Introduction

By law, the Property Tax Administrator must approve all personal property schedules, forms, and notices furnished or sent by assessors to owners of taxable property, the form of petitions for abatement or refund, the form of all field books, plat and block books, maps, and appraisal cards, and other forms and records used and maintained in the office of the assessor, §§ 39-2-109(1)(d) and (h), C.R.S.

This chapter includes information that provides the required content of many of the forms that are used in the assessor’s office. Additionally, form templates are provided on the Division's website under Forms Templates. The information in this chapter and the form templates are based on the statutory dates and deadlines used for the standard protest and appeal procedures. The statutory dates and deadlines may be changed to reflect the alternate protest procedure, or adjusted to dates that do not conflict with weekends or holidays. Refer to Addendum 9-A, Statutory and Adjusted Dates for Standard and Alternate Protest and Appeal Procedures.

Each county may develop forms that differ from the form templates in design or content (except Senior Citizen and Veteran With a Disability Property Tax Exemption applications and manufactured home forms). However, county-developed forms that differ in content must be submitted to the Division for review and approval. This centralized form approval system helps achieve statewide uniformity of the forms and ensures that the information requested of taxpayers and reported by assessors is consistent.

Form Approval Procedures

County-developed forms may be submitted to the Division for approval between January 1 and March 31. The form review process typically takes less than 10 business days. Following the procedures outlined below will expedite the approval process:

- Prior to developing a new form, review the form templates provided on the division website to ensure that the required content is incorporated into the county’s form. Any additional information that appears on the form must not conflict with or detract from the required content.

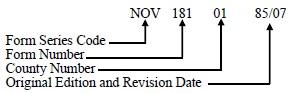

- Assign a number to the form that uniquely identifies the form. The form numbering system developed by the Division is shown in Addendum 9-B, Form Numbering System.

- The Division recommends submitting the form for approval prior to having it typeset or entered into the county’s computer program in an effort to reduce costs.

- Notification of form approval will typically be communicated within 10 working days.

- Any changes that must be made to the form prior to approval will typically be communicated within 10 working days.

- If changes are required, the revised form is submitted to the Division for a second review. (Steps four and five will continue until the form meets the required criteria.)

Availability of Forms

The forms referenced in this chapter are available on the Division's website. The availability of the forms that are in Microsoft Word format, or on the Division’s website, are shown below. Forms that are available in Microsoft Word format will be e-mailed to you upon request. The year in the templates are formatted as “20__” in order to provide greater flexibility in use. The assessor’s office will be required to fill in the appropriate year before making the form available to the public.

| Form | Microsoft Word | Website |

|---|---|---|

| Notices of Valuation (all) | x | x |

| Protest Forms (all) | x | x |

| Notices of Determination (all) | x | x |

| Special Notices of Valuation (all) | x | x |

| Special Protest Forms (all) | x | x |

| Special Notices of Determination (all) | x | x |

| Petitions for Abatement or Refund of Taxes | x | x |

| Manufactured Home Transfer Declaration | x | |

| Certificate of Permanent Location for a Manufactured Home | x | |

| Certificate of Permanent Location for a Manufactured Home Subject to a Long-Term Land Lease | x | |

| Affidavit of Real Property for a Manufactured Home | x | |

| Certificate of Removal for a Manufactured Home | x | |

| Certificate of Destruction for a Manufactured Home | x | |

| Mobile Equipment Form 301 | x | |

| Senior Citizen Property Tax Exemption Applications | x | x |

| Veteran with a Disability Property Tax Exemption Application | x | x |

| Spouse of a Veteran with a Disability Property Tax Exemption Application | x | x |

| Senior Citizen and Property with a Disability Tax Exemptions Notification Insert and Brochures | x | x |

| Real Property Transfer Declaration* | x |

Pre-approved forms that are not listed above (Certification of Levies, Certification of Valuation, Declaration Schedules, etc.) are available on the Division’s website.

Notice of Valuation – Real Property

Specific Requirements

The sample Real Property Notice of Valuation illustrates the form content required by the Property Tax Administrator and § 39-5-121(1), C.R.S. While the majority of the data that must be inserted in each section of the form is self-explanatory, items that may require additional explanation are addressed below.

Date of Notice/Mailing Deadline: A Notice of Valuation (NOV) must be mailed annually to each owner of real property no later than May 1. Upon taxpayer’s request, the NOV may be sent electronically. During intervening years, the Real Property NOV may be mailed with the tax bill when the value of the property has not changed, § 39-5-121(1.2), C.R.S.

Property Classification: The property must be listed by its class or subclassification description, e.g., Single Family Residence, Offices, Warehouse/Storage, etc.

Reclassification of Agricultural Property: Subject to the availability of funds under the assessor's budget for such purpose, no later than May 1 of each year, the assessor shall inform each person whose property has been reclassified from agricultural land to any other classification of property of the reasons for such reclassification including, but not limited to, the basis for the determination that the actual use of the property has changed or that the classification of such property is erroneous, § 39-1-103(5)(c), C.R.S. The reasons for the reclassification may appear in the Property Classification section of the NOV.

Property Values: Property values must be stated in the form of actual values. Listing the assessed value on the NOV is prohibited by law. For agricultural property, land and improvements must be LISTED and valued separately. For all other property, the total property value must be listed, § 39-5-121(1)(a), C.R.S.

Estimate of Taxes: The assessor shall include in the notice an estimate of the taxes, or an estimated range of the taxes, owed for the current property tax year. The following statement must be included in bold-faced type:

The tax amount is merely an estimate based upon the best information available. You have the right to protest the adjustment in valuation, but not the estimate of taxes, § 39-5-121(1), C.R.S.

Commercial Property Approach to Value Statement: Any NOV sent to the owner of commercial property must include contact information for the relevant county assessor along with the following statement: "If you would like information about the approach used to value your property, please contact your county assessor."§ 39-5-121(4)(b), C.R.S.

Timely Objection Statement: Any notice of valuation required by subsections (1) and (1.5) of this section sent to the owner of any real property must include the following statement: "if a property owner does not timely object to their property's valuation by June 8 under section 39-5-122, C.R.S., they may file a request for an abatement under section 39-10-114, C.R.S., by contacting the county assessor.".

Spanish Language Requirements: On October 21, 1985, the State Board of Equalization issued an order requiring certain counties to print a Spanish language statement on their NOVs. A second order, issued July 10, 1986, modified the Spanish language statement. The orders were issued pursuant to an action filed against the state board in Denver District Court by a group of Conejos County taxpayers. One of the points argued by the group was that county taxpayers were denied their right of due process by receiving NOVs written solely in English when a majority of county residents speak Spanish. The parties stipulated, and the court remanded the matter back to the state board to issue orders consistent with the stipulation.

The Director of the Census Bureau determines which counties must comply with the minority language assistance provisions of Section 203 of the voting rights act of 1965, as amended in 1982, 42 US CONST. 1973 et seq. Based on the results of the 2015 American Community Survey, the following counties must comply: Costilla, Denver, Rio Grande, and Saguache. Refer to Addendum 9-C, Spanish Language Requirements, for the required Spanish language that must be included on the NOV.

Notice of Senior Citizen and Veteran with a Disability Property Tax Exemptions: Notice for the senior exemption must be included with the treasurer’s tax bill in January. If the notice for the veteran with a disability exemption is not also included in the treasurer’s tax bill in January, the assessor must include it with the assessor’s Real Property Notice of Valuation, or send it as a separate mailing, § 39-3-204, C.R.S. Refer to Addendum 9-D, Notice of Senior Citizen and Veteran with a Disability Property Tax Exemptions for required content.

Protest Form: A form that may be completed by the property owner to initiate a protest of the classification or valuation of the property must be included with the Real Property NOV. A Real Property Protest Form is available on the Division's website under Forms Templates.

Required Alternative Protest Period Criteria

Property owners who are protesting the value of rent producing commercial real property, in accordance with § 39-5-122(2), C.R.S., shall provide the county assessor’s office on or before July 15 the following information pursuant to § 39-5-122(2.5), C.R.S.:

- Actual annual rental income for two full years including the base year for the relevant property tax year;

- Tenant reimbursements for two full years including the base year for the relevant property tax year;

- Itemized expenses for two full years including the base year for the relevant property tax year; and

- Rent roll data as of the valuation date, including the name of any tenants, the address, unit, or suite number of the subject property, lease start and end dates, option terms, base rent, square footage leased, and vacant space for two years including the year of the valuation date and the prior year.

Counties using the alternative protest period shall provide information about this requirement on their NOVs in order to inform taxpayers in a timely fashion. Refer to Alternate Protest Period Real Property Notice of Valuation in this chapter for required content.

Required Reappraisal Year Criteria

Property Characteristics: An itemized listing of the land and improvements, as well as the property characteristics that are germane to value must be included, §§ 39-5-121(1)(b)(I) and (II), C.R.S. To satisfy the first requirement, assessors may choose to provide a count and a total square footage or acreage for each subclassification comprising the subject property. To satisfy the second requirement, the physical characteristics relied upon to determine the actual value of the property (characteristics “germane to value”) must be listed. Each assessor must determine the categories of data to be included to satisfy the requirements set forth in §§ 39-5-121(1)(b)(I) and (II), C.R.S.

Required Intervening Year Criteria

Increase in Value of Land or Improvement Greater than 75%: If the difference between the actual value of the land or improvement in the reappraisal year and the actual value of the land or improvement in the intervening year increases by more than 75%, the assessor shall mail together with the NOV an explanation for the increase in value, § 39-5-121(1)(a), C.R.S. Note that the explanation is required when either the land or the improvement value increases by more than 75% – not simply when the total actual value increases by more than 75%.

County Discretion

Data Gathering Period: In the last two sentences of the Valuation Information section shown on the reverse side of the NOV, the references to the 18-month data gathering period may be changed to reflect the data gathering period used by the county, e.g. a 24-month data gathering period.

Protest Form: In lieu of sending a separate Real Property Protest Form with the NOV, an abbreviated version of the protest form may be printed below the Protest Procedures section on the reverse side of the NOV. Refer to the Real Property Protest Form standards shown in this chapter.

If an abbreviated version of the protest form is incorporated into the Real Property NOV, the sentence following the dates, time and location of hearings should be changed to:

To assist you in the protest process, you may elect to complete and submit the Real Property Protest Form shown below.

Alternate Protest and Appeal Procedure: If the county is utilizing the alternate protest and appeal procedure set forth in § 39-5-122.7, C.R.S., the dates that appear on the NOV must be changed as shown in Addendum 9-A, Statutory and Adjusted Dates for Standard and Alternate Protest and Appeal Procedures.

Adjusted Dates: The statutory dates and deadlines may be adjusted to reflect dates that do not conflict with weekends or holidays. Refer to Addendum 9-A, Statutory and Adjusted Dates for Standard and Alternate Protest and Appeal Procedures.

Access County Assessors' Template Forms.

Notice of Valuation Postcard – Real Property

Senate Bill 21-019 amended § 39-5-121, C.R.S., to allow the use of an abbreviated, postcard-sized Notice of Valuation. The intent of the bill is to help reduce county mailing costs as well as streamline the complexity of the language required by the Long Form Notice of Valuation.

Specific Requirements

The sample Real Property Notice of Valuation Postcard illustrates the form content required by the Property Tax Administrator and § 39-5-121(1.8), C.R.S. While the majority of the data that must be inserted in each section of the form is self-explanatory, items that may require additional explanation are addressed below.

Summary of Valuation Information: Postcard Notices of Valuation must contain an “accurate summary of the valuation information required under §§ 39-5-121(1) and (1.5), C.R.S.”

Provide Contact Information: Postcard Notices of Valuation must contain contact information for the assessor’s office.

Link to a Long Form Notice of Valuation: Postcard Notices of Valuation must include a link to the assessor’s website that will allow taxpayers to access a Long Form Notice of Valuation that contains all of the valuation information required under § 39-5-121(1), C.R.S. For long form requirements, consult the previous real property Notice of Valuation section of this document.

Option to Request Long Form Notice of Valuation by Mail (Current and Future): Postcard Notices of Valuation must contain a statement that informs taxpayers of their right to opt out of receiving a Postcard Notice of Valuation and instead receive a Long Form Notice of Valuation by mail in future years. Assessors must also honor requests to receive Long Form Notice of Valuation by mail if the taxpayer would prefer to not access the document via the internet.

Property Values: Property values must be stated in the form of actual values. Listing the assessed value on the Notice of Valuation is prohibited.

Commercial Property Approach to Value Statement: Any Notice of Valuation sent to the owner of commercial property must include contact information for the relevant county assessor along with the following statement: "If you would like information about the approach used to value your property, please contact your county assessor." § 39-5-121(4)(b), C.R.S.

Timely Objection Statement: Any Notice of Valuation sent to the owner of any real property must include the following statement: "If a property owner does not timely object to their property's valuation by June 8 under section 39-5-122, C.R.S., they may file a request for an abatement under section 39-10-114, C.R.S., by contacting the county assessor." § 39-5-121(4)(a), C.R.S.

Access County Assessors' Template Forms.

Notice of Valuation – Personal Property

Specific Requirements

The Personal Property Notice of Valuation is to be used for reporting the value of:

- Personal property (furnishings, machinery, and equipment)

- Non-producing mines (gross proceeds in the preceding calendar year of $5,000 or less)

- Producing mines that are excepted from the provisions of § 39-6-104, C.R.S., (coal, asphaltum, rock, limestone, dolomite, or other stone products, sand, gravel, clay or earths).

Non-producing mines and mines excepted from § 39-6-104, C.R.S., are valued in the same manner as other real property, § 39-6-111, C.R.S.

The sample Personal Property Notice of Valuation illustrates the form content required by the Property Tax Administrator and §§ 39-5-121(1.5)(a) and 39-6-111, C.R.S. While the majority of the data that must be inserted in each section of the form is self-explanatory, items that may require additional explanation are addressed below.

Date of Notice/Mailing Deadline: A Notice of Valuation (NOV) must be mailed annually to each owner of personal property no later than June 15. Upon taxpayer’s request, the NOV may be sent electronically.

Property Owner: With the exception of personal property located on oil and gas leaseholds and lands, the name and address of the owner of the personal property should be inserted in this section of the Personal Property NOV. For personal property located on oil and gas leaseholds and lands, the name and address of the operator who filed the declaration schedule should be inserted in this section of the Personal Property NOV, § 39-5-121(1.5)(b), C.R.S

Property Classification: The property may be described by its subclassification description or by type, e.g., Furniture, Fixtures, Machinery, Equipment, etc.

Property Values: Property values must be stated in the form of actual values. Listing the assessed value on the NOV is prohibited by law, § 39-5-121(1.5)(a), C.R.S.

Commercial Property Approach to Value Statement: Any NOV sent to the owner of commercial property must include contact information for the relevant county assessor along with the following statement: "if you would like information about the approach used to value your property, please contact your county assessor."§ 39-5-121(4)(b), C.R.S.

Estimate of Taxes: The assessor shall include in the notice an estimate of the taxes, or an estimated range of the taxes, owed for the current property tax year.

The following statement must be included in bold-faced type:

The tax amount is merely an estimate based upon the best information available. You have the right to protest the adjustment in valuation, but not the estimate of taxes, § 39-5-121(1), C.R.S.

Spanish Language Requirements: On October 21, 1985, the State Board of Equalization issued an order requiring certain counties to print a Spanish language statement on their NOVs. A second order, issued July 10, 1986, modified the Spanish language statement. The orders were issued pursuant to an action filed against the state board in Denver District Court by a group of Conejos County taxpayers. One of the points argued by the group was that county taxpayers were denied their right of due process by receiving NOVs written solely in English when a majority of county residents speak Spanish. The parties stipulated, and the court remanded the matter back to the state board to issue orders consistent with the stipulation.

The Director of the Census Bureau determines which counties must comply with the minority language assistance provisions of Section 203 of the voting rights act of 1965, as amended in 1982, 42 US CONST. 1973 et seq. Based on the results of the 2015 American Community Survey, the following counties must comply: Costilla, Denver, Rio Grande, and Saguache. Refer to Addendum 9-C, Spanish Language Requirements, for the required Spanish language that must be included on the NOV.

Protest Form: A form that may be completed by the property owner to initiate a protest of the valuation of the property must be included with the Personal Property NOV. Refer to the Personal Property Protest Form standards shown in this chapter.

County Discretion

Protest Form: In lieu of sending a separate Personal Property Protest Form with the NOV, an abbreviated version of the protest form may be printed below the Protest Procedures section on the reverse side of the NOV. Refer to the Personal Property Protest Form standards shown in this chapter.

If an abbreviated version of the protest form is incorporated into the Personal Property NOV, the sentence following the dates, time and location of hearings should be changed to:

To assist you in the protest process, you may elect to complete and submit the Personal Property Protest Form shown below.

Alternate Protest and Appeal Procedure: If the county is utilizing the alternate protest and appeal procedure set forth in § 39-5-122.7, C.R.S., the dates that appear on the NOV must be changed as shown in Addendum 9-A, Statutory and Adjusted Dates for Standard and Alternate Protest and Appeal Procedures.

Adjusted Dates: The statutory dates and deadlines may be adjusted to reflect dates that do not conflict with weekends or holidays. Refer to Addendum 9-A, Statutory and Adjusted Dates for Standard and Alternate Protest and Appeal Procedures.

In 2021 Senate Bill 21-019 amended § 39-5-121, C.R.S., in order to allow the use of an abbreviated postcard sized notice of valuation. The intent of the bill is to help reduce county mailing costs as well as streamline the complexity of the language required by the long form notice of valuation.

Specific Requirements

The Personal Property Notice of Valuation is to be used for reporting the value of:

- Personal property (furnishings, machinery, and equipment)

- Non-producing mines (gross proceeds in the preceding calendar year of $5,000 or less)

- Producing mines that are excepted from the provisions of § 39-6-104, C.R.S., (coal, asphaltum, rock, limestone, dolomite, or other stone products, sand, gravel, clay or earths).

Non-producing mines and mines excepted from § 39-6-104, C.R.S., are valued in the same manner as other real property, § 39-6-111, C.R.S.

The sample Personal Property Notice of Valuation Postcard illustrates the form content required by the Property Tax Administrator and §§ 39-5-121(1.8) and 39-6-111, C.R.S. While the majority of the data that must be inserted in each section of the form is self-explanatory, items that may require additional explanation are addressed below.

Summary of Valuation Information: Postcard Notices of Valuation must contain an “accurate summary of the valuation information required under § 39-5-121(1.5), C.R.S.”

Provide Contact Information: Postcard Notices of Valuation must contain contact information for the assessor’s office.

Link to a Long Form Notice of Valuation: Postcard Notices of Valuation must include a link to the assessor’s website that will allow taxpayers to access a Long Form Notice of Valuation that contains all of the valuation information required under §§ 39-5-121(1) and (1.5), C.R.S. For long form requirements, consult the previous personal property notice of valuation section of this document.

Option to Request Long Form Notice of Valuation by Mail (Current and Future): Postcard Notices of Valuation must contain a statement that informs taxpayers of their right to opt out of receiving a Postcard Notice of Valuation and instead receive a Long Form Notice of Valuation by mail in future years. Assessors must also honor requests to receive the Long Form Notice of Valuation by mail if the taxpayer would prefer to not access the document via the internet.

Property Values: Property values must be stated in the form of actual values. Listing the assessed value on the Notice of Valuation is prohibited.

Notice of Valuation – Oil and Gas Leaseholds and Lands

Specific Requirements

The Oil and Gas Leaseholds and Lands Notice of Valuation is to be used solely for reporting oil and gas production. Personal property used in the production of oil and gas should be reported on a Personal Property Notice of Valuation.

The sample Oil and Gas Leaseholds and Lands Notice of Valuation illustrates the form content required by the Property Tax Administrator and §§ 39-5-121(1.5)(a) and 39-7-102.5, C.R.S. While the majority of the data that must be inserted in each section of the form is self-explanatory, items that may require additional explanation are addressed below.

Date of Notice/Mailing Deadline: A Notice of Valuation (NOV) must be mailed annually to the operator of oil and gas leaseholds and lands no later than June 15. Upon taxpayer’s request, the NOV may be sent electronically.

Property Classification: The property must be described by its subclassification description, e.g., Producing Oil/Primary, Producing Oil/Secondary, Oil Shale/In-Situ, etc.

Actual/Production Value: Pursuant to § 39-7-102, C.R.S., the calculation of value for property classified as oil and gas leaseholds and lands is the valuation for assessment. The valuation for assessment of oil and gas leaseholds and lands is 87.5% of primary production, and 75% of secondary and tertiary production, § 39-7-102, C.R.S.

Estimate of Taxes: The assessor shall include in the notice an estimate of the taxes, or an estimated range of the taxes, owed for the current property tax year.

The following statement must be included in bold-faced type:

The tax amount is merely an estimate based upon the best information available. You have the right to protest the adjustment in valuation, but not the estimate of taxes, § 39-5-121(1), C.R.S.

Spanish Language Requirements: On October 21, 1985, the State Board of Equalization issued an order requiring certain counties to print a Spanish language statement on their NOVs. A second order, issued July 10, 1986, modified the Spanish language statement. The orders were issued pursuant to an action filed against the state board in Denver District Court by a group of Conejos County taxpayers. One of the points argued by the group was that county taxpayers were denied their right of due process by receiving NOVs written solely in English when a majority of county residents speak Spanish. The parties stipulated, and the court remanded the matter back to the state board to issue orders consistent with the stipulation.

The Director of the Census Bureau determines which counties must comply with the minority language assistance provisions of Section 203 of the voting rights act of 1965, as amended in 1982, 42 US CONST. 1973 et seq. Based on the results of the 2010 census, the following counties must comply: Costilla, Denver, and Rio Grande. Refer to Addendum 9-C, Spanish Language Requirements, for the required Spanish language that must be included on the NOV.

Protest Form: A form that may be completed by the property owner to initiate a protest of the valuation of the property must be included with the NOV. Refer to the Oil and Gas Leaseholds and Lands Protest Form standards shown in this chapter.

County Discretion

Schedule Number and Property Classification: Rather than sending multiple NOVs to a single owner, a spreadsheet showing the classification and value of each property may be attached to the NOV. “See attached spreadsheet” should appear in the Schedule Number and Property Classification sections of the NOV.

Protest Form: In lieu of sending a separate Protest Form with the NOV, an abbreviated version of the protest form may be printed below the Protest Procedures section on the reverse side of the NOV. Refer to the Oil and Gas Leaseholds and Lands Protest Form standards shown in this chapter.

If an abbreviated version of the protest form is incorporated into the NOV, the sentence following the dates, time and location of hearings should be changed to:

To assist you in the protest process, you may elect to complete and submit the Oil and Gas Leaseholds and Lands Protest Form shown below.

Alternate Protest and Appeal Procedure: If the county is utilizing the alternate protest and appeal procedure set forth in § 39-5-122.7, C.R.S., the dates that appear on the NOV must be changed as shown in Addendum 9-A, Statutory and Adjusted Dates for Standard and Alternate Protest and Appeal Procedures.

Adjusted Dates: The statutory dates and deadlines may be adjusted to reflect dates that do not conflict with weekends or holidays. Refer to Addendum 9-A, Statutory and Adjusted Dates for Standard and Alternate Protest and Appeal Procedures.

Notice of Valuation – Producing Mines

Specific Requirements

The Producing Mines Notice of Valuation is to be used for mines that are not excepted from the provisions of § 39-6-104, C.R.S. Mines that are excepted from § 39-6-104, C.R.S., are those that primarily produce coal, asphaltum, rock, limestone, dolomite, or other stone products, sand, gravel, clay or earths. A Personal Property Notice of Valuation must be used to report the value of non-producing mines and mines that are excepted from the provisions of § 39-6-104, C.R.S.

The sample Producing Mines Notice of Valuation illustrates the form content required by the Property Tax Administrator and §§ 39-5-121(1.5)(a) and 39-6-106(2), C.R.S. While the majority of the data that must be inserted in each section of the form is self-explanatory, items that may require additional explanation are addressed below.

Date of Notice/Mailing Deadline: A Notice of Valuation (NOV) must be mailed no later than June 15, annually, to each owner of a producing mine (except mines that primarily produce coal, asphaltum, rock, limestone, dolomite, or other stone products, sand, gravel, clay or earths. Upon taxpayer’s request, the NOV may be sent electronically.

Property Classification: The property must be described by its subclassification description, e.g., Precious Metals, Molybdenum, Strategic Minerals, etc.

Actual/Production Value: Pursuant to § 39-6-106(2), C.R.S., the calculation of value for property classified as producing mines (except mines that primarily produce coal, asphaltum, rock, limestone, dolomite, or other stone products, sand, gravel, clay or earths) is the valuation for assessment. The valuation for assessment of producing mines not excepted from the provisions of § 39-6-106(2), C.R.S., is either 25% of gross proceeds or 100% of the net proceeds of the prior year’s production, whichever is greater, § 39-6-106(2), C.R.S.

Estimate of Taxes: The assessor shall include in the notice an estimate of the taxes, or an estimated range of the taxes, owed for the current property tax year.

The following statement must be included in bold-faced type:

The tax amount is merely an estimate based upon the best information available. You have the right to protest the adjustment in valuation, but not the estimate of taxes, § 39-5-121(1), C.R.S.

Spanish Language Requirements: On October 21, 1985, the State Board of Equalization issued an order requiring certain counties to print a Spanish language statement on their NOVs. A second order, issued July 10, 1986, modified the Spanish language statement. The orders were issued pursuant to an action filed against the state board in Denver District Court by a group of Conejos County taxpayers. One of the points argued by the group was that county taxpayers were denied their right of due process by receiving NOVs written solely in English when a majority of county residents speak Spanish. The parties stipulated, and the court remanded the matter back to the state board to issue orders consistent with the stipulation.

The Director of the Census Bureau determines which counties must comply with the minority language assistance provisions of Section 203 of the voting rights act of 1965, as amended in 1982, 42 US CONST. 1973 et seq. Based on the results of the 2010 census, the following counties must comply: Costilla, Denver, and Rio Grande. Refer to Addendum 9-C, Spanish Language Requirements, for the required Spanish language that must be included on the NOV.

Protest Form: A form that may be completed by the property owner to initiate a protest of the valuation of the property must be included with the NOV. Refer to the Producing Mines Protest Form standards shown in this chapter.

County Discretion

Protest Form: In lieu of sending a separate Protest Form with the NOV, an abbreviated version of the Producing Mines Protest Form may be printed below the Protest Procedures section on the reverse side of the NOV. Refer to the Producing Mines Protest Form standards shown in this chapter.

If the Protest Form is incorporated into the NOV, the sentence following the dates, time and location of hearings should be changed to:

To assist you in the protest process, you may elect to complete and submit the Producing Mines Protest Form shown below.

Alternate Protest and Appeal Procedure: If the county is utilizing the alternate protest and appeal procedure set forth in § 39-5-122.7, C.R.S., the dates that appear on the NOV must be changed as shown in Addendum 9-A, Statutory and Adjusted Dates for Standard and Alternate Protest Procedures.

Adjusted Dates: The statutory dates and deadlines may be adjusted to reflect dates that do not conflict with weekends or holidays. Refer to Addendum 9-A, Statutory and Adjusted Dates for Standard and Alternate Protest Procedures.

Protest Form – Real Property

Specific Requirements

Pursuant to §§ 39-5-121(1) and 39-5-122(2), C.R.S., every NOV must be sent along with a form that, if completed by the property owner, allows the property owner to explain the basis for the protest of the property’s valuation or classification. However, completion of the protest form does not constitute the exclusive means of protesting the assessor's classification or valuation.

Access County Assessors' Template Forms.

County Discretion

The assessor may elect to print the Real Property Questionnaire, on the reverse side of the Real Property Protest Form. If the Real Property Questionnaire is used, the following language should appear on the Protest Form:

Completing the Real Property Questionnaire may help you determine an estimate of value for your property. Colorado law requires consideration of the market approach for residential property, and consideration of the cost, market, and income approaches to value for all other types of real property.

If desired, a line for the agent or property owner’s e-mail address may be inserted in the “Agent Authorization” and “Attestation” sections of the form.

Rather than sending a separate protest form, elements of the Real Property Protest form may be incorporated into the Real Property NOV. To satisfy form standards, the elements of the protest form that must be incorporated into the Real Property NOV are shown below.

Real Property Protest Form

You may use this section of the form to initiate the protest process. If you wish to protest the classification or valuation of your property, please complete this section and return a copy of both sides of this form to the Assessor’s office at the address shown on the Notice of Valuation.

What is your estimate of the property’s value as of June 30, __________ $_____________

What is the basis for your estimate of value or your reason for requesting a review? (Please attach additional sheets as necessary and any supporting documentation, i.e., comparable sales, photos, rent roll, appraisal, etc.)

________________________________________________________________________________

________________________________________________________________________________

________________________________________________________________________________

Attestation

I, the undersigned owner or agent1 of the property identified above, affirm that the statements contained herein and on any attachments hereto are true and complete.

____________________________

Signature

____________________________

Telephone Number

____________________________

Date

____________________________

Email Address

1 Attach letter of authorization signed by the property owner.

Protest Form – Personal Property

Specific Requirements

Pursuant to §§ 39-5-121(1.5)(a), and 39-5-122(2), C.R.S., every NOV must be sent along with a form that, if completed by the property owner, allows the property owner to explain the basis for the protest of the property’s valuation or classification. However, completion of the protest form does not constitute the exclusive means of protesting the assessor's classification or valuation.

Access County Assessors' Template Forms.

County Discretion

The assessor may elect to print the Personal Property Questionnaire, on the reverse side of the Personal Property Protest Form. If the Personal Property Questionnaire is used, the following language should appear on the Protest Form:

Completing the Personal Property Questionnaire may help you determine an estimate of value for your property. Colorado law requires consideration of the cost, market, and income approaches to value for personal property.

If desired, a line for the agent or property owner’s e-mail address may be inserted in the “Agent Authorization” and “Attestation” sections of the form.

Rather than sending a separate protest form, elements of the Personal Property Protest Form may be incorporated into the Personal Property NOV. To satisfy form standards, the elements of the protest form that must be incorporated into the Personal Property NOV are shown below.

Personal Property Protest Form

You may use this section of the form to initiate the protest process. If you wish to protest the valuation of your property, please complete this section and return a copy of both sides of this form to the Assessor’s office at the address shown on the Notice of Valuation.

What is your estimate of the property’s value? $_____________

What is the basis for your estimate of value or your reason for requesting a review? (Please attach additional sheets as necessary and any supporting documentation, i.e., original installed cost, comparable sales, rental income, etc.)

________________________________________________________________________________

________________________________________________________________________________

________________________________________________________________________________

________________________________________________________________________________

Attestation

I, the undersigned owner or agent1 of the property identified above, affirm that the statements contained herein and on any attachments hereto are true and complete.

____________________________

Signature

____________________

Telephone Number

______________________

Date

____________________________

Email Address

1 Attach letter of authorization signed by the property owner.

Protest Form – Oil and Gas Leaseholds and Lands

Specific Requirements

Pursuant to §§ 39-5-121(1.5)(a), 39-5-122(2), and 39-7-102.5, C.R.S., every NOV must be sent along with a form that, if completed by the property owner, allows the property owner to explain the basis for the protest of the property’s valuation or classification. However, completion of the protest form does not constitute the exclusive means of protesting the assessor's classification or valuation.

The sample Oil and Gas Leaseholds and Lands Protest Form illustrates the form content required by the Property Tax Administrator and §§ 39-5-121(1.5)(a), 39-5-122(2), and 39-7-102.5, C.R.S

County Discretion

If desired, a line for the agent or property owner’s e-mail address may be inserted in the “Agent Authorization” and “Attestation” sections of the form.

Rather than sending a separate protest form, elements of the Oil and Gas Leaseholds and Lands Protest Form may be incorporated into the Oil and Gas Leaseholds and Lands NOV. To satisfy form standards, the elements of the protest form that must be incorporated into the Oil and Gas Leaseholds and Lands NOV are shown below.

Oil and Gas Leaseholds and Lands Protest Form

You may use this section of the form to initiate the protest process. If you wish to protest the valuation of your property, please complete this section and return a copy of both sides of this form to the Assessor’s office at the address shown on the Notice of Valuation.

What is your estimate of the property’s actual/production value? $_____________

What is the basis for your estimate of value or your reason for requesting a review? (Please attach additional sheets as necessary and any supporting documentation.)

________________________________________________________________________________

________________________________________________________________________________

________________________________________________________________________________

Attestation

I, the undersigned owner or agent1 of the property identified above, affirm that the statements contained herein and on any attachments hereto are true and complete.

____________________________

Signature

____________________

Telephone Number

______________________

Date

____________________________

Email Address

1 Attach letter of authorization signed by the property owner.

Protest Form – Producing Mines

Specific Requirements

Pursuant to §§ 39-5-121(1.5)(a), 39-5-122(2), and 39-6-111.5, C.R.S., every NOV must be sent along with a form that, if completed by the property owner, allows the property owner to explain the basis for the protest of the property’s valuation or classification. However, completion of the protest form does not constitute the exclusive means of protesting the assessor's classification or valuation.

The sample Producing Mines Protest Form illustrates the form content required by the Property Tax Administrator and §§ 39-5-121(1.5)(a), 39-5-122(2), and 39-6-111.5, C.R.S.

County Discretion

If desired, a line for the agent or property owner’s e-mail address may be inserted in the “Agent Authorization” and “Attestation” sections of the form.

Rather than sending a separate protest form, elements of the Producing Mines Protest Form may be incorporated into the Producing Mines NOV. To satisfy form standards, the elements of the protest form that must be incorporated into the Producing Mines NOV are shown below.

Producing Mines Protest Form

You may use this section of the form to initiate the protest process. If you wish to protest the valuation of your property, please complete this section and return a copy of both sides of this form to the Assessor’s office at the address shown on the Notice of Valuation.

What is your estimate of the property’s actual/production value? $_____________

What is the basis for your estimate of value or your reason for requesting a review? (Please attach additional sheets as necessary and any supporting documentation.)

________________________________________________________________________________

________________________________________________________________________________

________________________________________________________________________________

Attestation

I, the undersigned owner or agent1 of the property identified above, affirm that the statements contained herein and on any attachments hereto are true and complete.

____________________________

Signature

____________________

Telephone Number

______________________

Date

____________________________

Email Address

1 Attach letter of authorization signed by the property owner.

Notice of Determination

Specific Requirements

Two copies of the Notice of Determination (NOD) must be mailed to each property owner who filed a protest with the assessor, § 39-5-122(2), C.R.S.

The sample Notice of Determination illustrates the form content required by the Property Tax Administrator and § 39-5-122(2), C.R.S. While the majority of the data that must be inserted in each section of the form is self-explanatory, items that may require additional explanation are addressed below.

Date of Notice: Under the standard protest and appeal procedures, NODs for real property protests must be mailed on or before the last working day in June, and NODs for personal property protests must be mailed on or before July 10. Under the extended protest and appeal procedures, NODs for both real property and personal property protests must be mailed on or before August 15. Upon taxpayer’s request, the NOD may be sent electronically, § 39-5-121(1.7), C.R.S.

Property Classification: Real property must be listed by its class or subclassification description, e.g., Single Family Residence, Offices, Warehouse/Storage, etc. For agricultural property, land and improvements must be listed and valued separately. Personal property may be described by its subclassification description or by type, e.g., Furniture, Fixtures, Machinery, Equipment, etc.

Property Values: Property values must be stated in the form of actual values, § 39-8-106(1)(b)(II), C.R.S. Listing the assessed value on the NOD is prohibited by law. For agricultural property, land and improvements must be listed and valued separately. For all other property, the total property value must be listed, §§ 39-5-121(1)(a) and 39-5-121(1.5)(a), C.R.S.

The Assessor’s determination of value after review is based on the following: This section of the NOD must be completed in accordance with § 39-8-106(1)(b)(III), C.R.S., which states that the grounds for the assessor’s determination “are appropriate consideration of the approaches to appraisal set forth in § 39-1-103(5)(a), C.R.S.” The Division recommends using the applicable statement(s) shown below:

| Property Classification | Statement |

|---|---|

| Residential | The actual value of residential property is determined solely by consideration of the market approach to appraisal, § 39-1-103(5)(a), C.R.S. |

| Agricultural Land | The actual value of agricultural lands, exclusive of building improvements, is determined by consideration of the earning or productive capacity of such lands, capitalized at a rate of 13%, § 39-1-103(5)(a), C.R.S |

| Vacant Land Commercial Industrial Personal | The actual value of the property is based on appropriate consideration of the cost approach, market approach, and income approach to appraisal, § 39-1-103(5)(a), C.R.S. |

| Possessory Interests | The property is valued in accordance with the specific standards and procedures established in § 39-1-103(17)(a), C.R.S. |

County Discretion

Alternate Protest and Appeal Procedure: If the county is utilizing the alternate protest and appeal procedure set forth in § 39-5-122.7, C.R.S., the dates that appear on the NOD must be changed as shown in Addendum 9-A, Statutory and Adjusted Dates for Standard and Alternate Protest and Appeal Procedures.

Adjusted Dates: The statutory dates and deadlines may be adjusted to reflect dates that do not conflict with weekends or holidays. Refer to Addendum 9-A, Statutory and Adjusted Dates for Standard and Alternate Protest and Appeal Procedures.

Counties may wish to include information on the back of the Notice of Determination for appeals beyond the county board of equalization. The following language may be added at the county’s discretion:

If you are dissatisfied with the County Board of Equalization’s decision and you wish to continue your appeal, you must appeal within 30 days of the date of the County Board’s written decision with ONE of the following options: The Board of Assessment Appeals, District Court, or Binding Arbitration. Information concerning further appeals will be included with the County Board’s written decision. For a list of arbitrators, contact the County Commissioners at the address listed for the County Board of Equalization.

Notice of Determination – Oil and Gas Leaseholds and Lands

Specific Requirements

Two copies of the Notice of Determination (NOD) must be mailed to each property owner who filed a protest with the assessor, § 39-5-122(2), C.R.S.

The sample Oil and Gas Leaseholds and Lands Notice of Determination illustrates the form content required by the Property Tax Administrator and § 39-5-122(2), C.R.S. While the majority of the data that must be inserted in each section of the form is self-explanatory, items that may require additional explanation are addressed below.

Date of Notice: Under the standard protest and appeal procedures, NODs for oil and gas leaseholds and lands protests must be mailed on or before July 10. Under the extended protest and appeal procedures, NODs for oil and gas leaseholds and lands must be mailed on or before August 31 (the last working day in August).

Property Classification: The property must be described by its subclassification description, e.g., Producing Oil/Primary, Producing Oil/Secondary, Oil Shale/In-Situ, etc.

Actual/Production Value: Pursuant to § 39-7-102, C.R.S., the calculation of value for property classified as oil and gas leaseholds and lands is the valuation for assessment. The valuation for assessment of oil and gas leaseholds and lands is 87.5% of primary production, and 75% of secondary and tertiary production, § 39-7-102, C.R.S.

County Discretion

Alternate Protest and Appeal Procedure: If the county is utilizing the alternate protest and appeal procedure set forth in § 39-5-122.7, C.R.S., the dates that appear on the NOD must be changed as shown in Addendum 9-A, Statutory and Adjusted Dates for Standard and Alternate Protest and Appeal Procedures.

Adjusted Dates: The statutory dates and deadlines may be adjusted to reflect dates that do not conflict with weekends or holidays. Refer to Addendum 9-A, Statutory and Adjusted Dates for Standard and Alternate Protest and Appeal Procedures.

Counties may wish to include information on the back of the Notice of Determination regarding appeals beyond the county board of equalization. The following language may be added at the county’s discretion.

If you are dissatisfied with the County Board of Equalization’s decision and you wish to continue your appeal, you must appeal within 30 days of the date of the County Board’s written decision with ONE of the following options: The Board of Assessment Appeals, District Court, or Binding Arbitration. Information concerning further appeals will be included with the County Board’s written decision. For a list of arbitrators, contact the County Commissioners at the address listed for the County Board of Equalization.

Access County Assessors' Template Forms.

Notice of Determination – Producing Mines

Specific Requirements

Two copies of the Notice of Determination (NOD) must be mailed to each property owner who filed a protest with the assessor, § 39-5-122(2), C.R.S.

The sample Producing Mines Notice of Determination illustrates the form content required by the Property Tax Administrator and § 39-5-122(2), C.R.S. While the majority of the data that must be inserted in each section of the form is self-explanatory, items that may require additional explanation are addressed below.

Date of Notice: Under the standard protest and appeal procedures, NODs must be mailed on or before July 10. Under the extended protest and appeal procedures, NODs for both real property and personal property protests must be mailed on or before the last working day in August.

Property Classification: The property must be described by its subclassification description, e.g., Precious Metals, Molybdenum, Strategic Minerals, etc.

Actual/Production Value: Pursuant to § 39-6-106(2), C.R.S., the calculation of value for property classified as producing mines (except mines that primarily produce coal, asphaltum, rock, limestone, dolomite, or other stone products, sand, gravel, clay or earths) is the valuation for assessment. The valuation for assessment for producing mines not excepted from the provisions of § 39-6-106(2), C.R.S., is either 25% of gross proceeds or 100% of the net proceeds of the prior year’s production, whichever is greater, §39-6-106(2), C.R.S.

County Discretion

Alternate Protest and Appeal Procedure: If the county is utilizing the alternate protest and appeal procedure set forth in § 39-5-122.7, C.R.S., the dates that appear on the NOD must be changed as shown in Addendum 9-A, Statutory and Adjusted Dates for Standard and Alternate Protest and Appeal Procedures.

Adjusted Dates: The statutory dates and deadlines may be adjusted to reflect dates that do not conflict with weekends or holidays. Refer to Addendum 9-A, Statutory and Adjusted Dates for Standard and Alternate Protest and Appeal Procedures.

Counties may wish to include information on the back of the Notice of Determination regarding appeals after the county board of equalization. The following language may be added at the county’s discretion.

If you are dissatisfied with the County Board of Equalization’s decision and you wish to continue your appeal, you must appeal within 30 days of the date of the County Board’s written decision with ONE of the following options: The Board of Assessment Appeals, District Court, or Binding Arbitration. Information concerning further appeals will be included with the County Board’s written decision. For a list of arbitrators, contact the County Commissioners at the address listed for the County Board of Equalization.

Access County Assessors' Template Forms.

Special Notices of Valuation

Assessors are allowed under statute to change property values after regular Notices of Valuation have been mailed, but only in the following circumstances:

- Omission of property from the tax warrant

- New construction added to assessment roll after May 1

- Titled manufactured home moved into the county from out of state

- Titled manufactured home not exempt as inventory

- Forfeiture of exempt status of property

- Revocation of exempt status by the Property Tax Administrator

- Loss of exempt status due to transfer of property

- Loss of exempt status because property is no longer leased by the state or political subdivision of the state

- Under-reported oil and gas volume

If values are changed based on one of the reasons above, the taxpayer must be given due process to challenge the new value. The Division of Property Taxation recommends that the assessor send the taxpayer a Special Notice of Valuation that gives the taxpayer notice of the new value and the opportunity to challenge the value.

For a more detailed discussion of the circumstances under which a Special Notice of Valuation should be issued, as well as the procedures for issuing a Special Notice of Valuation, refer to Chapter 3, Specific Assessment Procedures, and to ARL Volume 3, REAL PROPERTY VALUATION MANUAL, Chapter 6, Valuation of Natural Resources.

Sections 39-5-125 and 39-10-101(2)(a), C.R.S., authorize retroactive assessments only against “omitted property” not against “omitted value.”

Section 39-8-102(1), C.R.S., authorizes the county board to correct any errors made by the assessor. Such errors should be brought to the attention of the county board of equalization. A sample memo from an assessor notifying the county board of an error in valuation is shown in Addendum 9-E, Memo to CBOE Requesting Change in Value or Classification. If the county board determines that an adjustment is warranted, the county board issues a resolution to effect the change and mails a notice to the property owner that explains the board’s decision and advises the property owner of his/her appeal rights. A sample notice from the county board of equalization to an owner whose property was valued in error is shown in Addendum 9-H, Sample Notice from CBOE to Property Owner Regarding Change in Value or Classification.

Section 39-10-101(2)(d), C.R.S., authorizes retroactive assessments of omitted property or production of mines and oil and gas leaseholds and lands.

Access County Assessors' Template Forms.

Special Notice of Valuation – Real Property

Specific Requirements

The sample Real Property Special Notice of Valuation illustrates the form content required by the Property Tax Administrator and § 39-5-121(1), C.R.S. While the majority of the data that must be inserted in each section of the form is self-explanatory, items that may require additional explanation are addressed below.

Property Classification: The property must be listed by its class or subclassification description. For agricultural property, land and improvements must be listed and valued separately.

Property Values: Property values must be stated in the form of actual values. Listing the assessed value on the NOV is prohibited by law. For agricultural property, land and improvements must be listed and valued separately. For all other property, the total property value must be listed, § 39-5-121(1)(a), C.R.S.

Prior Actual Value: This section should be completed using the value that appeared on the last NOV that was issued for the property.

Actual Value for Tax Year _____: The appropriate tax year must be inserted.

Full Year: If the property is being assessed for the full year, the actual value should be listed in this section of the form.

Partial Year: If the property is being assessed for a portion of the year, the prorated value of the property should be listed in this section of the form.

Spanish Language Requirements: On October 21, 1985, the State Board of Equalization issued an order requiring certain counties to print a Spanish language statement on their NOVs. A second order, issued July 10, 1986, modified the Spanish language statement. The orders were issued pursuant to an action filed against the state board in Denver District Court by a group of Conejos County taxpayers. One of the points argued by the group was that county taxpayers were denied their right of due process by receiving NOVs written solely in English when a majority of county residents speak Spanish. The parties stipulated, and the court remanded the matter back to the state board to issue orders consistent with the stipulation.

The Director of the Census Bureau determines which counties must comply with the minority language assistance provisions of Section 203 of the voting rights act of 1965, as amended in 1982, 42 US CONST. 1973 et seq. Based on the results of the 2010 census, the following counties must comply: Costilla, Denver, and Rio Grande. Refer to 9-C, Spanish Language Requirements, for the required Spanish language that must be included on the Special NOV

Special Protest Form: A form that may be completed by the property owner to initiate a protest of the classification or valuation of the property must be included with each Special NOV. Refer to the Real Property Special Protest Form shown in this chapter.

Property Characteristics: An itemized listing of the land and improvements, as well as the property characteristics that are germane to value must be included, § 39-5-121(1)(b)(I) and (II), C.R.S. To satisfy the first requirement, assessors may choose to provide a count and a total square footage or acreage for each subclassification comprising the subject property. To satisfy the second requirement, the physical characteristics relied upon to determine the actual value of the property (characteristics “germane to value”) must be listed. Each assessor must determine the categories of data to be included to satisfy the requirements set forth in § 39-5-121(1)(b)(I) and (II), C.R.S.

Although this information is only required by law to appear on the Special NOV if the tax year at issue was a reappraisal year, the Division recommends supplying an itemized listing of the land and improvements, as well as the property characteristics that are germane to value on all Real Property Special NOVs.

Estimate of Taxes: The assessor shall include in the notice an estimate of the taxes, or an estimated range of the taxes, owed for the current property tax year.

The following statement must be included in bold-faced type:

The tax amount is merely an estimate based upon the best information available. You have the right to protest the adjustment in valuation, but not the estimate of taxes, § 39-5-121(1), C.R.S.

Commercial Property Approach to Value Statement: Any NOV sent to the owner of commercial property must include contact information for the relevant county assessor along with the following statement: "if you would like information about the approach used to value your property, please contact your county assessor."§ 39-5-121(4)(b), C.R.S.

The value of the property will be entered on the tax warrant for the following reason(s):

This section of the form must be completed. Possible explanations include but are not limited to the following:

- Your newly-constructed property was discovered after Notices of Valuation were mailed on May 1 of this year.

- Your property was omitted from the tax warrant for the tax year shown above.

- Your improvement was assessed as partially completed last year. As of January 1 of the tax year shown above, the improvement was fully completed.

- Your newly-constructed property was partially completed as of January 1 of the tax year shown above.

- Your titled manufactured home was moved into the county from another state.

- The exempt status of the titled manufactured home changed because it is no longer listed as inventory and located on a manufactured home dealer’s sales display lot.

- The exempt status of the property was forfeited because your organization failed to file an Exempt Property Report (Form 970) with the Property Tax Administrator.

- The exempt status of the property was revoked by the Property Tax Administrator.

- The property no longer qualifies for exemption due to transfer of ownership. If you think the property may qualify for exemption for religious purposes, private schools, or strictly charitable purposes, please contact the Division of Property Taxation at 303-864-7780 to apply for an exemption.

- The property no longer qualifies for exemption as the lease or rental agreement with the state, political subdivision or state-supported institution of higher education has been vacated.

Data Gathering Period: The year of the 18-month data gathering period and the year of the five-year data gathering period applicable to the tax year at issue must be completed.

Intervening Year Criteria

Increase in Value of Land or Improvement Greater than 75%: If the tax year at issue was an intervening year and the difference between the actual value of the land or improvement in the reappraisal year and the actual value of the land or improvement in the intervening year increased by more than 75%, an explanation for the increase in value must be provided, § 39-5-121(1)(a), C.R.S. Note than the explanation is required when either the land or the improvement value increases by more than 75% - not simply when the total actual value increases by more than 75%.

County Discretion

Data Gathering Period: In the last two sentences of the Valuation Information section shown on the reverse side of the NOV, the references to the 18-month data gathering period may be changed to reflect the data gathering period used by the county, e.g. a 24-month data gathering period.

Special Protest Form: In lieu of sending a separate protest form with the Special NOV, an abbreviated version of the Special Protest Form may be printed below the Protest Procedures section on the reverse side of the Special NOV. Refer to the Real Property Special Protest Form standards shown in this chapter.

If an abbreviated version of the protest form is incorporated into the Real Property Special NOV, the second paragraph in the section entitled “Protest Procedures” should be changed to:

To assist you in the protest process, you may elect to complete and submit the Real Property Special Protest Form shown below.

Access County Assessors' Template Forms.

Special Notice of Valuation – Personal Property

Specific Requirements

The sample Personal Property Special Notice of Valuation illustrates the form content required by the Property Tax Administrator and § 39-5-121(1.5)(a), C.R.S. While the majority of the data that must be inserted in each section of the form is self-explanatory, items that may require additional explanation are addressed below.

Property Owner: With the exception of personal property located on oil and gas leaseholds and lands, the name and address of the owner of the personal property should be inserted in this section of the Special NOV. For personal property located on oil and gas leaseholds and lands, the name and address of the operator who filed the declaration schedule should be inserted in this section of the Special NOV, § 39-5-121(1.5)(b), C.R.S.

Property Classification: The property may be described by its subclassification description or by type, e.g., Furniture, Fixtures, Machinery, Equipment, etc.

Property Values: Property values must be stated in the form of actual values. Listing the assessed value on the NOV is prohibited by law. For agricultural property, land and improvements must be listed and valued separately. For all other property, the total property value must be listed, § 39-5-121(1)(a), C.R.S.

Prior Actual Value: This section should be completed using the value that appeared on the last NOV that was issued for the property.

Actual Value for Tax Year ___ : The appropriate tax year must be inserted.

Estimate of Taxes: The assessor shall include in the notice an estimate of the taxes, or an estimated range of the taxes, owed for the current property tax year.

The following statement must be included in bold-faced type:

The tax amount is merely an estimate based upon the best information available. You have the right to protest the adjustment in valuation, but not the estimate of taxes, § 39-5-121(1), C.R.S.

Spanish Language Requirements: On October 21, 1985, the State Board of Equalization issued an order requiring certain counties to print a Spanish language statement on their NOVs. A second order, issued July 10, 1986, modified the Spanish language statement. The orders were issued pursuant to an action filed against the state board in Denver District Court by a group of Conejos County taxpayers. One of the points argued by the group was that county taxpayers were denied their right of due process by receiving NOVs written solely in English when a majority of county residents speak Spanish. The parties stipulated, and the court remanded the matter back to the state board to issue orders consistent with the stipulation.

The Director of the Census Bureau determines which counties must comply with the minority language assistance provisions of Section 203 of the voting rights act of 1965, as amended in 1982, 42 US CONST. 1973 et seq. Based on the results of the 2010 census, the following counties must comply: Costilla, Denver, and Rio Grande. Refer to Addendum 9-C, Spanish Language Requirements, for the required Spanish language that must be included on the Special NOV.

Special Protest Form: A form that may be completed by the property owner to initiate a protest of the valuation of the property must be included with each Special NOV. Refer to the Personal Property Special Protest Form shown in this chapter.

Commercial Property Approach to Value Statement: Any NOV sent to the owner of commercial property must include contact information for the relevant county assessor along with the following statement: "if you would like information about the approach used to value your property, please contact your county assessor." § 39-5-121(4)(b), C.R.S.

The value of the property will be entered on the tax warrant for the following reason(s):

This section of the form must be completed. Possible explanations include but are not limited to the following:

- Your taxable personal property was omitted from the tax warrant for the tax year shown above.

- The exempt status of the personal property was forfeited because your organization failed to file an Exempt Property Report (Form 970) with the Property Tax Administrator.

- The exempt status of the personal property was revoked by the Property Tax Administrator.

- The personal property no longer qualifies for exemption due to transfer of ownership.

County Discretion

Special Protest Form: In lieu of sending a separate protest form with the Special NOV, an abbreviated version of the protest form may be printed below the Protest Procedures section on the reverse side of the Special NOV. Refer to the Personal Property Special NOV form standards shown in this chapter.

If the protest form is incorporated into the Personal Property Special NOV, the second paragraph in the section entitled “Protest Procedures” should be changed to:

To assist you in the protest process, you may elect to complete and submit the Personal Property Special Protest Form shown below.

Access County Assessors' Template Forms.

Special Notice of Valuation – Oil and Gas Leaseholds and Lands

Specific Requirements

The Oil and Gas Leaseholds and Lands Special Notice of Valuation is to be used solely for reporting oil and gas production. Personal property used in the production of oil and gas should be reported on a Personal Property Notice of Valuation.

The sample Oil and Gas Leaseholds and Lands Special Notice of Valuation illustrates the form content required by the Property Tax Administrator and §§ 39-5-121(1.5)(a) and 39-7-102.5, C.R.S. While the majority of the data that must be inserted in each section of the form is self-explanatory, items that may require additional explanation are addressed below.

Property Classification: The property must be described by its subclassification description, e.g., Producing Oil/Primary, Producing Oil/Secondary, Oil Shale/In-Situ, etc.

Actual/Production Value: Pursuant to § 39-7-102, C.R.S., the calculation of value for property classified as oil and gas leaseholds and lands is the valuation for assessment. The valuation for assessment of oil and gas leaseholds and lands is 87.5% of primary production, and 75% of secondary and tertiary production, § 39-7-102, C.R.S.

Actual/Production Value for Tax Year : The appropriate tax year must be inserted.

Estimate of Taxes: The assessor shall include in the notice an estimate of the taxes, or an estimated range of the taxes, owed for the current property tax year.

The following statement must be included in bold-faced type:

The tax amount is merely an estimate based upon the best information available. You have the right to protest the adjustment in valuation, but not the estimate of taxes, § 39-5-121(1), C.R.S.

Spanish Language Requirements: On October 21, 1985, the State Board of Equalization issued an order requiring certain counties to print a Spanish language statement on their NOVs. A second order, issued July 10, 1986, modified the Spanish language statement. The orders were issued pursuant to an action filed against the state board in Denver District Court by a group of Conejos County taxpayers. One of the points argued by the group was that county taxpayers were denied their right of due process by receiving NOVs written solely in English when a majority of county residents speak Spanish. The parties stipulated, and the court remanded the matter back to the state board to issue orders consistent with the stipulation.

The Director of the Census Bureau determines which counties must comply with the minority language assistance provisions of Section 203 of the voting rights act of 1965, as amended in 1982, 42 US CONST. 1973 et seq. Based on the results of the 2010 census, the following counties must comply: Costilla, Denver, and Rio Grande. Refer to Addendum 9-C, Spanish Language Requirements, for the required Spanish language that must be included on the Special NOV.

Special Protest Form: A form that may be completed by the property owner to initiate a protest of the valuation of the property must be included with each Special NOV. Refer to the Oil and Gas Leaseholds and Lands Special Protest Form shown in this chapter.

The value of the property will be entered on the tax warrant for the following reason(s):

This section of the form must be completed. Possible explanations include but are not limited to the following:

- The property was omitted from the tax warrant for the tax year shown above.

County Discretion

Schedule Number and Property Classification: Rather than sending multiple Special NOVs to a single owner, a spreadsheet showing the classification and value of each property may be attached to the Special NOV. “See attached spreadsheet” should appear in the Schedule Number and Property Classification sections of the NOV.

Special Protest Form: An abbreviated version of the protest form may be printed below the Protest Procedures section on the reverse side of the Special NOV. Refer to the Oil and Gas Leaseholds and Lands Special Protest Form standards shown in this chapter.

If the protest form is incorporated into the Oil and Gas Leaseholds and Lands Special NOV, the second paragraph in the section entitled “Protest Procedures” should be changed to:

To assist you in the protest process, you may elect to complete and submit the Oil and Gas Leaseholds and Lands Special Protest Form shown below.

Access County Assessors' Template Forms.

Special Notice of Valuation – Producing Mines

Specific Requirements

The sample Producing Mines Special Notice of Valuation illustrates the form content required by the Property Tax Administrator and §§ 39-5-121(1.5)(a) and 39-6-111.5, C.R.S. While the majority of the data that must be inserted in each section of the form is self-explanatory, items that may require additional explanation are addressed below.

Property Classification: The property must be described by its subclassification description, e.g., Precious Metals, Molybdenum, Strategic Minerals, etc.

Actual/Production Value: Pursuant to § 39-6-106(2), C.R.S., the calculation of value for property classified as producing mines (except mines that primarily produce coal, asphaltum, rock, limestone, dolomite or other stone products, sand, gravel, clay or earths) is the valuation for assessment. The valuation for assessment for producing mines not excepted from the provisions of § 39-6-106(2), C.R.S., is either 25% of gross proceeds or 100% of the net proceeds of the prior year’s production, whichever is greater, § 39-6-106(2), C.R.S.

Prior Actual/Production Value: This section should be completed using the value that appeared on the last NOV that was issued for the property.

Actual/Production Value for Tax Year : The appropriate tax year must be inserted.

Estimate of Taxes: The assessor shall include in the notice an estimate of the taxes, or an estimated range of the taxes, owed for the current property tax year.

The following statement must be included in bold-faced type:

The tax amount is merely an estimate based upon the best information available. You have the right to protest the adjustment in valuation, but not the estimate of taxes, § 39-5-121(1), C.R.S.

Spanish Language Requirements: On October 21, 1985, the State Board of Equalization issued an order requiring certain counties to print a Spanish language statement on their NOVs. A second order, issued July 10, 1986, modified the Spanish language statement. The orders were issued pursuant to an action filed against the state board in Denver District Court by a group of Conejos County taxpayers. One of the points argued by the group was that county taxpayers were denied their right of due process by receiving NOVs written solely in English when a majority of county residents speak Spanish. The parties stipulated, and the court remanded the matter back to the state board to issue orders consistent with the stipulation.

The Director of the Census Bureau determines which counties must comply with the minority language assistance provisions of Section 203 of the voting rights act of 1965, as amended in 1982, 42 US CONST. 1973 et seq. Based on the results of the 2010 census, the following counties must comply: Costilla, Denver, and Rio Grande. Refer to Addendum 9-C, Spanish Language Requirements, for the required Spanish language that must be included on the Special NOV.

Special Protest Form: A form that may be completed by the property owner to initiate a protest of the valuation of the property must be included with each Special NOV. Refer to the Producing Mines Special Protest Form shown in this chapter.

The value of the property will be entered on the tax warrant for the following reason(s):

This section of the form must be completed. Possible explanations include but are not limited to the following:

- The property was omitted from the tax warrant for the tax year shown above.

County Discretion

Special Protest Form: In lieu of sending a separate protest form with the Special NOV, an abbreviated version of the protest form may be printed below the Protest Procedures section on the reverse side of the Special NOV. Refer to the Producing Mines Special Protest Form standards in this chapter.

If the protest form is incorporated into the Producing Mines Special NOV, the second paragraph in the section entitled “Protest Procedures” should be changed to:

To assist you in the protest process, you may elect to complete and submit the Producing Mines Special Protest Form shown below.

Access County Assessors' Template Forms.

Special Notice of Valuation – Possessory Interest