Chapter 6 - Valuation of Natural Resources

Classification

Natural resource leaseholds and lands are classified for valuation and abstract purposes into three major categories:

- Producing Mines

- Producing Oil and Gas Leaseholds and Lands

- Other Natural Resource Leaseholds and Lands (Excepted Mines)

Producing Mines

This classification includes all natural resource operations defined as producing mines pursuant to § 39-6-105, C.R.S., which had gross proceeds during the previous calendar year in excess of $5,000. Minerals extracted by such operations include, but are not limited to:

- Cadmium

- Copper

- Gold

- Iron

- Lead

- Molybdenum

- Silver

- Tin

- Tungsten

- Uranium

- Vanadium

- Zinc

Also included are oil shale mineral operations that mine oil shale rock for later extraction of kerogen (shale oil) through a retort process.

Producing Oil and Gas Leaseholds and Lands

All leaseholds and lands that produced oil and/or natural gas products, which were sold or transported from the production area during the previous calendar year, are included in this classification. Examples include leaseholds and lands producing carbon dioxide (CO₂) or other naturally occurring gases.

Also, included in this classification are oil shale operations which extract kerogen (shale oil) from in-place shale reserves using the in-situ or modified in-situ method.

Other Natural Resource Leaseholds and Lands

Natural resource lands, other than producing mines and oil and gas leaseholds and lands, should be included in this classification. It includes all mines excepted under § 39-6-104, C.R.S. Examples of mineral operations excepted from the producing mine statute are operations extracting:

- Asphaltum

- Coal

- Clay

- Dawsonite

- Dolomite

- Feldspar

- Fluorspar

- Ganister

- Granite

- Gravel

- Gypsum

- Limestone

- Peat

- Perlite

- Quartz

- Road Base

- Rock

- Sand

- Soda Ash (nahcolite)

- Stone

- Turquoise

- Volcanic Scoria

Also included in this classification are:

- All natural resource operations extracting any product with gross proceeds during the previous calendar year of less than or equal to $5,000

- Nonproducing patented mining claims

- Nonproducing severed mineral interests

Producing Mines

The following subsections refer to the assessment of producing mines.

Statutory References

The statutes in article 6 of title 39, C.R.S., cover producing mines, nonproducing mines, and operations that extract products excepted from the producing mine definition.

In this article, specific terms are defined.

Definitions.

As used in this article, unless the context otherwise requires:

(1) "Mine" means one or more mining claims or acres of other land, including all excavations therein from which ores, metals, or mineral substances of every kind are removed, except drilled wells producing sulfur and oil, gas, and other liquid or gaseous hydrocarbons, and all mining improvements within such excavations, together with all rights and privileges thereunto appertaining.(2) "Mining claims" means lode, placer, millsite and tunnelsite claims, whether entered for patent, patented, or unpatented, regardless of size or shape.

(3) "Ore" includes, without limitation, metallic and nonmetallic mineral substances of every kind, except those specifically excluded under section 39- 6-104.

(4) "Other land" means any parcel of real property which is not a mining claim.

§ 39-6-101, C.R.S.

Mines are also classified by statute.

Classification of mines.

All mines, except mines worked or operated primarily for coal, asphaltum, rock, limestone, dolomite, or other stone products, sand, gravel, clay, or earths, shall, for the purpose of valuation for assessment, be divided into two classes: Producing and nonproducing.

§ 39-6-104, C.R.S.

The terms, producing mines and nonproducing mines, are also defined by statute.

Producing mines defined.

All mines whose gross proceeds during the preceding calendar year have exceeded the amount of five thousand dollars shall be classified as producing mines, and all others shall be classified as nonproducing mines. Mines shall be classified in the manner provided for in this article regardless of the processing method, the ultimate use, or the consumption of the ores or minerals for which they are primarily worked or operated.

§ 39-6-105, C.R.S.

Additional statutes covering other important areas of producing mine assessment can be found in article 6 of title 39, C.R.S. and should be reviewed by the appraiser.

Mine Classification

The following minerals are included within the statutory producing mines classification.

- Molybdenum

- Precious Metals and Substances (platinum, gold, silver, diamonds)

- Base Metals (cadmium, copper, iron, lead, tin, tungsten, and zinc)

- Strategic Minerals (uranium, vanadium)

- Oil Shale (oil shale/retort)

For valuation of in-situ oil shale operations, refer to Producing Oil and Gas Leaseholds and Lands.

Colorado statutes define a producing mine as a mine whose gross proceeds exceeded five thousand dollars ($5,000) during the preceding calendar year. All other mines are considered nonproducing mines or excepted mines and are to be valued in the same manner as other real property.

A producing mine includes, as a unit, any contiguous mining property, tunnels, or other land owned or leased by the same person and used in any phase of the mine operation. Also within a mine excavation, improvements and fixtures associated with water and drainage systems, ventilation systems, and electrical power systems are included as mining improvements. They are not valued separately.

Not included in the producing mine value and subject to separate assessment are improvements, structures, and building system fixtures located outside of the mine portal or excavation, all machinery and equipment, and any other personal property. Milling or smelting operations contiguous to the mining operation are not to be included in the producing mine valuation but are to be valued in the same manner as other real property.

All other claims and other lands not included in the producing mine are to be valued in the same manner as other real property on an acreage basis, regardless of surface contiguity.

Mine Discovery

Several good sources for the discovery of and information about producing mines are:

- The Colorado Division of Reclamation, Mining, and Safety (DRMS), (formerly Division of Minerals and Geology) headquartered in Denver, is the best source for the discovery of pending and ongoing natural resource operations and maintains information on mining operations statewide. The reports contain information on locations, acreages, reserve lives and mining plans. The records of the DRMS are open for public inspection. The address is:

Division of Reclamation, Mining, and Safety

Centennial Building

1313 Sherman Street, Room 215

Denver, CO 80203

Telephone: 303-866-3567

Division of Reclamation, Mining, and Safety Website - The Colorado Geological Survey publishes maps, geological reports and general mine data on most natural resources within Colorado. Most of these resources are available online or through their bookstore. For more information, contact them directly at:

Colorado Geological Survey

Colorado School of Mines

Moly Building

1801 Moly Road

Golden, CO 80401

Telephone: 303-384-2655

Colorado Geological Survey Website - The Colorado State Land Board handles the leasing of all natural resource operations on state land. Its office contains information on the type of product(s) mined, royalty rates, lessor's name, status of property, acres under lease, and location. The address is:

Colorado State Land Board

1127 Sherman Street, Suite 300

Denver, CO 80203

Telephone: 303-866-3454

Colorado State Land Board Website

Mining Valuation Definitions

Statutory Definitions

In the valuation of producing mines, certain statutory definitions play an important part. The definitions, taken from § 39-6-106, C.R.S., follow:

Gross Value: The gross value from production of the ore extracted during said calendar year, which means and includes the amount for which ore or the first salable products and/or by-products derived therefrom were or could be sold by the owner or operator of a mine, as determined by actual gross selling prices.

Gross Proceeds: The gross proceeds from production of such ore, which means and includes the value of the ore immediately after extraction, which value may be determined by deducting from gross value all costs of treatment, reduction, transportation, and sale of such ore or the first saleable products and/or by-products derived therefrom.

Net Proceeds: The net proceeds from production of such ore, which means and includes the amount determined by deducting from the gross proceeds all costs of extracting such ore.

Other Definitions

Additional definitions have been developed by the Division for use in understanding and implementing producing mine valuation statutes and assessment procedures, § 39-6-109(3), C.R.S.

Agent: One who is authorized to act for or in place of another; a representative. (Black's Law Dictionary - 7th Edition)

An agent does not include salaried or hourly paid employees of a company or corporation.

Allocation: Recovery of the historical cost of capital (fixed) assets based on the life of the asset. An annual deduction for an amortized allocated fixed asset cost may be taken as a cost of production.

Capital Assets: Also called Fixed Assets. Capital assets are tangible assets of a permanent nature used to produce income. Capital assets are defined as improvements, fixtures, or equipment with an economic life in excess of one year.

For the purposes of these procedures, fixed assets consist of buildings, structures, fixtures, and personal property. Asset costs for land, including minerals rights, are not allowed for amortized cost allocation or depletion deduction as a cost of production.

Development Costs: Costs expended by the owner or operator of an operating producing mine to develop or prepare an ore body prior to extraction of the ore or unprocessed material. Expenditures, including government mandated costs, fees, and permit costs incurred in development of the ore body are considered development costs. Exploration costs are not allowed for inclusion or deduction as development costs.

Exploration Costs: Expenses incurred in prospecting, assaying, locating, or other activities to ascertain whether a mineral exists and to determine whether the mineral is physically and economically feasible to mine.

Doré Bullion: An impure alloy of silver or gold produced at a mine.

Margin Costs: Also called margin or profit, margin costs are allocated production costs or expenses reflecting direct, imputed, or implied profit accruing to the ore, unprocessed material, or refined products of the producing mine. Margin can accrue in any phase of the operation, including the treatment, reduction, transportation, sale, or extraction process.

Off-site Costs: These are expenses, either directly or indirectly associated with a producing mine, that are incurred at a location beyond the borders of the producing mine site. Allocated off-site costs, exclusive of compensation of officers or agents not actively and continuously engaged about the mine, that are directly associated with the extraction, treatment, reduction, transportation, and sale of the ore or first salable product(s) are allowed.

Officer: A person elected or appointed by the board of directors to manage the daily operations of a corporation, such as a CEO, president, or treasurer. (Black's Law Dictionary - 7th Edition)

Pre-production Development Costs: These are costs expended by the owner or operator in preparation for start-up of the mine. Expenditures, including government mandated costs, fees, and permit costs incurred in development of the mining property after a decision to build the mine has been made are considered pre-production development costs.

Exploration costs incurred to ascertain whether a mineral exists and to determine whether the mineral is physically and economically feasible to mine are not allowed for inclusion or deduction as pre-production costs.

Mine Taxpayer Filing Requirements

The person owning or operating a producing mine is required to file the following information

with the county assessor by April 15th, § 39-6-106(1), C.R.S.:

- List of contiguous mining claims or other lands and their acreages

- Name and address of the owner and operator

- Total number of acres contained in the mine and, if such mine is located in more than one county, the total number of acres contained in such mine in each county

If the taxpayer declares, according to § 39-6-106(1), C.R.S., the number of acres in each county, the taxpayer is not required, under § 39-6-113(4), C.R.S., to file any additional statements or declarations regarding mine acreage allocations, if no changes have occurred since the original statement was filed.

- Tons of ore extracted during the preceding calendar year and, if the value of the products derived from the ore is used to determine gross value, the number of tons, pounds, or ounces of products derived from the ore

- Gross value of production

- Cost of treatment, reduction, transportation, and sale

- Gross proceeds from production

- Cost of extraction

- Net proceeds from production

As stated in § 39-6-106(1.4), C.R.S., the owner or operator of a producing mine may request permission from the Board of County Commissioners in each county where the mine is located to state an average figure for items 4 through 9 listed above.

Specifically, the owner or operator may select any three (3), five (5), or ten (10) year reporting period (averaging period) immediately preceding January 1 of the year in which the declaration schedule is filed. This request must be in writing and filed at least 45 days prior to the statutory April 15 filing date (by March 2) of the year in which the declaration schedule is filed. A copy of the request must be attached to the declaration schedule filed by the owner or operator no later than April 15 of each year. The same reporting period must be used for all annual statements pertaining to a particular mine.

At least 30 days prior to the statutory April 15 filing date (by March 16), the county commissioners of each county must approve or deny the request to submit three, five, or ten year averaged figures. Failure of the commissioners to approve or deny the request by March 16th is deemed an approval of the request.

Producing mine owners or operators that have elected to use a three, five, or ten year averaging period may submit restated production cost figures that incorporate additional allowed deductions pursuant to current Colorado statutes, providing these procedures are used for the prior years within the selected reporting period.

Once approval has been given, the owner or operator must file all declaration schedules for subsequent assessment years using the same reporting method (averaging period). The reporting method can only be changed upon approval of the Board of County Commissioners in every county where the mine is located. Failure of the commissioners to approve or deny the request for a change in the reporting period by March 16th is deemed an approval of the request.

Regardless of whether approval has been received, the owner or operator of the producing mine must file the declaration schedule containing the required real and personal property information by the statutory April 15 filing date. The same reporting method must be used on all annual statements and declaration schedules filed in a single year pertaining to a particular mine.

Allowed and Non-Allowed Costs of Production

Mine Allowed Costs of Production

- Treatment Costs - costs incurred subsequent to mining but before sale. They include costs of crushing, grinding, concentrating, separating, agglomeration or any other form of processing performed prior to smelting. If the mining company does not own the mill or have any interest in it, then use the contract price paid for milling service. Any allocated on-site general and administrative costs directly tied to the treatment process would also be included as treatment costs.

- Reduction Costs - costs incurred subsequent to milling or other initial processing of the ore. Reduction costs include the smelting or conversion of the ore to its base product or products. The cost of reduction for precious metals is the total charge by the smelter for the production of refined products from Doré bullion. This may include transportation of bullion to the smelter, insurance, and smelter charges. Any allocated on-site general and administrative costs directly tied to the reduction process would also be included as reduction costs.

- Transportation Costs - include the movement of the ore from the mine portal (mine mouth) to the point of sale. The process of transporting ore from the mine to the crusher is allowable if not previously deducted elsewhere. If the point of sale is after treatment and reduction, then related transportation costs should be allowed. Any allocated onsite general and administrative costs directly tied to the transportation of the ore or products to the point of sale would also be included.

Haulage costs within the mine, from the mine face to the mine portal, are extraction costs and should not be included here.

Transportation costs, in the case of leach treatment of gold ore, could include trucking of ore from crusher to leach pad or conveyor transport of ore from the crusher to the leach vats. No additional deduction is allowed if the cost of transportation of the ore through the leach process has already been included as a treatment cost.

- Sale Costs - include costs of selling the marketable products. These costs should be itemized. If Doré bullion is sold, costs could include transportation, insurance and sampling. If refined products are sold, costs could include storage fees, insurance, and sampling. Sales commissions paid prior to the point of sale are an allowable cost of sale. Any on-site allocated general and administrative costs directly tied to the sale of the ore or products at the point of sale would also be included.

- Extraction Costs - extraction costs are direct mining costs. These are the costs involved in mining the undisturbed ore and transporting it to the mine portal.

Amortized pre-production development costs expended by the owner or operator in preparation for start-up of the mine are allowable costs of extraction. Exploration costs incurred to ascertain whether a mineral exists, and to determine whether it is physically and economically feasible to mine, are not allowed for deduction. Severance taxes, direct property taxes on the producing mine exclusive of machinery and equipment and surface improvements, and royalty expenses to exempt entities are allowable costs of extraction.

Any allocated, on-site general and administrative costs directly tied to the extraction operation would also be included.

- Other Miscellaneous Costs - off-site general and administrative costs, including employee salaries, wages, and benefits, are allowed if they are properly allocated and can be directly tied to the pre-production development cost of the mine site or the treatment, reduction, transportation, or sale of the ore, concentrate, or first salable product. If off-site general and administrative costs are allocated, the allocation methodology must be disclosed with the declared costs.

A detailed listing of itemized costs with associated narrative descriptions of those costs should be obtained and reviewed prior to allowing any deduction. Off-site costs that are not directly related to the mining operation are not allowed.

- Allocation of Capital (Fixed) Asset Costs - a deduction for amortized, allocated cost of fixed assets can be taken as a cost of production. However, fixed assets must be categorized as treatment, reduction, transportation, and sale assets, or as extraction assets prior to deduction. Deduction for amortized allocated cost of fixed assets may be included as a component of individual treatment, reduction, transportation, sales, and extraction costs, as reported by the taxpayer, but must reflect only those fixed assets that are currently in use in those production processes.

A deduction for an amortized allocated cost of treatment, transportation, reduction, and sale assets can be taken as a cost of production from the gross value of production in determining gross proceeds value. A deduction for an amortized allocated cost of extraction assets also can be taken as a cost of production from gross proceeds value in determining net proceeds value.

Deduction for amortized allocated cost of fixed assets is allowed for producing mine valuations beginning in the 1994 assessment year. As specified in § 39-6-106(1.7)(b)(II), C.R.S., all accumulated depreciation that was previously deducted, or could have been deducted prior to 1994, cannot be listed for additional deduction as a cost of a fixed asset.

Amortization of pre-production development costs is allowed for producing mine valuations established for the 1994 assessment year. All accumulated amortized preproduction amounts that were previously deducted, or could have been deducted prior to 1994, cannot be listed for additional deduction as a cost of a fixed asset.

Examples of Allocation of Asset Cost Methodologies

For allocation of asset costs such as buildings, structures, fixtures, and pre-production development costs, either a straight-line method over the estimated life of the operation or a units-of-production method over the life of the reserve is acceptable.

Example:

Producing Mine

| Original Acquisition Cost of Fixed Assets | $50,000,000 |

|---|---|

| Less: Previously deducted depreciation expense, allocated cost, or amortized cost | - $15,000,000 |

| Plus: Pre-production Development Costs (not otherwise expensed or previously deducted) | + $5,000,000 |

| Total Amount Subject to Allocation | $40,000,000 |

| Remaining Life of Mine | 25 years |

| Remaining reserve tonnage of ore (used by owner/operator to estimate mine life) | 75,000,000 tons |

Straight-line Method

| Yearly allocation percentage (1 ÷ 25 years) | 4% |

|---|---|

| Assessment Year Deduction ($40,000,000 X .04) | $1,600,000 |

Units-of-Production Method

| Yearly allocation percentage (3,000,000 tons ÷ 75,000,000 tons) | 4% |

|---|---|

| Assessment Year Deduction ($40,000,000 X .04) | $1,600,000 |

Assuming no additions or retirements, the amount subject to allocation should be reduced each year by the yearly allocation deduction taken by the producing mine owner or operator. However, the total amount subject to allocation may increase or decrease from year to year as assets are constructed, acquired, abandoned, or permanently retired.

For allocation of personal property costs such as machinery, equipment, furnishings, and other assets that are classified as personal property, a straight-line allocation method over the estimated life of the property is acceptable.

Example:

Producing Mine

| Original Acquisition Cost of Personal Property Assets1 | $10,000,000 |

|---|---|

| Less previously deducted depreciation expense, allocated cost, or amortized cost | - $2,000,000 |

| Total Amount Subject to Allocation | $8,000,000 |

1Amount subject to allocation (includes acquisition cost, installation cost, sales/use tax, and freight of item to the point of installation)

Remaining Economic life of personal property items 8 years

Straight-line Method

| Yearly allocation percentage (1 ÷ 8 years) | 12.5% |

|---|---|

| Assessment Year Deduction ($8,000,000 X .125) | $1,000,000 |

To determine the appropriate allocation deduction, personal property items should be grouped together by asset life. The deduction amounts for each asset life group can be calculated and then added together for the final allocation deduction(s).

Assuming no additions or retirements, the amount subject to allocation should be reduced each year by the yearly allocation deduction taken by the producing mine owner or operator. However, the total amount subject to allocation may increase or decrease from year to year as assets are acquired, salvaged, abandoned, or permanently retired.

Deduction for allocated asset costs and pre-production development costs must begin in the first calendar year after production has commenced. Unless otherwise shown here, rules contained within the Generally Accepted Accounting Principles (GAAP) will govern the application of amortization of these costs.

Non-Allowed Costs of Mine Production

The following costs are not allowable as costs of production:

- Interest Expense - interest expense is the cost of borrowing money. Management can control this cost by using various financial techniques.

- Income Taxes - income taxes are an expense based on the profitability of an operation and are not related to the value of the producing mine leaseholds and lands.

- Depletion Allowance - this is a deduction allowed by the IRS for income tax purposes.

- Dividend Expense - expenses paid to shareholders of a mining corporation are not directly related to the value of the producing mine leaseholds and lands.

- Incurred or Amortized Exploration Costs Prior to Production - costs or expenses incurred to ascertain whether a mineral exists and if it is physically and economically feasible to mine. These costs are generally incurred prior to the decision to begin development of the mine. Since such costs are not directly associated with preproduction development activities or actual production, they are not deductible.

- Royalty Expenses to Taxable Entities - royalties are an expense related to the right to extract minerals. Although not deductible, this right is included in the bundle of rights associated with the mine valuation, which is valued under the Gross/Net Proceeds formula.

- Compensation of Officers and Agents not actively and continuously engaged about the Mine - deduction of these costs (including benefits and commissions of officers and agents) are prohibited by §§ 39-6-106(1)(f) and 39-6-106(1.7)(a)(I)(C), C.R.S.

- Costs to Acquire Land or Subsurface Mineral Rights - asset costs for land, including minerals rights, are not allowed for amortized cost allocation deduction as a cost of production.

- Margin Costs - direct, indirect, or imputed profit that accrues to the extraction, treatment, transportation, or sale of the ore or products derived from the ore are not allowed. Deduction of this cost is prohibited by § 39-6-106(1.7)(b)(I), C.R.S.

- Non-Allocated General and Administrative Expenses - any general and administrative expenses that cannot be directly tied to the extraction, sale, reduction, treatment, or transportation cannot be deducted.

Any other costs or expenses not directly related to the extraction, transportation, treatment, reduction, or sale of the ore, concentrate, or product cannot be deducted.

Confidentiality of Taxpayer Information

The natural resources property declaration schedules and appraisal records are used for both real and personal property data. Since confidential real and personal property information is contained on both the front and back of these declaration schedules, requests for non-confidential information should be directed to other public agencies which have access to this information and have the means of disclosing it to the public without divulging confidential information, §§ 39-5-120 and 24-72-204(3)(a)(IV), C.R.S. Examples of these agencies might include, but are not limited to, the Colorado Division of Reclamation, Mining, and Safety or the Federal Bureau of Land Management.

Valuation of Producing Mines

Section 3 of article X of the Colorado Constitution requires that the value of a producing mine be based on the value of the unprocessed material. The gross (or net) proceeds amount represents the value of the unprocessed material immediately after extraction. This amount is the statutorily prescribed measure of value of the producing mine leaseholds and lands and any mining improvements within the mine excavation.

Mining improvements may include such real property improvements within the mine excavation such as roof supports, shafts, raises, drifts, tunnels, adits, stopes, and cutouts. Improvements and fixtures within a mine excavation that are associated with water and drainage systems, ventilation systems, and electrical power systems are also included as mining improvements and are not separately valued.

Not included in the producing mine value and subject to separate assessment are improvements, structures, and building system fixtures located outside of the mine portal or excavation, all machinery and equipment, and any other personal property.

The following are the statutory steps in the valuation of a mine by gross or net proceeds:

Step #1 Determine the gross value of the ore extracted during the preceding calendar year or approved reporting period.

Gross value is the amount for which the ore or first salable product derived therefrom was sold or could have been sold. If there is an established market value for the type of ore mined, this value may be shown, even if it is not actually sold as ore. If part or all of the ore mined was not sold, it should be valued at prevailing prices for the year of production or approved reporting period.

Step #2 Deduct all costs of treatment, reduction, transportation, and sale to estimate gross proceeds. Refer to Allowed and Non-Allowed Costs of Production.

Step #3 Deduct the costs of extraction from the gross proceeds to estimate net proceeds. Extraction costs are direct mining costs. These are the costs involved in mining the undisturbed ore and transporting it to the mine portal. Refer to Allowed and Non-Allowed Costs of Production.

Step #4 Determine current valuation for assessment. Determine the greater of the following:

25% of gross proceeds

100% of net proceeds

The greater of the two numbers is the valuation for assessment of the producing mine. If both numbers are negative, additional review of allowed deductions in the producing mine formula is necessary.

An example of gross or net proceeds valuation based on information in a sample declaration for a producing mine:

Statement of Production

| a. Tons of Ore Mined During Year | 66,000 Tons | |

|---|---|---|

| b. Gross Value of Ore Mined During Year | $396,000 | |

| c. Cost of Treatment* | 0 | |

| d. Cost of Transportation | 121,000 | |

| e. Cost of Sale | 2,000 | |

| f. Cost of Reduction | 205,000 | |

| g. Subtotal (line c+d+e+f) | (328,000) | |

| h. Gross Proceeds from Production | $ 68,000 | |

| i. Cost of Extraction | 101,000 | |

| j. Net Proceeds from Production | $ (33,000) |

CORRELATION

25% of current gross proceeds = $ 17,000

100% of net proceeds = $ (33,000)

Valuation For Assessment = $ 17,000

If the mine is located in more than one taxing jurisdiction, divide the valuation between the jurisdictions in proportion to the number of acres contained in the mine located in each jurisdiction. If the mine is located in more than one county, the mine must file a consolidated statement with the assessor of each county.

Mine Review and Audit of Books and Records

Under § 39-6-109, C.R.S., the assessor has the right to examine and review the books and records of any owner or operator of a producing mine to verify the information contained within the taxpayer's property declaration statement.

Assessor to examine books, records.

(1) The assessor has the authority and right at any time to examine the books, accounts, and records of any person owning, managing, or operating a producing mine in order to verify the statement filed by such person, and, if from such examination the assessor finds such statement or any material part thereof to be willfully false or misleading, the assessor shall proceed to value such producing mine for assessment as though no such statement had been filed.

(2) Upon the request of the assessor, the owner or operator of a producing mine shall provide to the assessor all documentation supporting the amounts reported on the statement filed by such owner or operator.

§ 39-6-109, C.R.S.

Omitted valuation, determined as a result of incorrect, misstated, or omitted information required under § 39-6-106, C.R.S., is considered omitted property and can be placed on the tax roll within six years, § 39-10-101(2)(b), C.R.S.

Colorado Revised Statute § 39-6-109(3) requires the Division to develop procedures for the review and auditing of the declaration schedule and the assessor's examination of the books and records of the producing mine. These procedures provide instruction for review of the books, records, and recommended documentation filed with the county assessor pursuant to § 39-6-106(1), C.R.S., for verification of the amounts declared for a producing mine.

All county assessors, assessors’ office staff, and their agents must utilize the procedures and instructions. For the purpose of these review and audit procedures, "agents" are defined as any person or business that contracts with the county to perform reviews or audits of producing mines to determine if the amounts declared to the county, by owners or operators of producing mines, are correct.

The process by which the books and records of a producing mine are examined consists of two stages; a "review" and, if necessary, an "audit."

Definition of "Review" and "Audit"

A review is defined as an analysis of the declared producing mine production volume, the gross value of ore or product produced, and summary reports of production costs for treatment, reduction, transportation, sales, and extraction, and yearly allocation amounts of fixed assets. The beginning point of a review is the DS 628, Producing Mine Real and Personal Property Declaration, filed by the producing mine for the selected reporting method (averaging period). A review is generally performed at the assessor's office or a site mutually agreed to between the taxpayer and assessor.

An audit is defined as an examination and analysis of taxpayer's records including source documents regarding production volumes, production value, production costs, and fixed asset allocations. Most audits are performed at the producing mine site or site where the operation and financial accounting records are kept.

General Review and Audit Procedures

Counties are permitted to establish reasonable review and audit procedures that they feel would fairly and accurately determine if any discrepancy exists between the taxpayer's declared information and amounts verified through the books and records of the company or through other information sources utilized by the county. The following must be included in the county's review program:

- The county assessor must provide the taxpayer with a letter, by certified mail, indicating that a “review” of that taxpayer's producing mine declaration has been conducted. The letter must include:

- The production year under review. If an averaging period has been selected, the years used by the owner or operator in the selected period.

- Any requests for additional information regarding the taxpayer's reporting discrepancy.

- A listing of the taxpayer's rights regarding the "review."

- If the taxpayer does not provide the requested information or refuses to make the information available, the assessor may:

- File in District Court under § 39-5-119, C.R.S., or

- Issue a Best Information Available (BIA) assessment.

Prior to a review, it is recommended that the assessor obtain the following documentation:

- A current Chart of Accounts.

- A narrative explanation of how the producing mine is operated.

Specifically, the following explanations should be requested:- How the ore is extracted.

- How the ore is transported from the mine face to the portal.

- An explanation of the process used for treatment of the ore.

- If the ore is reduced or smelted prior to sale, an explanation of the process used for treatment of the ore.

- How the ore and/or related products are transported through the treatment and reduction processes.

- The point of sale of the ore or related products, and how the ore or products are transported and sold.

- Financial information consisting of a summary of functional cost control accounts listed by function that will balance with the production volume figures, gross value amounts, or production costs declared for the producing mine.

This summary should have the appropriate financial account number(s) listed for each income or expense item or category listed.

- A summary report, by asset type, of all fixed assets that are subject to depreciation.

This summary report should contain the fixed asset historical cost, subsequent additions and retirements, accumulated depreciation, and remaining asset cost subject to depreciation. The assessor should also request documentation of the method of depreciation used and the life established for each of the asset types.

As a reminder, a deduction for amortized allocated cost of fixed assets is allowed for producing mine valuations established for the 1994 assessment year. All accumulated depreciation that was previously deducted, or could have been deducted, prior to 1994 cannot be listed for additional deduction. Only amounts based on allocated cost amortization methods set forth in these procedures will be allowed for deduction.

- A summary report of all pre-production development costs expended by the owner or operator in preparation for start-up of the mine.

This summary report should contain all expenditures incurred in development of the mining property after a decision to build the mine has been determined.

All reports should be prepared and examined to verify that only allowable costs, as specified in Colorado Statutes and these procedures, are listed for deduction and review.

During a review, the assessor should be concerned with an analysis of the filed declaration schedule and requested summary reports. Comparison with schedules and reports from past years may be beneficial. In all cases, the producing mine owner or operator should be allowed adequate time to provide explanations of any discrepancies or concerns by the county regarding the declared amounts.

Prior to an audit, it is recommended that the assessor notify the owner or operator of the specific gross value or production cost items under analysis.

Auditing books and records will generally require a trip to the producing mine site or the site where the operation and financial accounting records are kept. An appointment for the audit should be made prior to visiting the site to avoid disrupting the mining operation.

When the audit is completed, the assessor should notify the owner or operator in writing of the results of the audit and any impact to the production volume, gross value of production, and production expenses declared by the producing mine. The producing mine owners or operators should also be advised of their right to pursue their administrative remedies in accordance with Colorado statutory provisions.

Mine Taxpayer "Review" and "Audit" Rights

The following rights must be provided in writing to all taxpayers subject to a producing mine

"review" or "audit" by the county:

- At the request of the taxpayer, the county must schedule a meeting to discuss the scope of the review and/or audit by the county and receive any further information or response from the taxpayer.

- Taxpayers must have at least 15 days to respond to the "review" notification letter and to provide additional information to the county regarding concerns of the county and any request of additional financial records. The assessor may grant additional time at the request of the taxpayer, if deemed necessary.

All information and documents submitted in response to a review and/or audit request are to be considered confidential, under the provisions of §§ 39-5-120 and 24-72-204(3)(a)(IV), C.R.S. All assessors, employees of the assessor office, and outside agents of the county are bound by these statutory provisions.

Division Review of County Review and Audit Procedures

Counties should follow the above procedures when reviewing or auditing taxpayer producing mine declarations. If the county wishes to depart from one or more of the review or audit procedures, the county should submit their changes to the Division for review prior to implementation.

Level of Value for Producing Mines

Producing mines are to be valued at the current value, according to § 39-1-104(12)(a), C.R.S., using the previous year's production information or a three, five, or ten year average of production information, § 39-6-106(1.4), C.R.S.

Producing Mines’ Water Treatment Facilities

In 1996, a new subsection § 39-1-103(16), C.R.S., was added setting forth the valuation procedures to be used for valuation of real and personal property of a superfund water treatment facility that is constructed as part of a superfund site agreement with the federal government or the state of Colorado or any of its political subdivisions.

Specifically, this statute mandates that for valuation of real and personal property of qualified water treatment facilities, the value determined from the income approach to appraisal is the upper limit of value under the following circumstances:

- The term “superfund water treatment facility” is defined as real and personal property installed and constructed pursuant to an agreement with or order of the State of Colorado, United States Government, or any political subdivision thereof to satisfy the Comprehensive Environmental Response, Compensation, and Liability Act of 1980 (CERCLA), as amended.

- The facility must be operated for the purpose of eliminating, reducing, controlling, or disposing of pollutants, as defined in § 25-8-103(15), C.R.S., that could alter the physical, chemical, biological, or radiological integrity of state waters.

- The income approach must be applied to actual income generated by the facility during the calendar year preceding the assessment date capitalized at an annual rate of 10%.

The cost and market approaches to appraisal must be considered, but can only be used if the resulting value is less than the value determined from the income approach.

Producing Oil and Gas Leaseholds and Lands

Statutory References

Section § 39-1-103, C.R.S., specifies that producing oil or gas leaseholds and lands are valued according to article 7 of title 39, C.R.S.

Actual value determined - when.

(2) The valuation for assessment of leaseholds and lands producing oil or gas shall be determined as provided in article 7 of this title.

§ 39-1-103, C.R.S.

Article 7 covers the listing, valuation, and assessment of producing oil and gas leaseholds and lands.

Valuation:

Valuation for assessment.

(1) Except as provided in subsection (2) of this section, on the basis of the information contained in such statement, the assessor shall value such oil and gas leaseholds and lands for assessment, as real property, at an amount equal to eighty-seven and one-half percent of:

(a) The selling price of the oil or gas sold from each wellhead during the preceding calendar year, after excluding the selling price of all oil or gas delivered to the United States government or any agency thereof, the state of Colorado or any agency thereof, or any political subdivision of the state as royalty during the preceding calendar year;

(b) The selling price of oil or gas sold in the same field area for oil or gas transported from the premises which is not sold during the preceding calendar year, after excluding the selling price of all oil or gas delivered to the United States government or any agency thereof, the state of Colorado or any agency thereof, or any political subdivision of the state as royalty during the preceding calendar year.

§ 39-7-102, C.R.S.

The valuation of leaseholds and lands that use secondary and tertiary recovery is the same as above, except that the assessment rate to be used is seventy-five percent (75%). Secondary and tertiary recovery are defined under Definitions Pertaining to Oil and Gas Leaseholds and Lands Valuation, found later in the chapter.

Oil and Gas Classification

Classification of oil and gas leaseholds and lands includes all drilled wells producing any kind of petroleum or natural gas product such as oil, gas, helium, or carbon dioxide. Sulfur that is collected and sold as a by-product of the processing operation is also included. The classification includes all leasehold wells on lands owned by federal, state, or lesser governmental entities. Oil and gas classification also includes oil shale projects wherein the kerogen (shale oil) is extracted through the “in situ” process. In the “in situ” process, a portion of the shale deposit is mined out. The rest is fractured with explosives or by other means to create a highly permeable zone through which hot fluids can be circulated. For valuation of retort oil shale operations refer to the Producing Mines topic in this chapter.

Oil and Gas Discovery

The primary source of discovery is the Colorado Energy and Carbon Management Commission (ECMC) website. See Addendum 6-H, Instructions for Accessing the ECMC Website. The ECMC can also be contacted directly at:

Colorado Energy and Carbon Management Commission

The Chancery Building

1120 Lincoln Street, Suite 801

Denver, CO 80203

Phone: (303) 894-2100

Oil and Gas Taxpayer Filing Requirements

Section 39-7-101, C.R.S., requires every operator or, if there is no operator, owner of any oil and gas leasehold or lands in the state to file a statement with the county assessor by April 15th of each year. The statement is an Oil and Gas Real and Personal Property Declaration Schedule, DS 658, which must be sent by the assessor to every known operator/owner in the county as soon after January 1 as possible. Pursuant to §§ 39-7-110 and 39-10-106(2), C.R.S., the operator, or owner who filed the statement with the county assessor, is the taxpayer, Colorado Property Tax Administrator v. CO2 Committee, Inc., (publish pending).

The DS 658 applies to any oil and gas leaseholds or lands that are producing or capable of producing on the assessment date, including wells that produced the prior year but were shut in and capped or plugged and abandoned prior to the current assessment date. The DS 658 must include:

- The location of the wellsite and name of the well

- The name, address and fractional interest ownership of the operator

- The quantity of oil measured in barrels (Bbls) and/or the quantity of gas per thousand cubic feet (Mcf), or per million British Thermal Units (MMBTU), sold or transported from the premises during the preceding calendar year

- The amount of royalties paid in cash or product to the United States government, state of Colorado, or any lesser governmental entity

- The netback wellhead selling price of all oil and gas sold or transported from the premises during the preceding calendar year

- The name, address, and fractional interest of each interest owner taking production in kind and the proportionate share of total unit revenue attributable to each interest owner who is taking production in kind

If the taxpayer is the owner of record as of January 1, and had purchased the well during the prior year, the taxpayer is responsible to report all production for the prior year, and is liable for the taxes on the leasehold and land based on the prior year’s production for the entire year. Any proration of the tax liability for the benefit of the owner of record should have occurred between the owner of record and the previous owner(s) at closing.

Whenever oil and gas leaseholds or lands are located in more than one county, the production value is assigned to the county in which the wellhead is located, § 39-7-107(1), C.R.S. A separate statement is filed with the assessor of each affected county, § 39-7-107(3), C.R.S.

Whenever a group of contiguous leaseholds or lands is operated as a unit (production unit, unitized field) in more than one county, the person making the statement required under § 39- 7-101, C.R.S., shall assign to each wellhead the production value from the unit as is assigned by the unit agreement, § 39-7-107(2), C.R.S. A separate statement is filed with the assessor of each affected county, § 39-7-107(3), C.R.S.

Methods of reporting such as computer printouts or electronic spreadsheet files (if electronic spreadsheets have been approved for use by the assessor) are acceptable provided the information is segregated by well and is accompanied by one signed DS 658.

Should the owner or operator, agent, or person placed in control of the wellsite or lease by the owner or operator, fail or refuse to file a statement, the assessor may impose on the owner or operator a late filing penalty in the amount of one hundred dollars ($100) per calendar day that the statement is delinquent. At the sole discretion of the assessor, an extension may be granted without charge for the filing of the statement. The length of the extension is also within the discretion of the assessor, § 39-7-101(2), C.R.S.

The assessor may also value the property based on the best information available to and obtainable by the assessor, § 39-7-104, C.R.S. In addition, assessors have the authority and right to examine the books, accounts, and records of anyone owning or operating oil and gas leaseholds and lands in order to verify the statement filed. If the statement is found to be willfully false, misleading, or incomplete, the assessor may utilize the best information available (BIA) to determine the value for assessment as though no statement had been filed, § 39-7-105, C.R.S.

Reporting of Take-in-Kind Production

Any non-operating interest owner who received "Take-In-Kind" (TIK) revenues for oil and gas production taken in kind during the preceding calendar year may submit a TIK report to the unit operator. The TIK report describes the actual net taxable revenues and the actual exempt revenues received, but netted back to the wellhead, by the non-operating interest owner during the preceding calendar year. The TIK report is sent by certified mail and is received by the unit operator on or before March 15 of the current assessment year. Unit operators use the information to determine "selling price at the wellhead" for TIK production reported by non-operating interest owners, § 39-7-101(1.5), C.R.S.

If any non-operating interest owner fails to provide the TIK report to the unit operator by March 15 of the current assessment year, then the unit operator's selling price per unit of production at the wellhead is used by the unit operator to value the non-reporting, non-operating interest owner's TIK production, § 39-7-101(1.5) C.R.S.

If the operator had more than one selling price for a product during the preceding year, then the Division recommends using a weighted average selling price for the product. The weighted average selling price for each product is calculated by dividing the operator's total revenues for each product by the production volume for each product. The operator's weighted average selling price for a product is then multiplied by the TIK owner's share of production for that product.

If an oil and gas price and production audit, as described later in the chapter, discloses a problem with the net taxable revenues reported by the fractional interest owner, then the unit operator is not liable for any tax or any penalty interest levied against any amount of TIK production, § 39-10-106(4)(b)(IV), C.R.S.

Take-In-Kind usually applies to gas. It is rare for liquids (Oil, Condensate, NGLs) to be Take-In-Kind. Take-In-Kind should not be confused with percent of proceeds or processing fees, both of which are associated with processing plants that have no interest in the subject well.

A common example would have two gas working well interest owners; Company A and Company B, with Company A being the well operator. Company B feels they have more expertise at selling gas and chooses to market their own share. Often Company B would also market the shares of royalty owners they brought into the well. In the following calendar year, Company B must submit a TIK report to Company A on or before March 15th.

Gas Used Prior to the Point of Sale

Regarding gas used either at the wellsite or off-site prior to the point of sale, owners or

operators are permitted to:

- Report the gas as “sold gas” in which a deduction may be taken as a fuel cost related to processing, transporting, or manufacturing the oil or gas to the point of sale.

OR - Not report the gas as “sold gas” as long as no deduction is taken for production gas used on or off-site related to processing, transporting, or manufacturing the oil or gas to the point of sale.

Owners or operators are strongly encouraged to advise the assessor if any gas used on the lease is not being reported as sold gas on the DS 658 Oil and Gas Leaseholds and Lands Declaration Schedule.

Oil and Gas Leaseholds and Lands Valuation Definitions

Bona Fide Sale: “a sale made by a seller in good faith, for valuable consideration, and without notice of a defect in title or any other reason not to hold the sale.” (Black’s Law Dictionary, 7th Edition)

For oil and gas netback valuation, the Division considers an arm’s length sale between unrelated parties to be a bona fide sale. Sales between related parties are not considered to be arm’s length transactions.

Downstream: any activity or process that occurs to the oil or gas product immediately beyond the casinghead/tubinghead.

Exempt Interest: any interest owned by the United States, the State of Colorado, or any political subdivision of the State of Colorado.

Field: a grouping of wells on or related to a single reservoir, or a grouping of wells on multiple reservoirs related to the same geological formation.

Flowlines: small, surface pipelines through which oil or gas travels from a wellhead to wellsite equipment or to a tank battery.

Gathering: the movement, of oil or gas products by separate and individual pipelines, of a relatively small size, to a point of accumulation, dehydration, compression, separation, heating/treating, off-site storage, or further processing. For the purposes of these procedures, "Gathering" is included within the term "Transportation."

Gross Lease Revenues: revenues received by the taxpayer from the bona fide, arm’s length sale of oil and gas products to the first purchaser.

On-site: any activity that involves equipment located within the area of the wellsite. Typical wellsite equipment may include, but is not limited to, pressure gauges, control panels, switchboards, separators, dehydrators, heater/treaters, flowlines, in-line heaters, storage tanks, or tank batteries.

Off-site: any activity that involves equipment located outside the area of the wellsite.

On-site Processing: also known as “Wellsite Processing,” refers to changes made to the “unprocessed material” that require equipment utilized at the wellsite. Compression, separation, heating/treating, and/or dehydration of oil or gas products are examples of on-site processing.

Off-site Processing: any activity occurring beyond the wellsite that changes the well stream’s physical or chemical characteristics, enhances the marketability of the stream, or enhances the value of the separate components of the stream. Off-site processing includes, but is not limited to fractionation, absorption, flashing, refrigeration, cryogenics, sweetening, dehydration, beneficiation, heating/treating, separating, stabilizing, or compressing.

Oil and Gas Products: any oil or gas material, including but not limited to crude oil, lease condensate, natural gas, entrained natural gas liquids, natural gas liquids, carbon dioxide, and related products.

Operator: any person responsible for the day-to-day operation of a well by reason of contract, lease, or operating agreement. The oil and gas operator is responsible for filing the oil and gas declaration schedule under § 39-7-101, C.R.S, that lists the production and sales for the previous calendar year, and is the sole point of contact for notification, review, audit, protest, abatement, and appeal procedures, § 39-7-110, C.R.S.

Point of Sale: a point where the sale of oil or gas product occurs. The point of sale could be at the physical wellhead, at the meter run, at the Lease Automated Custody Transfer (LACT) unit, at the outlet of the tank battery, or at any place downstream or away from the wellhead.

Point of Valuation: the point, at the wellhead, where the assessor values the well’s unprocessed material that is produced and sold or transported from the wellsite to an off-site point of sale.

Premises: the well location, wellsite, or field area, as referenced in § 39-7-102(1)(b), C.R.S.

Primary Recovery: the recovery of oil, natural gas, or oil and natural gas product by any method (natural flow or artificial lift) that may be employed to produce these products through a single or multiple wellbore. The fluid enters the wellbore by the action of native reservoir energy or gravity. Compare with “secondary recovery.”

Processing: any physical or chemical change to the raw product after it leaves the wellbore, but prior to sale to the first purchaser. Processing can occur both on-site and off-site. Processing includes, but is not limited to, separation of the raw product into its constituent parts, dehydration, measurement, heating/treating, sweetening, compression, and extraction of natural gas liquids.

Secondary Recovery: all methods of oil and natural gas extraction in which energy sources external to the reservoir, other than pumps and pumping units, are used. Examples are: water injection (water-flooding) and gas injection.

Selling Price at the Wellhead: the net taxable revenues realized by the taxpayer for the sale of oil or gas, whether such sale occurs at the physical wellhead, or after wellsite processing, or after transportation that includes gathering, manufacturing, and off-site processing of the product. The net taxable revenues shall be equal to the gross lease revenues, minus deductions for transportation including gathering, manufacturing, and processing costs borne by the taxpayer. Processing costs refer to the costs incurred for both on-site and off-site processing of oil and gas products, § 39-7-101(1)(d), C.R.S.

Take-In-Kind (TIK): an election is made by an interest owner, under a lease or joint operating agreement with notice to the affected parties, to separately market or dispose of crude oil, natural gas, or natural gas products. An interest owner must affirmatively exercise an option under a lease or operating agreement to separately market the interest owner's share of the production to qualify as “take-in-kind.” The definition is taken in part from the Wyoming Department of Revenue, Regular Rules, Chapter 6, § 4b(s), Revised 10/04/1995.

Tertiary Recovery: enhanced methods for the recovery of oil and natural gas that require a means for displacing the oil or natural gas from the reservoir rock, or modifying the properties of the fluids in the reservoir and/or the reservoir rock, to cause movement of the oil or natural gas in an efficient manner and to provide the energy and drive mechanism to force the flow to a production well. Compare with “primary recovery” and “secondary recovery.” Examples are thermal displacement, chemical displacement, and miscible drive displacement.

Transportation: the costs incurred for any movement of a product beyond the gathering system, or beyond the wellsite if no gathering system exists, by truck, rail, or pipeline. For the purpose of the valuation procedures, "Transportation" also includes the term "Gathering."

Wellhead: the point at the surface of the wellbore where there are connections to the casinghead/tubinghead, such as control valves, pressure gauges, testing equipment, and/or flowlines. The end of the casinghead/tubinghead is the point where the “unprocessed material” (referred to in § 3(1)(b), article X, Colorado Constitution) comes out of the wellbore and is the “point of valuation” for oil and gas products. The actual wellhead is seldom used by the oil and gas industry as a “point of sale” for contract purposes.

Wellsite: referred to as the “location” of the wellbore, the wellsite provides a sufficient area of land to contain the wellhead and the equipment necessary for on-site activity, which consists of on-site processing, metering, and storage. Typical wellsite equipment may include: pressure gauges, flowlines, meter run, LACT unit, control panels, switchboards, separators, heater/treaters, dehydrators, storage tanks, tank batteries, and/or other equipment.

Determining Leasehold Value of an Oil or Gas Wellsite

The leasehold value of the wellsite is equivalent to 100% of all the interests in the well including all taxable royalty and working interests. The leasehold value is determined, using the following information:

- Amount of oil and/or gas product sold or transported from the premises at a downstream point of sale.

- The value of any product sold or taken-in-kind by an exempt royalty owner as specified in § 39-7-101(1.5), C.R.S.

- The actual or determined selling price at the physical wellhead of the oil and/or gas product.

The amount of oil and/or gas product sold or transported from the premises, and the value of any product sold or taken-in-kind by an exempt royalty owner (items #1 and #2 above) can be determined from information declared by the taxpayer on the DS 658.

Constitutional and Statutory References

Section 3, article X, Colorado Constitution, states, in part, that oil and gas valuation for assessment is based on the value of the unprocessed material.

Section 3. Uniform taxation - exemptions.

(1)(b) However, the valuation for assessment for producing mines, as defined by law, and lands or leaseholds producing oil or gas, as defined by law, shall be a portion of the actual annual or actual average annual production therefrom, based upon the value of the unprocessed material, according to procedures prescribed by law for different types of minerals. Non-producing unpatented mining claims, which are possessory interests in real property by virtue of leases from the United States of America, shall be exempt from property taxation (emphasis added).

§ 3(1)(b), article X, Colorado Constitution

The selling price of oil and gas sold or transported from the premises is determined at the wellhead, § 39-7-101(1)(d), C.R.S.

Statement of owner or operator.

(1)(d) The selling price at the wellhead. As used in this article, "selling price at the wellhead" means the net taxable revenues realized by the taxpayer for the sale of the oil or gas, whether such sale occurs at the wellhead or after gathering, transportation, manufacturing, and processing of the product. The net taxable revenues shall be equal to the gross lease revenues, minus deductions for gathering, transportation, manufacturing, and processing costs borne by the taxpayer pursuant to guidelines established by the administrator (emphasis added).

§ 39-7-101, C.R.S.

The operator, or owner that files the statement with the assessor, is the sole point of contact for the assessor, § 39-7-110(2), C.R.S.

Oil and gas operator - definition.

(2) Notwithstanding any other provision of law, the partial interests of oil and gas fractional interest owners are not subject to separate valuation by the assessor and shall be represented by the well or unit operator of each wellsite. The well or unit operator is the sole point of contact for all notification, review, audit, protest, abatement, and appeal procedures.

§ 39-7-110, C.R.S.

Interpreting these citations consistently requires that the product sold or transported from the premises be valued under three conditions:

- The product or material coming out of the wellbore must be valued in its “unprocessed” state.

- The product’s “selling price at the wellhead” must be determined at the wellhead, whether or not such sale actually occurred at the wellhead, and

- Partial interests of oil and gas fractional interest owners are represented by the operator and are not subject to separate valuation.

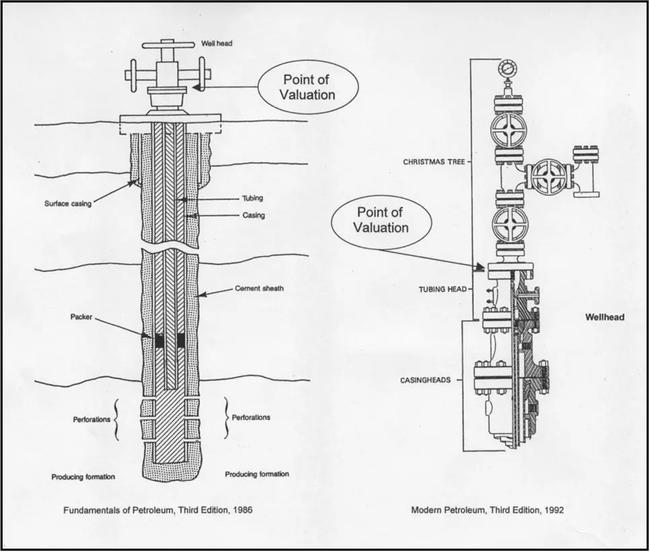

Illustration of Typical Wellheads

To understand what a “wellhead” consists of, please examine the two diagrams in the following illustration.

The diagram on the left is a simple well. It shows that the wellbore consists mostly of a cement sheath; and inside that, the well casing; and inside that, the well tubing. As the casing and tubing approach the top of the wellbore or hole, the ends must have reinforcement due to pressure and the need for stabilization at the top of the well. The reinforced end of the casing is called the “casinghead.” The end of the tubing is called the “tubinghead.” Attached at the ends of the casinghead/tubinghead are a set of valves connected to horizontal flowlines, as shown in the diagram. The casinghead, tubinghead, and attached valves constitute a “wellhead.” The flowlines deliver the oil or gas to other equipment. The configuration is typical for a low-pressure or free-flowing well.

The diagram on the right shows a typical configuration for a high pressure well. The series of valves and gauges attached to the casinghead/tubinghead is known as a “Christmas tree.” Its purpose is to confine and control the flow of fluids or gases from the well. The casinghead/tubinghead and the attached Christmas tree constitute a high-pressure “wellhead.”

The term “unprocessed,” as used in the Colorado Constitution, requires that the product or material receive no processing before valuation. Product flowing through the physical wellhead at the end of the casinghead/tubinghead qualifies as material that has received no processing.

The statute’s phrase “selling price at the wellhead” qualifies the “wellhead” as the point where the “unprocessed material” is valued. Allowable costs or expenses for “processing,” as stated in the statute, include both on-site and off-site processing because such processing occurs beyond the physical wellhead.

Point of Valuation at the Wellhead

For ad valorem purposes, the term “wellhead” is defined as “the point at the surface of the wellbore where there are connections to the casinghead/tubinghead, such as control valves, pressure gauges, testing equipment, and/or flowlines.” In the previous illustration, an arrow indicates the “Point of Valuation” for each wellhead. Direct costs and appropriate Return of Investment (RofI) and Return on Investment (ROI) related to control valves, pressure gauges, testing equipment, and/or flowlines are deductible netback expenses.

Historical Context of Wellhead Pricing and Statutes

Few oil and gas owners or operators actually sell their product at the physical wellhead (point of valuation). The term “selling price at the wellhead,” as traditionally used by the oil and gas industry, has frequently meant the price at the meter run, the price at the LACT unit, or the price at the outlet of the tank battery. The practice dates back to the period prior to the federal deregulation of the oil and gas industry when operators or owners could only sell product to pipeline companies. Current federal regulations permit operators or owners to sell to whomever and wherever they choose. Sales can occur at any designated point “downstream” from the physical wellhead. Regardless of the oil and gas industry’s practice, an ad valorem definition for “wellhead” must meet the criteria established by the Colorado Constitution and the statutes.

When completing the DS 658, it is the responsibility of the owner or operator to declare where the actual “point of sale” of an oil or gas product occurred. When the owner or operator’s gross lease revenues were determined to have occurred anywhere beyond the “point of valuation” at the wellhead, the revenues must be netted back to a wellhead selling price for assessment purposes.

Primary Production Valuation

For leaseholds and lands in primary production, the assessed valuation is eighty-seven and one-half percent (87.5%) of the following:

- The actual or determined selling price at the physical wellhead of product sold during the previous calendar year

- The actual or determined selling price at the physical wellhead for oil and gas sold in the same field area for product transported unsold from the premises during the preceding year

Example: Valuation of Leasehold in Primary Production

The subject is an oil well on state land that was producing in the prior year utilizing primary production methods. All products were sold to the first purchaser at the meter run. Costs (including RofI and ROI) related to the equipment used for on-site processing were deducted to arrive at a selling price at the wellhead.

The state land fractional royalty interest is 12.5% of gross production and totals $32,500. Royalty interest percentages can vary depending upon the terms of the lease; dollar amounts should be used. If the dollar amount is deducted it does not affect final value whether the deduction is from the gross or netback amount. The operator of the well filed a properly completed DS 658 for the assessment year.

Step #1 From Section C1 of the completed DS 658, determine the quantity of product (oil and gas) sold during the preceding calendar year.

Step #2 Also from Section C1 determine the point of sale price received for the product during the preceding calendar year.

Step #3 If the point of sale price is on a per-unit basis, multiply the quantity of product from Step #1 times the price from Step #2 to calculate the total value of the product sold.

Step #4 From Section D of the DS 658, determine the amount, in dollars, of royalty interest to be excluded and subtract that amount from the total value of the product sold to get the adjusted gross value.

Step #5 Determine the expenses (either by direct costs or by cost per barrel) that are appropriate to adjust the point of sale price back to the well head. These are known as the netback expenses.

Step #6 Deduct the netback expenses from the adjusted gross value to get the value of the product at the wellhead. This is the netback value.

Step #7 Multiply the netback value by 87.5% (the assessment percentage for primary production) to calculate the assessed value.

Calculation:

| Previous year’s amount of product sold | 4,000 Bbls |

|---|---|

| Previous year’s average point of sale price/Bbl | x $65.00 |

| Total Value of Product Sold | $260,000 |

| Less State of Colorado royalty | (32,500) |

| Adjusted Gross Value | $227,500 |

| Less Netback Expenses (if any) ($5.00/Bbl x 4,000 Bbls) | (20,000) |

| Netback Value | $207,500 |

| Statutory Assessment Rate | x 0.875 |

| Assessed value for oil and gas leasehold | $181,563 |

Only royalties paid to the United States government, the State of Colorado, counties, cities, towns, municipal corporations, or other governmental organizations within the State of Colorado, including Indian tribes are deducted. Royalties paid to any other person or entity are not deducted.

Secondary Production Valuation

For leaseholds and lands in secondary production, the assessed valuation is seventy-five percent (75%) of the following:

- The selling price at the physical wellhead of product sold during the previous calendar year

- The selling price at the physical wellhead for oil and gas sold in the same field area for product transported unsold from the premises during the preceding year

The calculation of the assessed valuation for a leasehold that has secondary or tertiary production for the whole year is the same as for primary production, except that the assessment rate is 75% instead of 87.5%.

An owner or operator, agent, or a person placed in control of the wellsite or lease by the owner or operator, claiming secondary production on the DS 658 must be on record with the Colorado Energy and Carbon Management Commission as approved for secondary production.

Example: Changing from Primary to Secondary or Tertiary Recovery

The producer/operator provided the amounts produced from each recovery method for the previous year. The subject is an oil well that was producing in the year prior to assessment utilizing both primary and secondary (water injection) production methods. All products were sold to the first purchaser at the outlet of the tank battery. Royalty interests have been deducted. Costs (including RofI and ROI) related to the equipment used for on-site processing were deducted to arrive at a selling price at the wellhead. The owner or operator of the well filed a properly completed DS 658.

Step #1: From Sections C1 and C2, determine the amount of product (oil and gas) sold for each recovery method during the preceding calendar year and the average price paid for the product during the preceding calendar year.

Step #2: For each recovery method, multiply the average netback wellhead price paid for the product by the amount of product sold during the previous calendar year to calculate the total value of the product.

Step #3: For each recovery method, multiply the total value of the product by the appropriate assessment rate: 87.5% for primary, 75% for secondary, to calculate the final assessed value.

Calculation:

Previous calendar year primary production 1,500 Bbls

Previous calendar year secondary production 2,500 Bbls

Average netback wellhead price paid per barrel $60.00/Bbl

Valuation of Primary Production

| Previous calendar year Primary Production | 1,500 Bbls |

|---|---|

| Previous year's average netback wellhead price per barrel | x $60.00 |

| Total value of product sold (Primary) | $90,000 |

| Assessment rate | x .875 |

| Assessed value | $78,750 |

Valuation of Secondary Production

| Previous calendar year Secondary Production | 2,500 Bbls |

|---|---|

| Previous year's average netback wellhead price per barrel | x $60.00 |

| Total value of product sold (Secondary) | $150,000 |

| Assessment rate | x .75 |

| Assessed value | $112,500 |

Total Assessed Valuation

| Primary Production Value | $78,750 |

|---|---|

| Secondary Production Value | + 112,500 |

| Total Production Value | $191,250 |

Example: Changing from Primary to Secondary or Tertiary Recovery Using the Percentage Allocation Method

The owner or operator of the well does not report the production under each method separately, although the assessor is aware of the change from primary to secondary/tertiary recovery. The assessor uses a percentage allocation method of valuation. The Colorado Energy and Carbon Management Commission (ECMC) has the date of change to another means of production for the wells, as well as the starting date of each secondary/tertiary recovery project.

The steps for the percentage allocation method follow:

- Calculate the percentage allocation for each recovery method by dividing the total number of days attributable to each recovery method by 365 days.

- Calculate the total value of production by multiplying the total production by the average netback wellhead price paid for the previous calendar year.

- Multiply the total value of production by the percentage allocation amount for each recovery method.

- Multiply the allocated total value of product sold by the appropriate rate – 87.5% for primary, 75% for secondary.

- Add the value at 87.5% to the value at 75% to arrive at total value for the production.

Assessed valuation attributable to secondary/tertiary recovery is abstracted separately from assessed valuation attributable to primary production.

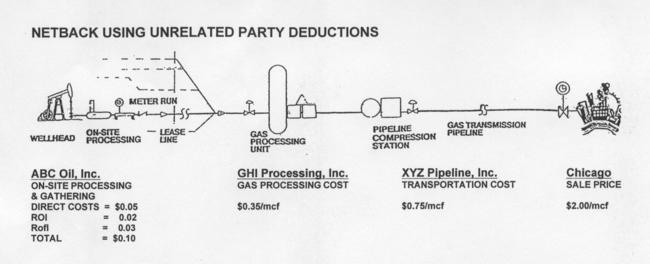

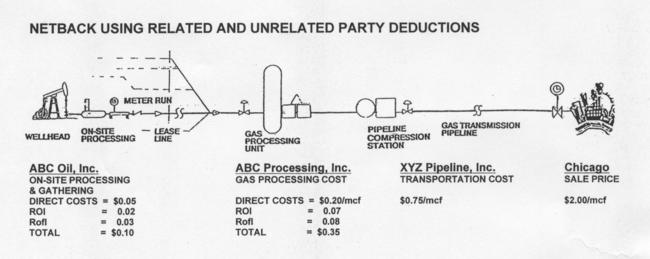

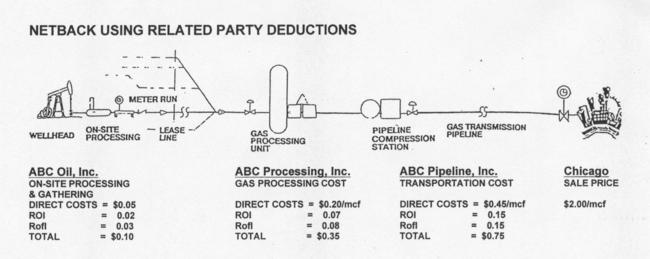

Methods for Leasehold Valuation

To recognize that each oil and gas owner or operator may have different points of sale, a suggested listing of wellhead pricing procedures was created. Assessors are encouraged to use the following method that is most likely to result in the leasehold’s actual value. The suggested listing is intended to generate equitable leasehold values among all companies and counties.

- Actual Wellhead Price

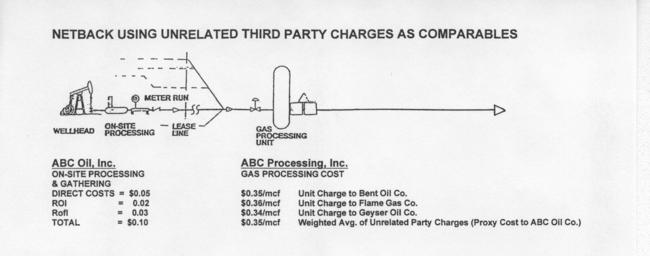

- Netback of Related and/or Unrelated Party Costs to Value the Leasehold

- Use of Actual Charges to Unrelated Party/Parties as a Comparable Expense Deduction in a Related Party Relationship to Value the Leasehold

- Comparable Netback Sales Price to Value the Leasehold (Only this method should be used for Best Information Available [BIA] valuations.)

The operator is responsible for indicating on the declaration schedule which of the above methods listed is being used. The operator is also responsible for attaching any information (including the Netback Expense Report Form [NERF], if sent by the assessor along with the declaration schedule) to the DS 658 that supports the method used.

Note: If the Netback Expense Report Form is not mailed with the DS 658, a copy may be obtained from the Division’s website. See Addendum 6-J, Oil & Gas Netback IG Corporate Bond Rate, NERF, and NERF Spreadsheet Instructions for more information regarding the NERF.