Introduction and Legal Basis

Using Chapter 6, Oil and Gas Equipment Valuation, as a guide, Colorado county assessors will be able to uniformly value oil and gas equipment across the state. All surface equipment and submersible pumps and sucker rods are taxable as personal property pursuant to § 39-7-103, C.R.S. For reference, the statute is repeated here in its entirety.

Surface and subsurface equipment valued separately.

All surface oil and gas well equipment and submersible pumps and sucker rods located on oil and gas leaseholds or lands shall be separately valued for assessment as personal property, and such valuation may be at an amount determined by the assessors of the several counties of the state, approved by the administrator, and uniformly applied to all such equipment wherever situated in the state. All other subsurface oil and gas well equipment, including casing and tubing, shall be valued as part of the leasehold or land under section 39-7-102.

§ 39-7-103, C.R.S.

The assessors of the several counties of the state, with input from industry and approval of the Property Tax Administrator, developed an equipment valuation method using Basic Equipment Lists (BELs) and valuation grids. The BELs were developed for the different types of oil and gas wells found in the state, and are used to identify and value equipment common to each particular type of well by basin, depth, production level, and method of production. Addendum 6-C, Additional Installed Equipment List, with corresponding values is provided in this chapter for the purpose of adding specific equipment to the BELs as necessary, depending on the information provided by the operator and from field inspections. Addendum 6-D, Stored Equipment List, is provided in this chapter to value equipment that is located at the wellsite, yard, or warehouse, is not in use, and is not declared as inventory of merchandise by the equipment owner. Addendum 6-E, Communal Equipment List, is provided in this chapter to value shared equipment on multi-well pads, and to value any tanks and additional equipment associated with an injection or disposal well that is not valued with a shared gathering system.

Accompanying each BEL are three valuation grids. The grids place a value on the BEL based on the condition of its equipment and the depth and production of its well. The three grids distinguish between very good condition equipment, average condition equipment, and minimum condition equipment. The procedure for valuing the equipment is discussed beginning with the Approaches to Value section in this chapter. At the end of the chapter, valuation problems that include example worksheets, illustrate the procedure.

Occasionally it may be necessary to modify or add to the BELs. This may occur with changes in technology or production practices. The BELs may be modified or added to if the change in the BEL configuration is significant for the basin affected.

The BEL modification or addition must be documented along with the depth, product, and production method. The assessors of the several counties of the state will determine if the new or modified BEL is appropriate, approve the new or modified BEL, determine an accurate value for such BEL and forward it to the Division of Property Taxation with a recommendation for approval by the Property Tax Administrator for inclusion in the manual.

The Additional Installed, Stored Equipment, and Communal Equipment Lists may also need to be modified. If an assessor believes that equipment needs to be added to the Additional Installed, Stored Equipment, or Communal Equipment Lists, they must submit the list of equipment to the assessors of the several counties of the state. They will determine if the equipment should be included as part of the Additional Installed, Stored Equipment, or Communal Equipment List, determine an accurate value for such equipment and forward it to the Division of Property Taxation with a recommendation for approval by the Property Tax Administrator for inclusion in the manual.

BELs were developed only for production and wellsite processing equipment, which is defined as the equipment necessary to produce, separate, and store fluids from the reservoir to the custody transfer point. Associated buildings and/or other improvements are valued as real property; however they must be valued and abstracted separately from the production value and personal property value of the well.

The custody transfer point for oil is considered to be the inlet of the Lease Automatic Custody Transfer (LACT) Unit or the outlet of the oil storage tank, whichever is appropriate for each lease. The custody transfer point for gas is considered to be the inlet to the gas meter run. If the producer maintains custody of the production beyond the lease line, then the custody transfer point will be considered to be the lease line.

All property beyond the custody transfer point is subject to local assessment by the assessor or unit assessment by the Division of Property Taxation as state assessed property. Equipment located in off-site facilities such as water/gas injection plants, field-wide gathering systems, gas processing plants, and amine production plants is not included or valued in this chapter. Also, CO2 wells are not included or valued in this chapter. This equipment is subject to local assessment by the assessor or central assessment by the Division's State Assessed Section. Only equipment located on the wellsite, or associated with the wellsite, but stored and not held for resale, is valued using this chapter.

Approaches to Value

In Colorado, assessors determine the "actual value" of taxable personal property. Colorado statutes define actual value as that value determined by appropriate consideration of the following approaches to value:

The BELs and the valuation grids shall be used to determine the actual value of the production equipment.

Oil and gas equipment valuation is subject to three general personal property exemptions:

- Exemption of “consumable” personal property.

- Exemption of $52,000 or less in total actual value of taxable equipment (personal property) on a “per county” basis.

- Exemption of personal property acquired but not yet put in to first use.

According to § 39-3-119, C.R.S., the Division has established criteria to determine whether or not the personal property qualifies as “consumable.” Please refer to Chapter 2, Discovery, Listing, and Classification, in this manual for specific information regarding consumable personal property.

In accordance with § 39-3-119.5, C.R.S., personal property is exempt from ad valorem taxation if the total actual value of all taxable well equipment (personal property) owned by the taxpayer per county is $52,000 or less. The real property valuation of the leasehold interest, based on well production, must not be combined with the personal property value to determine if the $52,000 threshold has been exceeded. The threshold is determined using only personal property valuation.

Cost Approach

The Cost Approach is described in Chapter 3, Valuation Procedures. To reiterate, the cost approach is based upon the principle that the value of a property equals the cost of acquiring an equally desirable substitute property. It is essentially an estimate of the cost of replacing the subject with a new property that is equivalent in function and utility and then adjusting the RCN value for appropriate depreciation. The current BELs reflect the most appropriate equipment necessary to produce a given amount of fluid from a given depth.

Sales Comparison (Market) Approach

The sales comparison (market) approach to value is based upon the assumption that property value may be measured by analyzing what buyers pay for similar property. The method used in the chapter to determine the market value is the sales comparison method. Market value can be defined as, “The most probable price, as of a specified date, in cash, or in terms equivalent to cash, or in other precisely revealed terms, for which the specified property rights should sell after reasonable exposure in a competitive market under all conditions requisite to fair sale, with the buyer and seller each acting prudently, knowledgeably, and for self-interest, and assuming that neither is under undue duress” (The Appraisal of Real Estate, 15th Edition, The Appraisal Institute, Chicago, IL, 2020).

The market value for oil and gas equipment is based on many considerations, including, but not limited to:

- Availability of equipment

- Current function of equipment

- Condition of equipment

- Current capacity of equipment

- Age of equipment

The method values the equipment separately from the value of the leasehold. When oil and gas properties having on-site equipment sell, any portion of the sales price that is attributable to on-site equipment may be different than the values listed herein, depending on the value placed on the oil and gas reserves. All values contained within this chapter reflect market value of equipment inclusive of acquisition cost, installation cost, sales/use tax and freight to the point of use.

Income Approach

The income approach to value has limited applicability to oil and gas equipment owned by the operator. However, the income approach can be used to value leased or rented equipment. The annualized net income stream can be capitalized to determine a value by the income approach. Refer to Chapter 3, Valuation Procedures, for additional information on the use of the income approach.

Market Approach Valuation Procedures

The following ten steps are essential to accurately value installed oil and gas equipment in the State of Colorado, using the Market Approach to Value. A detailed discussion of each step follows the list:

Step #1 Develop a detailed inventory of the personal property. This will require a physical inspection and an adequate description of the equipment, condition and ownership.

Step #2 Establish the total production for the lease, including oil, gas, and water production.

Step #3 Determine the depth of the well.

Step #4 Establish which method (flowing or pumping) is used to lift the production from the reservoir.

Step #5 Locate the well in its appropriate geological basin.

Step #6 Select the appropriate BEL based on the factors above.

Step #7 Determine the condition of the equipment.

Step #8 Determine stripper well status. With the above information in hand, a value can now be placed on the equipment for each well. Using the appropriate valuation grid, find the value of the BEL based on the depth and total production level. Add the value of any additional installed equipment. Add the value of any stored equipment. The result is the current actual value of the equipment for the well. Identify and value any shared equipment.

Step #9 Apply level of value (LOV) adjustment factor. To adjust to the specified year's level of value, multiply the current actual value by the specified year's adjustment factor. The LOV adjustment factor is sometimes referred to as the "rollback factor."

The 2024 adjustment (rollback) factor is: 0.95

Step #10 Multiply the adjusted actual value by the appropriate assessment rate for all personal property.

Detailed Discussion of Valuation Steps

Step #1 – Detailed Inventory of Personal Property

Itemized Listing Required From Operators

To use Chapter 6, Oil and Gas Equipment Valuation, the assessor must have a detailed listing of all oil and gas equipment located on each well in the county. Operators of producing oil and gas wells are required to file a production statement and complete listing of all machinery and equipment owned as of the assessment date, by well. This information is submitted to the assessor on the DS 658, Oil and Gas Real and Personal Property Declaration Schedule. These schedules must be completely filled out, signed, and filed with the county assessor.

Extension of filing deadlines beyond April 15 for receipt or postmark of the DS 658, Oil and Gas Real and Personal Property Declaration, and the lengths of these extensions are solely at the discretion of the county assessor pursuant to § 39-7-101(2), C.R.S. If granted, such extensions are without charge to the taxpayer. However, in the absence of the assessor granting such an extension, or after a granted extension period has elapsed, the assessor may impose a late penalty of $100 per calendar day, per schedule, not to exceed $3,000 per calendar year.

Pursuant to § 39-7-101(3)(a), C.R.S., the total amount of all fines assessed against an owner or operator in any calendar year shall not exceed three thousand dollars ($3,000) regardless of the number of leases or units owned or operated by the owner or operator, or the number and length of the willful failures or refusals to comply with an assessor’s request for documentation by the owner or operator.

If the operator has previously rendered a complete list by well name, then the operator will not be required to render such a list in the future. The operator only needs to provide annual additions or deletions.

It is suggested that assessors send a form letter along with the declaration schedule to operators within the county requesting a detailed listing of their oil and gas equipment. The letter should explain that such a listing is required by § 39-5-107, C.R.S., and should include the following information.

- Listing of all equipment, including but not limited to:

- Down-hole equipment including sucker rods and submersible pumps (Casing and tubing should not be listed since they are included in the value of the leasehold)

- Wellhead equipment complete with pipes and valves

- Surface pumping units with gas engine or electric motor

- Treating equipment including separators, heaters, free water knockouts, gas production units, dehydrators, etc.

- Storage and loading facilities

- Metering devices and equipment, including meter house if owned by the producer

- Flow lines and related equipment

- Pressure maintenance and secondary recovery equipment

- Electric, automatic, and computerized controls

- Power lines and poles, transformers, and communication lines

- A comment noting that the description of the equipment should include the following: manufacturer, model, capacity size, length, diameter, etc.; whether the equipment is installed or stored at the well-site; and any other information necessary for identification and valuation

- An explanation as to why, on future declaration schedules, the owner will need to furnish only additions and deletions since the assessor can update the original listing from such information

Physical Inventory by the Assessor

The assessor should implement a program for the physical inspection and listing of all oil and gas equipment in the county. This enables the assessor to compare the listings rendered by each operator with the physical inventory obtained by field inspection, determine the equipment missing from the incomplete declarations, and become more familiar with the equipment in the county’s oil and gas fields.

Before making a physical inspection and listing of the equipment, the assessor or appraiser should contact someone with authority for the particular lease, such as the operator, tax representative, production foreman, or pumper. These people are then aware that the appraiser will be present on the lease site, taking inventory.

At the time of inspection, the appraiser, using Addendum 6-B, Equipment Valuation Worksheet, found later in the chapter, should list the following information for each piece of equipment:

- Type of equipment, such as surface pumping unit, separator, treater, gas production unit, oil storage tank, etc.

- Make, model, and description, including size, diameter, height, etc., or any other information necessary to adequately describe the equipment

- Year manufactured or estimated age

- Condition of equipment

- See Step #7 – Condition of Equipment, in this chapter, for the guidelines on evaluating equipment.

- Whether the equipment is installed, stored, or shared at the well-site

- Ownership – taxable property in Colorado is generally assessable only to the owner thereof

Step #2 – Production Total

The BELs in this chapter are based on the production of all fluids, both oil and water, or the production of gas. The equipment needed on a lease is directly related to the volume of production. Therefore, it is important to determine the production total.

The actual production total will usually fall between one of the incremental values in the BEL tables. Without evidence to the contrary, always round up to the next highest production total. In theory, equipment used on a well producing 300 barrels of oil would not be adequate if the well were to produce 301 barrels of oil; therefore the BEL value associated with the next highest production total listed should be used.

Request Information From Operator

Oil and gas operators are required to provide the average flow rate of each product produced at each well. The information should include oil, water, and gas production. The flow rates on multiple well leases should be determined by well. However, total production can be divided by the number of wells to determine an average flow rate for each well.

In determining whether any given well should be classified as a “stripper well”, the assessor should request the total number of days that the well was capable of operation. The assessor should then determine the type of well (oil or gas) and calculate the average flow rate per day by dividing the oil or gas production amount declared by the number of days the well was capable of operation. If the resulting number is 10 barrels (Bbls) of oil per day (or less), for an oil well, or 60 Mcf (1,000 cubic feet) of gas per day (or less), for a gas well, then the well should be classified as a stripper well and valued using the minimum condition grid. When a well produces both oil and gas, the average flow rate per day of each product must fall below their respective thresholds to be classified as a stripper well.

To determine the number of days the well was capable of operation, subtract the number of days the equipment was not operated because of maintenance or mechanical reasons from the total calendar days in a year (365).

If the operator fails to submit flow rate information, the assessor should determine the average operating days for other wells within the field and calculate a “Best Information Available” flow rate for stripper well designation and well valuation purposes.

An example of the flow rate calculation for both stripper well designation and the actual well valuation is shown below.

Example:

Stripper Well Designation

Previous calendar year oil production 2,550 Bbls

(product quantity only – no water)

Number of days (365 days – 65 days) 300 days

2,550 Bbls ÷ 300 days = 8.5 Bbls/day

Flow rate per day 8.5 Bbls/day (used to determine Stripper Well classification)

Example:

Well Flow Rate Calculation for Valuation

Previous calendar year fluid production 28,000 Bbls

(oil product and water)

Number of days (365 days – 65 days) 300 days

28,000 Bbls ÷ 300 days = 93.3 Bbls/day

Flow rate per day: 93.3 Bbls/day (used to determine volume (Barrels) in BEL grid)

Verification by Assessor

The assessor can audit the information provided by the taxpayer in the following ways.

- Request information from the Colorado Energy and Carbon Management Commission (ECMC).

Colorado Energy and Carbon Management Commission

The Chancery Building

1120 Lincoln Street, Suite 801

Denver, CO 80203

(303) 894-2100

Operators are required to report oil production, water production, and gas production by well to the ECMC on a monthly basis. The information can be accessed on the COGCC website. See ARL Volume 3, Real Property Valuation Manual, Chapter 6, Addendum 6-H, Instructions for Accessing the ECMC Website, for instructions.

- Check for reasonableness by dividing production reported per well in Section C of the DS 658 by 365 days.

The average flow rate should equal or exceed the quotient because the method assumes that there were no days the well was shut down.

Step #3 – Well Depth

Operators are required to provide the depth of each well. This should be the depth of the perforation into the deepest producing reservoir. A well is often drilled deeper than the depth of the perforations to test for additional reservoirs. The assessor can audit the information by requesting completion reports from the ECMC.

The actual well depth will usually fall between one of the incremental values in the BEL tables. Without evidence to the contrary, always round up to the next highest depth. In theory, equipment used on a well that is 5,000 feet deep would not be adequate for a well that is 5,001 feet deep; therefore the BEL value associated with the next highest depth listed should be used.

Some basins have separate BEL tables for shallow wells. If a well is deeper than the greatest depth on the shallow grid by any amount, it is appropriate to move to the lowest depth of the normal grid with the same equipment configuration.

When valuing horizontal wells, the lowest vertical depth should be used since sucker rods and other well site equipment are not utilized in the horizontal section of these wells. For example, a well with a vertical depth of 6,495 feet that extends horizontally an additional 8,000 feet should be valued using a depth of 6,500 feet.

Step #4 – Method of Production

The BELs have been developed based on the method of lift, i.e., flowing or pumping. The operator should provide the information. The assessor can audit the information by reviewing data gathered by the physical inventory. For instance, if a pumping unit is present, the assessor knows that artificial lift is being employed. If the inventory does not meet the test of reasonableness, the operator should be contacted.

Step #5 – Geological Basins

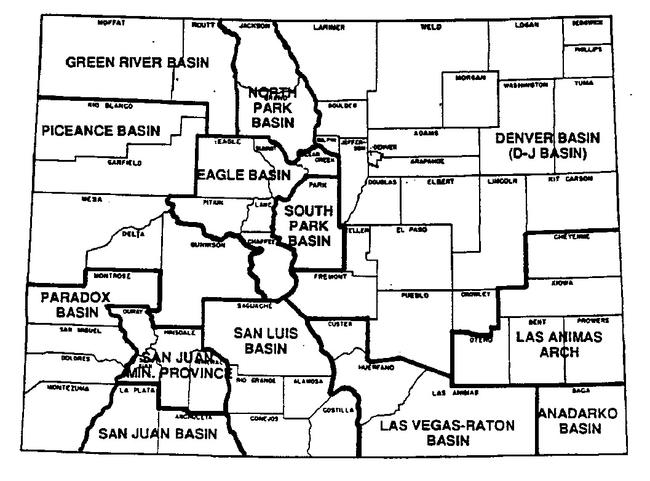

The BELs have been developed after consideration was given to the different equipment necessary to produce oil and gas in the various basins within the state. The American Association of Petroleum Geologists (AAPG) has identified 13 basins in Colorado. In five of these basins, little or no oil or gas activity currently exists. Because of this, corresponding BELs do not exist for these basins. Refer to Addendum 6-A, County/Basin Cross Reference, found later in this chapter, to determine which basin’s BELs to use for valuing equipment in a particular county.

Step #6 – Selection of Appropriate BEL

The correct BEL can now be determined. The BELs are categorized by basin, primary product, and method of lift. Choose the BEL that best conforms to the equipment on the well in question, within the particular basin. If an appropriate BEL cannot be found within the particular basin, the appraiser may use alternate basins to find a BEL that best conforms to the equipment on the subject well. The Division should be advised if alternative basins are used because additional BEL’s may be required for the subject basin.

When determining whether a well should be classified as an oil well or gas well, the assessor should first compare the actual equipment on the wells to the BEL equipment configuration to determine which well type, i.e., oil or gas, exists.

For example, gas wells will generally have a gas production unit (separator) to prepare the gas for insertion into the gas gathering system. On oil well sites, a treater or heater/treater can be found which processes the production emulsion into separate oil and water products. The oil product is then stored in storage tanks, either at the well-site or in a tank battery.

If the assessor is unable to make the appropriate well type determination, the BELs for both an oil well and a gas well should be reviewed, and the BEL that represents the type of well commonly found within the field should be used. If there is still uncertainty about the well type, the assessor should contact the operator to confirm the well classification or contact the Colorado Energy and Carbon Management Commission (ECMC) and use the original well type reported to them.

If the subject well does not share equipment with other wells, then the appropriate BEL will include all equipment required for production. This will generally include the wellhead, flowlines, lifting equipment, separating equipment, and liquid storage, if necessary. It may also be necessary to add equipment to satisfy regulatory requirements (flares, vapor recovery units, etc.), or account for non-uniform use or non-uniform ownership of common items on the lease (measurement equipment, LACT units, etc.). Addendum 6-C, Additional Installed Equipment List, is used to value any additional equipment, which is then added to the subject’s BEL value. Any additional tanks associated with a single well, in addition to those included on the subject’s BEL configuration, are not separately valued. They are considered super adequate and their contribution to value is already included in the BEL, unless the well is an injection well or disposal well. Any tanks or additional equipment associated with an injection well or disposal well are valued using Addendum 6-E, Communal Equipment List, and added to the subject’s BEL value.

If the subject well shares equipment with other wells, then the appropriate BEL may not include all equipment required for production. A wellhead will be included for each BEL; however shared equipment, which can include flowlines, lifting equipment, separating equipment, or liquid storage, may or may not be included in the BEL, depending on the basin. Shared equipment will need to be identified and valued separately using Addendum 6-E, Communal Equipment List. Any unshared additional equipment associated with a single well is valued using Addendum 6-C, Additional Installed Equipment List.

STEP #7 – Condition of Equipment

Three valuation grids have been created for each BEL based on the condition of the equipment and status of the well. The grids establish market values for very good condition equipment, average condition equipment, and minimum condition equipment.

In determining the condition of the equipment the assessor should compare information collected from physical inspections with the information reported by the operator on the declaration schedule. If the assessor discovers discrepancies, the operator should be contacted for clarification. However, new equipment on new wells and equipment on shut-in wells will be valued as either very good or minimum, respectively. The descriptions listed below for equipment condition are intended to be guidelines and are not necessarily the sole criteria. The final determination of equipment condition is the assessor’s responsibility.

The age of installed equipment is calculated based on the time between the assessment date and the first month of production for the well, unless there is evidence that the equipment has undergone major overhaul, substantial reconditioning, or refabrication. If the equipment has undergone reconditioning, refabrication, or major overhaul, the assessor should refer to the declaration schedule filed by the operator, and contact the operator for additional information, to determine an effective age of the equipment. For injection wells and disposal wells, the equipment age is calculated based on the time between the assessment date and the month that the well was converted to an injection well or disposal well.

The condition of stored equipment at the lease site should be determined independently from the condition of the equipment listed on the BEL. The condition of any additional installed or shared equipment should be the same as the condition rating determined for the associated BEL, regardless of the actual age of the additional installed or shared equipment.

Choose the grid, under the appropriate BEL, which corresponds to the condition rating of the equipment. The key is the condition of the equipment in total. The existence of one or two pieces of very good, average, or minimum condition equipment will not necessarily move the overall condition rating in those directions.

Very Good

The equipment is in near-perfect to perfect working condition. It has had limited use and has a long service life ahead. This includes equipment associated with a well that is zero to less than five years old.

Average

The equipment is in good mechanical condition and needs no major repairs or maintenance. This includes equipment associated with a well that is five to less than fifteen years old.

Minimum

The equipment has had a substantial amount of service, a limited amount of use remains. Equipment associated with a well that is fifteen years old or more, or equipment associated with a well that meets stripper well status, should be classified as minimum condition equipment.

Coal Bed Methane Wells (Fair condition rating exception)

Coal bed methane wells normally produce large quantities of water prior to any gas production. For coal bed methane wells, the criteria for rating the equipment very good and average applies as stated. An exception based on the age of the well is made under the minimum category.

For coal bed methane wells, equipment associated with a well that is fifteen to less than thirty years old, that is not associated with a stripper well, is valued using the Fair condition category in the appropriate valuation grids. When using the Additional Installed Equipment List, or Communal Equipment List, the Fair value of any additional installed or communal equipment under this exception is calculated as seventy-seven percent (77%) of the component’s Average condition list value. If such equipment is associated with a well that meets stripper well status, or if the equipment is thirty years or older, then it is valued using the minimum condition category in the valuation grids.

Step #8 – Stripper Well Status (Marginal Production)

Oil wells producing an average of 10 barrels or less per day, or gas wells producing 60 Mcf or less of gas per day, should be designated as “stripper wells” for equipment valuation purposes. When a well produces both oil and gas, and the production volume of either product exceeds its threshold, then the well is not classified as a stripper well. The number of days must be calculated based on days during the year the well was capable of operating. This classification applies to primary, secondary, and tertiary recovery wells and is based on product volumes only, without consideration of water production.

New wells cannot be classified as stripper wells until they have at least 12 calendar months of production data available. New wells may have minimal production when first drilled, but then produce substantially more oil or gas after a short period of time in production.

Equipment associated with stripper wells is to be valued using the minimum condition grid associated with the respective BEL for the well. This also applies to shared equipment, on multi-well pad sites, if the number of stripper wells exceeds the number of non-stripper wells associated with the equipment. Otherwise the condition is to be determined based on a physical inspection and the age of the associated equipment. In all cases, adequate documentation should be developed to support the condition rating assigned.

If any additional installed or shared equipment exists, it is valued using Addendum 6-C, Additional Installed Equipment List, or Addendum 6-E, Communal Equipment List, respectively, based on the same condition rating determined for the associated BEL. Add this value to the BEL value to determine the total value of the equipment on the well. Do not add for any additional equipment not shown on the Additional Installed Equipment List.

If there is stored equipment at the well-site, it is valued based on the age and condition of the equipment using Addendum 6-D, Stored Equipment List. Add this value to the BEL value to determine the total value of the equipment on the well.

The Additional Installed Equipment List, the Stored Equipment List, and Communal Equipment List are statewide lists. They are not basin specific.

Step #9 – Apply Level of Value Adjustment Factor

To adjust to the specified year’s level of value, multiply the current actual value by the specified year’s Level of Value (LOV) adjustment factor. The adjustment factor is sometimes referred to as the “rollback factor.”

The 2024 Level of Value (LOV) adjustment factor is: 0.95

Step #10 – Multiply by the Appropriate Assessment Rate

Waste Oil Recycling Operations

Tanks and separators that are associated with operations, which recycle holding pond oil, are not included in the Basic Equipment Lists (BEL) within this chapter. However, tanks and separators have been added to the Additional Installed Equipment List so that these operations may be valued by summing component values from the Additional Installed Equipment List. The use of tank and separator values on the Additional Installed Equipment List is restricted only to these recycling operations. They are not to be added to any other BEL.

Leased/Loaned Equipment Included in the BELS

If any of the equipment included within a BEL is leased or loaned to the operator, it is recommended that the assessor contact the operator to determine the proper allocation. If there is uncertainty as to how the situation is properly treated, the assessor should contact the Division of Property Taxation.

Care should be taken to determine the location of compressors. If the compressors are used and owned by the owner of the well site equipment, the appropriate additional BEL equipment should be used.

When “Gas Booster Line” compressors on the lease are larger than the additional equipment suggests, the county should work with the operator to establish a value. If the compressor is on the gathering system side of the meter, and is controlled by the gathering system operator, it should be valued with the gathering system.

Basic Equipment Lists and Valuation Grids

Basic Equipment Lists have been developed for the following basins that have been defined by the American Association of Petroleum Geologists:

- Anadarko Basin

- Denver-Julesburg (D-J) Basin

- Green River Basin

- Las Animas Arch Basin

- Paradox Basin

- Piceance Basin

- San Juan Basin

- Las Vegas-Raton Basin

BELs have not been developed for the following basins in Colorado. If a county is in one of these basins, refer to the county-by-county listing in the appendix for the alternate basin:

- Eagle Basin

- San Juan Mountain Province

- North Park Basin

- South Park Basin

- San Luis Basin

Within each basin, BELs have been developed for various types of production including the following:

- Pumping Oil Well With Tanks

- Pumping Oil Well Without Tanks

- Flowing Oil Well With Tanks

- Flowing Oil Well Without Tanks

- Pumping Gas Well With Tanks

- Pumping Gas Well Without Tanks

- Flowing Gas Well With Tanks

- Flowing Gas Well Without Tanks

- Water Injection Well or CO2/Water Injection Well

- Water Supply Well

In addition to the ten wellsite configurations listed above, certain basins required new wellsite configurations such as, Coal Seam Gas Wells, Plunger Lift Wells, Progressive Cavity Wells, Electric Submersible Pump (ESP) Wells and Horizontal Gas Wells.

History of the Basic Equipment Lists

Before the Basic Equipment Lists (BELs) were created, all assessors valued oil and gas equipment using the Cost Approach, which required annual submissions of original costs on large inventories of equipment for thousands of wells. The process was very time consuming for industry. Even more time consuming for assessment personnel was verifying data on all the equipment listed, trending to the assessment date, determining physical depreciation, trying to determine if functional or external obsolescence applied to the equipment, and then calculating the value and rolling it back to the level of value for the appraisal date.

The BELs were created and first published in 1990, utilizing the Market Approach, instead of the Cost Approach. The objective was to reduce the workload of both assessment and industry personnel, while recognizing and properly dealing with obsolescence in oilfield equipment. To properly recognize obsolescence, the BELs were based on engineering statistics. A common misconception about the BELs is that they were meant to reflect what is typically found at the wellsite. From their inception, the BELs were designed to reflect what would be typically engineered for a particular wellsite. Engineered configurations indicate what is necessary to produce oil or gas at a given depth, at a given rate of production per day. Any equipment being used on site with greater ability or capacity than that which was engineered to produce such oil or gas is essentially super-adequate to operate the well. By utilizing engineered wellsite configurations in the BELs, super-adequate functional obsolescence is eliminated.

For instance, a 4’ x 15’ vertical heater/treater may be all that is necessary to handle the production of a pumping oil well at a certain depth. However, instead of purchasing a new 4’ x 15’ heater/treater to place at the wellsite, the operator may utilize a 6’ x 20’ vertical heater/treater that the operator has on hand. A 6’ x 20’ unit is a larger, more expensive unit and is super-adequate for the needs of the well. Instead of valuing the 6’ x 20’ unit at the site, the BELs pick up the value of a 4’ x 15’ unit, thus accounting for the functional super-adequate obsolescence of the larger unit.

Note: Using the Cost Approach for the same valuation would require the appraiser to determine the replacement cost new of the unit, deduct for physical depreciation, determine the super-adequate functional obsolescence and then deduct for it, as well. The final outcome would be about the same as the value of a 4’ x 15’ unit, the same age, without functional obsolescence, except that much more work would be required to get there.

Therefore, the operator who is using a 6’ x 20’ unit is assessed at the same level as the operators who have 4’ x 15’ heater/treaters in place. This principle of recognizing obsolescence through the Market Approach in the BELs was accepted and approved by both assessors and industry involved in the first publication of the BELs.

Other BELs have been developed in certain basins where special circumstances warrant additional BELs.

The BEL is a list of the taxable equipment necessary to:

- Produce the fluid from the reservoir to the wellhead

- Separate the fluids into the basic components – oil, gas, and water

- Store and transport the products to the custody transfer point

The custody transfer point for oil is considered to be the inlet of the LACT unit or the outlet of the oil storage tank or tank battery; whichever is appropriate for each lease. The custody transfer point for gas is considered to be the inlet to the gas meter run. If the producer maintains custody of the production beyond the lease line, then the custody transfer point will be considered to be the lease line.

The grids list the value of the equipment based upon a particular range of depths and a particular range of volume produced. Each grid will value the equipment for a particular condition – very good, average, or minimum. Superior or inferior equipment may exist on any given well. However, the most appropriate BEL should be chosen and the corresponding value from the grids assigned to that well. All other oil and gas equipment, e.g., field compressors, are subject to local assessment by the county assessor.

Market Value of Additional Installed Equipment

In addition to the BELs, certain specific equipment, which is atypical to the wellsite, should be listed and valued. The equipment is identified as "Additional Installed or Communal Equipment" on the well. This is the only installed equipment that should be added to the value of the equipment listed on the BEL.

Additional equipment is characterized by its unique nature or its nonstandard ownership. For example, gas meters are included as additional equipment because it has been specifically stated that the BELs list the equipment up to but not including the custody transfer point. However, in some cases the operator owns the gas meter and therefore the value of the gas meter should be added to the total value of the equipment for that particular operator.

When more than one well is drilled on a single pad (multi-well pad), additional equipment (tanks, chemical pumps and tanks, vapor flare systems, etc.) may be “shared” by many wells. In such cases it may be appropriate to designate one “master” well on a multi-well pad and assign all communal equipment being shared on the pad to this master well, in addition to the BEL value for the master well. The remaining wells on the multi-well pad should be valued using the normal BEL procedure. The shared communal equipment assigned to the “master” well on multi-well pads should represent the typically engineered shared equipment configuration for a field or operator. Assessors may also opt to create separate accounts for the value of shared equipment.

Valuation Procedures

The steps for determining the value of additional installed or communal equipment are virtually the same as the steps for determining the value of installed equipment. For more information refer to the Approaches To Value topic at the beginning of this chapter.

The values in the Additional Installed Equipment and Communal Equipment Lists are based on the same condition grading scale as the valuation grids – very good, average, and minimum condition equipment. It should be noted that the values on the lists are statewide and not basin specific, except for the category of "Wellheads."

Wellheads as Additional Equipment

Dual Wellheads

The first two categories of Wellheads listed are: Flanged Wellhead (Total Value) and Threaded Wellhead (Total Value). These values have been supplied so that wells having dual wellheads might be properly valued. Dual wellheads are being used in the extraction of gas from one formation and oil from a second formation located either above or below the first formation. Since the same wellbore is being used, a cost savings is implied. The appropriate BEL to use would be based on the preponderance of production and the type of equipment being used at the wellsite. Please note that values for Flanged Wellhead (Total Value) and Threaded Wellhead (Total Value) are not to be used outside of the dual-well application.

Flanged Wellheads

Flanged wellheads are considered typical for the four basins listed below. Except for the Coal Seam Gas BELs in the San Juan Basin, flanged wellhead market values were included in the development of all the BEL grids in the following basins:

- Green River Basin

- Paradox Basin

- Piceance Basin (including Rangely Oilfield)

- San Juan Basin (except Coal Seam Gas Wells)

Flanged wellheads can be identified by the circle of bolts near the perimeters of both the Casinghead and the Tubinghead.

Threaded Wellheads

Threaded wellheads are considered typical for the remaining basins, which are listed below. Threaded wellhead market values were included in the development of all the BEL grids in these basins:

- Anadarko Basin

- Denver-Julesburg Basin

- Las Animas Arch Basin

- Las Vegas-Raton Basin

Threaded wellheads can be identified by the ability of the Casinghead and Tubinghead to be screwed on to the casing and tubing. There is an absence of bolts. The caps of the Casinghead and Tubinghead have three heavy-duty, exterior prongs that allow them to be tightened by a tool.

Combination Wellheads (Threaded Casinghead/Flanged Tubinghead)

The term “flanged/threaded combo” refers to a wellhead with a threaded Casinghead and a flanged Tubinghead. This combination wellhead is gaining popularity as a safety measure. In the event that a flanged/threaded combo wellhead is discovered or declared on a well in the Anadarko, Denver-Julesburg, Las Animas Arch, or Las Vegas-Raton basin, a “Flanged/Threaded Combo (Differential)” value for the appropriate condition may be added as Additional Installed Equipment. The “Differential” represents the difference between the typical threaded wellhead value and the value of the more expensive flanged/threaded combo wellhead. This “Differential” should be added to the total value of the wellsite equipment. Differential values are not to be used in conjunction with any other basins than those cited in this paragraph.

Atypical Wellhead Use

In the event that a flanged wellhead is discovered or declared on a well in the Anadarko, Denver-Julesburg, Las Animas Arch, or Las Vegas-Raton basin, a “Flanged Wellhead (Differential)” value for the appropriate condition may be added as Additional Installed Equipment. The “Differential” represents the difference between the typical threaded wellhead value and the value of the more expensive flanged wellhead. This “Differential” should be added to the total value of the wellsite equipment. Differential values are not to be used in conjunction with any other basins than those cited in this paragraph.

Vapor Flare/Recovery Systems

In 2004, the Colorado Department of Public Health and Environment (CDPHE) determined that flash emissions from qualifying oil condensate tanks located in the CDPHE designated Eight-hour Ozone Control Area be controlled by one of two methods – by flaring those emissions in a controlled environment or by capturing, compressing, and re-injecting the emissions into a gas system. Note that values for Vapor Flare Systems and Vapor Recovery Systems are not basin-specific and can apply to any tanks having such systems, statewide.

Vapor Flare System (Enclosed Stack)

Currently, oil and gas operators that produce a threshold of 600 barrels per day are required to install an Emission Control Device known as a Vapor Flare System to capture and burn oil condensate tank vapors in an enclosed stack to enhance air quality and prevent further erosion of the ozone layer. Typically, these Vapor Flare Systems are installed on tank batteries that service two or more wells; however, they can be installed on tanks at any given wellsite. A system will generally include 3-inch, interior-diameter pipe attached to the tops of the tanks through which vapors run to a scrubbing unit to remove water, then on to the flare stack for burning/flaring. A typical flare stack is 15 feet high and has from four to six burners, which are located approximately five feet off the ground, to dispose of the vapors.

Vapor Recovery System

The other Emission Control Device being used by some oil and gas operators is called a Vapor Recovery System. Such systems gather emissions the same as the flare systems, except that instead of burning the emissions, these vapors are scrubbed and then compressed so that they can be injected into a standard gas pipeline system. This method achieves the directive to keep flash emissions from damaging the ozone layer, but goes a step further by conserving natural resources. These systems are more costly, because the flare stack is replaced with a compressor, a compressor engine, and sophisticated monitoring equipment.

Add the value of any additional installed equipment to the value of the BEL, along with any stored or shared equipment, to determine the final value for all the equipment at the wellsite. Refer to Addendum 6-C, Additional Installed Equipment List, Addendum 6-D Stored Equipment List, or Addendum 6-E, Communal Equipment List.

Market Value of Stored Equipment

The Stored Equipment List is to be used to value taxable stored equipment located at the wellsite, in a warehouse, or in an inventory yard, which is not listed as inventories of merchandise for sale on a company's books and records. In order for stored oil and gas equipment to be considered inventory held for sale and therefore exempt from property taxation, the owner must provide a detailed listing of the equipment held for sale to the county assessor. In order for any other stored equipment to be taxable, it must have been put into use, by the current owner, at some time prior to the current assessment date and then afterward have been placed into storage. The stored equipment list is never to be used to value installed wellsite equipment.

Valuation Procedures

The steps for determining the value of stored equipment are virtually the same as the steps for determining the value of installed equipment. For more information refer to the Approaches to Value topic at beginning of this chapter. The values in the Stored Equipment List are based on the same condition grading scale as the BEL valuation grids - very good condition equipment, average condition equipment and minimum condition equipment. It should be noted that the values on the list are statewide and not basin specific.

If the stored equipment is located at the wellsite, then add the value of the stored equipment to the value of the BEL and any additional installed or shared equipment to determine the final value for the equipment at the wellsite. For equipment stored in a warehouse or yard, simply total the value of the equipment and place the value on the tax roll.

Wells that have been shut-in and capped or plugged and abandoned will be valued based upon their prior calendar year's production, if any. For shut-in and capped wells without any production during the prior calendar year, the wellhead should be listed and valued and any equipment stored at the wellsite should be listed and valued if it was not held for sale. For plugged and abandoned wells without any production during the prior calendar year, only the value of the equipment stored at the wellsite should be listed and valued if it was not held for sale.

The majority of typical oil field equipment has been included in the Stored Equipment List. However, if the producer declares equipment not listed, or if the assessor cites equipment not listed, then the assessor should determine the value of the equipment in the following manner. If the equipment is in very good condition, then the assessor should contact the operator to determine the cost of the equipment not listed. If the equipment is in average condition or minimum condition then the assessor should contact used equipment dealers in the area and request market value estimates of the equipment. The Division of Property Taxation can also aid in determining equipment market values.

Refer to Addendum 6-D, Stored Equipment List and Addendum 6-F, Examples of Well Equipment Appraisals.

Addendum 6-A, County/Basin Cross Reference

| Country | Basin |

|---|---|

| Adams | Denver (D-J) |

| Alamosa* | San Juan |

| Arapahoe | Denver (D-J) |

| Archuleta | San Juan |

| Baca | Anadarko |

| Bent | Las Animas Arch |

| Boulder | Denver (D-J) |

| Broomfield | Denver (D-J) |

| Chaffee* | Piceance |

| Cheyenne | Las Animas Arch |

| Clear Creek* | Denver (D-J) |

| Conejos* | San Juan |

| Costilla* | San Juan |

| Crowley | Denver (D-J) |

| Custer | Las Vegas-Raton |

| Delta | Piceance |

| Denver | Denver (D-J) |

| Dolores | Paradox |

| Douglas | Denver (D-J) |

| Eagle* | Piceance |

| El Paso | Denver (D-J) |

| Elbert | Denver (D-J) |

| Fremont | Denver (D-J) |

| Garfield | Piceance |

| Gilpin | Denver (D-J) |

| Grand* | Piceance |

| Gunnison | Piceance |

| Hinsdale* | San Juan |

| Huerfano | Las Vegas-Raton |

| Jackson* | Piceance |

| Jefferson | Denver (D-J) |

| Kiowa | Las Animas Arch |

| Kit Carson | Denver (D-J) |

| La Plata | San Juan |

| Lake* | Piceance |

| Larimer | Denver (D-J) |

| Las Animas | Las Vegas-Raton |

| Lincoln | Denver (D-J) |

| Logan | Denver (D-J) |

| Mesa | Piceance |

| Mineral* | San Juan |

| Moffat | Green River |

| Montezuma | Paradox |

| Montrose | Paradox |

| Morgan | Denver (D-J) |

| Otero | Las Animas Arch |

| Ouray* | San Juan |

| Park* | Denver (D-J) |

| Phillips | Denver (D-J) |

| Pitkin* | Piceance |

| Prowers | Las Animas Arch |

| Pueblo | Denver (D-J) |

| Rio Blanco | Piceance |

| Rio Grande* | San Juan |

| Routt | Green River |

| Saguache* | San Juan |

| San Juan* | San Juan |

| San Miguel | Paradox |

| Sedgwick | Denver (D-J) |

| Summit* | Piceance |

| Teller | Denver (D-J) |

| Washington | Denver (D-J) |

| Weld | Denver (D-J) |

| Yuma | Denver (D-J) |

Note: Counties in six basins where little or no oil and gas activity exists at this writing have been placed in appropriate adjoining basins. These counties are noted with an asterisk (*)

Addendum 6-B, Equipment Valuation Worksheet

Addendum 6-B, Equipment Valuation Worksheet

Addendum 6-C, 2024 Additional Installed Equipment List

Addendum 6-C, 2024 Additional Installed Equipment List

Addendum 6-D, 2024 Stored Equipment List

Addendum 6-D, 2024 Stored Equipment List

Addendum 6-E, 2024 Communal Equipment List

Addendum 6-E. 2024 Communal Equipment List

Addendum 6-F, Examples of Well Equipment Appraisals

Example Well Equipment Appraisal #1

You are valuing oil and gas equipment associated with a producing oil well in Prowers County, which is in the Las Animas Arch Basin. The well, which has a depth of 5,300 feet, was completed in 2017 and produces oil, some associated gas, and water. Daily flow rates declared for the well are: oil-450 Bbls per day, water-150 Bbls per day, gas-220 Mcf per day.

The operator has filed a DS 658 declaration listing the following equipment in average condition:

- Wellhead

- Model 320 Lufkin Pumping Unit

- 35 H.P. Gas Engine

- 1,800' of 3/4" Sucker Rod

- 3,500' of 5/8" Sucker Rod

- Rod Pump

- Two 400 Bbl Oil Storage Tanks

- One 210 Bbl Water Storage Tank

- 600' Flowline

- Measurement Equipment

- Vertical Heater/Treater

All equipment was manufactured in 2017 with the following exceptions: heater/treater (2019) and measurement equipment (2022). You have physically inspected the well site and found the equipment, except for the measurement equipment, to be in average condition as described in Step #7 – Condition of Equipment earlier in this chapter. The 2” Meter Run, Sending Unit & RTU appears new and is in very good condition.

Using the BELs listed for the Las Animas Arch Basin, you find that the equipment declared generally conforms with the BEL titled Total Value Pumping Oil Well With Tanks (Pump Drive). Based on the declared and observed condition for the equipment, you determine the average condition grid should be used.

The depth of the well is greater than 5,000 feet but less than 5,500 feet. Using the grid intersection of 5,500 feet and 600 barrels per day, the base equipment value of $187,786 is noted. The measurement equipment is not on the equipment list for the BEL but is noted on the Additional Installed Equipment List. The value for installed measurement equipment in very good condition is $38,660. However, because the BEL equipment is considered to be in average condition, any additional equipment is also considered average. The value under average condition is $29,563.

Adding the base equipment value of $187,786 to the additional equipment value of $29,563 results in a total value of $217,349. The total value of $217,349 multiplied by the specified year’s adjustment factor of 0.95 indicates an actual value of $206,482 for all of the well equipment.

Oil and Gas Equipment Valuation Worksheet Example #1

Example Well Equipment Appraisal #2

You are to appraise the oil and gas equipment on a producing well located in Montezuma County. The operator of the well has reported the following information on this year’s DS 658: the well was completed in 2017 and has a depth of 7,900 feet. The well flows naturally and primarily produces gas with some associated water. The flow rate of the gas is 275 Mcf per day with 4 Bbls per day of associated water. The gas is metered and flows in a gas gathering system. The gas meter is owned by the purchaser.

You have physically inspected the wellsite and have noted the following:

- Wellhead

- Production Unit

- Dehydrator

- 1000' Flowline

- Gas Meter Run

The equipment was new, at the time of installation, and the observed condition, on the date of inspection, was average condition, as defined in Step #7 – Condition of Equipment earlier in this chapter.

Referring to Addendum 6-A, County/Basin Cross Reference, located later in this chapter, the appraiser determines that the subject property is located within the Paradox Basin.

Comparing the listed equipment with the BELs for the Paradox Basin, you determine that the equipment most closely conforms to a Total Value Flowing Gas Well with Dehydrator and Without Tanks. Based on the observed condition for the equipment, you determine the average condition grid should be used. The depth of the well is greater than 7,500 feet but less than 8,000 feet and the gas production is greater than 250 Mcf per day but less than 350 Mcf per day.

Using the grid intersection of 8,000 feet and 350 Mcf per day, the base equipment value is $112,573. The gas meter is owned by the gas purchaser and will not be valued here. However, it should be valued and assessed separately to the gas purchaser. The indicated total value for the well site equipment of $112,573 is then multiplied by the specified year’s adjustment factor of 0.95 for an actual value of $106,944.

Oil and Gas Equipment Valuation Worksheet Example #2

Example Well Equipment Appraisal #3

You are valuing oil and gas equipment associated with a producing coal seam gas well in La Plata County, which is in the San Juan Basin. The well, which has a depth of 3,500 feet, was completed in 2022 and produces gas and water. Daily flow rates declared for the well are: water-557 Bbls per day, gas-356 Mcf per day.

The operator has filed a DS 658 declaration listing the following equipment:

- Wellhead

- Model 320 Lufkin Pumping unit

- 35 H.P. Gas Engine

- 1,155' of 3/4" Sucker Rod

- 2,310' of 5/8" Sucker Rod

- Rod Pump

- Separator

- Water Storage Tanks

- 600' Flowline

- Measurement Equipment

All equipment was manufactured in 2022. You have physically inspected the well site and found the equipment to be in very good condition as described in Step #7 – Condition of Equipment earlier in this chapter. The gas meter run is owned by the operator and is also in very good condition.

Using the BELs listed for the San Juan Basin, you find that the equipment declared generally conforms with the BEL titled Total Value Pumping Coal Seam Gas Well With Tanks. Based on the observed condition for the equipment, you determine the very good condition grid should be used.

Because this is a pumping coal seam gas well, water production flow rates will be used to determine values. The declared water production flow rate is greater than 500 Bbls per day and less than 600 Bbls per day.

Using the grid intersection of 3,500 feet and 600 barrels per day, the base equipment value is $225,689. The gas meter run is included in the BEL as measurement equipment and no additional installed equipment is added to the BEL value.

The total value of $225,689 is multiplied by the specified year’s adjustment factor of 0.95, which indicates an actual value of $214,405 for all well equipment.

Oil and Gas Equipment Valuation Worksheet Example #3

Example Well Equipment Appraisal #4

You are to appraise the oil and gas equipment on a producing well located in Baca County. The operator of the well has reported the following information on his DS 658: the well was completed in 2017 and is 3,300 feet deep. The well is mechanically pumped and produces gas, oil, and water. The flow rate of the gas is 42 Mcf per day with 2 Bbls per day of oil, and 15 Bbls of water per day. The gas is metered and flows into a gas gathering system and the oil is stored in an on-site tank. The gas meter is owned by the purchaser.

You have physically inspected the well site and have noted the following:

- Wellhead

- Pumping Unit

- Electric Motor

- Control Panel

- 600' Flowline

- Sucker Rods to Depth

- Rod Pump

- 210 Bbl. Water Storage Tank

- Gas Meter Run

The equipment was new, at the time of installation, and the observed condition, on the date of inspection, was average condition, as defined in Step #7 – Condition of Equipment earlier in this chapter. The appraiser has also noted that the subject’s well equipment is typical of gas producing wells within the same field as the subject.

Referring to Addendum 6-A, County/Basin Cross Reference, located later in the chapter, the appraiser determines that the subject property is located within the Anadarko Basin. Comparing the listed equipment with the BELs for the Anadarko Basin, you determine that the equipment most closely conforms to a Total Value Pumping Gas Well With Tanks (Pump Drive). The determination is also supported by noting that other equipment in the field is typical of gas production.

Based on the production of 42 Mcf per day of gas, and 2 Bbls per day of oil, the subject well qualifies as a stripper well. Based on the stripper well classification, the minimum condition grid should be used.

The depth of the well is greater than 3,000 feet, but less than 3,500 feet. The total fluid pumped per day is 17 Bbls (add water Bbls to oil Bbls), which is less than 20 Bbls per day.

Using the grid intersection of 3,500 feet and 20 Bbls per day of fluid, the base equipment value is $16,626. The gas meter is owned by the gas purchaser and will not be valued here. However, it should be valued and assessed separately to the gas purchaser. The indicated total value for the well site equipment of $16,626 is then multiplied by the specified year's adjustment factor of 0.95 for an actual value of $15,795.

Oil and Gas Equipment Valuation Worksheet Example #4

Example Well Equipment Appraisal #5

You are valuing oil and gas equipment associated with a producing oil well in the Denver- Julesburg (D-J) Basin. The well, which has a depth of 5,500 feet, was completed in 2017 and produces oil, some associated gas, and water. Daily flow rates declared for the well are: oil-3.7 Bbls per day, water-131.3 Bbls per day, gas-50 Mcf per day.

The operator has filed a DS 658 declaration listing the following equipment in average condition:

- Wellhead

- Model 160 Lufkin Pumping Unit

- 20 H.P. Electric Motor

- 1,870' of 3/4" Sucker Rod

- Rod Pump

- Two 300-Bbl. Oil Storage Tanks

- Control Panel

- 1,000' Flowline

- 3,630' of 5/8" Sucker Rod

- Chemical Pump and Tank

The appraiser noted that the two oil storage tanks are no longer used because the emulsion is flowing to a common tank battery. All equipment was installed and put into service in 2017. You have physically inspected the well site and found the equipment to be in average condition as described in Step #7 – Condition of Equipment earlier in the chapter.

Using the BELs listed for the D-J Basin, you find that the equipment declared generally conforms with the BEL titled Total Value Pumping Oil Well without Tanks (Pump Drive). The equipment is also similar to other equipment located within the field and is typical of producing oil wells. Based on the oil production of 3.7 Bbls per day, and gas production of 50 Mcf per day, the subject well qualifies as a stripper well. Based on the stripper well classification, the minimum condition grid should be used.

The total volume of fluid is greater than 100 Bbls per day, but less than 200 Bbls per day. Using the grid intersection of 5,500 feet and 200 Bbls per day, the base equipment value of $12,870 is noted.

The two 300-Bbl. oil storage tanks are not on the equipment list for the BEL, but are noted in the Stored Equipment List. The operator has indicated the tanks are for future use and are not being held for resale. The value for the storage tanks in average condition is $20,014 each, or $40,028 total.

Adding the base equipment value of $12,870 to the stored equipment value of $40,028 results in a total value of $52,898. The total value of $52,898 is multiplied by the specified year’s adjustment factor of 0.95 indicating an actual value of $50,253 for the well equipment.

The appraiser next needs to determine the value of the communal equipment. Upon physical inspection the appraiser noted that the shared equipment serviced 15 wells, of which 8 wells are categorized as stripper wells. The tank battery was constructed last year with used equipment that appears to be in average condition. The appraiser noted the following equipment shared among the wells:

- Three 300 Bbl. Oil Storage Tanks

- One 300 Bbl. Fiberglass Water Storage Tank

- Recycle Pump

- Horizontal Heater/Treater

Since more than 50% of the wells serviced by the tank battery are stripper wells, the minimum condition values in the Communal Equipment List should be used for valuing the communal equipment. Locate and add the minimum condition values associated with the communal equipment to determine a total shared equipment value. For shared equipment, the appraiser would add the following values: For each 300 Bbl. Oil Storage Tanks, add $5,422; for the 300 Bbl. Fiberglass Water Storage Tank, add $3,233; for the Recycle Pump, add $272; and for the Horizontal Heater/Treater, add $4,251. These values added together result in a total shared equipment value of $24,022.

If this well is designated as the master well, then the shared equipment total value of $24,022 is added to the stored equipment value of $40,028, and BEL value of $12,870, for a total value of $76,920. The total value of $76,920 is then multiplied by the specified year's adjustment factor of 0.95, indicating an actual total value of $73,074 for the complete master well equipment.

If a separate account is created for the shared equipment, then the shared equipment total value of $24,022 is multiplied by the specified year’s adjustment factor of 0.95, for a total value of $22,821.

Oil and Gas Equipment Valuation Worksheet Example #5