total valuation for assessment

- New Base =

- Reconcile and calculate new base/increment percentages.

Step 8.a. + Step 8.b. should equal the current year total valuation for assessment (Step 2).

- Step 8.a. divided by Step 2 equal the new base percentage

- Step 8.b. divided by Step 2 equal the new increment percentage

Changes in Taxable/Exempt Status

A change in taxable status to property located in a TIF plan area can occur as a result of six events:

- Transfer of property from a taxable owner to an exempt owner, or the reverse.

- The Administrator grants or revokes tax exempt status to property owned by a religious, private school or charitable entity.

- Property is leased to a political subdivision of the state, § 39-3-124(1)(b)(I)(A), C.R.S.

- Property owned by a URA is leased to a non-public body, § 31-25-110, C.R.S.

- A change in use creates a different assessment rate, from non-residential to residential, or the reverse.

- When the value of a personal property account moves below the exempt threshold it becomes entirely exempt; and, when it moves above this threshold it becomes entirely taxable.

These events have both positive and negative effects on the total valuation for assessment within a TIF plan area and must be accounted for so as to track the change in value annually.

The statutory scheme, outlined below, which is identical in UR/DD/CR law, precludes such events from applying to the base value. “Valuations for assessment” is comprised of taxable property and never includes exempt property. Only value that generates taxes can be attributable to the base value. The base value, excepting specific statutory provisions that require its adjustment, is constant. Increment value, however, is variable and is qualified by statute as being dependent on the base value. Mathematically, barring no other changes, this dependent function means that when the total valuation for assessment decreases from one year to the next due to property changing from taxable to exempt, the increment value must decrease accordingly.

On the other hand, property that is exempt when a TIF plan is approved contributes no assessed value to the base or to the plan area, even though the property may have significant market value. When such property becomes taxable, all the value and revenue it now generates was never before realized by the public bodies. Whether or not such increase in property valuation would, or would not, exist but for the project, the clear intent of the law is that the increment, if any, is comprised of value that exceeds the base.

Statutory scheme (only the UR provisions are referenced pertaining to § 31-25-107(9), C.R.S., but the TIF provisions for DDA and CRA law follow the same scheme):

- Exempt property does not generate “tax by or for the benefit of [any] designated public body [that] must be divided”, (9)(a).

- Exempt property is absent from “such portion” that “shall be paid into the funds of each public body”, (9)(a)(I) – the base.

- “Unless and until the total valuation for assessment of the taxable property exceeds the base valuation for assessment of the taxable property in such urban renewal area, all of the taxes levied upon the taxable property in such urban renewal area must be paid into the funds of the respective public bodies,” (9)(a)(II)

- When property goes from exempt to taxable, the increase in value creates a “portion of property taxes in excess of the property taxes paid into the funds of each public body”, (9)(a)(II) –the increment.

- “As used in this subsection (9), the word ‘taxes’ shall include all levies authorized to be made on an ad valorem basis”, (9)(c) – for exempt property no such levy exists.

- These changes are property specific, are not due to reassessment; therefore, (9)(e), does not apply.

Mathematical Scheme

Valuation for Assessment = Gross Taxable Value

Base Valuation = Net Value

Increment Value = Increment

Then, according to the statutory function,

Gross = Net + Increment; and, Gross – Net = Increment

If Gross = Net, then Increment = 0

If Gross < Net, then Increment is < 0 (taxable to exempt)

If Gross > Net, then Increment is > 0 (exempt to taxable)

In order to account for value increases and decreases resulting from the changes enumerated above the assessor must:

- Track these changes on a property by property basis;

- Quantify the difference from the prior year accounting for the change at the current level of value; and

- Include these value changes as non-reassessment events (Step 4) in the calculations for determining base and increment values annually.

The following example outlines and illustrates the negative impact that a change in taxable to exempt status can have on the increment. The impact will be positive when a property goes from exempt to taxable. Ultimately, the net effect of these possible events impacts the increment.

EXAMPLE

Assume that the base value in 2014 is $15,000,000 and that the only non-reassessment change occurring in the UR plan area in 2014 is the completed construction of a new office building. Here are the hypothetical facts:

- As of January 1, 2014 a new office building, 100% taxable, is completed as an undertaking of a UR plan with a TIF provision. This building’s 2014 market value, estimated by the assessor as of June 30, 2012 (the 2013/2014 level of value) is $1,724,140 with an assessed value of $500,000, producing an increment increase of $500,000.

- In March 2015, an abatement petition is filed with the assessor’s office demonstrating that, as of July 1, 2014, fifty percent of the subject office space was leased to a state agency, creating an exempt use, pursuant to § 39-3-124(1)(b), C.R.S. The assessor processes the abatement and determines a valuation reduction of $126,030 according to the following prorated corrections:

- 50% × $500,000 = $250,000 assessed value

- Taxable: January 1 to June 30, 2014 = 181 days taxable.

$250,000 assessed ÷ 365 days = $684.90 assessed value per day

$684.90 × 181 days = $123,970 assessed taxable value - Exempt: July 1 to December 31, 2014 = 184 days exempt

$684.90 × 184 days = $126,030 assessed exempt value

- The assessor applies these corrected values in 2015 to correct the prior year base/increment calculations as follows.

- Correct last year’s increment value increase.

- In 2015, the assessor revalues all real property within the county and determines that values in the subject UR plan area have appreciated since the prior level of value by 7%.

- The assessor applies a hypothetical condition and determines that the 2015 value for the office building at 100% taxable is $535,000 assessed.

- Unlike last year, in 2015 the exemption is complete (not prorated), reducing the total valuation for assessment (gross value) by last year’s taxable prorated assessed value, expressed at the current level of value, or $123,970 × 1.07 = $132,650.

- Such reduction eliminates any property tax revenues that could be collected by the taxing entities, and also reduces the increment diversion to the URA’s special fund.

- Applying the 9-Step base and increment calculations follow:

Illustration of the Annual Calculation of the Base and the Increment

Prior Year Value Reduction Increment Only Adjustment

Recall this procedure involves 9 basic steps. Depending on which events take place annually, each basic step may have to be further segregated into minor steps.

Step 1:

All tax roll corrections discovered in the current year were applied to the prior year. Corrected prior year base value = 3,375,000. Corrected prior year increment value = 1,125,000. Corrected percentages: 75% base, 25% increment.

Step 2:

Determine the current year total taxable assessed value. 5,000,000

Step 3:

Subtract the prior year corrected total taxable assessed value. -4,500,000

Difference = non-reassessment changes and all reassessment changes, if any = 500,000

Step 4:

Track and sum non-reassessment changes

New Construction +250,000

New Platted subdivision with installed site improvements +120,000

Contaminated land mitigated +70,000

Changes from taxable to exempt -20,000

Total = 420,000

Step 5:

Step 3 result minus Step 4 result = reassessment changes 500,000 - 420,000 = 80,000

Step 6:

Proportional allocation according to last year’s (corrected if necessary)

base/increment percentages.

- 80,000 × 75% = base portion 60,000

- 80,000 × 25% = increment portion 20,000

Step 7:

Non-reassessment gain (Step 4) 420,000 + Reassessment increment gain Step 6.b 20,000 = 440,000

Step 8:

Calculate the current year total base and increment values.

- Base = base gain in step 6 60,000 + prior year base value 3,375,000 = Current Year Total Base Value 3,435,000

- Increment = increment gain in step 7 440,000+ Prior year Increment value 1,125,000 = Current Year Total Increment Value 1,565,000

- Step 8.a 3,435,000 + Step 8.b 1,565,000 = Current Year Total Value (Step 2) 5,000,000

Step 9:

Reconcile and calculate new base/increment percentages

Base percentage = 3,435,000 ÷ 5,000,000 = 68.70%

Increment percentage = 1,565,000 ÷ 5,000,000 = 31.30%

Total = 100.00%

Exception: Value Reductions

Any time the total valuation for assessment is reduced as a result of appeals or ordered adjustments, the base and increment values must be adjusted. If the adjusted value pertains to base property in the year of the ordered adjustment, the base value is adjusted. If the adjustment was due to non-reassessment (e.g., new construction), adjustment is made to the increment value. The basic steps for these two scenarios are as follows:

Scenario 1: Ordered Adjustment Requiring Adjustment to Base Value

Step 1: Determine the current year total taxable assessed value.

Current year total taxable assessed value 9,310,000

Step 2: Adjust the prior year total and base values for abatement or appeals board reduction.

Prior year total value 9,248,220 100.00% - Prior year base value 5,553,300 60.05% = Prior year increment value 3,694,920 39.95%

Reduction ordered by appeals board for prior year: 42,220

Prior year total value 9,248,220 - Ordered reduction 42,220 = Adjusted prior year total taxable value 9,206,000

Adjusted prior year total assessed valuation 9,206,000 - Prior year increment value 3,694,920 = Prior year Adjusted base value 5,511,080

Step 3: Calculate the increment value and distribution percentages.

Adjusted Prior Year Total Assessed Value 100.00% 9,206,000 - Prior Year Base Value 59.86% 5,511,080 = Adjusted Prior Year Increment Value 40.14% 3,694,920

(If the calculated increment is negative, the increment for distribution purposes is zero.)

Scenario 2: Ordered Adjustment requiring adjustment to Increment Value

Step 1: Determine the current year total taxable assessed value.

Current year total taxable assessed value 9,310,000

Step 2: Adjust the prior year total and increment values for abatement or appeals board reduction.

Prior year total value 9,248,220 100.00% - Prior year base value 5,553,300 - 60.05% = Prior year increment value 3,694,920 39.95%

New construction property ordered reduction by appeals board for prior year: 42,220

Prior year total value 9,248,220 - Ordered reduction 42,220 = Adjusted prior year total taxable value 9,206,000 - Prior year base value 5,553,300 = Adjusted increment value 3,652,700

Step 3: Calculate the adjusted percentages.

Adjusted Prior Year Total Assessed Value 100.00% 9,206,000 - Prior Year Base Value 60.32% 5,553,300 = Adjusted Prior Year Increment Value 39.68% 3,652,700

Step 4: Apply Adjusted Percentages to Current Year’s Value

Current year total taxable assessed value 9,310,000 - Prior Year Base Value -5,553,300 = Current Year Increment Value 3,756,700

(If the calculated increment is negative, the increment for distribution purposes is zero.)

The reasons for the division of the reduced valuation are twofold. First, statute provides that when there is a general reassessment of taxable property in any county in which there is a TIF area, the portions of assessed valuation attributable to the base and the increment are to be proportionately adjusted in accordance with such reassessment, or change. A reassessment cycle is not complete until the review and appeal process has concluded and final values have been set for all properties. In certain instances, final values of appealed properties may not be determined until later.

Second, division of the reduced valuation ensures that only those increases in property tax revenue occurring because of the redevelopment project are used to pay the revenue bonds. This prevents a "windfall" in increased revenues to the authority caused only by a reappraisal at a higher level of value. When value accrues to the increment as a result of redevelopment, later reductions in that same value are subtracted from the increment.

Value Corrections Due To Mistakes

The statutory TIF provisions presume that the assessor’s certification of values prior to the approval of a TIF plan is accurate, that the information contained in the TIF plan is accurate, and that the communication of this information between the assessor and the authority is accurate. The Division instructs in these procedures that mistakes are to be identified and corrected prior to initially establishing the base value. However, it is always possible that some mistakes will be discovered later. Except with regard to abatements and refunds, UR/DD law does not provide any instruction on how mistakes should be corrected.

However, title 39, C.R.S. provides instruction:

Omission – correction of errors.

(2) Omissions and errors in the assessment roll, when it can be ascertained therefrom what was intended, may be supplied or corrected by the assessor at any time before the tax warrant is delivered to the treasurer or by the treasurer at any time after the tax warrant has come into his hands.

§ 39-5-125, C.R.S.

When mistakes are discovered relating to TIF plans, the assessor should first confirm the mistake and then correct it in the year that it is discovered, so that going forward the division of the valuation for assessment is reliable.

Corrections should be handled in a manner similar to that outlined in the above procedures for addressing value reductions. If the correction is related to base valuation, the base value should be increased or decreased according to the correction. If the correction is related to increment valuation, the same should apply. Unlike ordered valuation adjustments, such corrections are not applied retroactively.

Agricultural Land in Urban Renewal Area

The General Assembly has prohibited inclusion of agricultural land within an urban renewal or county revitalization area unless certain exceptions are satisfied. The prohibition does not affect agricultural land made part of a plan area prior to June 1, 2010. For the purposes of the prohibition, agricultural land is defined as land that was classified by the assessor as agricultural land at any time during the five years prior to its inclusion into a plan area.

Plans approved or substantially modified after May 31, 2010, must include the legal description of any agricultural land added to the urban renewal area. It is crucial that assessors independently verify the existence of agricultural land when enforcing the agricultural land restriction.

Exceptions Under Which Agricultural Land May be Included

Note: the corollary statutes for county revitalization plans are found in §30-31-109(1)(c)(II), C.R.S.

A municipality may not include agricultural land into a new or existing urban renewal area after May 31, 2010, unless the land meets one or more of the five conditions enumerated in subparagraph (II), OR, all three of the conditions enumerated in subparagraph (III) of § 31-25-107(1)(c), C.R.S.

The five conditions in subparagraph (II) are as follows:

- The land is a brownfield site. The term “brownfield site” is defined at § 31-25-103(3.1), C.R.S, as real property, the development, expansion, redevelopment, or reuse of which will be complicated by the presence of a substantial amount of one or more hazardous substances, pollutants, or contaminants, as designated by the United States Environmental Protection Agency (EPA).”

This brownfield site definition is based on the federal definition of the same term. The general portion of that definition reads as follows. “The term ‘brownfield site’ means real property, the expansion, redevelopment, or reuse of which may be complicated by the presence or potential presence of a hazardous substance, pollutant, or contaminant,” § 42 U.S.C. 9601(39)(A). The Colorado definition requires the “presence of a substantial amount” of hazardous substances, pollutants, or contaminants, whereas the federal definition requires only their “potential presence.” Therefore, it is possible for an area that has been labeled a “brownfield site” in accordance with federal law to fall short of the Colorado definition of a brownfield site.

The identification of a property as a brownfield site is typically made by the property owner, the Colorado Department of Public Health and Environment (CDPHE), a municipality, or other local government. For more information on brownfield sites, contact CDPHE.

- At least one-half of the urban renewal area consists of parcels containing “urban level development” that constitute a slum or blighted area, and at least two-thirds of the perimeter of the urban renewal area borders “urban level development.” The Division’s position is that “perimeter” means properties outside of and touching the UR plan boundary.

As defined in § 31-25-103(7.5), C.R.S., “‘urban level development’ means an area in which there is a predominance of either permanent structures or above-ground or at-grade infrastructure.”

- The land is an enclave within the municipality, and the entire perimeter of the enclave borders “urban level development.” The Division’s position is that enclave parcel(s) must be surrounded by urban level development.

- Each public body that levies a property tax on the agricultural land agrees to its inclusion into the urban renewal area.

- The agricultural land was included in an approved urban renewal plan prior to June 1, 2010.

Or agricultural land may be incorporated into an urban renewal area prior to June 1, 2020, if each of the conditions found in subparagraph (III) are satisfied:

- The agricultural land is contiguous to the urban renewal area, and the urban renewal area existed on June 1, 2010; and

- Since June 1, 2010, the current owner has owned both the agricultural land and other land located within the urban renewal area that is contiguous to the agricultural land; and

- Both the agricultural land, and the owner’s other land described in item b., are to be developed solely to create long-term jobs related to manufacturing.

Assessor Enforcement of Agricultural Land Restriction

The assessor has a statutory enforcement role over the inclusion of agricultural land in a UR/CR plan. Within 30 days after receiving notice that an urban renewal plan authorizing the use of sales or property tax TIF has been approved or substantially modified, the assessor may notify the municipality if he or she believes that agricultural land has been improperly included within the urban renewal area. If the assessor does so, the municipality may file an action in district court to establish its right to include the area in conformance with the exceptions listed above. If the assessor fails to do so, the inclusion of the agricultural land becomes incontestable.

The Division recommends that assessors consult with their county attorney and county commissioners regarding the application of this provision, which reads as follows:

Approval of urban renewal plans by local governing body.

(13) Not later than thirty days after the municipality has provided the county assessor the notice required by paragraph (a) of subsection (10) of this section, the county assessor may provide written notice to the municipality if the assessor believes that agricultural land has been improperly included in the urban renewal area in violation of subparagraph (II) or (III) of paragraph (c) of subsection (1) of this section. If the notice is not delivered within the thirty-day period, the inclusion of the land in the urban renewal area as described in the urban renewal plan shall be incontestable in any suit or proceeding notwithstanding the presence of any cause. If the assessor provides notice to the municipality within the thirty-day period, the municipality may file an action in state district court exercising jurisdiction over the county in which the land is located for an order determining whether the inclusion of the land in the urban renewal area is consistent with one of the conditions specified in subparagraph (II) or (III) of paragraph (c) of subsection (1) of this section and shall have an additional thirty days from the date it receives the notice in which to file such action. If the municipality fails to file such an action within the additional thirty-day period, the agricultural land shall not become part of the urban renewal area.

§ 31-25-107, C.R.S. (emphasis added)

Procedures for Allowing Agricultural Land in an Urban Renewal or County Revitalization Area

The following procedures provide an outline for analyzing and determining if the criteria established by §§ 31-25-107(1)(c)(II)(B) and 30-31-109(1)(c)(II)(B), C.R.S., are met so that agricultural land can be included in a UR or CR area. Statute requires that two criteria must be met: 1) not less than one-half of the urban renewal area as a whole consists of parcels of land containing urban-level development, and 2) not less than two-thirds of the perimeter of the urban renewal area as a whole is contiguous with urban-level development. Urban Level Development is defined as an area in which there is a predominance of either permanent structures or above-ground or at-grade infrastructure, §§ 31-25-103(7.5) and 30-31-103(15), C.R.S. The “area as a whole” requires that all land within the urban renewal area be considered in analyzing these two criteria: both the parcels to which the assessor has assigned a parcel identification number (PIN) as well as tracts of land to which the assessor does not assign a PIN, such as rights-of-way. The following procedures will refer to these two categories of land respectively as “assessor parcels” and “other tracts of land”.

General process and steps in the analysis:

- An approved UR/CR plan shall include a legal description of the urban renewal area, §§ 31-25-107(1)(d) and 30-31-109(1)(d), C.R.S. The assessor cannot determine if agricultural land is properly included unless a proper legal description, including area and perimeter, is prepared. If other tracts of land such as rights-of-way are included in the UR plan, the legal description should be sufficiently detailed to allow calculation of the area and perimeter of all land within the plan.

- Verify the physical characteristics of the UR/CR area as of the date of approval. Based on the final adopted legal descriptions of the UR/CR area provided by the urban renewal authority:

- Map the UR/CR area.

- Identify and list individual assessor parcels based on assessor ownership records.

- Identify and list other tracts of land.

- Verify the total land area including assessor parcels and other tracts of land.

- Verify the total perimeter of the plan area.

- Categorize each assessor parcel and other tract of land in conformance with the statutory definition of “urban level development”.

- Verify current development status for each property based on field inspection or review of aerial photographs.

- Asphalt, concrete, or gravel surfaced roads and parking lots are considered urban level development.

- Assessor parcels such as undeveloped tracts of land, open space buffers, and vacant land that was previously developed are not considered urban level development. “Vacant Land” includes, but is not limited to, land classified by the assessor as agricultural for property tax purposes.

- Determine whether each assessor parcel or other tract of land contains a predominance of urban level development.

- Predominance means the permanent structures or above-ground or at-grade infrastructure that due to its nature, size, location or use is greater, superior, or more important to the overall nature or use of the parcel of land than the balance of the parcel. This definition generally conforms to that of The American Heritage Dictionary (Second College Edition): “To be of greater power, importance, or quantity; be most important or outstanding.”

- There is no pro-ration. If the predominance test is met, the entire assessor parcel or other tract of land is considered urban level.

- Verify current development status for each property based on field inspection or review of aerial photographs.

- Each assessor parcel or other tract of land in the plan area should be categorized into either Urban Level or Non-Urban Level.

- Label each assessor parcel or other tract of land determined to have a predominance of urban level development as Urban Level.

- Label each assessor parcel or other tract of land determined to not have a predominance of urban level development as Non-Urban Level.

- Categorize each assessor parcel and other tract of land bordering the UR/CR area in accordance with the statutory definition of “urban level development”

- Verify current development status for each based on field inspection or review of aerial photographs.

- Asphalt, concrete, or gravel surfaced roads and parking lots are considered urban level development.

- Undeveloped tracts of land, open space buffers, vacant land that was previously developed and agriculturally classified land are not considered urban level development.

- Determine whether each assessor parcel and other tract of land contain a predominance of urban level development.

- For this determination, the definition of predominance provided in step 3.b.i. above is used.

- Verify current development status for each based on field inspection or review of aerial photographs.

- All assessor parcels or other tracts of land bordering the plan area should be categorized into either Urban Level or Non-Urban Level.

- Label each assessor parcel or other tract of land determined to have a predominance of urban level development as Urban Level.