Common Interest Community Ownership

Statutory References

The previous homeowners' organization statute, § 39-1-103(10), C.R.S., provided that under certain conditions, property owned by a homeowners' organization should not be separately assessed, but should be appraised and valued with the residential real property owned by the members of the organization.

With the enactment of HB 93-1070 on April 30, 1993, that statute was amended to read as follows:

Actual value determined - when.

(10) Common property or common elements within a common interest community as defined in the "Colorado Common Interest Ownership Act", article 33.3 of title 38, C.R.S., shall be appraised and valued pursuant to the provisions of section 38-33.3-105, C.R.S.

§ 39-1-103, C.R.S.

Section 38-33.3-105, C.R.S., reads, in part, as follows:

Separate titles and taxation.

(2) In a condominium or planned community with common elements, each unit that has been created, together with its interest in the common elements, constitutes for all purposes a separate parcel of real estate and must be separately assessed and taxed. The valuation of the common elements shall be assessed proportionately to each unit, in the case of a condominium in accordance with such unit's allocated interests in the common elements, and in the case of a planned community in accordance with such unit's allocated common expense liability, set forth in the declaration, and the common elements shall not be separately taxed or assessed. Upon the filing for recording of a declaration for a condominium or planned community with common elements, the declarant shall deliver a copy of such filing to the assessor of each county in which such declaration was filed.

(3) In a planned community without common elements, the real estate comprising such planned community may be taxed and assessed in any manner provided by law.

§38-33.3-105, C.R.S.

To better understand the Common Interest Ownership Act (CIOA) taxation statute, § 38-33.3- 105(2), C.R.S., it is helpful to look at the definitions of terms in the Act, which are used in the taxation statute. These definitions are listed in § 38-33.3-103, C.R.S.

Definitions.

(2) "Allocated interests" means the following interests allocated to each unit:

(a) In a condominium, the undivided interest in the common elements, the common expense liability, and votes in the association (emphasis added);

(b) In a cooperative, the common expense liability and the ownership interest and votes in the association(emphasis added); and

(c) In a planned community, the common expense liability and votes in the association (emphasis added).(3) "Association" or "unit owners’ association" means a unit owners' association organized under section 38-33.3-301.

(5) "Common elements" means: (a) In a condominium or cooperative, all portions of the condominium or cooperative other than the units; and (b) In a planned community, any real estate within a planned community owned or leased by the association, other than a unit.

(8) "Common interest community" means all real estate described in a declaration with respect to which a person, by virtue of such person's ownership of a unit, is obligated to pay for real estate taxes, insurance premiums, maintenance, or improvement of other real estate described in a declaration. Ownership of a unit does not include holding a leasehold interest in a unit of less than forty years, including renewal options. The period of the leasehold interest, including renewal options, is measured from the date the initial term commences.

(13) "Declaration" means any recorded instruments however denominated, that create a common interest community, including any amendments to those instruments and also including, but not limited to, plats and maps.

(22) "Planned community" means a common interest community that is not a condominium or cooperative. A condominium or cooperative may be part of a planned community.

§38-33.3-103, C.R.S.

Criteria

Typically, there were few problems with these concepts relative to condominiums and cooperatives whenever they were created. However, older planned communities, created prior to July 1, 1992, may not comply with the common interest community criteria established by the statutes. These noncompliance situations will require additional work on the part of assessors until the planned communities are reorganized to comply with the common interest ownership statutes. Therefore, the first question to be asked, regarding older planned communities, is whether or not the community meets the common interest community criteria under the statutes. If the following criteria are met, a common interest community exists and no separate assessment of common interest community real property, including real property owned by the association, is to be made.

- On or after July 1, 1992, a common interest community can only be created by a declaration. The declaration is to be executed in the same manner as a deed, as required by § 38-33.3-201, C.R.S., and, in a cooperative, the real estate subject to this declaration must be conveyed to the cooperative's association. The declaration is to be recorded in every county in which any portion of the common interest community is located. Except for cooperatives, a plat or map of the common interest community also must be recorded in the same manner.

- On or after July 1, 1992, a copy of the recorded declaration and any amendments to the declaration shall be delivered to the assessor as required by § 38-33.3-105(2), C.R.S. Except for cooperatives, a current plat or map of the common interest community property shall also be delivered to the assessor.

- Regardless of when it was created, in order for a common interest community to conform to § 38-33.3-103(8), C.R.S., each unit owner must be under an obligation, by virtue of each such person's ownership of a unit, to pay expenses for other real estate described as real property common elements in the declaration. According to § 38- 33.3-103(5)(b), C.R.S., the other real estate common elements in a planned community may be any real estate owned or leased by the unit owner's association, other than a unit.

The association must provide the assessor sufficient evidence to support the claim that all unit owners share in these obligations to pay expenses for other common element real property described in the declaration. - Membership in the unit owners' association is mandatory for each unit owner only for common interest communities created on or after July 1, 1992. The definition of "association" in § 38-33.3-103(3), C.R.S., requires the unit owners' association be organized under § 38-33.3-301, C.R.S., which in turn, provides that membership in the association at all times shall consist solely of all unit owners.

However, if the criteria listed above are not met, common elements should be separately listed and assessed to the association as described under the Valuation Procedures, Market Approach section later in this chapter.

Noncompliance problems, relative to the first three listed criteria, may exist in older organizations. Some unit owners within these older organizations may believe there are common elements, but no recorded documentation describing these common elements exists. If there is such legal documentation that has not been recorded, simply recording these documents in the appropriate county clerk and recorder's office may solve this compliance problem.

However, many noncompliance situations have multiple problems, such as the absence of recorded documents that substantiate every unit owner's obligation for the payment of expenses for common elements. There may not be a method of resolving such expense payment obligation issues, assuming that legal documents substantiating expense payment obligations do not exist, other than creating a new, legal, common interest community. The unit owners should seek legal advice in these situations.

Valuation Procedures

Once the assessor receives a recorded common interest community declaration, or documents that serve as a declaration, which include a description of common elements and a description of each unit owner's expense payment obligations for those common elements, the assessor shall assess the common interest community's common elements with the residential real property owned by the unit owners. The assessor shall not assess it separately, § 38-33.3- 105(2), C.R.S.

After reviewing the declaration documents, the assessor should add a notation on the property record immediately below the legal description of each unit that states "Includes ____ percent interest in common elements."

Market Approach

The procedures outlined in this manual must be used in valuing the unit owner's residential real property. As required by § 20(8)(c) of article X of the Colorado Constitution, the assessor can only consider the market approach in determining the actual value of a unit owner's residential property.

Common interest community real property described in the declaration, including property actually owned by the association, will be reflected in the actual (market) value of the individual units. If real property owned by a legal common interest community is not described in the declaration, or in amendments to the declaration, it must be separately assessed to the association.

In the case of noncompliance with the Common Interest Ownership Community Criteria listed previously, the market value of the property should be listed and assessed to the association. However, the actual value assigned to this property must include market adjustments necessary to account for any legal land use and building restrictions.

If the common elements include, or the association actually owns, nonresidential improved property, this property is to be valued by consideration of the cost, market, and income approaches as applicable. After valuation, the assessor should use the administrative procedures under Nonresidential Common Elements Valuation.

Nonresidential Common Elements Valuation

When the common interest community criteria are met, residential common elements are not to be assessed separately from the living units even if the residential common elements are not exclusively used by members of the common interest community.

In the case of nonresidential use of the common elements, the land and improvements associated with this nonresidential use must be valued separately. After apportionment of the nonresidential value is made to the units within the common interest community, the proper assessment percentage is applied. For instance, if there is commercial use, the assessment rate applied to such common element actual value must be the commercial rate. Commercial use must be an ongoing use such as a restaurant or health club which is open to the general public. Incidental commercial use, such as occasional community garage sales or craft sales, does not preclude the residential use of the property.

The actual value determined for such nonresidential common elements must first be apportioned among the units, then extracted from the total actual value of each unit. Although § 39-5-121(1)(a), C.R.S., requires the notice of value to state only the total actual value of land and improvements, the Division recommends that the individual unit’s allocation of the value of nonresidential common elements also be separately stated on each NOV and tax bill. The purpose of this inclusion is to help taxpayers better understand how their tax liability is developed.

The apportionment of this nonresidential value shall be made on an equal pro rata basis, unless the apportionment of nonresidential property value is specifically controlled by the declaration.

The actual value determined for the owner's property will include land, improvements, if any, and the owner's interest in the common elements. An example of this situation, including commercial property owned by a homeowners' association, follows.

Example:

Meadowlark Subdivision is a sold out development of 50 lots. The homeowners’ association owns residential common elements that consist of tennis courts and a swimming pool. The homeowners’ association also owns a commercial common element that consists of a clubhouse that has been converted to a restaurant. This restaurant is leased to an operator and is open to the public. As the assessor, you are valuing the house on Lot 21. The legal description of this property includes a notation that the owner also owns an undivided 1/50th share of the common elements.

Since the commercial common element has a different assessment rate, its contribution to the total property value must be accounted for separately.

You must first estimate the total market value by comparison with sales of similar residences in this same subdivision. You have estimated this total value to be $100,000. (The total value includes the owner’s interest in the common elements.) Your next step is to estimate the land value by comparison with sales of similar lots in this subdivision. The value of the land is estimated to be $25,000 (part of this value reflects the value contribution of the common elements to the land). The difference between the total property value of $100,000 and the $25,000 land value is the value of the improvements, or $75,000.

The next step is to estimate the value of the commercial common element. This value should be developed by traditional appraisal methods considering the three approaches to value. In this case, a value of $500,000 has been estimated. Since the apportionment of this value has not been specified in the declaration, it should be allocated on an equal pro rata basis to each of the fifty lots in this subdivision. Each lot would then have a 1/50th share of this value or $10,000 ($500,000 ÷ 50). You know that the improvement only value of $75,000 includes $10,000 that is attributed to the commercial common element, the restaurant.

The property appraisal record would read as follows:

Meadowlark Subdivision, Lot 21, including a 1/50th interest in the common elements.

Improvement value: $75,000

Land: + 25,000

Total: $100,000 Actual Value

Equals: $65,000 Residential Imps Value

+ 25,000 Land Value

+ 10,000 Improved Commercial Value

Total: $100,000 Actual Value

There will be 50 such entries for the subdivision and it will represent the value of the entire subdivision. Although § 39-5-121(1)(a), C.R.S., requires the notice of value to state only the total actual value of land and improvements, the Division recommends that the individual unit’s allocation of the value of nonresidential common elements also be separately stated on each NOV and tax bill. The purpose of this inclusion is to help taxpayers better understand how their tax liability is developed.

The assessor must keep a record of any nonresidential common element property, including nonresidential common elements actually owned by the association. This record should list the description of any nonresidential property, the methods used to value the nonresidential property, the final correlated (reconciled) value, and the method used to apportion this value to the individual units.

As mentioned before, the assessor should add a notation on the property record immediately below the legal description of each unit that states “Includes ____ % interest in common elements.”

The assessment ratios are the residential assessment rate if the common elements are improved residential property and the commercial rate if the common elements are commercial land and improvements.

Level of Value

The value of all real property owned by a common interest community must reflect the appropriate level of value in effect for the applicable assessment year. The valuation date is the June 30 appraisal date preceding the year of general reappraisal.

Water Rights Valuation

Colorado statutes require that water rights used to support any item of real property, including agricultural real property, must be valued as a unit with the property served. Following are the statutes covering the definition, classification and unit assessment of water rights.

Water Rights Statutory References

Title 39 of the Colorado Revised Statutes includes water rights in the statutory definition of the term "improvements."

Definitions.

As used in articles 1 to 13 of this title, unless the context otherwise requires:

....

(6.3) "Improvements" means all structures, buildings, fixtures, fences, and water rights erected upon or affixed to land, whether or not title to such land has been acquired.§ 39-1-102, C.R.S.

In the instance where water rights furnish water for residential purposes, water rights are

included in the statutory definition of the term "residential improvements."

Definitions.

As used in articles 1 to 13 of this title, unless the context otherwise requires:

....

(14.3) "Residential improvements" means a building, or that portion of a building, designed for use predominantly as a place of residency by a person, a family, or families. The term includes buildings, structures, fixtures, fences, amenities, and water rights that are an integral part of the residential use. The term also includes a manufactured home as defined in subsection (7.8) of this section, a mobile home as defined in subsection (8) of this section, and a modular home as defined in subsection (8.3) of this section.§ 39-1-102, C.R.S.

According to Colorado statutes, water rights used to support the use of any item of real property, including agricultural use, must be appraised and valued with the land as a unit.

Improvements - water rights - valuation.

(1) Improvements shall be appraised and valued separately from land, except improvements other than buildings on land which is used solely and exclusively for agricultural purposes, in which case the land, water rights, and improvements other than buildings shall be appraised and valued as a unit.

(1.1)(a)(I) Water rights, together with any dam, ditch, canal, flume, reservoir, bypass, pipeline, conduit, well, pump, or other associated structure or device as defined in article 92 of title 37, C.R.S., being used to produce water or held to produce or exchange water to support uses of any item of real property specified in section 39-1-102(14), other than for agricultural purposes, shall not be appraised and valued separately but shall be appraised and valued with the item of real property served as a unit.

(II) For purposes of this section, valuing the water rights and the item of real property served by the water rights "as a unit" means that any increase in value of the property served with water made available directly, or by exchange, by the use of any dam, ditch, pipeline, canal, flume, reservoir, bypass, conduit, well, pump, or other associated structure or device, as defined in article 92 of title 37, C.R.S., shall be included in the valuation of the real property served by the water rights.

(b) The general assembly finds and declares that the value of water rights, and any dam, ditch, pipeline, canal, flume, reservoir, bypass, conduit, well, pump, or other associated structure or device, as defined in article 92, of title 37, C.R.S., used or held to produce or exchange water, for taxation purposes, should be recognized as a contribution to the value of all of the interests in the entire property served thereby and that the separate valuation of such water rights could result in double taxation. The provision of this subsection (1.1) shall not be construed to exempt any water rights from taxation but shall be construed as setting forth procedures for the valuation thereof.

§ 39-5-105, C.R.S.

From a review of these statutes, it is clear that the Colorado legislature did not intend for water rights, and associated structures and devices, to be separately assessable in any situation where the rights are used to provide or exchange water. In all cases where water rights are used, the rights must be appraised and valued with the land on which the rights are used.

Water Rights Assessment

The following examples and respective responses should provide an adequate understanding of how water rights are assessed.

- The land and water rights and associated structures and devices are owned by the same entity. The rights are used by the owner on the land.

Colorado statutes clearly state that water rights and associated structures and devices must be valued as a unit with the land upon which the rights are used. This unitary valuation applies to all types of property, including agricultural.

For all classes of property except agricultural, water rights are considered an improvement to the land. In valuing nonagricultural property with water rights and associated structures and devices, the appraiser should use comparable properties that have water and similar structures and devices for determining property value. Use of these comparables will allow the appraiser to account for the additional value attributable to the rights, structures, and devices in the applicable approaches used to value the subject.

In valuing agricultural property, water rights and associated structures and devices must be assessed with the land as a unit. Generally, use of water rights, structures, and devices affect crop yields and thus the agricultural sub-classification of the land.

- Water rights have been severed from the land and are being used agriculturally under lease by either the original landowner or by a different landowner.

The assessor must determine the parcel that currently has the benefit of the water rights and classify and value that parcel with the rights as a unit. The classification of the land will be irrigated or meadow hay.

If the rights are leased back to the original agricultural land owner, the assessment of the water rights will be as it was prior to severance, i.e., included in the valuation of the land as a unit.

If the rights are leased to another landowner and used agriculturally, the water rights must be included as a unit in valuing the other landowner's land. The original landowner’s land must then be classified and valued according to its use.

If the land is determined to still be agricultural, classification and valuation must be based on current use, either as dry farm, meadow hay, or as grazing land.

If the land ceases to have agricultural use, the assessor must classify it based on the land's use as of January 1 and consider all applicable approaches in the land's valuation.

- Water rights have been severed from the land and are being used on nonagricultural land, e.g., a residential subdivision. Colorado statutes clearly state that water rights must be valued with nonagricultural property in the same manner as with agricultural property, as a unit with the real property being served. In a nonagricultural situation, the water is determined to be an amenity to the land. Valuation must be accomplished by using comparable properties that have existing water.

The original land from which the rights were severed is still subject to agricultural assessment as long as the land qualifies as agricultural. If the assessor determines that the land still qualifies for agricultural assessment, the valuation of the land is based on its agricultural classification. The classification must be based on the current agricultural use, either as dry farm, meadow hay, or as grazing land. If the land ceases to have agricultural use, the assessor must reclassify it at the land's most probable use and consider all applicable approaches in the land's valuation.

- Water rights are severed from the land and sold to a company doing business in Colorado as a public utility.

Under §§ 39-4-101 through 109, C.R.S., public utility property is valued by the Property Tax Administrator and apportioned to the counties. In the administrator's valuation, the value of any water rights owned by the public utility will be included.

As long as the water rights are used or held for use with land owned by the public utility, any additional value due to the rights will be included in the valuation of the public utility land. If the land is determined to be public utility operating property, any value attributable to the land and water rights will be apportioned to the county by the administrator as part of that county's state assessed valuation.

If the land with the water rights is designated as non-operating public utility property, it must be locally assessed. The assessor must determine whether the land is agricultural or not. If agricultural, the land must be classified and valued as all other agricultural land. If the land does not qualify as agricultural, the assessor must determine the use as of January 1 and value accordingly.

If the rights are not used in conjunction with other public utility property, the assessor must determine where the rights are being used. If the rights are being used in conjunction with agricultural land, the assessor must identify that land and make sure that the valuation of the land includes the water rights as a unit.

- Water rights have been severed and are not currently being used with any parcel of land.

It is highly unlikely that severed water rights would be held unused for any appreciable amount of time. The threat of the loss of water rights through abandonment, i.e., nonuse, as well as the loss of rental income to the water right holder, make this situation unlikely.

For further information on the valuation of agricultural land with water rights, please refer to Chapter 5, Valuation of Agricultural Land.

For further information on the taxable status of domestic water companies, please refer to ARL Volume 2, ADMINISTRATIVE AND ASSESSMENT PROCEDURES MANUAL, Chapter 10, Exemptions.

Long-Term Non-Market Lease Valuation

Long-term, non-market lease situations usually occur when:

- Rental income per unit of comparison (usually $/sf), is outside the range that is typical of similar properties;

- The lease is of long enough duration to have a significant impact on value.

When appraising real property encumbered by a long-term non-market lease, these procedures should be observed to ensure accuracy of the assessment. The following procedures comply with the 1993 Colorado Supreme Court ruling, which allows non-market rents to be considered while achieving a unity of value for assessment, City and County of Denver v. BAA and Regis Jesuit Holding, Inc., 848 P.2d 355, (Colo. 1993).

Consideration of the following criteria will be helpful in determining the applicability of long-term, non-market lease valuation procedures:

- Long-term lease refers to a lease that has a significant impact on value. Lease options are not relevant in this determination, unless there is strong evidence that the option(s) will be exercised. (Examples of this type of evidence may include: a letter of intent to renew, a lease renewal agreement, or a solid history of exercising renewal options.)

- Lease terms are not renegotiable upon sale of the property.

- Lease terms are not renegotiable upon exercise of a renewal option.

- The tenant’s interest (leasehold estate) must be transferable for there to be any leasehold value.

Leased Fee and Leasehold Defined

Leased Fee Interest – A leased fee interest is the lessor’s, or landlord’s interest. It is an ownership interest held by a landlord with the rights of use and occupancy conveyed by a lease to others.

Leasehold Interest – A leasehold estate is the lessee’s, or tenant’s estate. It is the interest held by the lessee (tenant or renter) through a lease conveying the rights of use and occupancy for a stated term under certain conditions.

Valuation Method

Colorado statute § 39-1-103(5)(a), C.R.S., requires that the fee simple estate be valued for property tax purposes. This requirement is confirmed by § 39-1-106, C.R.S., - the Unit Assessment Rule. The valuation process should reflect a market value, using market assumptions, including market rent, market expenses, and market occupancy. There are a few specific exceptions to this requirement. The valuation of property subject to a long-term, nonmarket lease is one of those exceptions.

Colorado statutes, court decisions, and Uniform Standards of Professional Appraisal Practice (USPAP) require that all three approaches to value be considered when valuing this property type.

Cost Approach

The cost approach is most helpful when the lease rate and terms are at market levels, i.e., leased fee and fee simple values are the same. Contract rent that is below market may reflect a type of external obsolescence that could be estimated and deducted as a part of total depreciation. If such obsolescence exists, the calculation used to develop the estimate is simply an exercise of the Income Approach.

Market (Sales Comparison) Approach

The sale of a property subject to a long-term, non-market lease cannot reflect the value of both the leased fee and leasehold estates; therefore, each component of value should be considered separately by this method.

Leased Fee Interest:

The market approach may be helpful in valuing the leased fee interest in this property type if:

- The sale property is leased;

- The sale property has a lease term that is similar to the subject’s lease term;

- The sale property has a lease rate that is similar to the subject’s lease rate;

- The sale property has rent escalations that are similar to the subject’s rent escalations;

- The creditworthiness of the tenant in the sale property is similar to the creditworthiness of the tenant in the subject.

As the number of items of comparability decreases, the reliability of this method diminishes.

Leasehold Interest:

Sales of leasehold interests in buildings rarely occur. It is unlikely that the market approach will be helpful in valuing this component of the fee simple interest.

Income Approach

The income approach is the most useful method when providing an opinion of the value of a property encumbered by a long-term, non-market lease.

Long-term, non-market leases frequently include other sources of income in addition to base rent, such as percentage rent. It is important to include income from all sources when analyzing the relationship of contract rent to market rent.

Frequently, large national tenants are able to negotiate below market rental rates. Because of the good creditworthiness of this type of tenant, these properties may sell at a lower overall rate. Where this situation exists, the value of the leased fee interest may be equal to the value of the fee simple interest, even if the contract rent would otherwise be considered below market.

Unit Assessment Rule

Partial interests not subject to separate tax.

For purposes of property taxation, it shall make no difference that the use, possession, or ownership of any taxable property is qualified, limited, not the subject of alienation, or the subject of levy or distraint separately from the particular tax derivable therefrom. Severed mineral interests shall also be taxed.

Annotation:

This section establishes a unity rule for the assessment of property rather than requiring assessment of the various interests in the property.§ 39-1-106, C.R.S.

In the Regis case, 848 P.2d 355 (Colo. 1993), the court cited § 39-1-106, C.R.S. as applying the Unit Assessment Rule in Colorado. The court defines this as “a rule of property taxation which requires that all estates in a unit of real property be assessed together.” This is an important concept in the valuation of a property encumbered by a below market rent on a longterm basis. For example, a leased property includes both the rights of the landlord (leased fee estate) and the rights of the tenant (leasehold estate). As noted in The Appraisal of Real Estate, 14th ed., p. 72, “A leasehold interest may have value if contract rent is less than the market rent.”

The problem the court had in the Regis case was that by capitalizing the market rent into value, the assessor ignored the value impact of the existing lease. The court ruled that “the BOAA is free to place whatever weight it deems appropriate” on the lease, (Regis, p. 361). In the facts of that case the court noted that the BOAA concluded a value well above the leased fee interest in the property, and further stated “it is clear that the BOAA considered the lessee’s interest in determining the actual value of the subject property,” (Regis, p. 361). The court concluded: “We do not hold that actual rent is the only factor to be considered in valuing property, nor is it necessarily the predominate factor, only that theoretic market rent is not the exclusive factor to be considered,” (Regis, p. 362).

Recommended Procedure

In order to be in compliance with the statutory requirement of § 39-1-106, C.R.S. (Unit Assessment Rule) and the Supreme Court ruling in Regis, the Division recommends the following procedure for developing an opinion of value for properties leased on a long-term basis at below market rent:

- Calculate the value of the leased fee position by capitalizing net income based on contract rent;

- Calculate the value of the leasehold position by estimating the present worth of the difference between market rent and contract rent over the remaining term of the lease, and

- Conclude the value of all estates in the “unit of property.” (The appraiser should recognize that the market value of a property is not necessarily the sum of the value of the individual estates.)

Some of the factors to be considered are:

- The general concept is that lower risk positions should be capitalized into value at lower overall rates;

- Items to be considered in assessing the level of risk with non-market leased properties include:

- duration of the lease,

- variance compared to market rent,

- rent escalation clauses during the base lease term,

- percentage rent clauses.

- The leased fee interest is a lower risk position, therefore, a lower overall rate is appropriate;

- Conversely, the leasehold interest is a higher risk position and requires use of a higher overall rate;

- Sources to be considered in developing the appropriate overall rates:

- market sales data,

- comparison of actual rates for financing instruments with varying degrees of risk, e.g., comparison of treasury bills (very low risk), corporate bonds (moderate risk), and junk bonds (higher risk).

Example:

The following example may be helpful in developing the required values:

Given Lease Information

Contract Rent: $108,519/year

Market Rent: $128,519/year

Remaining Lease Term: 10 years

Leased Fee Value

Potential Gross Income (at contract rent): $ 108,519

Less Vacancy & Collection Loss @ 5% ( $5,426)

Effective Gross Income: $ 103,093

Less Expenses: ( $3,093)

Net Operating Income: $ 100,000

Leased Fee Capitalization Rate: 10%

Value of Leased Fee Interest Equals: $1,000,000

Leasehold Value

Difference between Contract and Market Rent: $ 20,000/year

Leasehold Discount Rate: 15%

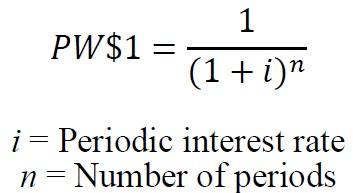

Present Value of Rent Difference for Remaining

Lease Term, (Column 5, PW of $1 Per Period): 5.018769

Value of Leasehold Interest Equals: $ 100,375*

Rounded To: $ 100,000

*(Present Worth of Rent Difference: $20,000 x 5.018769)

Unit Value of the Property for Assessment Purposes

Leased Fee Value: $1,000,000

Leasehold Value: 100,000

Unit Value: $1,100,000

Definitions

The following definitions have been generally taken from The Dictionary of Real Estate Appraisal, 7th Edition, Appraisal Institute, 2022.

Base Rent: the minimum rent stipulated in a lease.

Contract Rent: the actual rental income specified in the lease. DPT note: it may be the same, lower, or higher than market rent.

Excess Rent: the amount by which contract rent exceeds market rent at the time of the appraisal; created by a lease favorable to the landlord (lessor) and may reflect unusual management, unknowledgeable or unusually motivated parties, a lease execution in an earlier, stronger rental market, or an agreement of the parties. DPT note: Due to the higher risk inherent in the receipt of excess rent, it may be calculated separately and capitalized at a higher rate in the income capitalization approach.

Fee Simple Estate: absolute ownership unencumbered by any other interest or estate, subject only to the limitations imposed by the governmental powers of taxation, eminent domain, police power, and escheat.

Lease: a contract in which the rights to use and occupy land, space, or structures are transferred by the owner to another for a specified period of time in return for a specified rent.

Leased Fee Estate (Leased Fee Interest): the ownership interest held by the lessor, which includes the right to receive the contract rent specified in the lease plus the reversionary right when the lease expires.

Leasehold Estate (Leasehold Interest): the right held by the lessee to use and occupy real

estate for a stated term and under the conditions specified in the lease.

Leasehold Value: the value of a leasehold interest. Usually applies to a long-term lease when market rental for similar space is higher than rent paid under the lease.

Lessee: one who has the right to occupancy and use of the property of another for a period of time according to a lease agreement.

Lessor: one who conveys the rights of occupancy and use to others under a lease agreement.

Long-Term Lease: generally a lease agreement extending for 5 years or more, though it may be less in some markets. DPT note: the definition varies slightly; assessors should understand how leases impact value in their markets.

Market Rent: the most probable rent that a property should bring in a competitive and open market under all conditions requisite to a fair lease transaction, the lessee and lessor each acting prudently and knowledgeably, and assuming the rent is not affected by undue stimulus. Implicit in this definition is the execution of a lease as of a specified date under conditions whereby

- Lessee and lessor are typically motivated;

- Both parties are well informed or well advised, and acting in what they consider their best interests;

- Payment is made in terms of cash or in terms of financial arrangements comparable thereto; and

- The rent reflects specified terms and conditions, such as permitted uses, use restrictions, expense obligations, duration, concessions, rental adjustments and revaluations, renewal and purchase options, and tenant improvements (TIs). DPT note: the rate prevailing in the market for comparable properties and is used in calculating market value by the income approach; sometimes called economic rent.

Overage Rent: the percentage rent paid over and above the guaranteed minimum rent or base rent; calculated as a percentage of sales in excess of a specified breakpoint sales volume. DPT note: overage rent is a contract rent.

Percentage Lease: a lease in which the rent or some portion of the rent represents a specified percentage of the volume of business, productivity, or use achieved by the tenant.

Government-Assisted Housing Valuation

In 1937, Congress passed the Federal Housing Act that provided for the construction of low-income, affordable multi-family housing. Since then, the Act has been modified several times to include state and local low- and moderate-income housing programs as well. In the 1970s, the federal Housing and Urban Development (HUD) agency initiated low-interest rate programs along with federal Farmer’s Home Administration loan programs for rural areas.

In 1986, Congress added the Low-Income Housing Tax Credit (LIHTC) program to encourage private industry to invest in and construct low income housing or rehabilitate existing housing projects. Federal income tax credits are given to investors in qualified projects in exchange for equity participation and to offset property restrictions that all or part of the project be leased at below-market rents to qualified low-income tenants. Beginning in 1989, an irrevocable recorded Land Use Restriction Agreement (LURA) was placed against each new LIHTC property in Colorado requiring the continuation of low-income housing use for a minimum of 30 years.

These procedures have been developed for use by all county assessors in identifying government-assisted housing. For those properties that have restricted rents and that are subject to property use restrictions that limit the use of the property, specific market value adjustment procedures have been developed to allow assessors to make adjustments to value to take into account the effects of the restricted rents and land use restrictions on market value. If any question arises as to whether a property is subject to these procedures, contact the Division of Property Taxation.

Definition of Government-Assisted Housing

For use with this procedure, the following definition from the Uniform Standards of Professional Appraisal Practice (USPAP) will apply:

“Subsidized housing may be defined as single- or multifamily residential real estate targeted for ownership or occupancy by low- or moderate-income households as a result of public programs and other financial tools that assist or subsidize the developer, purchaser, or tenant in exchange for restrictions on use and occupancy.”

Advisory Opinion AO-14, USPAP

Government-assisted or “subsidized” housing includes both rent-restricted and rent-subsidized housing. Rent-restricted housing reflects the fact that the property owner receives less than market rent, but receives other benefits such as federal income tax credits and/or preferential loan terms and guarantees. Rent-subsidized means the property owner receives rent subsidies from a government agency to bring rental income up to market levels.

Types of Programs

The United States Department of Housing and Urban Development (HUD) provides the primary definition of income and asset eligibility standards for low and moderate income households. Other federal, state, and local agencies define income eligibility standards for specific programs and developments under their jurisdictions.

There are three main categories of government-assisted (low-income) housing:

- Public housing operated by a public housing authority (PHA),

- Affordable housing projects developed by non-profit 501(c)(3) corporations, and

- Private, for-profit government-assisted housing projects that meet requirements of the United States Department of Housing and Urban Development (HUD) or Rural Development – Rural Housing Service (RHS) for low- and moderate-income families. The RHS was formerly known as the Farmers Home Administration. In addition, both the project and investors must meet IRS requirements with regard to receiving low-income housing income tax credits.

Public Housing Authority (PHA) Programs

PHA programs are usually associated with and administered by a local public housing authority. These entities provide housing to qualifying families based on a percentage of their gross or adjusted gross income.

A City Housing Authority, § 29-4-203, C.R.S., a County Housing Authority, § 29-4-502, C.R.S., a Multijurisdictional Housing Authority, § 29-1-204.5, C.R.S., or a Middle-Income Housing Authority, § 29-4-1103, C.R.S., are exempt from general taxation pursuant to the statutes pertaining to each type of authority. For more information on Housing Authorities, refer to ARL Volume 2, ADMINISTRATIVE AND ASSESSMENT PROCEDURES MANUAL, Chapter 10, Exemptions.

Non-Profit, 501(C)(3) Corporations

In metropolitan areas, local government-assisted housing corporations may be established to provide housing assistance for low- and moderate-income families. These corporations provide direct rent subsidies or low-income loans for the development of new affordable housing units or rehabilitation of existing affordable housing. In addition, loans may be provided to purchase existing affordable housing units to keep them from being converted to traditional multi-family housing and apartment projects.

Unless the project has specifically been designated as a charitable property pursuant to a determination of the Division of Property Taxation – Exemptions Section, it is taxable and should be valued under these procedures. If you have questions whether a specific property is exempt as a charitable property, contact the Exemptions Section of Division of Property Taxation.

Sections 39-2-117, 39-3-113, and 39-3-127, C.R.S., provide charitable housing developers community land trusts with a property tax exemption on land that they own and intend for affordable housing development; and on land that they have already developed, but retain ownership of the site, which they then lease back to the purchaser of the structure.

For-Profit Programs

In private, for-profit subsidized housing programs, the Federal Government (HUD & RHS) and the Colorado Housing and Finance Authority (CHFA) provide regulatory, financial, and administrative services. HUD does not own or manage housing projects but does insure mortgage loans and oversees compliance with federal guidelines, laws, and rules.

Unless the project has specifically been designated as a charitable property pursuant to a determination of the Division of Property Taxation – Exemptions Section, it is taxable and should be valued under these procedures. If you have questions whether a specific property is exempt as a charitable property, contact the Exemptions Section of Division of Property Taxation.

Housing and Urban Development Programs

In 1965, the United States Department of Housing and Urban Development (HUD) was created as a cabinet-level agency. Since then, amendments to the 1937 Federal Housing Act and other changes in various federal acts in 1970, 1974, 1983, and 1990 established the need for programs that address the nation’s housing needs by encouraging economic growth in distressed neighborhoods, providing housing assistance for the poor, helping rehabilitate and develop moderate and low-cost housing, and enforcing the nation’s fair housing laws.

Specific programs administered by HUD in Colorado are:

- Section 8 - Rental Subsidy program is the most popular. Existing Section 8 participants provide qualified renters with a voucher. The renter locates a suitable unit and, with the assistance of the public housing authority, will negotiate a contract with the owner.

- Section 8 - Moderate Rehabilitation is similar to the Rental Subsidy program except the subsidy is tied to the unit and not to the tenant.

- Section 8 - New Construction/Substantial Rehabilitation program is tied to the project. Under this program, HUD has a contract with the property owner, HUD paying the owner the difference between market rent and the tenant’s calculated rent.

Since market rent is being received by the owner of a property under the Section 8 program, the specific market adjustment procedures utilizing restricted rents are not applicable. However, any adjustment in value that is necessary due to location or physical condition of the property should be considered by the appraisers when determining actual value for Section 8 properties.

Rural Housing Service Programs

Since 1916, the Federal Government has created and re-created various agencies to administer financial and technical assistance to rural families and communities. Currently, the United States Department of Agriculture-Rural Development Agency administers various programs to provide loans and grants for construction of rural housing and community facilities as well as to provide rental assistance for low-income rural people.

RHS programs are available to eligible applicants in rural areas, typically defined as open country or rural towns with no more than 20,000 in population. Programs currently in operation in Colorado are:

- Under the Multi-Family Housing Direct Loan (aka Section 515) program, the RHS primarily makes direct, low interest loans to developers of affordable multi-family housing properties. The RHS may subsidize a portion of the rent up to a “basic rent level.” The term “basic rent level” applies to the level of rent necessary to achieve an 8 percent return on investment for the property owner. In nearly all cases, the basic rent level is below fair market rents for the area.

- The Rural Rental Housing Guaranteed Loan Program (aka Section 538) provides for loan guarantees of up to 90 percent of the amount of a loan from a private lender to a developer of low-income housing. There are currently no Section 538 properties in Colorado.

- The Farm Labor Housing and Grant Program provides capital financing for the development of housing for domestic farm laborers. One part of the program, Section 514, provides loan funds to buy, build, improve, or repair housing for farm laborers in rural and, in some cases, urban areas for nearby farm labor. Another part, Section 516, provides grants that may be used to cover 90 percent of farm housing development cost.

In RHS programs, rents are restricted to a percentage of the renter’s income. Since the developer receives a below-market loan or high percentage loan-to-value guarantee, the actual rents, even though restricted, allow for a reasonable rate of return for the project.

According to the RHS, only Section 515 properties would be “rent-restricted” because their rents would likely be less than fair market level. As such, the specific market adjustment procedure for properties with restricted rents would be applicable.

Colorado Housing and Finance Authority

The Colorado Housing and Finance Authority (CHFA) is a quasi-governmental organization created in 1973 by the Colorado General Assembly to assist in financing housing for low- and moderate-income families. Through statutory amendments in 1983 and 1987, CHFA was allowed to provide financing for small businesses and economic development in specified locations. CHFA is solely funded from revenue generated by the programs it administers.

Today, CHFA programs encompass three areas of interest: Home Finance programs for qualified low and moderate income families, Rental Finance programs providing housing loans for construction and/or rehabilitation of existing rental housing, and Business Finance programs providing commercial loans to locally-owned businesses in Colorado.

To fund its programs, CHFA issues notes and bonds and uses the proceeds to provide financing to developers of low and moderate income rental housing. In addition, CHFA administers the financial aspects of both the federal and state assisted-housing programs that receive CHFA loans or LIHTC tax credits in Colorado.

Specific federal programs administered by CHFA are:

- Tax-Exempt or Private Activity Bond (PAB) Loans – FHA/CHFA “shared-risk” permanent or construction loans are provided to qualified developers who receive below market financing and flexible repayment options. For 501(c)(3) non-profit corporations and public housing authorities, loans are provided through the issuance of tax-exempt bonds.

- Low Income Housing Tax Credits (LIHTC) – CHFA allocates federal income tax credits to investors in low-income housing. Developers must apply through a competitive process to CFHA for allocations of credits based on eligibility and rankings related to a state tax credit allocation plan.

Programs developed by CHFA include:

- SMART Program – Similar to the Tax Exempt/PAB Loan program, CHFA provides permanent loans of up to $1,000,000 for up to 20 unit projects for new construction or acquisition and rehabilitation. Developers may be either for-profit or non-profit and may receive flexible repayment terms and a streamlined loan process.

- Taxable Loans for Low Income Housing Tax Credit Projects (LIHTC) – Provides for debt financing of LIHTC projects for both construction and permanent loans.

- CHFA Housing Fund – Provides short-term (up to 2 years) loans to qualified developers to cover pre-development costs, acquisition, or construction of low-income housing.

- CHFA Housing Opportunity Fund – Provides first mortgage or subordinate loans at flexible terms to leverage other funding for non-profit developers and public housing authorities to create housing for very-low-income households.

Since 1989, most taxable government-assisted housing projects in Colorado involve allocation of LIHTC tax credits by CHFA. Most of these properties are rent-restricted as well. As such, the specific market adjustment procedure for properties with restricted rents would be applicable.

Sources of Information on Housing Projects

Government-Assisted Housing Questionnaire

The Division developed a questionnaire for collecting information on total rental unit counts and gross contract rental amounts to determine a market adjustment. Some projects may have several levels of restricted rents. The different levels are based on the percentage of median income level that designates the maximum allowed rent level for that unit. Rent levels can vary from 30% to 60% of median income levels. CHFA median income levels and maximum allowed restricted-rents by income level can be obtained by accessing CHFA’s website or by contacting CHFA directly.

Each project owner or manager should be provided with a copy of the Division-developed questionnaire for completion. A copy of the questionnaire is provided as Addendum 7-B, Government-Assisted Housing Questionnaire.

Property owners or managers should be advised that failure to complete this questionnaire or to provide adequate information to the assessor regarding the rent-restricted housing project may result in not receiving the market adjustment for the current assessment year.

Verifying Contract Rent Information

In determining the restricted rent amount to be used in calculating the economically derived market adjustment (EDMA), actual contract rents in place as of the June 30 appraisal date should be used. However, if actual contract rent is not available, counties may use the CHFA maximum allowed rents. CHFA median income levels and maximum allowed rents by income level can be obtained by accessing CHFA’s website or by contacting CHFA directly.

Actual contract rents should be obtained through the use of Addendum 7-B, Government- Assisted Housing Questionnaire.

Colorado Housing and Finance Authority (CHFA)

Annually, property owners or managers complete an Occupancy Report (Form G-1) or Mixed Income Occupancy Report (Form G-2) that lists the number of bedrooms and gross tenant rent by apartment unit. The report is filed with CHFA. If verification of unit count and/or contract rent information is needed, a copy of the applicable report that is nearest to, but not later than the June 30 appraisal date should be obtained from the property owner or manager.

Additional information about CHFA projects can also be found at the CHFA website. CHFA offices can be contacted at:

Colorado Housing and Finance Authority

1981 Blake Street

Denver, CO 80202-1272

(303) 297-2432 (CHFA)

Rural Housing Service (RHS)

A multi-family housing project property owner is required to file a planned budget (Form RD 1930-7) no later than 45 days prior to the beginning of the property owner’s fiscal year. Part IV of the budget document contains a schedule of rents received from tenants in the project. The contract rent information is listed in the column headed RENTAL RATES – BASIC. If verification of unit count and/or contract rent information is needed, a copy of Part IV of the budget document that is nearest to, but not later than the June 30 appraisal date should be obtained from the property owner or manager.

Additional information about RHS projects can be obtained by contacting:

United States Department of Agriculture – Rural Housing Service

Denver Federal Center Building 56, Room 2300

PO Box 25426

Denver, CO 80225

1-800-424-6214

Specific project information may also be obtained from the local Rural Housing Service offices.

Fair Market Rental Information

For properties with rent restrictions, Fair Market Rents (FMR) as compiled and published by the United States Department of Housing and Urban Development (HUD) are used in the calculation of the economically derived market adjustment (EDMA). Schedule B containing the listing of FMRs by county can be obtained from the HUD website.

For the purpose of uniformity, the market rents listed in the FMR table should be used in determining the market adjustment for rent-restricted government-assisted housing projects. For those counties for which the HUD Fair Market Rent schedule is not reflective of local market rent levels, local market rent studies may be developed to establish market rents. These studies should be sufficiently detailed to the extent that economic rent levels by bedroom count can be established. Locally-developed rent studies must reflect market rent levels as of the June 30 appraisal date.

Government-Assisted Housing Valuation

General Market Analysis Considerations

Colorado assessors are restricted by § 20(8)(c) of article X of the Colorado Constitution, and § 39-1-103(5)(a), C.R.S., to sole consideration of the market (sales comparison) approach when valuing residential real property including government-assisted housing. Analysis of gross rental levels between rent-restricted and non-rent restricted properties is an accepted unit of comparison in the market approach. In addition, a formal Colorado Attorney General’s Opinion dated June 13, 2000, states that the Property Tax Administrator may consider the effects of government-mandated economic restrictions and government-mandated property use restrictions, including restricted rents, when publishing procedures concerning the market approach to appraisal. A copy of the Attorney General’s Opinion is located as Addendum 7- C, Formal Opinion of the Attorney General, at the end of this section.

The market for government-assisted housing is different from other residential investment property because of inherent restrictions on income (restricted rents) realized by the property owner and the inability of the property owner to sell the housing projects without meeting regulatory requirements imposed on them by federal and state authorities.

Discussions with CHFA indicate that sale of government-assisted housing for conversion to regular, market level multi-family housing would be unlikely before the mandated 30+ year restricted use period expires. Both the IRS and CHFA would enact severe penalties and commence legal action to recapture tax credits and any subsidized loans given to the developer of the project.

If sales of government-assisted housing do exist, assessors should fully analyze the market to determine whether or not there is a market-recognized value difference between rent-restricted and non- rent restricted properties. If a value difference can be demonstrated, appropriate adjustments must be made.

If no difference can be demonstrated by the market or if there are insufficient sales to make an accurate determination, non-government assisted housing sales, with appropriate adjustments for any differences (location and physical characteristics) between the sales and the subject property, can be used to determine actual value. However, if the subject government-assisted property has restricted rents, a market adjustment must be considered to account for the reduced income stream and the long-term (30+ years) land use restriction agreement (LURA).

Rent-Restricted Government-Assisted Housing

Valuation of taxable rent-restricted housing properties that receive below-market rents should reflect an economically derived market adjustment (EDMA) due to the reduced revenue stream. Restricted rents are mandated through land use restrictions (LURAs) recorded by CHFA against the property.

The steps to calculate this adjustment are listed below:

Step #1 Determine the valuation of the property assuming that it has no rental or property use restrictions.

Using time-adjusted sale prices of comparable non-rent-restricted housing properties, a value is determined using the sales comparison approach:

45,000 sq. ft. X $65.00/sq ft* = $2,925,000 actual value

* A base value per rental unit can also be used.

Because of the constitutional provision mandating exclusive use of the market (sales comparison) approach, assessors should review as many sales as possible. If sufficient sales are not available within the statutory eighteen-month data collection period, the data collection period should be expanded, in six-month intervals as needed up to the full sixty-month period. If an adequate number of sales are still not available, sales within neighboring counties having similar economic conditions should be examined. Sales prices must be trended to the appraisal date and adjusted to reflect any comparable locational and physical characteristic differences.

Step #2 From the property owner and/or manager, obtain the number of rent-restricted and non-rent-restricted rental units and number of bedrooms

contained within each unit.

The Division has developed Addendum 7-B, Government-Assisted Housing Questionnaire, to aid in obtaining this information.

Step #3 Using the actual (contract) rent amounts for each rental unit in the property, calculate the gross actual revenue per month that would be received if the property was 100 percent occupied. An example of this calculation is shown below:

20 1 bedroom units @ $350/month = $ 7,000/mo

30 2 bedroom units @ $400/month = $12,000/mo

50 Total rentable units $19,000/mo

Actual rents used in this step must reflect the actual rents that were in place as of the statutory June 30 appraisal date. Use of actual contract rent is preferred, but CHFA maximum-allowed rents can be used as a “proxy” if actual contract rent is not available. CHFA median income levels and maximum allowed rents by income level can be obtained by accessing CHFA’s website or by contacting CHFA directly.

Step #4 Using Fair Market Rents (FMRs) listed on Schedule B, Rules and Regulations of the Department of Housing and Urban Development (HUD), 24 CFR 888, calculate the gross FMR revenue per month assuming the property was not rent restricted and was 100 percent occupied. An example of this calculation is shown below:

20 1 bedroom units @ $500/month = $10,000/mo

30 2 bedroom units @ $600/month = $18,000/mo

50 Total rentable units $28,000/mo

If desired, local market rent studies can be substituted as a source for Fair

Market Rents.

Step #5 Calculate the economically derived market adjustment (EDMA) percentage by dividing total actual revenue from STEP #3 by the gross FMR from STEP #4. An example of this calculation is shown below:

$19,000 ÷ $28,000 = 0.679

1.000 - 0.679 =0.321 which is a 32.1% market adjustment as a rent-restricted property

Step #6 Apply the EDMA to the base value established under Step #1

$2,925,000 Actual Value X 0.679 (1.000 - 0.321) EDMA adjustment = $1,986,075 Adjusted Actual Value

The adjusted value of $1,986,075 reflects a 32.1% market adjustment for restricted rents.

If the total actual revenue is equal to or exceeds the gross FMR revenue for the property, no EDMA adjustment is necessary or should be made.

Use Of Gross Rent Multipliers (GRMs) As A Check for EDMA Calculation

Pursuant to § 39-1-103(5)(a), C.R.S., a gross rent multiplier (GRM) may be used as a unit of comparison in the market approach to appraisal. Counties may use GRMs as a “check” against the EDMA calculation.

Level of Value and Assessment Considerations

All government-assisted housing, including rent-restricted affordable housing, is real property and must be valued at the specified year’s level of value as required by § 39-1-104(10.2), C.R.S. When using the sales comparison approach, all sales must be adjusted to reflect estimated sales prices as of the June 30 appraisal date preceding the year of general reappraisal.

When calculating the economically derived market adjustment (EDMA), contract rents as of the June 30 appraisal date must be considered along with the published HUD fair market rent (FMR) table applicable to the general year of reappraisal. Additionally, all government-assisted housing is classified as residential property and must be assessed at the residential assessment rate.

Mixed-Use Property Valuation

Hotels/Motels as Mixed-Use Properties

This procedure has been developed to assist assessors in the determination of whether a hotel/motel property is subject to mixed-use classification and to provide procedures for the valuation and allocation of hotel and motel property value between residential and nonresidential (commercial) classifications.

Hotels and motels are to be classified, valued, and assessed as commercial property unless documentation exists to support a classification as mixed-use property. To be classified as a mixed-use property, the hotel or motel property owner and/or operator must be able to document the use of any portion of the property as residential property. Specifically, evidence of an overnight accommodation that is leased or rented for thirty (30) consecutive days or longer by the same person or business entity must be provided. Additional information and definitions regarding mixed-use and other terms used in these procedures are listed in the section of these procedures entitled Terminology Definitions.

Hotel or motel properties, including hotels and motels having mixed-use, must be valued through consideration of the cost, market, and income approaches to appraisal.

In addition, § 20 (8)(c) of article X of the Colorado Constitution requires that residential property must be valued through the use of the market approach to appraisal exclusively. This requirement applies to all types of residential property including the residential portion of mixed-use property.

To value mixed-use hotels and motels in accordance with this requirement, the following valuation steps should be used:

Step #1 Determine the actual value of the mixed-use hotel or motel including both land and improvements through consideration of the cost, market, and income approach to value.

Step #2 Determine the percentage of the hotel or motel property that is residential by using the Revenue Analysis Methodology and/or Room Night Analysis Methodology that is explained under the topic, Allocation of Mixed-Use Hotel/Motel Property.

Step #3 Allocate the actual value determined in Step #1 to residential and nonresidential portions by multiplying the actual value of the total property by the residential and non-residential percentages determined from Step #2.

Step #4 Convert the actual value allocated to the residential portion of the hotel or motel improvement from Step #3 to actual value per square foot. For this conversion, only the square footage of the motel or hotel structure housing the residential portion should be used.

This step requires two calculations:

Calculation #1

Total sq. ft. of the mixed-use property X the residential allocation percentage (from step #2) = Allocated residential square footage

Calculation #2

Allocated Residential actual value (from step #3) ÷ Allocated residential square footage (from calculation #1) = Actual value per square foot for residential portion

Step #5 Convert the sales of comparable improved properties to time-adjusted sales prices per square foot (TASP/sf). Select the TASP/sf most comparable to the mixed-use subject property. In determining sales comparability, the following priority should be used:

- Sales of mixed-use hotels and motels

- Sales of commercially-classified hotels and motels

- Sales of apartments

- Sales of other residential property, e.g., condominiums

Compare the TASP/sf of the comparable sale(s) to the actual value per square foot of the residential portion of the mixed-use subject property.

- If the actual value per square foot of the residential portion of the subject property is equal to or lower than the TASP/sf rate determined from the comparable sales, do not change the total actual value of the hotel or motel property.

- If the actual value per square foot of the residential portion of the hotel or motel is higher that the TASP/sf indicated from comparable sales, reduce the value of the residential portion to reflect the value indicated from the comparable sale(s). This is done by multiplying the TASP/sf of the comparable by the allocated square footage of the residential portion. Add back the reduced value of the residential portion to the actual value of the commercial portion of the property to determine the total actual value of the entire mixed-use property.

An example of this valuation procedure is shown below:

The 30-unit Shady Rest motel is classified as a mixed-use property. The motel operated at 70% occupancy in the prior year. The motel structure contains 11,000 square feet.

Step #1

The county has valued the motel for the current assessment year using the following approaches to value:

| Cost Approach | $1,200,000 |

|---|---|

| Income Approach | $950,000 |

| Market Approach | $1,100,000 |

| Reconciled Actual Value | $1,000,000 |

Step #2

The motel provided information on room revenue and room night usage as follows:

Residential Allocation Percentage = Extended Stay Revenue $ 27,000 ÷ Total All Room Revenue $100,000 = 0.27 or 27% Residential Use

Residential Allocation Percentage = Extended Stay Room Nights 2,410 ÷ Total Room Nights 7,665* = 0.31 or 31% Residential Use

* Calculated as 30 units x 365 days x 0.70 (70% occupancy)

Based on the reliability and completeness of the revenue information supplied by the motel owner, the room revenue methodology was used to determine the 27% residential and 73% commercial mixed-use allocation of the motel’s actual value.

Step #3

Using the 27% residential allocation percentage determined in Step #2, a residential and non-residential allocation of the subject property’s actual value was calculated:

$1,000,000 x 0.27 = $270,000 (actual value allocated to residential portion)

$1,000,000 x 0.73 = $730,000 (actual value allocated to non-residential portion)

Step #4

Using the total square footage of the mixed-use property and the residential allocation percentage from Step #2, calculate the allocated square footage attributable to residential use for the property:

11,000 square feet x 0.27 = 2,970 square feet (residential portion)

Calculate the actual value per square foot for the residential portion by dividing them allocated residential actual value from Step #3 by the allocated residential square footage from the Step #4 calculation shown above.

$270,000 ÷ 2,970 sf = $90.91 per square foot (residential actual value)

Step #5

Review of hotel and motel sales including mixed-use hotel and motel properties indicates a range of TASP between $75.00/sf and $85.00/sf inclusive of both land and improvements. Based on the size and amenities of the subject property, a TASP of $80.00/sf was indicated for the subject property.

Comparison of the indicated rate derived from the comparable sales analysis ($80.00/sf) to the allocated original actual value for the residential portion ($90.91/sf) indicates that the TASP/sf value from the comparable sales is below the allocated value indicated for the residential portion of the subject property. As such, the actual value of the residential portion of the motel should be adjusted as shown below:

$270,00 $237,600 Residential portion (2,970 sf x $80.00/sf)$730,000 730,007 Commercial portion (8,030 sf x $90.91/sf)$1,000,000 $967,607 Total actual value of mixed-use property

Allocation of Mixed-Use Assessment

Allocation of mixed-use property values to residential and non-residential classifications is required under § 39-1-103(9), C.R.S. The preceding example, illustrating the mixed-use allocation methodology, applies to hotel or motel mixed-use properties. Allocation of the actual value of Bed and Breakfast properties can be found under the topic, Bed and Breakfast Properties, within this chapter. For general information regarding the allocation of mixed-use property refer to § 39-1-103(9), C.R.S.

Colorado Statutory References

The following statutes should be considered when using this procedure:

Definitions.

As used in articles 1 to 13 of this title, unless the context otherwise requires:

(5.5) (a) "Hotels and motels" means improvements and the land associated with such improvements that are used by a business establishment primarily to provide lodging, camping, or personal care or health facilities to the general public and that are predominantly used on an overnight or weekly basis;

. . . .

(14.3) "Residential improvements" means a building, or that portion of a building, designed for use predominantly as a place of residency by a person, a family, or families. The term includes buildings, structures, fixtures, fences, amenities, and water rights that are an integral part of the residential use. The term also includes a manufactured home as defined in subsection (7.8) of this section, a mobile home as defined in subsection (8) of this section, and a modular home as defined in subsection (8.3) of this section.(14.4)(a)

(I) “Residential land” means a parcel of land upon which residential improvements are located. The term also includes:

(A) Land upon which residential improvements were destroyed by natural cause after the date of the last assessment as established in section 39-1-104 (10.2);

(B) Two acres or less of land on which a residential improvement is located where the improvement is not integral to an agricultural operation conducted on such land; and

(C) A parcel of land without a residential improvement located thereon, if the parcel is contiguous to a parcel of residential land that has identical ownership based on the record title and contains a related improvement that is essential to the use of the residential improvement located on the identically owned contiguous residential land.

(II) “Residential land” does not include any portion of the land that is used for any purpose that would cause the land to be otherwise classified, except as provided for in section 39-1-103 (10.5).

(III) As used in this subsection (14.4):

(A) “Contiguous” means that the parcels physically touch; except that contiguity is not interrupted by an intervening local street, alley, or common element in a common-interest community.

(B) “Related improvement” means a driveway, parking space, or improvement other than a building, or that portion of a building designed for use predominantly as a place of residency by a person, a family, or families.

(14.5) "Residential real property" means residential land and residential improvements but does not include hotels and motels as defined in subsection (5.5) of this section.§ 39-1-102, C.R.S.

Assessment of a mixed-use property having a single improvement is referenced in Colorado Revised Statutes.

Actual value determined - when.

(9)(a) In the case of an improvement which is used as a residential dwelling unit and is also used for any other purpose, the actual value and valuation for assessment of such improvement shall be determined as provided in this paragraph (a). The actual value of each portion of the improvement shall be determined by application of the appropriate approaches to appraisal specified in subsection (5) of this section. The actual value of the land containing such an improvement shall be determined by application of the appropriate approaches to appraisal specified in subsection (5) of this section. The land containing such an improvement shall be allocated to the appropriate classes based upon the proportion that the actual value of each of the classes to which the improvement is allocated bears to the total actual value of the improvement. The appropriate valuation for assessment ratio shall then be applied to the actual value of each portion of the land and of the improvement.

§ 39-1-103, C.R.S.

Assessment of a mixed-use property consisting of more than one improvement is also referenced in the Colorado Revised Statutes.

Actual value determined - when.

(9)(b) In the case of land containing more than one improvement, one of which is a residential dwelling unit, the determination of which class the land shall be allocated to shall be based upon the predominant or primary use to which the land is put in compliance with land use regulations. If multiuse is permitted by land use regulations, the land shall be allocated to the appropriate classes based upon the proportion that the actual value of each of the classes to which the improvements are allocated bears to the combined actual value of the improvements; the appropriate valuation for assessment ratio shall then be applied to the actual value of each portion of the land.

§ 39-1-103, C.R.S.

Colorado Case Law Involving Mixed-Use Property

E.R. Southtech, Ltd., et al., v. Arapahoe County Board of Equalization, 972 P.2d 1057 (Colo. App. 1998).

At issue in this case was whether the hotel property should be classified as mixed-use because it provided “long term extended stays” (unit occupancy of 30 days or more) for some of its units as well as “short term stays” (unit occupancy of less than 30 days). Using Colorado sales tax statutes and regulations as criteria, the Colorado Court of Appeals agreed with the Colorado Board of Assessment Appeals (BAA) that long term extended stays constituted a residential use and that a mixed-use classification and allocation of actual value to residential and nonresidential assessment classifications is appropriate.

Manor Vail Condominium Assoc. v. Board of Equalization of the County of Eagle, et al., 956 P.2d 654 (Colo. App. 1998).