Legal Basis

The Colorado Constitution and the Colorado Revised Statutes are the legal foundation upon which all valuations for assessment are determined. Taken together with valuation procedures and case law, the Constitution and statutes provide the necessary guidance for the valuation of all property for ad valorem (property tax) purposes.

The constitutional and statutory references in this manual are taken from the Colorado Revised Statutes. The Colorado Revised Statutes, commonly called the "Red Books," are reenacted by the Colorado General Assembly and distributed by LexisNexis.

The Division of Property Taxation produce the Statutory Index in the back of Volume 2, which provides copies of the relevant portions of the Constitution and an index of Constitutional and statutory citations. For questions involving legal interpretations or when litigation is involved, reference should always be made to the Colorado Revised Statutes (C.R.S.).

The ad valorem tax law in Colorado is specific in that it mandates the consideration of the three approaches to value in determining the value of personal property. The assessor should document the process by which the three approaches were considered and the reasons why a particular approach produced the most representative values for a class of property as required by § 39-1-103(5)(a), C.R.S., and Montrose Properties v. Board of Assessment Appeals, 738 P.2d 396 (Colo. App. 1987).

However, the statutes also require that if the taxpayer has timely and properly filed the personal property declaration schedule, including costs of acquisition, installation, sales/use tax, and freight to the point of use, the cost approach shall establish the maximum value and the market or income approaches can only be used to establish value if they produce a lower value than the cost approach as required by § 39-1-103(13), C.R.S. The law is also specific in mandating which property is taxable and which is exempt.

Assessor’s Responsibility

The county assessor is the official who is responsible for the discovery, listing, classification, and valuation of all taxable property within each county, except public utility property which is the responsibility of the Division of Property Taxation (Division).

Property Discovery

Discovery is the process whereby the assessor locates or discovers property to be valued. There are several techniques and sources of information useful to the assessor to accomplish the discovery of property. A complete discussion of the discovery process is found in Chapter 2, Discovery, Listing, and Classification.

Property Listing

The assessor is required by § 39-5-101, C.R.S., to list all real and personal property located in the county on the assessment date.

A declaration schedule form, on which the taxpayer who owns taxable personal property shall list all personal property, must be furnished to the taxpayer as soon after January 1 as practicable as required by § 39-5-108, C.R.S. Additional information regarding the listing of personal property is found in Chapter 2, Discovery, Listing, and Classification.

Property Classification

Property is defined by § 39-1-102(13), C.R.S., as both real and personal property.

Colorado statutes require that certain procedures be used for valuation of different kinds of property. Therefore, prior to valuation, the assessor classifies personal property based on the classification system established by the Division of Property Taxation.

All classes and subclasses established by the Division are listed in ARL Volume 2, Administrative and Assessment Procedures, Chapter 7, Abstract, Certification, and Tax Warrant.

Real Property

Real property is defined in § 39-1-102(14), C.R.S. The definition may be paraphrased as all lands or interests in lands, all mines, quarries, minerals in and under the land, all rights and privileges thereunto, and improvements.

Improvements are defined in § 39-1-102(6.3), C.R.S., as "all structures, buildings, fixtures, fences, and water rights erected on or affixed to land, whether or not title to such land has been acquired."

Fixtures

Fixtures are defined in § 39-1-102(4), C.R.S. The definition may be paraphrased as those articles that were once movable chattels, but have become an accessory to or a part of real property by having been physically incorporated therein or annexed or affixed thereto. Fixtures include systems for the heating, air conditioning, ventilation, sanitation, lighting, and plumbing of a building. These systems will be collectively referred to as fixture systems.

Fixtures do not include machinery, equipment, or other articles related to a commercial or industrial operation, which are affixed to the real property for proper utilization of such articles. In addition, for property tax purposes only, fixtures do not include security devices and systems affixed to any residential improvements including, but not limited to security doors, security bars, and alarm systems. Refer to Chapter 2, Discovery, Listing, and Classification, for a more complete discussion of fixture systems.

Personal Property

Personal property is defined in § 39-1-102(11), C.R.S. The definition may be paraphrased as everything which is the subject of ownership and which is not included in the term real property. Personal property includes machinery, equipment, and other articles related to the business of a commercial or industrial operation rather than components of fixture systems that are required for the proper operation of the improvements.

Taxable Personal Property

According to § 39-1-102(16), C.R.S., "'Taxable property' means all property, real and personal, not expressly exempted from taxation by law." The assessor has the responsibility to determine if property is exempt from property taxation under Colorado law, except for property granted exemption by the Property Tax Administrator under §§ 39-3-106 through 39- 3-113.5, and § 39-3-116, C.R.S. All personal property is taxable in Colorado unless specifically exempted by sections 3 to 6 of article X of the Colorado Constitution.

Exempt Personal Property

To be valid, the property tax exemption must be described in the Colorado Constitution. Several classes of personal property, both private and public, are listed in the Constitution as being exempt from property taxation. Colorado Constitutional exemptions are shown in four categories below. Applicable statutory citations follow these Constitutional exemption categories under the topic heading Statutory Exemptions.

Private Property:

Sections 3 to 6 of article X of the Colorado Constitution describe the following categories of private property as being exempt:

- Nonproducing unpatented mining claims

- Household furnishings not used to produce income at any time

- Personal effects not used to produce income at any time

- Inventories of merchandise, materials and supplies that are held by a business primarily for sale or consumption by the business

- Livestock

- Agricultural and livestock products

- Agricultural equipment used on a farm or ranch in the production of agricultural products

- Intangible personal property not owned by a state assessed public utility, e.g., stocks and bonds; copyrights, patents, trademarks, and other special privileges; franchises; contract rights and obligations; and operating software. Intangible personal property is exempted by 39-3-118, C.R.S. Certain intangible personal property, e.g., stocks and bonds, once was taxable, but its status was changed to exempt by Constitutional amendment. Computer software was exempted in 1990.

Certain classes of property in sections 3 to 6 of article X of the Colorado Constitution are exempt by definition and the assessor has the responsibility to determine whether or not property meets these criteria for exemption.

A complete discussion of the private exemptions described in the Colorado Constitution is found in Chapter 2, Discovery, Listing, and Classification.

Public Property:

Section 4 of article X of the Colorado Constitution exempts all personal property owned by the state, counties, cities, towns, other municipal corporations, and public libraries. The exemptions described in section 4 of article X of the Colorado Constitution include property owned by a political subdivision of the state, including school districts and special districts.

The property of the United States is exempt from all taxes imposed by the state of Colorado, including property taxes. The exemption of U. S. government property from state taxes is found in Section 4 of the Enabling Act. The Enabling Act allowed Colorado to enter the Union in 1876. Specific information about public property exemptions may be found in ARL Volume 2, Administrative and Assessment Procedures, Chapter 10, Exemptions.

Property Dedicated to Religious Worship and Charitable Purposes:

Section 5 of article X of the Colorado Constitution authorizes the exemption of property used for religious worship, private nonprofit schools and charitable purposes. The taxpayer must prove qualification for exempt status after filing an application with the Property Tax Administrator as described in § 39-2-117, C.R.S. Specific definitions for property exemptions under the provisions of Section 5 of the Colorado Constitution are found in §§ 39-3-106 to 113 and 39-3-116, C.R.S. Any questions about these exemptions should be directed to the Division of Property Taxation, Exemptions Section.

Self-Propelled Equipment, Motor Vehicles, and Other Mobile Equipment:

All motor vehicles, wheeled trailers, semi-trailers, trailer coaches and mobile and self propelled construction equipment are valued based upon a graduated specific ownership tax, which is imposed in lieu of ad valorem taxation as required by section 6 of article X of the Colorado Constitution and title 42 of the Colorado Revised Statutes.

Statutory Exemptions

The following is a reference list of categories of exempt property and their corresponding

citations:

| Agricultural and livestock products | § 39-3-121, C.R.S. |

|---|---|

| Agricultural equipment (farm and ranch) | § 39-3-122, C.R.S. |

| Charitable property ** | § 39-3-108, C.R.S. § 39-3-109, C.R.S. § 39-3-110, C.R.S. § 39-3-111, C.R.S. § 39-3-111.5, C.R.S. § 39-3-112, C.R.S. § 39-3-112.5, C.R.S. § 39-3-113, C.R.S. § 39-3-113.5, C.R.S. § 39-3-116, C.R.S. |

| City or town property | § 39-3-105, C.R.S. |

| Consumable personal property | § 39-3-119, C.R.S. |

| County fair property | § 39-3-127, C.R.S. |

| County lease-purchase property | § 30-11-104.1, C.R.S. § 30-11-104.2, C.R.S. |

| County owned property | § 39-3-105, C.R.S. |

| Credit Union personal property | § 11-30-123, C.R.S. |

| Household furnishings not producing income | § 39-3-102, C.R.S. |

| Indian property (on reservation) | By Treaty |

| Intangible personal property | § 39-3-118, C.R.S. |

| Inventories of merchandise and materials and supplies held for sale or consumption by a business | § 39-3-119, C.R.S. |

| Livestock | § 39-3-120, C.R.S. |

| Municipality leased property | § 31-15-801, C.R.S. § 31-15-802, C.R.S. |

| Nonproducing Unpatented Mining Claims | § (3)(1)(b), art. X, COLO. CONST. |

| Personal effects not producing income | § 39-3-103, C.R.S. |

| Private school property ** | § 39-3-107, C.R.S. |

| Public library property | § 39-3-105, C.R.S. |

| Religious worship property ** | § 39-3-106, C.R.S. |

| School District lease-purchase property | § 22-32-127(1)(b), C.R.S. |

| School District leased or rented property | § 22-32-127(1)(b), C.R.S. |

| School District owned property | § 39-3-105, C.R.S. |

| Software | § 39-3-118, C.R.S. |

| Special District property | § 39-3-105, C.R.S. |

| Special District lease-purchase property | § 39-3-124, C.R.S. |

| State lease-purchase property | § 39-3-124, C.R.S. |

| PP of $52,000 total actual value or less per county | § 39-3-119.5, C.R.S. |

| Until Personal Property is First Used by Current Owner | § 39-3-118.5, C.R.S. |

| U. S. Government property | Enabling Act |

| Works of Art | § 39-3-102, C.R.S. § 39-3-123, C.R.S. |

** Exemption initially must be granted and then be reviewed annually by the Property Tax Administrator. Any questions regarding these exemptions should be directed to the Division of Property Taxation, Exemptions Section.

Valuation for Assessment

Appraisal of the current actual value of personal property is described in Chapter 3, Valuation Procedures.

Level of Value

The current actual value of personal property as of the assessment date must be adjusted to the level of value in effect for real property as required by §§ 39-1-104(10.2)(a) and (12.3)(a)(I), C.R.S. The Division publishes Level of Value (LOV) Factors to adjust the actual value of personal property to the level applicable for real property. LOV Factors are found in Chapter 4, Personal Property Tables.

Assessment Rate

In Colorado, the assessor must determine the assessed values. Assessed values are calculated using a percentage, i.e., an assessment rate. The property's actual value multiplied by the appropriate assessment rate results in assessed value.

Historically, the assessment rate for most personal property was 29 percent as required by §39-1-104(1), C.R.S. However, for tax year 2023, the personal property assessment rate (except for renewable energy property) was temporarily reduced to 27.9 percent. For 2024, the assessment rate for personal property is 29 percent.

For tax years 2022, 2023, and 2024, renewable energy personal property valued under §39-5-104.7, C.R.S, is assessed at 26.4 percent.

Suspicion of Removal

If at any time the treasurer believes that taxable personal property may be removed, dissipated, or distributed so that the taxes would not be collectible, the treasurer may immediately collect the taxes on such property. Upon request of the treasurer, the assessor must certify the current year's valuation of personal property that is under suspicion of removal as required by § 39- 10-113(1)(a), C.R.S. If the mill levy for the current year has not been fixed and made, the mill levy for the previous year shall be used to determine the amount of taxes due.

Valuation Certification

The assessor has responsibilities concerning the certification of various values. These responsibilities include the following:

- Certification of values, including personal property values, to the taxing entities, the Division of Local Government, and to the Department of Education as required by §§ 39-5-128(1), 39-5-121(2), and 39-1-111(5), C.R.S.

- Certification of the value associated with personal property that the treasurer believes may be removed or transferred prior to payment of personal property taxes as required by § 39-10-113, C.R.S.

- Delivery of the tax warrant as required by § 39-5-129, C.R.S.

Tax Warrant

As soon after the taxes have been levied, but not later than January 10, the assessor must deliver the tax warrant to the county treasurer. The tax warrant is a public document and must be available for inspection by the public in the assessor's office.

The tax warrant contains the assessment roll which is a listing of the names of all taxpayers in the county, the class of their taxable property, its assessed valuation, the taxes levied against the property and the total amount of all property taxes levied in the county. The treasurer is required to collect all taxes listed in the tax warrant, § 39-5-129, C.R.S.

Taxpayer’s Responsibilities

The personal property owner has several statutory duties in the valuation and assessment of personal property. These range from the submission of the annual personal property declaration schedule, as required by §§ 39-1-120(1)(a) and 39-5-108, C.R.S., to the final payment of the personal property taxes levied against the property as required by §§ 39-10-102 and 103, C.R.S. Taxpayers' statutory duties and requirements are discussed in the paragraphs that follow.

Submitting the Property Declaration Schedule

The primary responsibility of the taxpayer is the submission of information regarding the taxpayer's property to the assessor. This responsibility may be broken out as follows:

- Completion and submission of the declaration schedule

- Submission of additional information pertinent to the valuation of the property

The statutes describe filing requirements for both personal and real property taxpayers.

Personal Property Filing Requirements

Taxpayers owning taxable personal property are required to complete and return the Personal Property Declaration Schedule to the assessor by no later than April 15 of each year. In accordance with § 39-1-120(1)(a), C.R.S., documents that are required to be filed (declaration schedules) that are mailed are “deemed filed with and received by the public officer or agency to which it was addressed on the date shown by the cancellation mark stamped on the envelope or other wrapper containing the document required to be filed.” The taxpayer must provide a list of all property owned or in the taxpayer's possession or under the taxpayer's control as of January 1. The property must be described in sufficient detail for the assessor to make a valuation as required by §§ 39-5-107, 108, 110(1), and 114, C.R.S.

Taxpayers should include a listing of any leasehold improvements, also known as tenant improvements or trade fixtures, on the declaration schedule as required by §§ 39-5-108 and 116, C.R.S.

Taxpayers may request an extension of ten or twenty days for filing the personal property declaration schedule. Any requests for extension must be made in writing by April 15. The fee for extension is two dollars per day for the number of days requested ($20 or $40), regardless of the number of schedules to be filed by the taxpayer as required by § 39-5-116, C.R.S.

The Personal Property Declaration Schedule and any attachments to it are private, confidential documents as required by § 39-5-120, C.R.S.

Failure to File the Declaration Schedule

When the taxpayer fails to return a declaration schedule required by statute by April 15, or if no request for extension was filed, or if the declaration is submitted after the last day of the extension period, the assessor shall impose a late filing penalty of 15 percent of the taxes due or $50.00, whichever is less, pursuant to § 39-5-116, C.R.S.

The failure of the assessor to receive a declaration schedule required by statute does not invalidate an assessment based upon the “Best Information Available” (BIA). Assessors may make BIA valuations based upon the “Best Information Available” to them as permitted by §§ 39-5-116 and 118, C.R.S. In Property Tax Administrator v. Production Geophysical et al., 860 P. 2d 514 (Colo. 1993), abatements for BIA values in excess of what should have been reported, had the taxpayer filed a declaration schedule, were disallowed. Note that to be considered a BIA assessment, the taxpayer must not have timely filed a declaration schedule or legally requested and paid for a filing extension and timely filed in line with the requested extension for the tax year.

A complete discussion of BIA assessments is found in Chapter 3, Valuation Procedures.

Failure to Fully and Completely Disclose

A taxpayer who owns taxable personal property fails to make full and complete disclosure if the taxpayer submits information on the declaration schedule that is false, erroneous, or misleading or fails to include all personal property owned by the taxpayer as described in § 39-5-116(2), C.R.S.

If any such taxpayer, to whom one or more declaration schedules have been mailed or upon whom the assessor has called and left one or more schedules, fails to complete and return a personal property declaration schedule to the assessor by the next April 15, the assessor shall impose a late filing penalty of $50.00 or, if a lesser amount, fifteen (15) percent of the amount of tax due on the valuation for assessment determined for the personal property for which any delinquent schedule or schedules are required to be filed, as provided for in § 39-5-116(1), C.R.S.

If any taxpayer, to whom two successive declaration schedules have been mailed or upon whom the assessor has called and left one or more schedules, fails to make a full and complete disclosure of personal property, the assessor shall apply a late filing penalty as provided for in § 39-5-116(1), C.R.S., and upon discovery, determine the actual value of such undisclosed property on the basis of the “Best Information Available” (BIA).

When, after the BIA assessment has been determined, a complete rendition of such property is made and in the event that the BIA value omitted the actual value of certain personal property, the assessor may impose a penalty of not more than 25 percent of the omitted personal property’s assessed value as provided for in § 39-5-116(2), C.R.S.

A penalty valuation can be applied only once, i.e., when it is discovered that the taxpayer failed to make a full and complete disclosure of specific omitted personal property. It is the assessor's responsibility to identify the omitted personal property and its assessed value in the event of a taxpayer appeal of the penalty valuation.

The assessor must notify the taxpayer of the failure to make full and complete disclosure and allow the taxpayer ten days from the date of notification to comply as required by § 39-5-116, C.R.S. Additionally, the percentage of omitted assessed value applied as a penalty should be documented as county policy and applied consistently throughout the county.

Further information on full and complete disclosure is found in Chapter 3, Valuation Procedures.

Declaration Schedule Information

The Division recommends when taxpayers make a full and complete disclosure, especially for their first filing to the assessor, they submit a complete itemized list of all personal property owned by them, in their possession, or under their control on the assessment date. The information submitted by the taxpayer should include the following:

- Whether Property is New or Used (year of manufacture, if known)

- Year Acquired, and Cost Data

- Market and Income Data (if available)

- Apportionment Data

- Proration Data

Year Acquired and Cost Data

The year of acquisition and original installed cost are very helpful to the assessor in valuing personal property using the cost approach. The information for year acquired and original installed cost may be available from the taxpayer's financial records. Procedures for acquiring cost information required by the assessor from the taxpayer are found in Chapter 2, Discovery, Listing, and Classification.

Market and Income Data

Market Data:

The taxpayer may submit market information, or comparable sales information, if it is available. Under § 39-5-115(1), C.R.S., the assessor may request market information from the taxpayer. However, if the taxpayer does not regularly buy and sell property in the equipment marketplace, no market data may be forthcoming. The failure of the taxpayer to submit market information does not excuse the assessor from gathering market data where it does exist, nor from giving appropriate consideration to the market approach.

Refer to Chapter 3, Valuation Procedures for the procedures used by assessors to complete the market approach.

Income Data:

When the income stream attributable to the personal property can be determined, the taxpayer should submit income and expense information to the assessor. The largest subclass of personal property subject to valuation by the income approach is leased or rented equipment. The DS 056 declaration schedule provides a place for taxpayers to file income information for leased equipment.

Under § 39-5-115(1), C.R.S., the assessor may request income and expense information from the taxpayer. However, if the taxpayer does not regularly rent or lease personal property, no income data may be forthcoming. Actual income data submitted by taxpayers is used by assessors to establish the economic rent of equipment. This economic rent may be applied to all similar equipment in order to determine value by the income approach. Refer to Chapter 3, Valuation Procedures for the procedures used by assessors to complete the income approach. The failure of the taxpayer to submit income and expense information does not excuse the assessor from gathering income data where it does exist, nor from giving appropriate consideration to the income approach.

Apportionment of Personal Property Valuation

Several situations require the apportionment, or division, of personal property value between two or more counties. The value of movable or portable equipment owned by a business that is typically used in more than one county during a year must be apportioned among those counties as required by § 39-5-113, C.R.S. This movable or portable personal property apportionment does not apply to special mobile machinery that is Class F personal property. Class F personal property is subject to specific ownership tax, in lieu of personal property taxes, as required by section 6 of article X of the Colorado Constitution.

Also, skid mounted oil and gas drilling rigs are subject to apportionment of their value according to their locations during the previous calendar year as required by § 39-5-113.3, C.R.S. This does not include self-propelled drilling rigs that are Class F personal property. No apportionments of personal property, other than those described below, are allowed. Specific procedures and examples for the apportionment of values are found in Chapter 7, Special Issues.

Movable or Portable Equipment:

Owners of movable or portable equipment, which in the ordinary course of business is likely to be located in more than one county during the current assessment year, must provide the assessor with the following information as required by § 39-5-113, C.R.S. This type of equipment does not include skid-mounted oil and gas drilling rigs.

- Description of the equipment

- Serial number of the equipment

- Counties in which such equipment will be located during the year

- Estimated number of days that the property will be located in each county

The specific procedures for the apportionment of movable equipment are found in Chapter 7, Special Issues.

Skid-Mounted Oil and Gas Drilling Rigs:

Taxpayers owning skid-mounted oil and gas drilling rigs, which operated in the state during the previous calendar year, must submit the following information to the assessor as required by § 39-5-113.3, C.R.S.:

- Descriptions of all such drilling rigs located in each county during the preceding calendar year

- Drilling logs for each rig, describing the locations in the state where the rig was used and the number of days that it was used at each location

- An inventory of the rig's equipment, sufficient to determine a value, must be submitted to the first county in the state in which the rig was located

The specific procedures for the apportionment of skid-mounted oil and gas drilling rigs are found in Chapter 7, Special Issues.

The repeal of personal property prorations described below does not affect the apportionment of movable equipment as provided for in § 39-5-113, C.R.S.; the apportionment of skid-mounted oil and gas drilling rigs as provided for in § 39-5-113.3; or the proration of Works of Art as provided for in § 39-5-113.5, C.R.S. Movable equipment can only be valued for the days it is traveling in or was located within Colorado. Skid-mounted drilling rigs can only be valued for the days they were traveling in, were operating within, or were stacked within Colorado.

Proration of Personal Property Valuation

Proration means the proportional valuation of property for assessment purposes based upon the number of days that the property is taxable compared to the full calendar year. As of January 1, 1996, the only proration of personal property that is allowed under Colorado statutes is for Works of Art as defined in § 39-1-102(18), C.R.S., and as described in Chapter 7, Special Issues. If other taxable personal property was located in Colorado on the assessment date, it is taxable for the entire assessment year, providing that, if it was newly acquired, it was put into use as of the assessment date. If it was newly acquired and it was not put into use as of the assessment date, it cannot be taxed until the next assessment year.

Personal property is valued as of the assessment date and is valued for the entire year regardless of any destruction, conveyance, relocation, or change in taxable status, § 39-5-104.5, C.R.S. Personal property removed during the assessment year is taxable for the entire year, § 39-5- 104.5, C.R.S. Whenever taxable personal property is brought into the state after the assessment date, the taxpayer must complete a personal property declaration and file it with the assessor if the total actual value of all of the taxable personal property owned by the taxpayer is over $52,000 per county, § 39-5-110, C.R.S. The owner of any taxable personal property removed from the state is liable for the entire tax obligation, § 39-5-110(2), C.R.S.

Except for the proration of Works of Art and except for movable equipment and skid-mounted oil and gas drilling rigs, which are apportioned, personal property exempt on the assessment date retains its exempt status for the entire assessment year. These requirements do not affect the proration of real property.

If proration of personal property value is not specifically allowed by statute, no proration may be applied. Procedures for the proration of Works of Art changing taxable status are found in Chapter 7, Special Issues.

Under §39-1-123, C.R.S., real and business personal property that is determined by the county assessor to have been destroyed by a natural cause, as defined in §39-1-102(8.4), may be eligible for a reimbursement of property tax liability for the year in which the natural cause occurred. Please refer to Assessors’ Reference Library, Administrative and Assessment Procedures, Volume 2, Chapter 4, Assessment Math, for procedures regarding this reimbursement.

Collection of Taxes on Property Moving Out of One County to Another

It is common practice for the treasurer to collect estimated taxes on personal property for the

entire year, if it is to be moved to another county within the state. This is due to the following

reasons:

- There is no statutory provision to prorate or apportion the value of this property.

- There is no statutory provision to reassess this property on its arrival to the next county.

- The treasurer cannot be certain that once the property leaves the county it will remain in the state. Once personal property leaves the state, collection of taxes can be virtually impossible.

Penalties

Penalty for Late Filing

A late filing penalty may be applied in the following circumstances:

Failure to file schedule - failure to fully and completely disclose.

(1) If any person owning taxable personal property to whom one or more personal property schedules have been mailed, or upon whom the assessor or his deputy has called and left one or more schedules, fails to complete and return the same to the assessor by the April 15 next following, unless by such date such person has requested an extension of filing time as provided for in this section, the assessor shall impose a late filing penalty in the amount of fifty dollars or, if a lesser amount, fifteen percent of the amount of tax due on the valuation for assessment determined for the personal property for which any delinquent schedule or schedules are required to be filed. Any person who is unable to properly complete and file one or more of such schedules by April 15 may request an extension of time for filing, for a period of either ten or twenty days, which request shall be in writing and shall be accompanied by payment of an extension fee in the amount of two dollars per day of extension requested. A single request for extension shall be sufficient to extend the filing date for all such schedules which a person is required to file in a single county. Any person who fails to file one or more schedules by the end of the extension time requested shall be subject to a late filing penalty as though no extension had been requested. Further, if any person fails to complete and file one or more schedules by April 15 or, if an extension is requested, by the end of the requested extension, then the assessor may determine the actual value of such person's taxable personal property on the basis of the best information available to and obtainable by him and shall promptly notify such person or his agent of such valuation. Extension fees and late filing penalties shall be fees of the assessor's office. Penalties, if unpaid, shall be certified to the treasurer for collection with taxes levied upon the person's property

§ 39-5-116, C.R.S.

Penalty for Failure to Fully & Completely Disclose Personal Property

A penalty for failure to fully and completely disclose personal property may be applied in the following circumstances:

Failure to file schedule - failure to fully and completely disclose.

(2)(a) If any person owning taxable personal property to whom two successive personal property schedules have been mailed or upon whom the assessor or his deputy has called and left one or more schedules fails to make a full and complete disclosure of his personal property for assessment purposes, the assessor, after notifying the person of his failure to make such a full and complete disclosure and allowing such person ten days from the date of notification to comply, shall, upon discovery, determine the actual value of such person's taxable property on the basis of the best information available to and obtainable by him and shall promptly notify such person or his agent of such valuation. The assessor shall impose a penalty in an amount of up to twenty-five percent of the valuation for assessment determined for the omitted personal property. Penalties, if unpaid, shall be certified to the treasurer for collection with taxes levied upon the person's personal property. A person fails to make a full and complete disclosure of his personal property pursuant to this paragraph (a) if he includes in a filed schedule any information concerning his property which is false, erroneous, or misleading or fails to include in a schedule any taxable property owned by him.

(b) Any person who makes full and complete disclosure on the first personal property schedules issued to him on or after August 1, 1987, shall not be assessed a penalty for property previously omitted from the assessment rolls under this article.

(c) Any person subject to paragraph (a) of this subsection (2) shall have the right to pursue the administrative remedies available to taxpayers under this title, dependent upon the basis of his claim.

§ 39-5-116, C.R.S.

The penalty valuation for omitted property may only be added if specific personal property has been omitted. Therefore, the BIA valuation must be based on an itemized list of personal property and associated values which are typical of a business of this type.

When the value of the personal property is declared or listed during a subsequent physical inspection, if the actual value of the personal property is determined to be more than the BIA assessment due to specific personal property not being included in the BIA valuation, then a penalty of up to 25 percent of the omitted personal property's value is added to the BIA assessed value. The assessor must notify the taxpayer of the failure to make full and complete disclosure and allow the taxpayer ten days to comply before actually placing the penalty on the omitted property value. The penalty valuation is applied only for the assessment year that the assessor discovers that the taxpayer has failed to make a full and complete disclosure.

The assessor immediately bills the taxpayer the penalty, which can be up to 25% of the BIA assessed value of the undeclared omitted personal property.

The assessor should maintain written documentation regarding the percentage used for the penalty because the penalty should be uniformly applied.

Omitted property can be valued for each of the past six years providing the failure to collect tax on the property was not due to an error or omission of a governmental entity, § 39-10-101(2)(b)(II), C.R.S. If the taxes were not collected because of an error or omission on the part of a governmental entity, taxes for any period, together with any interest thereon, shall not be assessed for a period of more than two years after the tax was or is payable. See ARL, Volume 2, Administrative and Assessment Procedures, Chapter 3, Specific Assessment Procedures, for additional omitted property information.

Example:

Assessment Date: January 1, 2023

Date of Acquisition/First Use: December 20, 2018

2019 Omitted Assessed Value: $1,000

Personal Property Valuations not included in the BIA:

| Assessment Year | Omitted Assessed Value |

|---|---|

| 2021 (no penalty) | $1,100 assessed value |

| 2022 (no penalty) | $1,050 assessed value |

| 2023 (25% penalty derived) | $1,000 assessed value |

Penalty of 25% of the $1,000 Assessed Value = $250 penalty billed

In the example, declaration schedules were mailed to the taxpayer for the years 2021-2023. The assessed value of the omitted property changes each year because additional depreciation is deducted. The penalty assessment is only applied in the current assessment year 2023, since it is applied only in the year of discovery and only if the owner fails to make full and complete disclosure. The penalty may be applied for this one year only and no penalty may be carried forward into subsequent assessment years.

Additional Information

The assessor may request additional information from the taxpayer at any time before or after April 15. The taxpayer must furnish the information requested by the assessor as required by § 39-5-115(1), C.R.S.

If any taxpayer refuses to furnish information to the assessor or refuses to be interviewed or answer questions asked by the assessor, the assessor may petition the district court to cite the taxpayer. The court may, at its discretion, require the taxpayer to furnish such information as requested by the assessor as controlled by § 39-5-119, C.R.S.

Additionally, at the request of the assessor, furnished rental residential property owners who advertise, or agents who advertise on behalf of the property owners, shall provide to the assessor a list of each property so advertised by address and owner pursuant to § 39-5-108.5, C.R.S.

Taxpayer Appeals Procedures

Owners of taxable personal property are given many opportunities to have their personal property valuations reviewed and appealed. The steps necessary for proper review and appeal are commonly referred to as "taxpayers’ administrative remedies." These steps must be adhered to by both the assessor and taxpayer to ensure the taxpayer's statutory due process rights. It is the taxpayer's responsibility to initiate and timely work through the administrative remedies. At the written request of any taxpayer, the assessor must make every attempt to inform the taxpayer of the methods used to value the personal property as required by § 39-5- 121.5, C.R.S.

A complete discussion of the rights of the taxpayer and the steps of the administrative appeals procedure are found in ARL Volume 2, Administrative and Assessment Procedures, Chapter 5, Taxpayer Administrative Remedies.

The specific sequence of events and the statutory references for owners of personal property are found in the assessment calendar in Addendum 1-A, Personal Property Assessment Calendar.

Notice of Valuation

The administrative remedies process starts with the mailing of the Notice of Valuation (NOV), which lists the previous year's total actual value, the current year's total actual value and the amount of such adjustment in value. The NOVs for personal property are mailed no later than June 15th.

Under section 20(8)(c) of article X of the Colorado Constitution, NOVs must be mailed by the assessor to each owner of taxable personal property every year. It is the taxpayer's responsibility to review the NOV and pursue the following administrative remedies if the taxpayer disagrees with the value assigned to the personal property by the assessor.

Assessor Hearing

To receive a hearing before the assessor between June 15 and July 5, the owner or the owner's agent must file a protest with the assessor. The taxpayer may contact the assessor in person or in writing and request a review. All mailed protests are considered timely filed if they are postmarked by June 30, or the next business day if June 30 falls on a holiday or weekend. All protests made in person are timely filed if they are made no later than June 30, or the next business day if June 30 falls on a holiday or weekend, as controlled by § 39-5-121(1.5), C.R.S.

If a representative or agent is used by the owner, a letter of agency or other document that conveys agency authorization from the owner must be obtained.

Owners acquiring personal property after January 1 of the current assessment year have the right to file a protest of the value the assessor has assigned to the newly acquired personal property. In such cases, the assessor should schedule a physical inspection of the property as soon as possible and use the list of property obtained during the inspection to determine its correct actual value.

Any written protest or objection to valuation received during the protest period must be answered with a Notice of Determination. The assessor must respond in writing to any personal property protest no later than July 10. Justification for the assessor's decision must be included as required by § 39-5-122, C.R.S.

Appeal of County Assessor’s Determination to CBOE

If a taxpayer is not satisfied with the assessor's valuation determination and the taxpayer files an appeal to the County Board of Equalization (CBOE), either in a letter postmarked or by appearing in person no later than July 20, the right to an appeal before the CBOE is guaranteed. If July 20 falls on a holiday or weekend and the letter is postmarked or the taxpayer appears in person the next business day, an appeal before the CBOE also is guaranteed.

Beginning on July 1, the CBOE will sit to hear appeals from value determinations made by the assessor, § 39-8-104, C.R.S. The taxpayer must be notified of these hearings, must be given the opportunity to attend, and must be allowed to present witnesses and other evidence, § 39-8-106, C.R.S. The CBOE must conclude hearings and render value decisions on or before August 5th and must mail their determination within five business days of making their decision. The assessor or a representative of the assessor shall be present at hearings on appeal as required by § 39-8-107, C.R.S.

Appeal of the CBOE’S Valuation Determination

Valuation determinations made by the CBOE may be appealed by the taxpayer in one of three ways.

Arbitration Process

The taxpayer may choose to use the binding arbitration procedure instead of appealing to the BAA or to the district court. No appeals from the decision of the arbitrator are permitted under §§ 39-8-108(4) and 108.5, C.R.S.

Specific arbitration procedures may be found in the ARL Volume 2, Administrative and Assessment Procedures, Chapter 5, Taxpayer Administrative Remedies or may be obtained from the county commissioner's office in each county.

Board of Assessment Appeals

When taxpayers disagree with the decision of the CBOE, they may file an appeal with the Board of Assessment Appeals (BAA). The hearing is a de novo hearing meaning that it is a new hearing based upon evidence submitted at the hearing. The CBOE and the taxpayer both present cases for the record before the BAA, § 39-8-108, C.R.S.

District Court

The taxpayer may appeal the decision of the CBOE to the district court of the county wherein the property is located. The hearing before the district court is a trial de novo and each party must present its case for the record as required by § 39-8-108, C.R.S.

Court of Appeals

If the petitioner has appealed to the Board of Assessment Appeals and the decision is against the petitioner he may, not later than 49 days after the decision, petition the court of appeals for judicial review.

If the petitioner has appealed to the district court and the decision is against the petitioner, the petitioner may seek review by the court of appeals upon filing for such review according to the Colorado appellate rules as controlled by §§ 39-8-108(3) and 24-4-106(9), C.R.S.

See September listings for county appeal rights in Addendum 1-A, Personal Property Assessment Calendar.

Abatement or Refund

Taxpayers who do not exercise the statutory rights listed above may petition for a change in valuation through the abatement or refund procedure. Abatements may be granted in cases of overvaluation as allowed by §§ 39-10-114(1)(a)(I)(A) and (D), C.R.S., but cannot be granted if the valuation was protested during the assessment year in question, or if the declaration was not filed according to §§ 39-5-107 and 108, C.R.S. However, if the following conditions are met, the taxpayer retains the right to file an abatement petition, § 39-10-114(1)(a)(I)(D), C.R.S.

Additional abatement information may be found in the ARL Volume 2, Administrative and Assessment Procedures, Chapter 5, Taxpayer Administrative Remedies.

Refund of Interest

With two exceptions, interest accrues from the date the taxes are paid pursuant to § 39-10-114(1)(b), C.R.S.

- Refund interest is not included in a refund of prior years’ taxes in cases involving an error made by a taxpayer in completing personal property schedules according to article 5 of title 39, C.R.S.

- Regarding refunds involving errors or omissions made by a taxpayer in completing statements pursuant to article 7 of title 39, C.R.S., interest accrues from the date a complete abatement petition is filed if the county pays the refund within the timeframe described in § 39-10-114(1)(a)(I)(B), C.R.S., which could be as long as the payment of property taxes for the year the final determination is made.

Abatement, cancellation of taxes.

(1)(b) Any taxes illegally or erroneously levied and collected, and delinquent interest thereon, shall be refunded pursuant to this section, together with refund interest at the same rate as that provided for delinquent interest set forth in section 39-10-104.5; except that refund interest shall not be paid if the taxes were erroneously levied and collected as a result of an error made by the taxpayer in completing personal property schedules pursuant to the provision of Article 5 of this title. Said refund interest shall accrue only from the date payment of taxes and delinquent interest thereon was received by the treasurer from the taxpayer; except that refund interest shall accrue from the date a complete abatement petition is filed if the taxes were erroneously levied and collected as a result of an error or omission made by the taxpayer in completing the statements required pursuant to the provisions of article 7 of this title and the county pays the abatement or refund within the time frame set forth in sub-subparagraph (B) of subparagraph (I) of paragraph (a) of this subsection (1). Refund interest on abatements or refunds made pursuant to the sub-subparagraph (F) of subparagraph (I) of paragraph (a) of this subsection (1) shall only accrue on taxes paid for the two latest years of illegal or erroneous assessment. (emphasis added)

§ 39-10-114, C.R.S.

A discussion of the abatement procedure is found in ARL Volume 2, Administrative and Assessment Procedures, Chapter 5, Taxpayer Administrative Remedies.

Effective July 1, 2010, Senate Bill 10-212 repealed § 39-22-124, C.R.S. Therefore, the perpetual Colorado state tax refund based on business personal property taxes paid has been repealed.

Personal Property Tax Reimbursements

House Bill 21-1312 creates a personal property tax reimbursement program due to the increase of the personal property exemption contained in § 39-3-119.5, C.R.S., beginning in the 2021 tax year.

For the 2021 tax year, each assessor is required to calculate the total value of the additional personal property exempted by this bill. This includes all personal property accounts with a total actual value of $50,000 or less but greater than $7,900. This total value establishes the “baseline exemption total” for a county or local government entity. The county treasurer must then calculate the total property tax revenues lost by each local governmental entity, based on exempted personal property actual value greater than $7,900 but not exceeding $50,000.

Beginning with the 2022 tax year, assessors must calculate the adjusted total value of the additional personal property exempted by this bill for the county and each local governmental entity. This adjusted total is calculated by taking the baseline exemption amount adjusted by the “growth factor.” The growth factor is the total statewide percentage increase or decrease in personal property values as calculated by the Property Tax Administrator (Administrator).

No later than February 1, 2022, and each year thereafter, the Administrator must calculate the “growth factor” and publish this information on the Division’s website.

Beginning with the 2022 tax year, the county treasurer must calculate the total property tax revenues lost by each local governmental entity using the growth factor adjusted exemption amount calculated by the county assessor. No later than March 1, 2022, and each March 1 thereafter, the county treasurer will report to the Administrator the total property tax revenues lost by each local governmental entity. The Administrator is required to review these tax revenue amounts, confirm their accuracy, and make corrections as necessary. The Administrator then forwards this information to the state treasurer.

The state treasurer will issue warrants (reimbursements) to the county treasurers beginning April 15, 2022, and each year thereafter. The county treasurer shall distribute the total amount received from the state treasurer to the individual local governmental entities.

Pursuant to § 39-5-128(1.5), C.R.S., assessors are required to report the aggregate value of exempt business personal property on the annual certification of values for each town, city, school district, or special district.

Addendum 1-A, Personal Property Assessment Calendar

January

| Date | Activity | Colorado Revised Statute |

|---|---|---|

| January 1, Noon | Assessment date for all taxable property. | § 39-1-105 |

| January 1, Noon | Lien of general taxes for current year attaches. | § 39-1-107 |

| January 1 | Property taxes for the prior year become due and payable. Optional payment dates are: April 30, full payment; the last day in February and June 15, half-payments | § 39-10-102(1)(b)(I) § 39-10-104.5 |

| As soon after January 1 as practicable | Assessor mails or delivers a personal property schedule. | § 39-5-108 |

| Not later than January 10 | Assessor delivers tax warrant to treasurer. | § 39-5-129 |

April

| Date | Activity | Colorado Revised Statute |

|---|---|---|

| Prior or subsequent to April 15 | Assessor may require additional information from owners of taxable property. | § 39-5-115 |

| Not later than April 15 | Taxpayers return personal property schedules to assessor, including works of art display statement. Schedules are considered filed on the postmarked date. | § 39-5-108 § 39-5-113.5(1) § 39-1-120(1)(a) |

| Not later than April 15 | Taxpayers may request extension of 10 or 20 days for filing personal property schedule. | § 39-5-116(1) |

| Not later than April 15 | Owners and operators of producing mines file statement with the assessor. | § 39-6-106 |

| Not later than April 15 | Owners and operators of oil and gas leaseholds file statement with assessor. | § 39-7-101 |

| Subsequent to April 15 | Assessor determines personal property values from best information available and imposes a penalty for taxpayers failing to file. | § 39-5-116 |

May

| Date | Activity | Colorado Revised Statute |

|---|---|---|

| On or before May 1 | Assessor gives public notice of hearings May 1 on real and personal property. | § 39-5-122(1) |

June

| Date | Activity | Colorado Revised Statute |

|---|---|---|

| Not later than June 15 | Assessor sends notice of valuation, together with a protest form, for personal property, drilling rig valuations, and valuation of producing and nonproducing mines and oil and gas leaseholds and lands to taxpayer. | § 20, art. X, COLO CONST. § 39-5-121(1.5) § 39-6-111.5 § 39-5-113.3(2) § 39-7-102.5 |

| Beginning on June 15 | Assessor sits to hear all objections concerning personal property and valuation of producing and nonproducing mines and oil and gas leaseholds and lands valuation | § 39-5-122(1) § 39-6-111.5 § 39-7-102.5 |

| Not later than June 30 | Taxpayer mails or physically delivers notice of personal property protest and protests of the valuation of producing and nonproducing mines and oil and gas leaseholds and lands to assessor. (Postmarked no later than June 30) | § 39-5-121(1.5) § 39-6-111.5 § 39-7-102.5 §39-5-122 |

July

| Date | Activity | Colorado Revised Statute |

|---|---|---|

| Prior to July 1 | County board of equalization publishes notice of sitting to review assessment roll and hear appeals on real and personal property valuations. | § 39-8-104 |

| Beginning on July 1 | County board of equalization sits to hear appeals on real and personal property valuations | § 39-8-104 |

| By July 5 | Assessor concludes personal property hearings. | § 39-5-122(4) |

| On or before July 10 | Assessor mails two copies of the notice of determination of protests for valuation of personal property, producing and nonproducing mines, and oil and gas leaseholds and lands to taxpayer. | § 39-5-122(2) § 39-6-111.5 § 39-7-102.5 |

| July 15 | Assessor reports to county board of equalization the assessed value of all taxable personal property in the county, movable equipment that was apportioned with other counties, a list of all people who failed to file a declaration schedule and the action in each case, and a list of all personal property protests and the action in each case. | § 39-8-105(2) |

| On or before July 20 of that year | Taxpayer mails one copy of assessor's determination of the protest of personal property, producing and nonproducing mines, and oil and gas leaseholds and lands valuation to county board of equalization. Protests bearing postmarks on or before this date constitute proper filing. | § 39-8-106(1)(a) § 39-6-111.5 § 39-7-102.5 |

August

| Date | Activity | Colorado Revised Statute |

|---|---|---|

| Not later than August 5 of that year | County board of equalization concludes hearings and renders decisions on real and personal property appeals. | § 39-8-107(2) |

| Within five business days of rendering decision | County board of equalization mails decisions on real and personal property appeals. | § 39-8-107(2) |

| Not later than 30 days after decision of county board of equalization is mailed | Appeals from county board of equalization decisions must be filed with Board of Assessment Appeals, district court, or the county commissioners for a binding arbitration hearing. | § 39-8-108(1) |

| Not later than August 25 | Assessor transmits abstract to Administrator. Assessor reports assessed value in the county, each municipality, and each school district by class and subclass on form prescribed by the Administrator. Assessor also reports the assessed value of new construction, destroyed property, and net change in volume of minerals and oil and gas production. (For counties that elect to use the alternate appeals procedure, the deadline is November 21.) | § 39-2-115(1)(a) § 39-5-123 |

| Not later than August 25 | Assessor notifies each taxing entity, the Division of Local Government, and the Department of Education of the total assessed value of real and personal property within the entity, and the exceptions to the 5.5 percent property tax revenue limitation. (See § 39-5-121(2)(a), C.R.S., for specifics.) | § 39-5-121(2)(a) § 39-5-128(1) |

September

| Date | Activity | Colorado Revised Statute |

|---|---|---|

| September 15 | Final report of the annual valuation for assessment study is submitted to the General Assembly and the State Board of Equalization. | § 39-1-104(16)(a) |

| Not later than 49 days after decision of Board of Assessment Appeals | Taxpayer appeals to court of appeals. | § 39-8-108(2) § 24-4-106(11) |

| Not later than 49 days after decision of Board of Assessment Appeals | County appeals to court of appeals. (if BAA recommends that its decision is a matter of statewide concern or has resulted in a significant decrease in the assessed valuation of the county) | § 39-8-108(2) § 24-4-106(11) |

| Not later than 30 days after decision of Board of Assessment Appeals | County appeals to court of appeals. (if judicial review is sought for alleged procedural errors or errors of law) | § 39-8-108(2) |

| Not later than 30 days after decision of Board of Assessment Appeals | County appeals to court of appeals. (if BAA makes no recommendation on statewide concern or there is no significant valuation decrease as a result of the BAA decision) | § 39-8-108(2) |

| Not later than 30 days after final decision of Property Tax Administrator | Appeals from orders and decisions of the Administrator must be filed with Board of Assessment Appeals. | § 39-2-125(1)(b)(I) |

November

| Date | Activity | Colorado Revised Statute |

|---|---|---|

| Not later than November 21 | Assessor transmits abstract to Administrator. Assessor reports assessed value in the county, each municipality, and each school district by class and subclass on form prescribed by the Administrator. Assessor also reports the assessed value of new construction, destroyed property, and net change in volume of minerals and oil and gas production. (For counties that elect to use the alternate appeals procedure.) | § 39-5-123 |

December

| Date | Activity | Colorado Revised Statute |

|---|---|---|

| Prior to December 10 | Assessor transmits a single notification to board of county commissioners, other taxing entities, Division of Local Government and the Department of Education if value changes were made after August 25 certification of values. | § 39-1-111(5) |

Three administrative steps must be taken by the assessor prior to determining the value of personal property. These steps are discovery of all taxable personal property, creation of an accurate listing of taxable personal property, and proper classification of the property. The assessor must ensure that effective office procedures exist to complete these steps, so that all taxable property will be properly assessed for property tax purposes.

Discovery and Listing of Personal Property

One of the most difficult jobs for a county assessor is the discovery of personal property. However, good discovery practices will yield positive results in accurate property records and assessments.

Overview

Personal property discovery must be an ongoing task because personal property is movable and may leave the county faster than the assessor can discover it. A thorough program of discovery must be created and maintained to ensure accurate property listings. Inaccurate property listings mean that certain personal property owners may escape paying their legal share of property taxes which results in a heavier tax burden on the taxpayers who do pay their legal share.

The personal property listing process begins by setting up account records in the assessor's office for businesses owning taxable personal property. A cross check should be conducted on existing office records to determine if a new business is filing under another name and/or at another location. An assessor's staff member should call or visit the property owner to gather any necessary information for the listing process.

Declaration Schedule

A primary source of personal property discovery is the annual declaration schedule. After the names of the businesses or owners have been recorded in the personal property account records, a declaration schedule is mailed.

It is especially important that owners of personal property located in the county on the January 1 assessment date receive the declaration schedules as soon after January 1 as possible. As noted in Chapter 1, Applicable Property Tax Laws, each person who owns more than $52,000 in total actual value of personal property per county on the assessment date must file a declaration schedule by no later than April 15. This allows the mailing of a Notice of Valuation (NOV) to the taxpayers by June 15.

However, a Special Notice of Valuation (SNOV) can be mailed at any time during the year. In this way the assessor preserves the rights of the taxpayer in the abatement process and presents a complete assessment roll to the County Board of Equalization (CBOE) in July.

In cases where property was in the county on the assessment date, but discovered after April 15, the assessor must still assess the property pursuant to §§ 39-5-110 and 125, C.R.S. In these cases, the taxpayer must be notified of the value via the SNOV and a thirty-day period must be given to the taxpayer to protest any personal property valuation made after June 15.

In addition to being a valuable discovery tool, the declaration schedule is the primary method used by the taxpayer to provide an original listing of personal property to the assessor. The taxpayer who owns taxable personal property must report all personal property owned by, in the possession of, or under the control of the taxpayer on January 1 to the assessor.

Taxable personal property that is fully depreciated or expensed by the business, must be declared and listed by the taxpayer on the declaration schedule. Property acquired prior to the January 1 assessment date, but not put into use until after January 1, should be declared for the following assessment year. For a complete discussion of “Personal Property in Storage” that have been stored after their use, refer to Chapter 7, Special Issues. Property leased from others and used in the business must be declared and the name and address of the lessor (owner) noted in the leased equipment area on the declaration schedule.

The taxpayer must completely describe all listed personal property so that the assessor can correctly classify and value it. The importance of accurate, detailed property descriptions cannot be overstated. The assessor cannot properly consider the cost, market, or income approaches to appraisal unless a very clear description has been obtained. General property descriptions such as “equipment” or “furniture and fixtures” are not acceptable because they do not sufficiently describe the property.

Information contained on the declaration schedules is often transferred directly to the appraisal records for analysis. The declaration schedule then becomes a part of the taxpayer's account valuation file.

Recorded Documents and Other Discovery Sources

Publicly recorded documents, such as real estate deeds, may also be useful in discovering personal property. Any evidence, such as notations on the TD-1000 real property transfer declaration or sales/use tax records from the Department of Revenue, which may be submitted to the clerk and recorder as proof of personal property that is included in a real property sale, can be used in the discovery process pursuant to §§ 39-13-102(5)(a) and 39-14-102, C.R.S.

Leases and bills of sale are useful in helping the assessor to discover personal property. These documents often will list specific pieces of property leased or sold from which the assessor can make an assessment even if the taxpayer does not file a declaration schedule. Leases may be recorded in the county clerk's office.

The following additional sources of information are available for the assessor to use in the discovery of personal property:

Federal Government Records

Bankruptcy filings

Lease records

State Government Records

Business licenses (sales/use tax)

Corporation filings

Trade name affidavits

State lease records

Local Government Records

Business licenses (city or county)

Permits (sign or building)

Lease records

Recorded real property conveyance documents for new owner/operators

Business Records and Publications

Business (City) or personal directories

Telephone directories

Trade journals

Utility hookups or disconnects

Media Sources

Newspaper articles and advertising

Radio and TV commercials

Real estate newsletters

Other

Location inspections, taxpayer visits, area canvasses

Voluntary filings by property owners

A complete discovery program uses all of the tools to find personal property that has not as yet been listed on the assessment roll. Most counties have an annual cycle in which one or more of these sources are reviewed, at different times of the year, to monitor any changes in the number of businesses or the locations of personal property.

Obtaining Depreciation Information

There is a provision in Colorado Revised Statutes that allows county assessors to obtain Colorado income tax returns for business taxpayers, including depreciation information, from the Colorado Department of Revenue (DOR).

Reports and returns.

(7) Notwithstanding the provisions of this section, the executive director of the department of revenue shall supply any county assessor of the state of Colorado or his representative with information relating to ad valorem tax assessments or valuation of property within his county and, in his discretion, may permit the commissioner of internal revenue of the United States, or the proper official of any state imposing a similar tax, or the authorized representative of either to inspect the reports and returns of taxes covered by this article.

(10) Notwithstanding the provisions of this section, the executive director of the department of revenue shall supply any county assessor of the state of Colorado or his representative with information obtained through audit of reports and returns covered by this article dealing with such taxpayers’ ability to pay or to properly accrue any ad valorem tax collected by such county assessor.

§ 39-21-113, C.R.S.

However, the DOR does not regularly receive depreciation information because it relies on the return information filed with the Internal Revenue Service. As such, it may not be possible to obtain this information directly from the DOR. If information is requested, discussions with DOR representatives indicated the following procedures should be used by assessors in obtaining DOR tax return information.

- Prepare a cover letter, on county letterhead, requesting under authority of §§ 39-21-113(7) and 39-21-113(10), C.R.S., taxpayer income tax returns for the tax years under review by your office. Make sure that you include sufficient information about the tax years, taxpayer's name, trade name, location, Federal Employer Identification Number, etc., so that the DOR can locate the appropriate records.

- Attach a DR 5714 (05/20/16) Request For Copy of Tax Records form completed by you to the best of your ability. Copies of this form can be directly obtained from the DOR website.

- Mail both the letter and the completed form to:

Colorado Department of Revenue

Tax Files – Room B112

PO Box 17087

Denver, Colorado 80217-0087

Copying cost: 1 – 10 Free, each additional page is $0.25.

(303) 866-5407

NOTE: Any tax return information that you obtain from DOR must remain confidential in the same manner as the personal property declaration schedule and accompanying exhibits, pursuant to § 39-21-113(4), C.R.S.

Obtaining New Sales Tax Account Listings

DOR makes available to the counties sales tax records of their vendors. Counties that impose a sales tax have access to this information through the DOR's Sales and Use Tax System (SUTS) (previously known as the “Local Government Sales Tax Information System”). This is a secured site and you will need to contact the county finance office to request any sales tax information.

NOTE: Any sales tax information you obtain from the DOR must remain confidential in the same manner as the personal property declaration schedule and accompanying exhibits, pursuant to § 39-21-113(4), C.R.S.

Review of Property Account Files and Records

All property declaration schedules, supporting data, and correspondence contained in the taxpayer's files should be carefully reviewed before the initial telephone call. Also, any previous personal property audit information contained in the file should be reviewed. These reviews allow the assessor to become familiar with the business so that records relevant to past problems can initially be requested and so that appropriate questions regarding these records may be asked during the interview.

Physical Inspection

The physical inspection of property is another widely used tool in discovering and listing personal property. Physical inspection is fully discussed in Chapter 5, Personal Property Reviews.

Assessor Responsibilities

The assessor has several responsibilities relative to the listing of personal property. The

responsibilities are as follows:

- To provide declaration forms to taxpayers

- To use approved manuals, procedures, forms, and related data

- To maintain accurate records

Provide Declaration Forms

The assessor must provide a copy of the declaration schedule form to each taxpayer believed to own taxable personal property in the county. As described in the “Discovery” portion of this chapter, assessors attempt to discover all owners of personal property in the county so that the declaration schedules may be delivered to the taxpayer. Taxpayers must still obtain and file a declaration schedule even if the assessor fails to send the schedules as required by §§ 39- 5-107 and 108, C.R.S.

If desired, assessors have the option to mail out a declaration schedule to all personal property taxpayers. However, only when the total actual value of the personal property exceeds $52,000 per county is the taxpayer required to return the completed declaration. A late filing or failure to fully disclose penalty cannot be applied unless the total actual value exceeds $52,000 per county.

Use Approved Data

The assessor has the responsibility to use the approved manuals, procedures, and forms developed by the Division of Property Taxation as required by §§ 39-2-109(1)(d) and (e), C.R.S. Assessors must also consider any other pertinent data provided by the taxpayer to establish the total actual value of personal property as provided for in § 39-5-107, C.R.S.

Approved Manuals

The ARL Volume 5, Personal Property Manual, is the approved manual to be used in the valuation of personal property. The manual contains all recommendations and procedures published by the Division of Property Taxation, as approved by the State Board of Equalization (SBOE), concerning the valuation of personal property. In Huddleston v. Grand County, 913 P. 2d 15 (Colo. 1996), the Colorado Supreme Court recognized and affirmed the Property Tax Administrator’s broad authority to prepare manuals and procedures, as well as to require that the Colorado county assessors utilize these manuals and procedures to carry out their responsibilities pursuant to Colorado Constitution, Article X, § 3.

Forms

Pursuant to § 39-2-109(1)(d), C.R.S., the Property Tax Administrator is required to approve the form and size of all personal property declaration schedules, forms, and notices furnished or sent by the assessor to owners of taxable property. Exclusive use of approved schedules, forms, and notices are required. This standardizes the information that is being requested statewide and provides for equal treatment of all taxpayers.

NOTE: County assessors may create customized or computerized county Personal Property Declaration Schedules and taxpayer notification forms if they have these forms approved by the Property Tax Administrator prior to their use.

Appraisal Records

Appraisal records are used by assessors for listing information from the declaration schedule submitted by the taxpayer and to determine the actual and assessed values of personal property.

The personal property appraisal record is a one-year value calculation worksheet for developing cost approach estimates for all machinery, equipment, and furnishings. The appraisal record provides for the determination of current replacement or reproduction cost new less depreciation (RCNLD) and for adjusting the current value to the correct level of value. Computerized output documents may be used in lieu of the following manual form. The specific manual appraisal record used to list and maintain personal property cost information is as follows:

| Form No. | Description |

|---|---|

| AR 290 | Personal Property Appraisal Record Form |

Additional documentation is required for application of the market and income approaches and reconciliation to a final value estimate. All appraisal records and appraisal documents should be initialed and dated by the assessor, the appraiser, or the data entry operator as appropriate and maintained as a part of the personal property valuation files.

Personal property may be manually valued using the AR 290 personal property appraisal record. A PDF version of the AR 290 may be found on the Division’s website.

Real property should be valued, and any related assessment records maintained, on appropriate real property appraisal records. Real and personal cross-reference indexes or files should be kept for related real and personal property. The index or file data should be reviewed annually to eliminate the possibility of duplicate or omitted assessments of property.

Notices of Valuation

The assessor must notify the taxpayers on approved Notices of Valuation (NOVs). The specific requirements and form standards for the NOV are found in ARL Volume 2, Administrative and Assessment Procedures, Chapter 9, Form Standards.

Maintain Accurate Records

Accurate property appraisal files must be maintained for each personal property taxpayer. These files, and their associated records, serve as the permanent documentation for any assessments made by the assessor. The files are the repository of all information gathered by the assessor regarding the taxpayer and the taxpayer's property.

Files should include all declaration schedules and documents submitted by an individual taxpayer or business, along with appraisal records, worksheets, copies of Notices of Valuation, all correspondence, and any other data pertaining to that specific taxpayer or business.

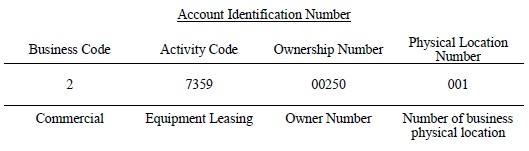

Account Identification System

To provide overall control of the ownership files and records, a permanent unique personal property account identification number should be assigned to each personal property account.

The recommended unique account identification number consists of the business activity code, ownership number, and physical location number.

Business Activity Code (5 digits):

The first digit corresponds with the general property class.

1 = residential

2 = commercial

3 = industrial

4 = agricultural

5 = open

6 = natural resources

7 = open

8 = state assessed

9 = exempt

The next four digits correspond with the Standard Industrial Classification Manual published by the Office of Statistical Standards of the Federal government for each type of business or industry.

As an example, 7359 is the standard industrial code for an equipment leasing business. Thus 27359 indicates a commercial equipment leasing business. Refer to the Standard Industrial Classification Manual that is available from any U.S. Government Printing Office or online.

Ownership Number (5 digits):

The assignment of a five-digit owner number provides for 99999 possible individual owners of personal property for each specific type of business or industry within the county. The ownership number is assigned by the assessor.

Physical Location Number (3 digits):

The assignment of a three-digit physical location number provides for 999 possible locations within the county for one owner.

An example account identification number 2-7394-00250-001 is shown below:

Account identification numbers provide for control of the personal property accounts. It also allows the assessor to keep records for similar types of businesses together for easy reference and comparison, on a business-by-business basis, when needed.

The ownership control numbers should be used on all records pertaining to a given taxpayer. Listed below are various records, which may be cross-referenced when using the ownership control numbers.

- Alpha listing

- Numerical listing

- Cadastral cards

- Property declaration schedules

- File jackets

- Appraisal records

- Master property record cards

- Notice of Valuation

- Location listing

- Correspondence

- Out of state owner listing

- Tax warrant

- Tax bills

Archives Requirements

Personal property listings and valuation records are kept for six years, plus the current year, after which they may be destroyed with the permission of the State Archivist. Refer to ARL Volume 2, Administration and Assessment Procedures, Chapter 1, Assessor’s Duties and Relationships, for specific archive retention procedures.

Confidentiality