Chapter 8 - Oil and Gas Pipeline

Pipeline Classification and Valuation Procedures

Statutory References

In 1998, the following statute was enacted to classify pipelines, as well as other types of property installed through an easement, right-of-way or leasehold, as personal property.

Definitions.

(11)Except as otherwise specified in articles 1 to 13 of this title, any pipeline, telecommunications line, utility line, cable television line, or other similar business asset or article installed through an easement, right-of-way, or leasehold for the purpose of commercial or industrial operation and not for the enhancement of real property shall be deemed to be personal property, including, without limitation, oil and gas distribution and transmission pipelines, flow lines, process lines, and related water pipeline collection, transportation, and distribution systems. Structures and other buildings installed on an easement, right-of-way, or leasehold that are not specifically referenced in this subsection (11) shall be deemed to be improvements pursuant to subsection (6.3) of this section,

§ 39-1-102, C.R.S.

Specific policies and procedures developed to implement this statute are contained in the sections below.

General Policy Provisions

This policy and associated procedures cover classification and valuation of all oil and gas gathering, transmission, and distribution pipelines located in Colorado.

With respect to classification, both locally assessed gathering and transmission pipeline systems and systems that are state assessed as pipeline companies, gas transmission carrier companies, and gas companies are to be considered personal property. However, since valuation of state assessed property is specifically determined using the “unitary valuation concept” the pipeline valuation procedures contained herein do not apply to state assessed companies.

Examples of property that would be classified as personal property and covered under these procedures are:

- Pipeline Tubulars inclusive of installation cost

- Cathodic Protection Units, Compressors

- Pipeline Controls, Regulators, and Meters

- Gas Measurement Devices such as orifice, turbine, and venturi meters

- All other assets and articles, exclusive of buildings and structures, installed within the pipeline right-of-way.

Examples of property that would be classified as real property and covered under these procedures are:

- Land owned by the pipeline company

- Buildings, structures, fixtures, and fences classified as improvements pursuant to § 39-1-102(6.3), C.R.S.

Other components of the pipeline system may fall under one of the two examples as either real or personal property. For further clarification and guidance, contact the Division of Property Taxation.

Although flow line and piping located at oil and gas wellsites and tank battery sites are also similar to the types of pipeline property listed above, the value of flow line and piping is included in the market values published in Chapter 6, Oil and Gas Equipment Valuation, and should not be valued under this policy. Each Basic Equipment List (BEL) configuration created for the various basins in Colorado contains a value for the pipe and flow lines.

Definitions

Most oil and gas pipeline systems fall into one of three groups: gathering, trunk/transmission, or distribution. For the purpose of this policy and associated procedures, the following definitions will be used.

Pipeline System

A pipeline system is defined as a collection of pipeline facilities used to transport oil, natural gas, or NGLs from a source of supply (generally well site tanks) to the end user (natural gas) or final processing at a petrochemical refinery (crude oil and NGLs). The system may include gathering systems, transmission lines, distribution systems, and related facilities for compression, treatment, and processing the oil and/or gas during its journey through the system.

Gathering System

A gathering system is defined as a network-like system of pipelines that transport crude oil and natural gas from individual wellsites to a compressor station, treating or processing plant, or main transmission line. Gathering lines are generally short in length, operate at a relatively low pressure, and are small in diameter. The "Gathering" Percent Good Table should be used for pipe diameters less than 6 inches. In contrast, gathering lines of 6-inch diameter are considered as gathering “trunk” lines, despite their length. In the valuation process, the "Trunk/Transmission" Percent Good Table should be used for 6-inch, or more, diameter pipe.

Product Transmission System

A product transmission system is defined as pipelines designed and constructed for transporting product from principal supply areas to distribution systems, larger volume customers, other transmission lines, or petrochemical refineries. Transmission lines generally have a linear configuration, larger diameter pipe, operate at a relatively high pressure, and traverse long distances. Pipe diameters can be as small as 6 inches, but are generally 10 to 12 inches, or more. The “Trunk/Transmission” Percent Good Table should be used for these pipelines.

Distribution System

A distribution system is defined as a network-like system of pipelines that transport natural gas from a transmission line to end users’ service lines or to other distribution lines. Generally large pipelines are laid in principal streets, with smaller lateral lines extending along side streets and connected at the ends to form a grid or brought to a dead end.

Pipeline Classification Policies

Classification of Pipelines as Personal Property

Under the provisions of § 39-1-102(11), C.R.S., pipelines are to be classified as personal property. Land owned by the pipeline company, buildings, and structures located within the right-of-way or easement are to be classified as real property. The value of pipeline rights-of-way and easements is included as part of the value of the assets of the pipeline and associated machinery and equipment. No separate assessment of pipeline rights-of-way or easements is to be done.

State Assessed vs. Locally Assessed Pipelines

The Division of Property Taxation - State Assessed Section relies on the following general criteria when determining applicability for state assessment:

- The intent of statutory language contained in article 4 of title 39 of the Colorado Revised Statutes

- Existing Colorado case law

- Whether the entity owning the property is regulated by the Colorado Public Utility Commission (PUC), Federal Energy Regulatory Commission (FERC), or other governmental agency

- Whether the property crosses county and/or state boundaries

- Comparison of the subject property to assessment practices of other companies that are currently state and/or locally assessed.

If a question exists as to whether a pipeline property will be state or locally assessed, contact the State Assessed Section of the Division of Property Taxation for a determination.

Gathering Pipeline Systems vs. Trunk/Transmission Pipeline Systems

The final determination as to whether a pipeline should be designated as a gathering system pipeline (14 year economic life) as opposed to a trunk or transmission pipeline (22 year economic life) should reflect the judgment of the assessor based on the facts as they apply to the specific pipeline system under appraisal. Assessors are strongly encouraged to examine the physical characteristics and purpose of the pipeline when determining whether it is a gathering or trunk/transmission pipeline.

It is possible that larger diameter “trunk” lines, from 6 inches to 30 inches, could be used in the gathering system. Typically, such large-diameter pipe has a longer economic life than the smaller-diameter lines used in the rest of the gathering system. In this instance, if the trunk line measures 6 inches or more, it would be considered a gathering system “trunk/transmission” line and would be valued using a 22-year economic life for trunk/transmission lines.

Pipeline Valuation Procedures

As personal property, Colorado statutes require that the cost, market, and income approaches to value be considered in the valuation process. However, § 39-1-103(13)(a), C.R.S., mandates that the value determined using the cost approach to appraisal shall set the maximum value for the pipeline if all costs incurred in the acquisition and installation of the pipeline have been provided to the assessor. Additionally, all forms of depreciation are to be considered when establishing a final actual value for the pipeline. The assessment rate for pipeline systems is the same assessment rate for all personal property.

For gathering systems, the primary approach to value will generally be the cost approach. However, market and income approaches are to be considered and applied if sufficient comparable sales or actual income and expense information exists. Assessors should be aware that few gathering systems sell or operate separately from the oil and gas reserve and/or gas processing plant to which the gathering system is connected. Total values determined from market and/or income approaches to value must be allocated to the various components of the total system so that separate values for each component are determined.

For product transmission and distribution systems, all three approaches are to be considered. Assessors should request income and expense information upon which to analyze net operating income. When sales of transmission and/or distribution systems occur, assessors need to confirm the sales price and terms of the sale and ascertain the allocated sales price for each component (transmission system v. other oil and gas assets) contained in the sale.

Cost Approach Valuation Procedures

When utilizing the cost approach to value, assessors may consider historical installed costs as well as replacement costs in establishing the cost new prior to application of depreciation. However, consideration of all forms of depreciation (physical, functional, and economic) is required when applying the cost approach.

Based on typical Federal Energy Regulatory Commission (FERC) filings from July 1, 2024 to June 30, 2025, the average breakdown of costs for onshore pipelines is shown as follows:

| Right of Way/Damages | 6.07% |

|---|---|

| Labor | 38.21% |

| Materials | 15.4% |

| Miscellaneous | 40.32% |

| Total | 100.00% |

Based on information compiled by the Oil and Gas Journal, an average investment breakdown for crude oil and products pipelines is also listed below.

| Crude Oil Pipelines | Products Pipelines | |

|---|---|---|

| Land and Right of Way | 3.99% | 3.60% |

| Line Pipe and Fittings | 19.73% | 20.82% |

| Pipeline Construction | 42.61% | 34.91% |

| Miscellaneous | 0.79% | 5.94% |

| Pump Stations and Equipment | 32.89% | 34.73% |

| 100.01% | 100.00% |

These percentages are overall industry averages and may not reflect exact cost allocations for a specific pipeline project in Colorado. Assessors should be aware of any substantive differences between the industry averages and information provided by the taxpayer and are encouraged to discuss with the pipeline owner any significant differences between the above cost allocation percentages and actual costs reported to the assessor.

Establishing Original Installed Cost:

For these procedures, the primary basis of the cost approach is the Original Installed Cost of the pipeline system. When possible, the assessor should obtain actual pipeline construction costs for each pipeline system in the county.

Research and discussions with industry indicates that there is no “typical” or “representative” pipeline system as far as installed cost is concerned. Construction costs depend on geographical area, size of the pipeline, number and size of pump and compressor stations, and general economic conditions.

Components of Historical Cost:

Examples of typical types of costs incurred when constructing a pipeline system are:

- Right of way

- Damages

- Land survey

- Pipeline materials and labor

- Cost of pipeline tubulars (e.g., line pipe and fittings)

- Installation costs

- Pipeline coating

- Cathodic protection

- Engineering inspection

- General overhead and contingencies

- Regulatory and Legal fees

- Cost of other services

- Telecommunication equipment

Depending on the size and purpose of the pipeline, not all of the above costs may be separately listed by the pipeline owner. Assessors are strongly encouraged to solicit an accurate cost of the pipeline from the pipeline owner.

Costs used for valuation purposes are generally those costs that have been classified as assets and are capitalized and depreciated on the books and records of the company. However, pipeline right-of-way (ROW) acquisition costs should not be separately valued when valuing the assets of a pipeline, as original ROW acquisition costs are associated with land or its use. Since the pipeline could not exist without the Right-of-Way, the value of the Right-of-Way attributable to the pipeline is assumed to be included in the total actual value of the pipeline, once that value is determined. Damage costs paid to the landowner for damage caused by installation of the pipeline system are expenses, not capitalized assets, and are not to be valued with the pipeline or separately from it.

In general, the longer a pipeline is, the lower its cost per mile. A pipeline a few miles long will cost considerably more per mile than a pipeline several hundred miles long even though both are the same diameter and are laid out in similar terrain. Pipeline costs are often compared on an “inch-mile” basis to make the comparison less dependent on pipeline size. To convert to inch-miles, multiply the pipeline interior diameter by the number of actual miles of the pipeline.

Capitalized installed costs incurred to replace a component of the pipeline system can be accounted for by one of two methods. The first is to show the cost of replacement as a separate cost, trend this cost to reproduction cost new (RpdCN) as of January 1 of the assessment year, and depreciate the RpdCN as any other pipeline asset cost. However, a reduction in the original historical cost for the replaced component must be made to account for the fact that the original component is no longer a part of the pipeline system. Normal maintenance and repair costs that do not increase the economic life of the pipeline system should not be considered as capitalized replacement costs under this procedure.

The second method for the accounting of replaced equipment is to increase the percent good of the pipeline system to account for the added economic life due to replacement of the pipeline component. If this method is employed, the assessor should validate with the pipeline owner any measurable change in the remaining economic life of the system. In valuing the pipeline under the cost approach, the adjusted economic life (and resulting percent good) is used as the basis for recognizing normal physical depreciation.

Establishing Current Reproduction Cost New:

Once historical pipeline costs have been obtained, they must be trended to reproduction cost new (RpdCN) as of January 1 of the assessment year. When trending historical cost, the result is considered to be Reproduction Cost New (RpdCN), because it represents what was actually installed when the pipeline was new.

The Division has developed Cost Trending Factors to trend original installed costs to costs as if new as of the assessment date. These trending factors are based on “Total Transmission Plant” gas utility construction cost trends listed in Table G-5 of the Handy-Whitman Index of Public Utility Construction Costs by Whitman, Requardt and Associates. The trending factors for pipelines are also applicable to compressor station equipment, as well as measuring and regulating equipment. Since the factors in these tables have been calibrated to include the level of value adjustment factor, pipeline values do not require the use of a Level of Value (LOV) adjustment or “Rollback” factor. Put another way, the LOV Factor will always be 1.00.

The table containing the trending factors is found in Addendum 8-A, Cost Trending Factors and Percent Good Tables at the end of this chapter. A basic illustration on the use of the factors in the valuation of a gathering system for the 2026 assessment year is shown below:

| Description | Year Acquired | Original Installed Cost | Cost Trending Factor | Reproduction Cost New |

|---|---|---|---|---|

| Field Gathering Line | 2014 | $1,590,000 | 1.424 | $2,264,160 |

| Field Structures | 2016 | $160,000 | 1.489 | $238,240 |

The resulting reproduction cost new (RpdCN) figures represent the estimated cost to build the pipeline as if new as of the January 1 assessment date.

Special Rule Regarding the “Freezing” of the Cost Trending Factor:

When a component of pipeline personal property has reached its minimum depreciated value (15 percent), the applicable Cost Trending Factor in use at that time is "frozen," and will remain frozen until the component is permanently taken out of service. If this rule were not established, pipeline values would increase as they got older. This situation does not realistically happen in the marketplace.

An exception to this rule applies when the property has been reconditioned to extend its remaining economic life. In this instance, the assessor may substitute a later ‘year acquired’ thus increasing the cost approach value of the pipeline to reflect the additional value attributable to a longer remaining economic life.

The next step is to apply depreciation to the trended reproduction costs new in order to calculate reproduction cost new less depreciation (RpdCNLD).

Calculation of Depreciation

Depreciation calculations should consider the economic life of the pipeline, the economic life of the oil and gas reserve served by the pipeline, any loss in value due to super-adequacy of pipeline capacity or loss in functional utility, and economic obsolescence due to market forces affecting the oil and gas industry.

Types of depreciation that are recognized in the cost approach valuation of pipelines:

- Normal Physical Deterioration (due to normal wear and tear over the economic life of the pipeline).

- Extraordinary Physical Deterioration due to excessive physical deterioration from soil conditions or transportation of corrosive materials over and above the loss in value due to normal wear and tear.

- Functional/Economic Obsolescence due to lower than normal pipeline “throughput” in relation to operating design capacity.

Each of these forms of depreciation is discussed in greater detail below.

Normal Physical Deterioration:

Normal physical depreciation is accounted for through the use of depreciation tables. The depreciation tables are based on Iowa State University Retirement and Survivor Curve Studies for various types of commercial and industrial assets.

For trunk/transmission pipeline systems, the table is based on a 22 year economic life. For gathering systems using less than 6-inch pipe, the table is based on a 14 year economic life. These tables are identical to tables used for the valuation of other personal property components having the same economic lives.

Please note that the Iowa State University studies extend the minimum depreciated value floor from 14 to 17 years for gathering systems and from 22 to 29 years for trunk/transmission pipeline systems.

This table is found in Addendum 8-A, Cost Trending Factors and Percent Good Tables at the end of this chapter. An example of this procedure using the 14-year life table (Gathering System Pipeline) for the 2026 assessment year is shown below:

| Description | Year Acquired | RpdCN | Percent Good | RpdCNLD |

|---|---|---|---|---|

| Field Gathering Line | 2014 | $2,264,160 | 32% | $724,531 |

| Field Structures | 2016 | $238,240 | 43% | $102,443 |

The percent good numbers listed in the Percent Good Table reflect normal depreciation assigned to the pipeline assets, excluding ROW costs, over the economic life of the pipeline.

Extraordinary Physical Deterioration:

Extraordinary forms of physical deterioration can exist from exposure to caustic or corrosive products transported within the pipeline as well as soil conditions that shorten the economic life of the pipeline.

Allowance for extraordinary deterioration can be made in one of two ways:

- Allowance of additional physical deterioration can be measured by deducting the net “cost-to-cure” relating to the condition causing the extraordinary physical deterioration. Net cost-to-cure is determined by the total cost-to-cure less the current depreciated cost of the pipeline component being replaced.

- Reduction of the remaining economic life of the pipeline causing a higher percentage of depreciation (lower percent good) to be applied to the reproduction cost new.

Generally, incurable extraordinary physical deterioration can be accounted for by reducing the percentage good assigned to the pipeline through the use of the depreciation table in Addendum 8-A, Cost Trending Factors and Percent Good Tables at the end of this chapter. This adjustment has the effect of lowering the remaining economic life of the pipeline or pipeline component that is affected by the condition.

The assessor should work closely with the pipeline owner to determine the reason for reducing the remaining economic life of the system. The adjusted economic life (and resulting percent good) serves the basis for application of normal physical depreciation and no additional adjustment for extraordinary depreciation is allowed.

For example, assume a gathering system pipeline with a normal remaining economic life (REL) of 10 years is suffering from advanced corrosion due to sulfuric acid created by excessive hydrogen sulfide gas (H2S) in the natural gas stream. Although the pipeline owner had applied an interior coating to the pipeline to protect it from corrosion, the pipeline has only five (5) years left until the corroded section will have to be replaced or a new line installed.

The assessor may recognize this additional loss in value by decreasing the percent good obtained from the gathering system depreciation table found in Addendum 8-A, Cost Trending Factors and Percent Good Tables.

Functional/Economic Obsolescence:

After a pipeline system has begun operation, functional/economic obsolescence may become evident. This obsolescence may be caused by a drop in “throughput” (amount of product shipped through the pipeline) due to reduced oil or gas reserve estimates, super-adequacy of the system based on current supply, the shut-in (shut down) of wells due to economic conditions making production uneconomical, or other functional problems or economic conditions affecting the pipeline system.

Because of the time needed to connect wells and/or gathering systems to a new pipeline system, functional/economic obsolescence should be considered only after either of the following two conditions are met:

- All of the wells and/or gathering systems for which the system was constructed to handle have been connected, or

- Two full assessment years have passed since the pipeline began operation.

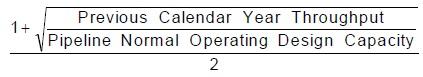

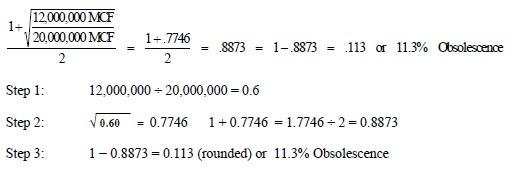

Calculation of functional/economic obsolescence should be done using the following formula:

An example calculation of physical depreciation and functional/economic obsolescence is shown below.

Example:

A natural gas gathering system, acquired in 2004 with regulators and structures constructed in 2006, experienced a drop in pipeline utilization (throughput) during the previous calendar year due to several gas wells being "shut-in" by outside producers that were connected to the pipeline. The previous year’s throughput was 12,000,000 MCF and the system’s capacity for which it is currently designed is 20,000,000 MCF.

Note: It is important to perform the mathematical calculations in proper order. Functional and economic obsolescence are to be applied to the physically depreciated value. Application of depreciation should be made in the following manner:

| Description | Original Cost | RpdCN | Normal Physical Depr. %1 | Functional/Economic Obsol. %2 | Total Actual Value |

|---|---|---|---|---|---|

| Field Gathering Line | $1,590,000 | $2,264,160 | $1,539,629 | - $81,872 | = $642,659 |

| Field Structures | $160,000 | $238,240 | $135,797 | - $11,576 | = $90,867 |

| Total Value | $733,526 |

Depreciation calculations (inverse of table)

1 Field line physical depreciation $2,264,160 x 0.68 = $1,539,629

Field structures physical depreciation $238,240 x 0.57 = $135,797

2 Field line functional/economic obsolescence $724,531 x 0.113 = $81,872

Field structures functional/economic obsolescence $102,443 x 0.113 = $11,576

The value illustrated above represents the actual value of the pipeline including the value of the right-of-way attributable to the pipeline. In addition to the field pipe and field structures values, any other real and personal property used in conjunction with the pipeline must be valued and assessed separately.

Special Procedures for Newly Acquired Used Pipeline Personal Property:

In valuing used pipeline personal property, if the actual historical age of the personal property at the time it was acquired by the current owner either meets or exceeds the age corresponding to 15% Good in the Percent Good Tables for pipeline systems, the current owner’s actual acquisition cost is to be treated as the Reproduction Cost New, Less Depreciation (RpdCNLD). The actual used-property acquisition cost is "frozen" at that value until that component is permanently taken out of service. Cost Trending Factors and percent good tables do not apply to “frozen” values.

In valuing used pipeline personal property, if the actual historical age of the personal property at the time it was acquired by the current owner was less than the age corresponding to 15% Good in the Percent Good Tables for pipeline systems, the used personal property is treated as if new. The current owner’s actual acquisition cost is subject to depreciation as if the property’s economic life for ad valorem tax purposes had begun at the time it was acquired.

In both of the above circumstances, the resulting value should be compared to the sales comparison (market) value for the component, if sales are available.

Depreciated Value Floor for Pipelines (15 percent):

When using the cost approach to value pipelines, the minimum percent good inclusive of physical, functional, and/or economic obsolescence will be 15 percent (15 percent) of the pipeline’s reproduction cost new (RpdCN).

This floor may be exceeded when the market or income approach indicates a lower value or when the pipeline has been abandoned and no longer is capable of being used. Any pipeline value established from the use of the cost approach should be crosschecked with sales comparison (market) and income information sources, if possible, and the appropriate value used.

Income Approach Valuation Procedures

In accordance with Colorado constitutional and statutory provisions, the income approach to appraisal must be considered when establishing a value for a pipeline system.

The income (and market) approaches have applicability for valuation of both gathering systems and product transmission and distribution pipeline systems. Most gathering system values are tied to the economic life and economic viability of the oil and gas production field and/or processing plant that is connected to the gathering system. Allocation of income and expenses to the various components may be difficult. If an overall “system” income value is calculated, additional analysis of the relative worth of the various components may be required to arrive at a value of the pipeline property.

For product transmission and distribution pipeline systems, the income approach should be considered in determining actual value. When utilizing the income approach to value for transmission and distribution pipelines, the following steps should be followed:

Step #1 Obtain an Income and Expense Statement for the pipeline operation. A minimum of three (3) calendar years should be obtained.

Step #2 Determine Net Operating Income (NOI)

Step #3 Determine the Appropriate Capitalization Rate

Step #4 Capitalize the NOI to an Actual Value Estimate

Step #5 Allocate the Total Actual Value into Real and Personal Property Components

Each of these steps is more specifically discussed below.

Step #1 - Obtain an Income and Expense Statement:

Crucial to using the income approach to value is obtaining income and expense information about the pipeline. In many cases, the pipeline company may be able to provide the assessor with a financial statement listing income and expenses. It is recommended that at least three calendar years of income and expense history be obtained in order to stabilize estimate revenue and expense amounts to what would typically be experienced by the pipeline operation.

Gross income (revenue) estimates are based on the transportation revenue paid to the pipeline company for transporting the product. In some cases, the pipeline company may have a published (or unpublished) tariff that sets forth the fees and charges for transporting the oil and gas product. If a tariff or other form of transportation agreement exists between the producer and pipeline company, the assessor should request it. Because unpublished tariffs and transportation agreements may be proprietary and confidential in nature, the assessor must treat all such tariffs and agreements as confidential according to § 24-72-204(3)(a)(IV), C.R.S.

A list of typical expense categories that may be found in a pipeline income and expense statement are:

Operations Expenses

- Supervision and engineering

- System load and control dispatching

- Communication system expenses

- Compressor station labor & expenses

- Fuel and power costs

- Rents and leased equipment costs

- Compression of gas by others

- Other transmission expenses

- General overhead and administrative

Maintenance Expenses

- Supervision and engineering

- Maintenance costs for: structures and Improvements

- Transmission mains

- Compressor equipment

- Measuring and regulating station equipment

- Communication equipment

- Other equipment expenses

For the above categories, general types of expenses would be:

- Salaries, wages, and benefits paid to employees in the operation and maintenance of transportation mains, equipment and facilities

- Fuel and utility costs

- Materials and supplies including chemicals and lubricants

- Non-capitalized repairs, labor, materials, and supplies directly related to the transportation mains, equipment, and facilities

- Real and personal property taxes

- Insurance and payroll taxes

- Arm's-length rental, leasing, or contract service costs for operation and maintenance of the equipment and facility

- Allocated direct general and administrative overhead costs, e.g., headquarters personnel, telephone service, payroll taxes, employee benefits, vehicle expenses, office supplies, etc., that represent typical expenditures that are directly related to the operation and maintenance of the pipeline system, equipment, and improvements. Assessors should request a copy of the allocation methodology for any on-site or offsite general and administrative costs that are allocated and deducted.

- Book depreciation of the pipeline system assets that is calculated on a straight-line basis over the assigned economic life of the asset.

The assessor should evaluate all taxpayer-provided income and expense information and allow those expenses as a deduction from gross revenue that are directly related to the pipeline operation.

Step #2 - Determine Net Operating Income:

Net operating income is defined as the income remaining after deduction of operating expenses, maintenance expenses, and annual depreciation expense from gross revenue received by the pipeline. Depreciation must be calculated as a straight-line (non-accelerated) deduction from the capitalized remaining undepreciated balance of pipeline assets over its assigned economic life.

After appropriate expenses are deducted, the remaining income is termed net operating income (NOI).

Step #3 - Determine an Appropriate Capitalization Rate:

The Division of Property Taxation annually publishes capitalization rates for use in valuing locally assessed oil and gas pipelines. For 2026, the capitalization rates by pipeline type that must be used are:

| Fluid Transmission Pipelines | Gas Transmission Pipelines | Gas Distribution Pipelines |

|---|---|---|

| 10.40% | 10.77% | 8.14% |

This capitalization rate must be applied to the NOI of the pipeline. Because the overall rate applicable for gathering systems is tied to the economic life of the field or processing plant, this rate must be determined locally.

Step #4 - Capitalize Net Operating Income to an Actual Value Estimate:

Capitalizing net income estimates to actual value is calculated by dividing the net income estimates by the capitalization rate. An example of this calculation for a gas transmission pipeline is shown below:

$100,000 Net Operating Income (NOI)

÷ 0.1077 Published capitalization rate (Gas Transmission Pipelines)

$928,505 Actual Value Determined Through the Income Approach

The final step is to allocate the above pipeline system value to various real and personal property components.

Step #5 - Allocate Value into Real and Personal Property Components:

The actual value estimate determined from capitalization of net income represents the value of the entire pipeline system including land, rights of way, line pipe, structures, and personal property. To arrive at a reasonable value for the line pipe and attached fixtures, an allocation of the total actual value to the various components is required.

Allocation by original acquisition cost of the various pipeline system components can be considered. The assessor should request actual original acquisition costs from the company’s financial records for each of the pipeline system components such as rights of way, other lands, transmission mains, pipeline structures, compressor and pumping equipment, and other real and personal property components that are included in the system value of the pipeline. Right-of-way acquisition costs should be excluded from the allocation, as original ROW acquisition costs are associated with land or its use. Since the pipeline could not exist without the Right-of- Way, the value of the Right-of-Way attributable to the pipeline is assumed to be included in the total actual value of the pipeline, once that value is determined. Damage costs paid to the landowner for damage caused by installation of the pipeline system are expenses, not capitalized assets, and are not to be valued with the pipeline. Any intangible personal property will also have to be excluded before the final value is considered in the reconciliation process.

In determining allocation percentages, the original acquisition cost of all pipeline system assets, exclusive of right-of-way acquisition costs and damage costs to landowners, are totaled and percentages calculated for each asset as part of the total (100%). These percentages are applied to the indicated income approach value to determine the contributory value of each component of the pipeline system. If oil and gas reserves are included in the overall value of the pipeline system, qualified engineering studies will have to be obtained from the taxpayer to support the allocation of the overall system income value to the contributory value of the reserves. For the purposes of this methodology, it is assumed that each component of the pipeline system contributes equally to establish the total value of the pipeline system from the income approach.

The income (or market) value of personal property can only be considered if it is less than the value determined by the cost approach to value, § 39-1-103(13), C.R.S.

Market Approach Valuation Procedures

In accordance with Colorado constitutional and statutory provisions, the market (sales comparison) approach to value must be considered when establishing a value for a pipeline system.

The market (and income) approaches have applicability for valuation of both gathering systems and product transmission and distribution pipeline systems. Most gathering system values are tied to the economic life and economic viability of the oil and gas production field and/or processing plant that is connected to the gathering system. Allocation of the sales price paid for an integrated system into various components may be difficult.

If an overall “system” market value is calculated, additional analysis of the relative worth of the various components may be required to arrive at a value for the pipeline property. As stated earlier in these procedures, the cost approach typically is the primary method of value for gathering systems. However, for product transmission and distribution pipeline systems, the market approach should be considered in determining actual value.

Discussions with independent appraisal industry sources indicate that a considerable amount of sales information is unpublished and must be gathered directly from the seller or buyer. In addition, other sources of market sales information are industry reports and Security and Exchange Commission (SEC) 10-K reports for publicly traded companies.

If a product transmission pipeline sells within Colorado, the assessor should confirm the sales price paid and obtain additional information about the pipeline, such as:

- Allocation of the pipeline sale price to the component values for rights-of-way, line pipe, improvements, and personal property, if possible. If non-pipeline assets such as oil and gas wells, gathering lines, or a gas processing plant were included, portions of the sale price attributable to each component of the pipeline system should be allocated.

- Description of the pipeline operation including type of product transported.

- Pipeline operational and physical characteristics, such as:

- Pipeline design capacity in MMcfd (million cubic feet per day)

- Average daily pipeline throughput in MMcfd for prior year(s)

- Type of product transported

- The length of the pipeline converted to inch-miles. To convert to inch-miles, multiply the pipeline interior diameter by the number of actual miles of the pipeline

- Age of the pipeline and buyers or sellers estimate of the remaining economic life

- Has any major rehabilitation or replacement of the pipeline been done since construction?

- Does the sale price represent 100% ownership of the system?

- Are the seller and buyer related parties?

- Is there any intangible property included in the sale? (e.g., goodwill, tradename, workforce in place, etc.)

Each of the above questions and answers is useful in determining the comparability of the sold pipeline to the pipeline system under appraisal.

Making Market Adjustments to Comparable Pipeline System Sales:

Each pipeline system exhibits specific operating characteristics that will allow the appraiser to analyze sales of other pipeline systems similar to the subject property. These characteristics can be used as a unit of comparison when analyzing comparable pipeline system sales.

If a pipeline transports crude oil or natural gas, comparable pipeline sales could be analyzed on a barrel (Bbl) or million cubic feet (MMcf) per day actual throughput as a unit of comparison. Other areas of comparison that should be considered are:

- Age of the pipeline system

- Location in relation to proven oil and gas reserves

- Inclusion of non-pipeline assets such as oil and gas reserves, gathering systems, and product processing facilities

It must be pointed out that the valuation determined by the market approach encompasses all of the real and personal property of the pipeline system: land, rights of way, line pipe, buildings, structures, and personal property. It may also include intangible assets such as longterm transportation contracts as well. Intangible personal property must be excluded before the final value is considered in the reconciliation process.

Determining Market Values for Pipeline Systems Using Comparable Sales:

Because of the wide variance in pipeline design and product throughput volume, obtaining sufficient truly comparable sales may be problematic. The wide variety of pipeline locations, pipeline types and sizes, type of product transported, and pipeline operating characteristics requires a large database of sales with similar characteristics to ascertain comparability.

If determining a market value estimate is contemplated, it is suggested that a market range based on confirmed sales prices divided by the actual throughput in MMcf per day be attempted. Comparison of this range with other approaches to value will enable the appraiser to determine if the value is reasonable and defensible.

Reconciliation of Valuation Approaches to a Final Estimate of Value

In textbook examples of the reconciliation process, the cost approach, market approach, and income approach are weighed carefully to determine, in the appraiser's opinion, the final market value of the property. The reconciliation is the attempt by the appraiser to explain or reconcile differences that may exist between the various indicators of value and to review the strengths and weaknesses of each approach.

The final value conclusion is subjective, but is based on the indicators plus general overall value influences. Where the appraiser has adequate and reliable data, the greatest reliance is placed on this data in the reconciliation process. For newer pipeline systems in Colorado, the historical cost less depreciation approach is typically considered as the most reliable indicator of value. When the assessor is made aware of additional obsolescence based on functional and/or economic concerns, these adjustments should be considered.

However, as a pipeline ages, the cost approach becomes less reliable. Pipelines that are 15 - 20 years old typically generate higher values through the capitalization of net income than would be represented by the depreciated historical cost approach. However, uses of the income and market approaches carry with them some additional cautions regarding allocation of the indicated value into real and personal property components. Careful allocation of the market and/or income approach values must be done in order to estimate the representative market or income value attributable to the real property assets.

The actual value estimate determined from sales comparison analysis of comparable pipeline sales or from the capitalization of income approach will generally represent the value of the entire pipeline system including land, rights of way, line pipe, structures, and personal property. To arrive at an allocation of value between pipeline real property and personal property, allocation of the pipeline components by original acquisition or installation cost of the various pipeline system components can be considered.

The assessor should request actual original acquisition costs from the company’s financial records for each of the pipeline system components such as rights of way, other lands, transmission mains, pipeline structures, compressor and pumping equipment, and any other real or personal property components included in the pipeline system. Please note that intangible personal property will have to be excluded before the pipeline components are analyzed. Note also that right-of-way acquisition costs and damage costs paid to landowners are to be excluded from the analysis.

In determining allocation percentages, the original acquisition costs of all pipeline system assets are totaled and percentages calculated for each asset as part of the total (100%). These percentages are applied to the market approach value and/or income approach value(s) to determine the contributory value of each component of the pipeline system. For the purposes of this methodology, it is assumed that each component of the pipeline system contributes equally to establish the total value of the pipeline system from the income approach. Finally, each component is then classified as real or personal property in accordance with Colorado statutes and these procedures. According to § 39-1-103(13)(a), C.R.S., the market (or income) value of personal property can only be considered if it is less than the value determined by the cost approach to value.

If oil and gas reserves are included in the overall value of the pipeline system, qualified engineering studies will have to be obtained from the taxpayer to support the allocation of the overall system market value to the contributory value of the reserves.

Locally Assessed Pipelines

Level of Value Adjustment (Rollback) Factor

As required by § 39-1-104(12.3)(a)(I), C.R.S., the current actual value determined each year for personal property must be adjusted to the level of value applicable for real property. The procedure involves the multiplication of the current actual value estimate by the appropriate factor for the type of property being valued. Each year, the Division of Property Taxation researches and publishes these adjustment factors for use by all Colorado Assessors.

However, since the Cost Trending Factors for Pipeline Systems have been calibrated to include the Level of Value (LOV) adjustment (Rollback) factor, pipeline values do not require the use of a LOV factor. Put another way, the LOV factor will always be 1.00.

Best Information Available (BIA) Valuation of Pipelines

If a taxpayer is unable or unwilling to supply basic historical cost and/or income information for the valuation of the pipeline system, the assessor may determine a BIA valuation for the property. Two possible sources for BIA values can be used:

- Comparable pipeline values per mile based on other pipeline assessments within the county or in other neighboring counties. Age of the system, pipeline throughput, and pipe size are important units of comparison when establishing BIA values. Assessors within the same oil and gas production basin are encouraged to discuss pipeline assessment practices and provide comparative assessment information to be reviewed by all assessors.

- Section 62, page 6, of the Marshall Valuation Service manual should also be considered as a source of BIA assessments. Make sure you read the explanatory paragraph under “Pipeline Costs” associated with the typical costs per mile so the appropriate rate can be assigned. (As with most sections of the Marshall Valuation Service manual, local multipliers may be applicable to the section. Final figures may need to be adjusted to the appropriate level of value using Marshall’s own indices for such data.) You will also have to add costs for compressor/pumping equipment.

It is important that the BIA value be based on comparable pipeline cost information, assessment information, or other source of information related to the pipeline industry.

Bibliography of Sources

The following sources may contain additional information regarding how oil and gas pipelines are constructed and used:

- Fundamentals of Oil and Gas Accounting - 3rd. Edition

- “Gas Handling and Field Processing,” Plant Operations Training text, Penwell Books

- Modern Petroleum - A Basic Primer of the Industry, Penwell Books

- Oil and Gas Pipeline Fundamentals - 2nd Edition, Penwell Books

- Natural Gas Desk Book, published by Mobil Natural Gas Inc.

Assessors are encouraged to obtain one or more of the reference texts for use in understanding pipeline terminology and other intricacies of pipeline operations.

Example Valuation of an Oil and Gas Gathering System

The subject property is a 12.00-mile natural gas gathering system owned by B & B Production Company that encompasses 100 oil and gas wells in the Allentown gas field in Carbon County, Colorado. Also included is a pre-engineered metal field office (20’x40’) with concrete floor, four (4) field measurement and regulation station structures that contain regulation and measurement equipment, and two field compressors. For the purpose of this example, the field structures are portable and are classified as personal property.

Right-of-way acquisition cost for construction of the line was $350,000. Damage costs paid to landowners were included in the right-of-way acquisition cost. A pipeline site map was requested by the assessor and supplied by the taxpayer.

As of January 1, the gathering system consisted of the following assets:

| Asset Description | Mileage | Pipe or Size or Capacity | Year Const | Original Installed Cost | District |

|---|---|---|---|---|---|

| Gathering Line | 6.5 | 4" | 2014 | $857,600 | |

| Gathering Line | 1.5 | 4" | 2016 | $457,000 | |

| Transmission Line | 4.3 | 8" | 2017 | $1,100,000 | |

| Transmission Line | 2 | 10" | 2016 | $400,000 | |

| Field Meas. Equipment | n/a | n/a | 2015 | $25,000 | 1 |

| Portable Field Stations (Trans.) | n/a | n/a | 2016 | $32,000 | 2 |

| Field Office | n/a | n/a | 2008 | $14,560 | 2 |

| Right-of-Way | 12.00 | 2004 | $350,000 |

Although the system has been in place for several years, the taxpayer indicates that as of the January 1 assessment date, the line was not at normal operating capacity and that this condition had existed during the prior year. Discussion with the pipeline operator revealed that price negotiations had deteriorated between the pipeline company and a few large field owners and many gas wells were selling to local users, instead. This economic condition existed as of the assessment date. Design operating throughput for the pipeline is 25MMcf per day. Daily average throughput for the prior year was 12MMcf per day. The taxpayer did not indicate that any other forms of obsolescence were affecting the pipeline system.

Valuation of Subject Gathering System

Valuation of this gathering system will be based on the cost approach to value with additional consideration given to functional/economic obsolescence due to diminished throughput. The cost approach will be calculated using published factors and economic life depreciation guidelines. These factors and depreciation guidelines are included as Addendum 8-A, Cost Trending Factors and Percent Good Tables at the end of this chapter.

Valuation of Gathering System Field Line and Right of Way:

Since the pipelines are of different diameters both the 14 year-life and the 22 year-life tables will be used. If there are different years of construction, each year must be considered separately.

| Asset Description | Pipe or Size or Capacity | Year Const | Original Installed Cost | Cost Trending Factor | Cost New Reproduction |

|---|---|---|---|---|---|

| Gathering Line | 4" | 2014 | $857,600 | 1.424 | $1,221,222 |

| Gathering Line | 4" | 2016 | $457,000 | 1.489 | $680,473 |

| Transmission Line | 8" | 2017 | $1,100,000 | 1.404 | $1,544,400 |

| Transmission Line | 10" | 2016 | $400,000 | 1.489 | $595,600 |

| Field Meas. Equipment | n/a | 2015 | $25,000 | 1.448 | $36,200 |

| Portable Field Stations (Trans.) | n/a | 2016 | $32,000 | 1.489 | $47,648 |

| Totals | $2,871,600 | $4,125,543 |

For pipeline valuation, Reproduction Cost New Less all Depreciation (RpdCNLD) is also termed the Actual Value of the pipeline. This is because pipeline Cost Trending Factors include the Level of Value Adjustment in the factors. Note also that the Right-of-way acquisition cost of $350,000, (which included damage costs paid to landowners) is excluded before the pipeline components are analyzed. Pipeline right-of-way (ROW) acquisition costs should not be separately valued when valuing the assets of a pipeline, as original ROW acquisition costs are associated with land or its use. Since the pipeline could not exist without the Right-of-Way, the value of the Right-of-Way attributable to the pipeline is assumed to be included in the total actual value of the pipeline, once that value is determined. Since damage costs are expenses and not assets, they should not be valued as part of the pipeline system.

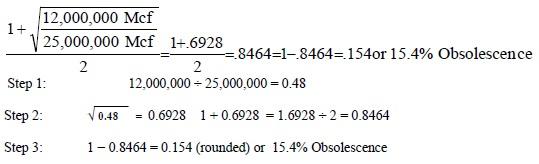

Determination of Functional/Economic Obsolescence:

The analysis of gathering system throughput for the prior year indicates the pipeline is not operating at design capacity. This economic condition was caused by adverse contract negotiations causing lesser quantities of gas to enter the pipeline than expected. Recognition of the above condition is in the form of obsolescence and is calculated using the following formula:

Calculation of the actual obsolescence number is shown below:

Note: It is important to perform the mathematical calculations in proper order.

This calculation takes into account the loss in value for the gathering system assets due to diminished use.

Valuation of Field Structures:

Field structures typically include small, shed-like structures used to enclose meters or field regulators attached to line pipe. They may or may not be attached to a concrete foundation. Since the field structures are closely tied to and considered part of the line pipe, for convenience purposes they should be classified and valued as personal property using the same factors and depreciation tables as the line pipe.

| Description | Current Cost New | Eff. Age | Depr. Table | Percent Good | Phys. Dept. Value | Less Funct. Obsol. | Cost New Less Depreciation |

|---|---|---|---|---|---|---|---|

| Gathering Line 4" | $1,221,222 | 12 | 14 yr | 32% | $390,791 | 15.4% | $330,609 |

| Gathering Line 4" | $680,473 | 10 | 14 yr | 43% | $292,603 | 15.4% | $247,542 |

| Transmission Line 8" | $1,544,400 | 9 | 22 yr | 77% | $1,189,188 | 15.4% | $1,006,053 |

| Transmission Line 10" | $595,600 | 10 | 22 yr | 73% | $434,788 | 15.4% | $367,831 |

| TOTAL | $1,952,035 | ||||||

| Field Meas. Equipment | $36,200 | 11 | 14 yr | 38% | $13,756 | 15.4% | $11,638 |

| Portable Field Stations (on Gathering/Trans Line) | $47,648 | 10 | 22 yr | 73% | $34,783 | 15.4% | $29,426 |

| Total | $41,064 |

Valuation of the Field Office

Since the field office is a pre-engineered metal improvement, it must be classified and valued as real property according to § 39-1-102(14)(c), C.R.S. To determine the cost approach value of the improvement, the Marshall Valuation Service commercial cost manual was used. Specifically, May 2023 base costs for Class S, average quality Light Commercial – Commodity Warehouse (104) utility buildings were used.

These costs are found in Section 17, page 11, of the Marshall Valuation Service manual. Using Section 98, page 5, the base costs were adjusted to reflect June 30, 2024, level of value by using the appropriate cost multiplier for the Western Region to trend the May 2023 base costs to the June 30, 2024, level of value.

Marshall Valuation Service recommended 25-year life and the depreciation table applicable for the improvements were used. The depreciation table is located in Section 97, page 8 of the Marshall Valuation Service manual. The field office was installed in 2008 and has an effective age of 17 years.

Field Office 800 Sq.Ft. (20’ x 40’) $30.50 x 1.004

x $30.62

= 6/30/2024 RCN $24,496

x 0.79 Percent Good (100% - 21% deprec.)

Actual Value $19,352

Total Valuation of Gathering System Assets

Valuation of all the pipeline assets is summed as follows:

| Description of Asset | Total of Values |

|---|---|

| Right of Way | (included in overall value) |

| Field Gathering/Transportation Pipeline | 1,952,035 |

| Field Structures/Equipment | $41,064 |

| Field Office | $19,352 |

| Total Actual Value | $2,012,451 |

Market Approach to Value

Under the Colorado constitutional and statutory provisions, the market (sales comparison) approach to value must be considered along with the cost approach when establishing a value for this gathering system.

In this example, there were no arms-length sales of pipeline gathering systems within the county or within Colorado. As such, this approach to value was considered but not used.

Income Approach to Value

According to Colorado constitutional and statutory provisions, the income approach to value must be considered when establishing a value for a gathering system.

In this example, the gathering system was operated as part of an integrated oil and gas production, processing, and transportation venture. There was no actual sale of the product upon which to complete an income and expense analysis. As such, this approach to value was considered but not used.

Consideration of lost revenue due to underutilization of the pipeline is accounted for in the functional/economic obsolescence analysis portion of the cost approach procedures.

Addendum 8-A, 2026 Cost Trending Factors and Percent Good Tables

| RCN Trending Factors | Percent Good Tables | |||

|---|---|---|---|---|

| Year of Acquisition | Trend Factor | Effective Age | Gathering | Trunk/Transmission |

| 2025 | 1.000 | 1 | 95% | 98% |

| 2024 | 0.951 | 2 | 90% | 96% |

| 2023 | 0.965 | 3 | 84% | 93% |

| 2022 | 0.881 | 4 | 78% | 91% |

| 2021 | 1.023 | 5 | 72% | 88% |

| 2020 | 1.305 | 6 | 67% | 86% |

| 2019 | 1.285 | 7 | 61% | 83% |

| 2018 | 1.298 | 8 | 55% | 80% |

| 2017 | 1.404 | 9 | 49% | 77% |

| 2016 | 1.489 | 10 | 43% | 73% |

| 2015 | 1.448 | 11 | 38% | 70% |

| 2014 | 1.424 | 12 | 32% | 67% |

| 2013 | 1.546 | 13 | 28% | 63% |

| 2012 | 1.462 | 14 | 23% | 59% |

| 2011 | 1.6 | 15 | 18% | 56% |

| 2010 | 1.654 | 16 | 16% | 52% |

| 2009 | 1.708 | 17 | 15% | 48% |

| 2008 | 1.593 | 18 | 45% | |

| 2007 | 1.829 | 19 | 41% | |

| 2006 | 1.9 | 20 | 38% | |

| 2005 | 1.933 | 21 | 34% | |

| 2004 | 2.111 | 22 | 31% | |

| 2003 | 2.554 | 23 | 28% | |

| 2002 | 2.579 | 24 | 25% | |

| 2001 | 2.614 | 25 | 23% | |

| 2000 | 2.641 | 26 | 21% | |

| 1999 | 2.659 | 27 | 19% | |

| 1998 | 2.659 | 28 | 17% | |

| 1997 | 2.696 | 29 | 15% | |

| 1996 | 2.733 | |||

| 1995 & Prior | 2.885 | |||

Please note that while gathering systems have a 14 year economic life, they do not reach their fully depreciated fifteen percent good residual floor until year 17. Also note that while trunk/transmission pipeline systems have a 22 year economic life, they do not reach their fully depreciated fifteen percent good residual floor until year 29. The Iowa State University studies support the application of the above tables and residuals. The RCN Trending Factors are displayed in the same order as the Percent Good Tables allowing a straight-edge to be applied at the bottom of any particular Year’s row will reveal the correct Trending Factor, the Effective Age for that Year of Acquisition and the appropriate Percent Good for either a Gathering System or a Trunk/Transmission System.